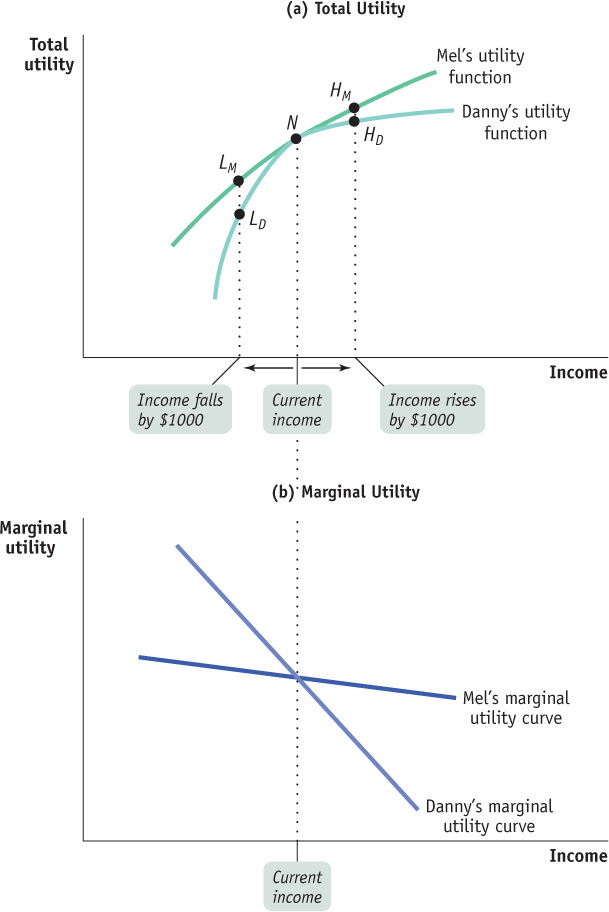

Figure20-2Differences in Risk Aversion Danny and Mel have different utility functions. Danny is highly risk- averse: a gain of $1000 in income, which moves him from N to HD, adds only a few utils to his total utility, but a $1000 fall in income, which moves him from N to LD, reduces his total utility by a large number of utils. By contrast, Mel gains almost as many utils from a $1000 rise in income (the movement from N to HM) as he loses from a $1000 fall in income (the movement from N to LM). This difference— reflected in the differing slopes of the two men’s marginal utility curves— means that Danny would be willing to pay much more than Mel for insurance.