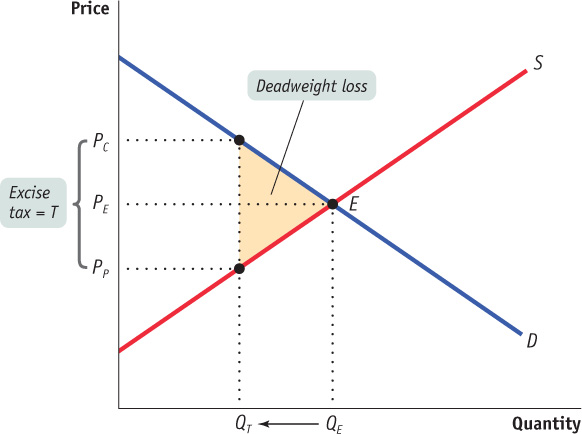

Figure7-9The Deadweight Loss of a Tax A tax leads to a deadweight loss because it creates inefficiency: some mutually beneficial transactions never take place because of the tax— namely, the transactions QE − QT. The shaded area here represents the value of the deadweight loss: it is the total surplus that would have been gained from the QE − QT transactions. If the tax had not discouraged transactions— had the number of transactions remained at QE—no deadweight loss would have been incurred.