Business Cycles

business cycles Alternating increases and decreases in economic activity that are typically punctuated by periods of recession and recovery.

Macroeconomics is concerned with business cycles, those short-run fluctuations in the macroeconomy known also as booms and busts. Business cycles are a common feature of industrialized economies, and are important to study because they emphasize the idea that markets are intertwined with one another. What happens in one market is not usually independent from other markets, as we saw with the persistent unemployment during the recession of 2007–2009.

Defining Business Cycles

Business cycles are defined as alternating increases and decreases in economic activity. As economists Arthur Burns and Wesley Mitchell wrote,

Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recession, contractions and revivals which merge into the expansion phase of the next cycle.1

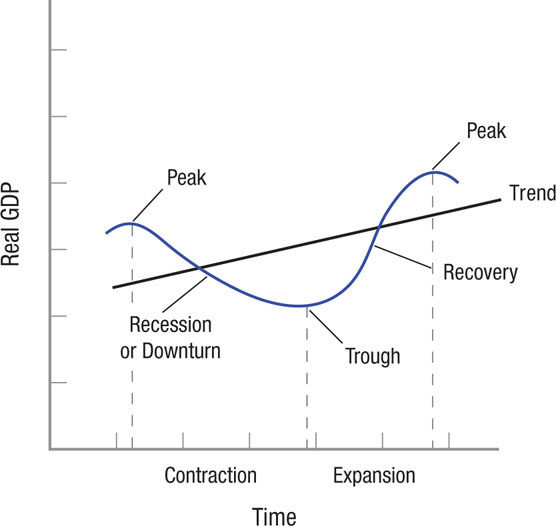

Figure 2 shows the four phases of the business cycle. These phases, around an upward trend, include the peak (sometimes called a boom), followed by a recession (often referred to as a downturn or contraction), leading to the trough or bottom of the cycle, finally followed by a recovery or an expansion to another peak.

FIGURE 2

Typical Business Cycle The four phases of the business cycle are the peak or boom, followed by a recession (often called a downturn or contraction), leading to the trough or bottom of the cycle, followed by a recovery or an expansion leading to another peak. Note that although this diagram suggests business cycles have regular movements, in reality the various phases of the cycle vary widely in duration and intensity.

A peak in the business cycle usually means that the economy is operating at its capacity. Peaks are followed by downturns or recessions. This change can happen simply because the boom runs out of steam and business investment begins to decline, thereby throwing the economy into a tailspin.

Once a recession is under way, businesses react by curtailing hiring and perhaps even laying off workers, thus adding to the recession’s depth. Eventually, however, a trough is reached, and economic activity begins to pick up as businesses and consumers become more enthusiastic about the economy. Often, the federal government or the Federal Reserve Bank institutes fiscal or monetary policies to help reverse the recession. We will look at government actions in future chapters.

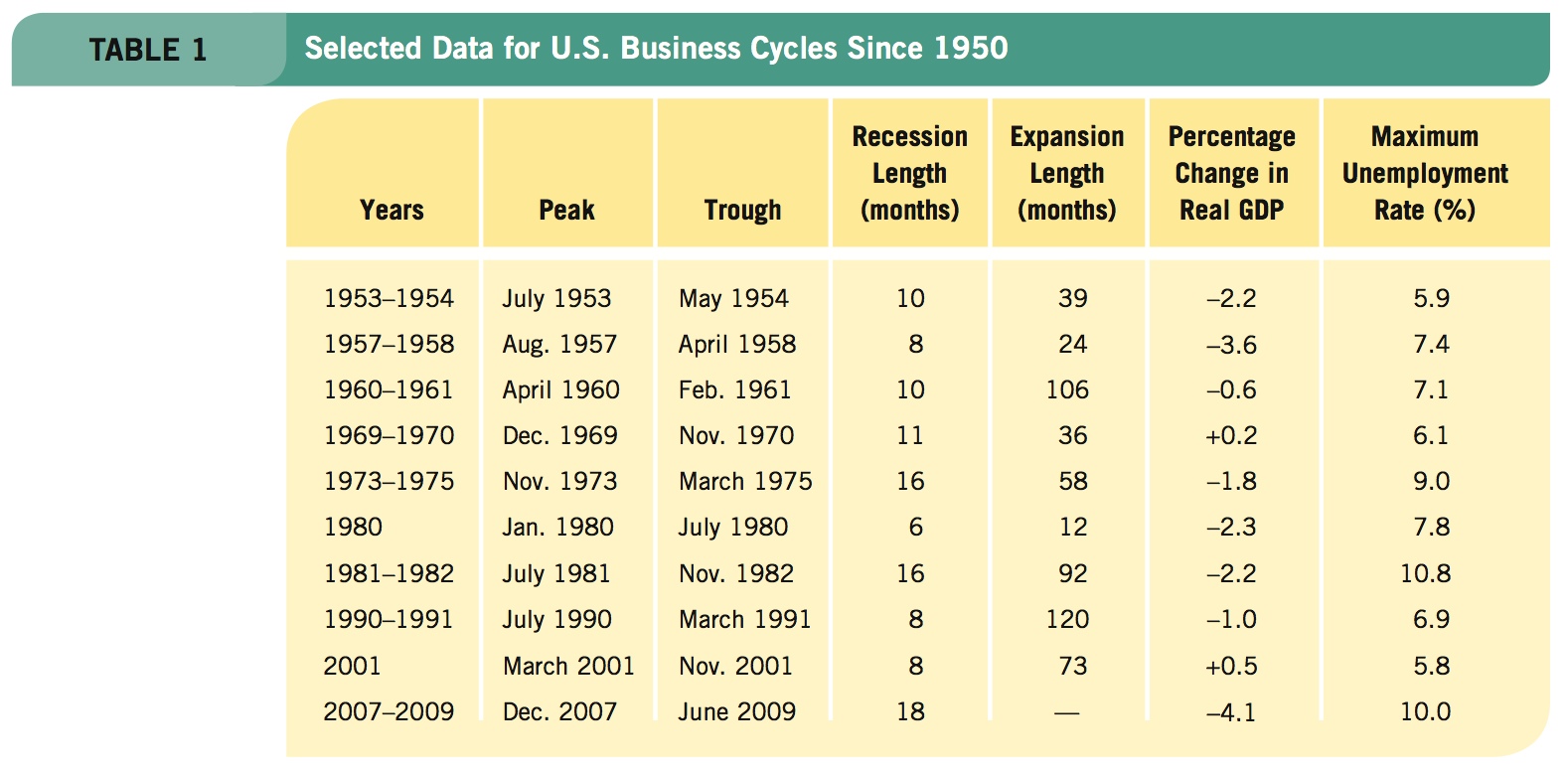

Figure 2 suggests that business cycles are fairly regular, but in fact the various phases of the cycle can vary dramatically in duration and intensity. As Table 1 shows, the recessions of the last half-century have lasted anywhere from 6 months to 18 months. Expansions or recoveries have varied even more, lasting from 1 year to as many as 10 years. Some recessions, moreover, have been truly intense, bringing about major declines in income, while others have been little more than potholes in the road, causing no declines in real income.

double-dip recession A recession that begins after only a short period of economic recovery from the previous recession.

A good metaphor for the wide variation in business cycles is a roller coaster. Some roller coasters rise higher than others, fall faster than others, or climb slower than others. Some roller coasters have one large dip followed by a series of smaller ups and downs, while others may have a large dip followed by another large dip. This is true with business cycles—some business cycles are higher, faster, or longer than others, but all have the same four phases described earlier. An important difference between a business cycle and a roller coaster, however, is that a roller coaster typically ends at the same level as it starts, while business cycles tend to have an upward long-run trend in most countries, indicating a growing economy over time.

Unemployment has shown a similar variability: The more severe the recession, the higher the unemployment rate goes. In the recessions of 1990–1991 and 2001, the economy as a whole showed remarkable resiliency, but the recoveries were termed jobless recoveries because the economic growth following the recessions did not coincide with strong levels of job growth. In fact, sometimes an economy’s recovery falls short and enters another recession before it fully recovers; this is referred to as a double-dip recession. The last double-dip recession occurred in the early 1980s. However, the slow recovery following the 2007–2009 recession caused many economists to worry that another double-dip recession would occur. Fortunately, it did not.

Dating Business Cycles

Business cycles are officially dated by the National Bureau of Economic Research (NBER), a nonprofit research organization founded in 1920. The NBER assigns a committee of economists the task of dating “turning points”—times at which the economy switches from peak to downturn or from trough to recovery. The committee looks for clusters of aggregate data pointing either up or down. Committee members date turning points when they reach a consensus that the economy has switched directions.

The committee’s work has met with some criticism because the decisions rest on the consensus of six eminent economists, who often bring different methodologies to the table. The committee’s deliberations, moreover, are not public; the committee announces only its final decision. Finally, the NBER dates peaks and troughs only after the fact: Their decisions appear several months after the turning points have been reached.2 By waiting, the panel can use updated or revised data to avoid premature judgments. But some argue that the long lag renders the NBER’s decisions less useful to policymakers.

Nonetheless, the work of the NBER in dating the turning points is important for investors and businesses alike, as they help form expectations of how the economy might perform based on the phase of the business cycle it has reached. Businesses are more likely to invest during a time of expansion, and they don’t want to be investing in greater production capacity at a time of recession when sales might fall.

Alternative Measures of the Business Cycle

Because the NBER focuses on historical data to date phases of the business cycle after they occur, economists have developed tools to analyze trends in an effort to predict phases of the business cycle before they occur. The following are three examples of methods used to predict business cycle movements.

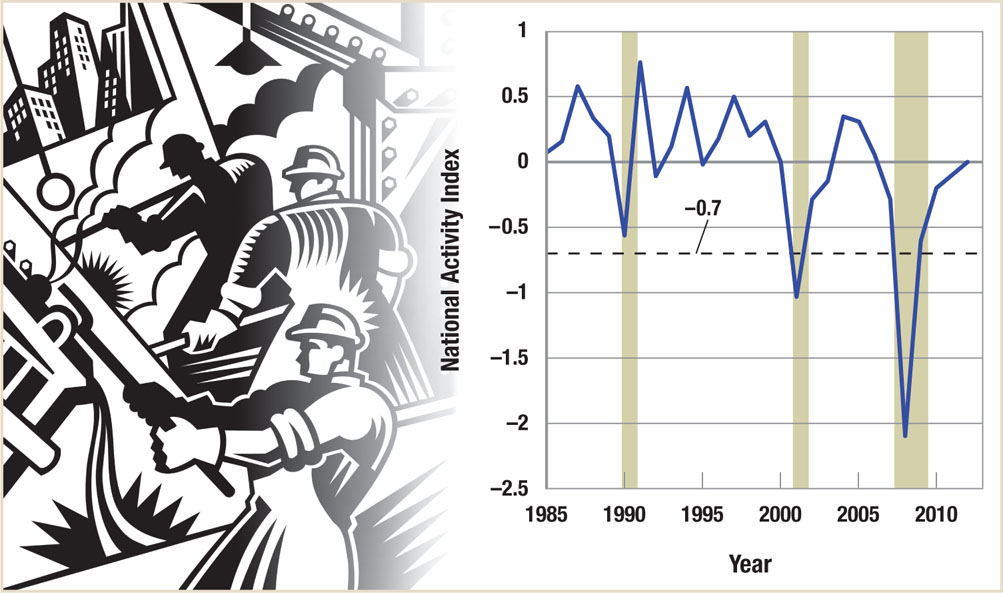

National Activity Index The National Activity Index, developed by the Federal Reserve Bank of Chicago, is a weighted average of 85 indicators of national economic activity. These indicators are drawn from a huge swath of economic activity including production, income, employment, unemployment, hours worked, personal consumption, housing, sales, orders, and inventories.

Figure 3 shows the index since 1985. When the index has a zero value, the economy is growing at its historical trend rate of growth. Negative values mean that the economy is growing slower and positive rates imply it’s growing faster than its long-term trend. When the index moves below −0.70 following a period of expansion, this suggests a high likelihood that the economy has moved into recession. The index has done a remarkable job in pinpointing the signs of recession in a reasonably current time frame.

FIGURE 3

The Federal Reserve Bank of Chicago’s National Activity Index The National Activity Index is a weighted average of 85 indicators of economic activity in the economy. When the index moves below −0.70 (dashed line), the economy is probably moving into a recession. This index appears to track the official NBER peak turning points.

Leading Economic Index The Leading Economic Index (or LEI) established by The Conference Board, an independent business and research association, is another index that economists look to when predicting movements in the business cycle. The LEI uses ten important leading indicators to produce a weighted index. Because each indicator is a predictor of how the economy should perform in the near future, any change in the LEI index today is supposed to reflect how the economy will change tomorrow.

Indicators in the LEI Index

Average weekly hours, manufacturing

Average weekly initial claims for unemployment insurance

Manufacturers’ new orders, consumer goods and materials

Index of supplier deliveries—vendor performance

Manufacturers’ new orders, nondefense capital goods

Building permits, new private housing units

Stock prices, 500 common stocks

Money supply, M2

Interest rate spread, 10-year Treasury bonds less federal funds

Index of consumer expectations

The LEI predicts a recession whenever the index falls for three months in a row (compared to the same month the previous year). In fact, it has successfully predicted the last seven recessions since 1969, although critics point to the fact that it has also provided some false warnings of recessions (a funny adage shared among economists is that forecasters have predicted ten of the last seven recessions).

yield curve Shows the relationship between the interest rate earned on a bond (measured on the vertical axis) and the length of time until the bond’s maturity date (shown on the horizontal axis).

Yield Curve Perhaps the simplest, and surprisingly accurate, predictor of changes in the business cycle is the yield curve. A yield curve shows the interest rates for bonds (shown on the vertical axis) with different maturity rates (shown on the horizontal axis). For example, it would show the difference in interest rates between a 3-month Treasury bill and a 30-year Treasury bond (a “bill” is a type of bond with a maturity of less than one year).

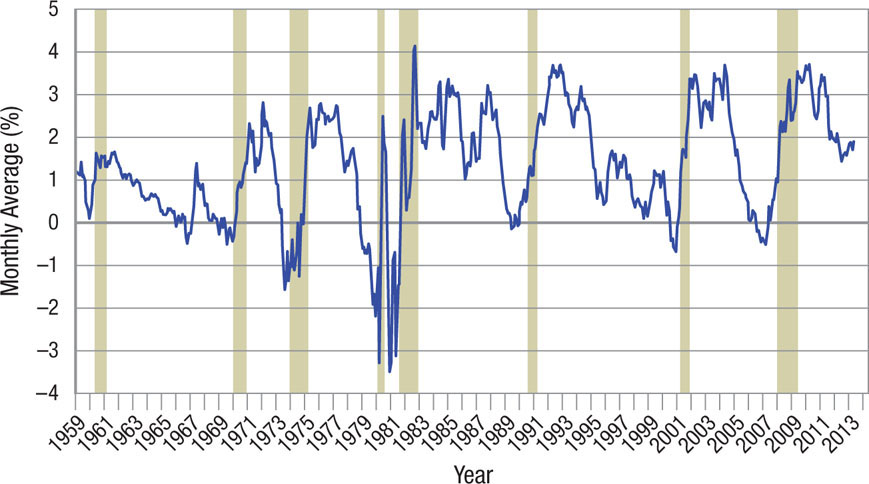

One approach economists have used to predict recessions, shown in Figure 4, is to take the interest rate of a long-term 10-year bond and subtract the interest rate on a short-term 3-month bill. Whenever this value turns negative (in other words, interest rates on short-term bills exceed those on long-term bonds), a recession is likely to occur. Why? When investors believe an economic slowdown may occur, they buy long-term bonds to lock in interest rates, pushing interest rates on long-term bonds lower. This has been true for seven of the last eight recessions. However, some economists remain skeptical, pointing to several false warnings that the yield curve has given which did not result in actual recessions.

FIGURE 4

Treasury Spread The 10-year bond rate minus 3-month bill rate (monthly average). Shaded bars indicate recessions. In all but one recession since 1960, the difference in rates turned negative prior to the recession.

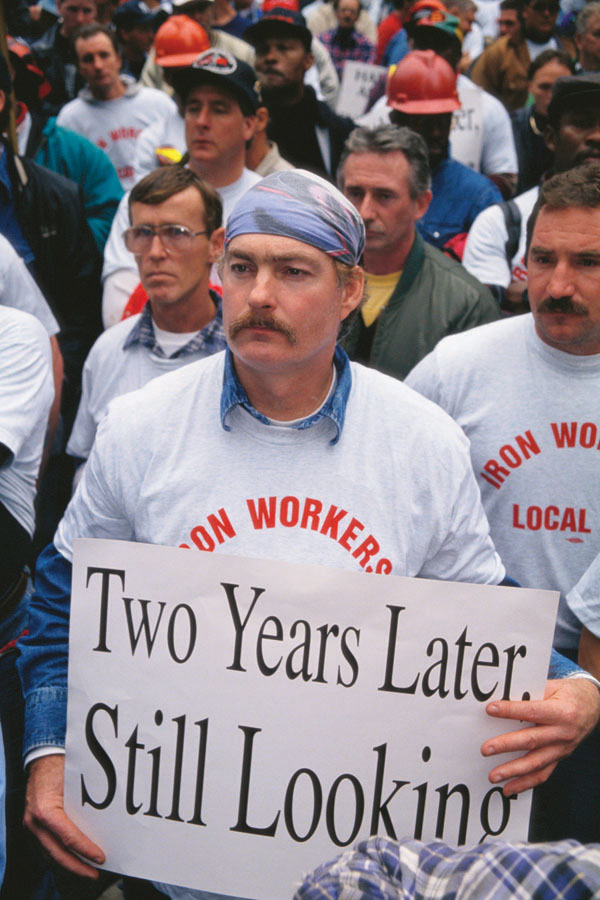

The End of the Recession … It Does Not Feel Like It

According to the National Bureau of Economic Research, the most recent U.S. recession officially ended in June 2009. But ask most people (besides economists) at the time or even a year later whether they thought the recession was over and you would have likely been laughed at. Indeed, in June 2009, the economy was not in good shape: The unemployment rate was 9.5%, GDP was over 4% below its peak, and the stock market was nearly 40% below its high two years prior. Why would such dismal economic conditions signal the end of the recession?

Part of the explanation is how economists date the business cycle. The NBER looks at “turning points” when the economy goes from a peak to a downturn or from a trough to a recovery. A recession officially ends when the economy is at the trough, which occurs when the economy is at its worst (or near worst) condition. In fact, the NBER generally waits until evidence of two quarters of GDP growth is found before declaring the recession over. Therefore, some recovery may already have occurred when a recession ends.

Looking at the lives of everyday people, the beginning of a recovery is sometimes a more difficult time to live through than the recession itself. This brings about the other part of the explanation—how economists define each phase of the business cycle. A recession describes a decrease in the growth of the economy from its peak, while a recovery describes an increase in the growth of the economy from its trough. Therefore, although a recession may have officially begun, life is still good (for the time being), and people subsequently believe that the economy is still strong. Contrast this with the start of a recovery, in which life is dismal (for the time being) and people subsequently believe the economy is still in recession. The following tables provide a comparison.

To many people, life at the start of a recession was much better than life at the start of the recovery. In fact, the most recent recession had such a slow recovery period that even after two years from the official end of the recession, the unemployment rate stood at 9.1%, much higher than the 6.2% unemployment rate during the middle of the recession in 2008.

In sum, how economists date recessions and recoveries is based largely on the turning points of the business cycle, which as shown may not always reflect what everyday people experience.

Each of the three indices is one of the many methods economists use to predict the movements of the business cycle. Although a perfect predictor of booms and busts is not possible, many people follow these indices because of the importance of the business cycle in the macroeconomy.

The duration and intensity of business cycles are measured using data collected by the Bureau of Economic Analysis and U.S. Department of Labor. These data for aggregate income and output come from the national income and product accounts. We turn in a moment to see how these data are collected and analyzed and consider how well they measure our standard of living. Keep in mind that these data are the key ingredients economists use to determine the state of the macroeconomy.

BUSINESS CYCLES

- Business cycles are alternating increases and decreases in economic activity.

- The four phases of the business cycle include the peak, recession (or contraction), trough, and recovery (or expansion).

- Business cycles vary in intensity, duration, and speed.

- Business cycles are dated by the National Bureau of Economic Research (NBER). Business cycles are usually dated some time after the trough and peak have been reached.

- Economists have developed different methods to predict movements in the business cycle, including the National Activity Index, the Leading Economic Index, and the yield curve method.

QUESTIONS: Do you think that the business cycle has a bigger impact on automobile and capital goods manufacturers or on grocery stores?

Big-ticket (high-priced, high-margin) items such as automobiles are affected by a recession more than grocery stores, where the margins are smaller and prices are lower. When the economy turns downward, investment falls, therefore the capital goods industry is one of the first to feel the pinch.