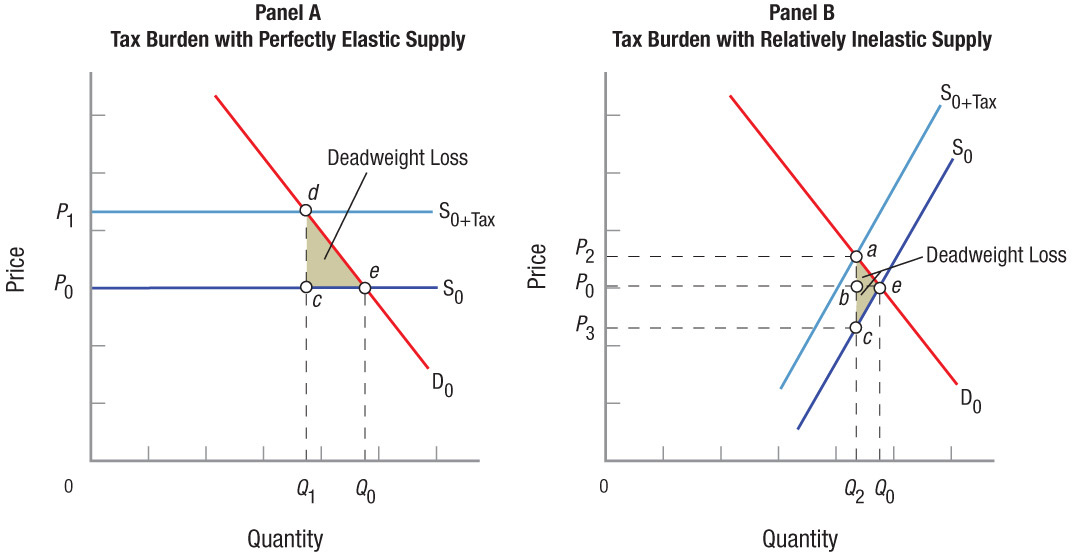

FIGURE 9

Tax Burden and Supply Elasticities When supply curve S0 is perfectly elastic as shown in panel A, a per unit excise tax added to the product shifts supply vertically to S0+Tax. In this limiting case of perfectly elastic supply, the full burden of the tax (P1 − P0) is borne by consumers through higher prices. The deadweight loss is relatively large with elastic supply curves and equal to area cde. When supply is inelastic as in panel B, with the same excise tax (ac in panel B = cd in panel A), price increases are less, and the reduction in output is also less than before. Consumers pay only part of the tax, ab, and the deadweight loss to society is equal to area cae, less than with the elastic supply shown in panel A.

[Leave] [Close]