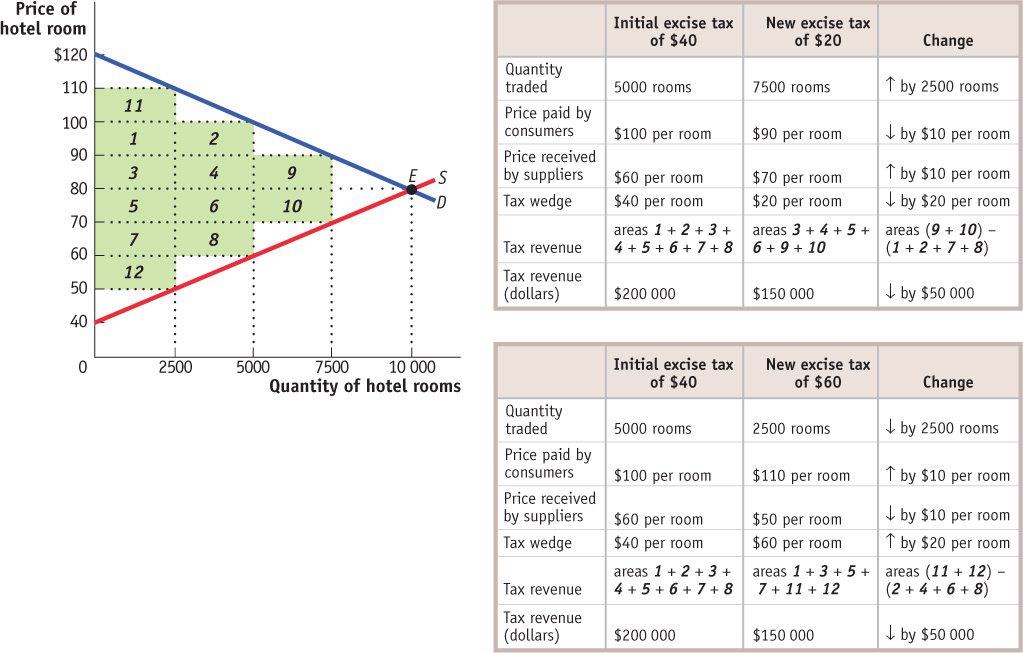

Figure7-7Tax Rates and Revenue The tables above compare the effect of a change to an excise tax on the market. When the excise tax falls from $40 per room to $20 per room, tax revenue falls by $50 000 because the tax revenue gained from the higher quantity traded (areas 9 + 10) doesn’t offset the revenue lost as a result of the lower tax rate (areas 1 + 2 + 7 + 8). When the excise tax rises from $40 per room to $60 per room, tax revenue falls by $50 000 because the tax revenue gained from the higher tax rate (areas 11 + 12) doesn’t offset the revenue lost as a result of the lower quantity traded (areas 2 + 4 + 6 + 8). In general, doubling an excise tax rate doesn’t double the amount of revenue collected because the tax increase reduces the quantity of the good or service sold. And the relationship between the level of the tax and the amount of revenue collected may not even be positive.