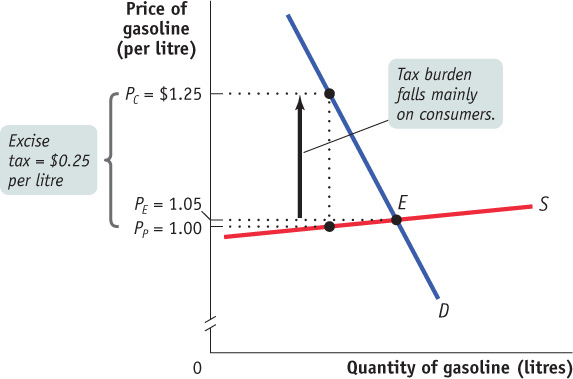

Figure7-4An Excise Tax Paid Mainly by Consumers The relatively steep demand curve here reflects a low price elasticity of demand for gasoline. The relatively flat supply curve reflects a high price elasticity of supply. The pre- tax price of a litre of gasoline is $1.05, and a tax of $0.25 per litre is imposed. The price paid by consumers rises by $0.20 to $1.25, reflecting the fact that most of the burden of the tax falls on consumers. Only a small portion of the tax is borne by producers: the price they receive falls by only $0.05 to $1.00.