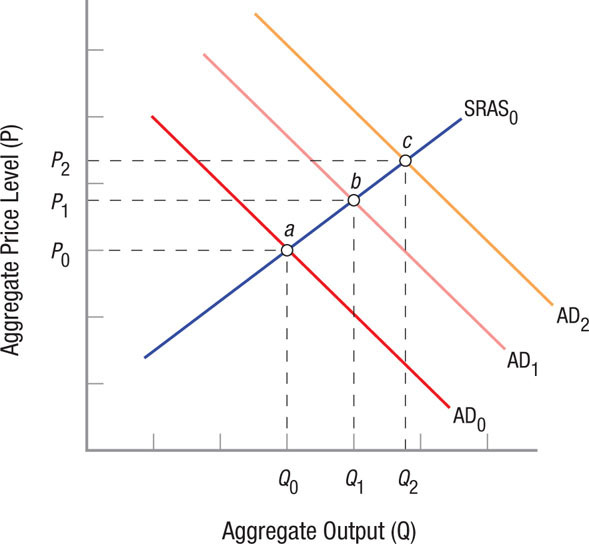

FIGURE 5

Monetary and Fiscal Policy in an Open Economy When the government engages in expansionary policy, aggregate demand rises, resulting in output and price increases. A rising domestic price level reduces exports while rising incomes increases imports, worsening the current account.An expansionary monetary policy (holding fiscal policy constant), increases the money supply and reduces interest rates. Lower interest rates result in capital outflow, pushing the money supply back down and moving aggregate demand back toward AD0.

An expansionary fiscal policy (holding monetary policy constant), increases interest rates, leading to capital inflow, pushing aggregate demand further to the right to AD2.

[Leave] [Close]