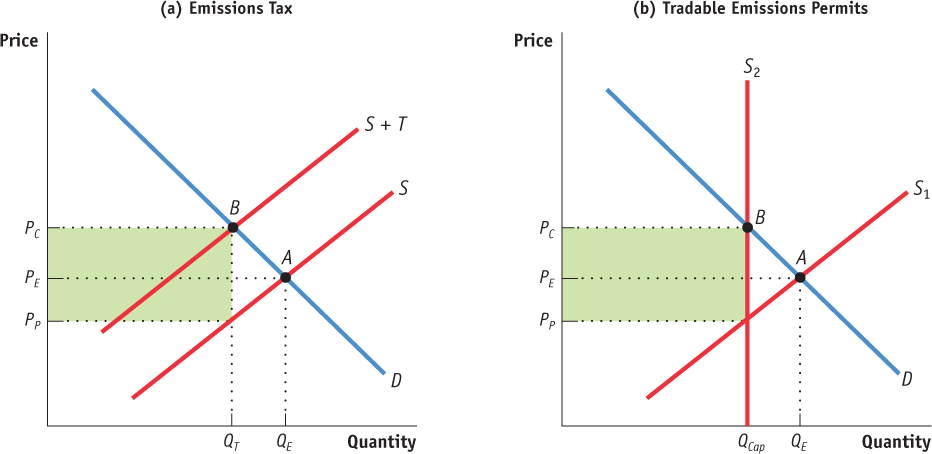

Figure16-6Comparing Emissions Taxes and Tradable Emissions Permits As shown in panel (a), a per- unit emissions tax collected from suppliers shifts the supply curve up. This reduces the quantity of the product exchanged, raises the price that consumers pay, lowers the price that suppliers receive, and results in tax revenue for the government (equal to the green- shaded area).

Using a system of tradable emissions permits makes the supply curve perfectly vertical at the government imposed maximum level of output, as shown in panel (b). This reduces the quantity of the product exchanged and raises the price that consumers pay. If the permits are free, the green- shaded area represents profits captured by firms. If permits are sold by the government, this area represents the revenue for the government.

Using a system of tradable emissions permits makes the supply curve perfectly vertical at the government imposed maximum level of output, as shown in panel (b). This reduces the quantity of the product exchanged and raises the price that consumers pay. If the permits are free, the gree