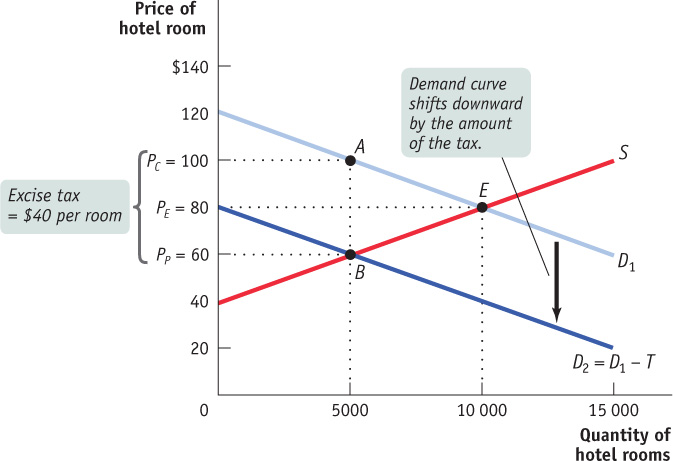

Figure7-3An Excise Tax Imposed on Hotel Guests A $40 per room tax imposed on hotel guests shifts the demand curve from D1 to D2, a downward shift of $40. The equilibrium price of hotel rooms falls from $80 to $60 a night, and the quantity of rooms rented falls from 10 000 to 5000. Although in this case the tax is officially paid by (levied on, or collected from) consumers, while in Figure 7-2 the tax was paid by (collected from) producers, the outcome is the same: after taxes, hotel owners receive $60 per room but guests pay $100. This illustrates a general principle: The incidence of an excise tax doesn’t depend on whether the government levies the tax on consumers or producers.