The Role of Government in Promoting Economic Growth

Government plays an important role in how well a country utilizes its resources in production. The policies and incentives put into place affect a country’s total factor productivity. We will discuss some of the key ways in which government plays a role in influencing productivity.

Government as a Contributor to Physical Capital, Human Capital, and Technology

The government is the single largest consumer of goods and services in the United States. Each year, the U.S. government spends over $350 billion on purchases including highways, bridges, transportation systems, public education, military equipment, and more. By investing heavily in capital goods, the government is promoting a higher level of labor productivity in the country.

Physical Capital: Public Capital and Private Investment One of the reasons why some nations are rich and others are poor lies in the different levels of infrastructure development among various countries. The focus on infrastructure means that there is something important that lies behind our aggregate production: We do not just increase capital, increase labor, improve technology, and turn a crank to obtain economic growth.

infrastructure The public capital of a nation, including transportation networks, power-generating plants and transmission facilities, public education institutions, and other intangible resources such as protection of property rights and a stable monetary environment.

Infrastructure is defined as a country’s public capital. It includes dams, roads, and bridges; transportation networks, such as air and rail lines; power-generating plants and power transmission lines; telecommunications networks; and public education facilities. These items are tangible public goods that can easily be measured. All are crucial for economic growth.

The government also encourages private investment in physical capital through tax incentives and other subsidies to firms willing to invest in capital projects. Industries that receive the largest tax incentives include aerospace, defense, energy, and telecommunications.

Human Capital: Public Education and Financial Aid The government plays an important role in ensuring that every person has access to a minimum level of education. In the United States, state laws mandate that children stay in school until a minimum age, typically 16. Public schools and universities are highly subsidized by local and state governments to provide affordable access to educational opportunities.

Besides providing funding directly to schools and universities, the government offers various forms of need-based and merit-based financial assistance directly to students to use toward educational expenses. These include Pell Grants and the G.I. Bill, federal subsidized loans, and various types of tax incentives that allow qualified students (or their parents) to deduct a portion of their tuition and fees from their taxable income or from their taxes directly. The government also allows teachers to deduct certain expenses from their taxes, and provides tax-exempt status for organizations whose mission is to provide scholarships, such as the prestigious National Merit Scholarship Program. These grants, loans, and tax incentives contribute to the government’s role in promoting human capital.

Technology: Government R&D Centers and Federal Grants Some of the largest research centers in the country are government funded. These include Los Alamos National Laboratory and Sandia National Laboratories (part of the Department of Energy), the National Institutes of Health, the National Aeronautics and Space Administration (NASA), and the National Oceanic and Atmospheric Administration (NOAA), just to name a few. These government research centers employ thousands of scientists, researchers, and doctors for the purpose of advancing knowledge and inventing products that enhance the lives of all citizens and promote economic growth.

In addition to running research centers, the government provides funds directly to public and private research centers as well as to individual researchers. Among the largest grantors of funds is the National Science Foundation (NSF), founded in 1950. In 2012, the NSF provided nearly $7 billion in grants to nearly 12,000 projects, and has maintained its mission of promoting research essential for a nation’s economic health and global competitiveness.

Government as a Facilitator of Economic Growth

A second major role of government in promoting economic growth is to ensure that an effective legal system is in place to enforce contracts and to protect property rights, and that the financial system is kept stable. These are the less tangible yet equally important components of a country’s infrastructure.

Enforcement of Contracts The legal enforcement of contract rights is an important component of an infrastructure that promotes economic growth and well-being. Without contract enforcement, people are less likely to be willing to enter into contracts, for example, to produce and deliver goods for payment at some future date. Therefore, contract enforcement promotes economic growth by ensuring that production and purchasing commitments made by producers and consumers are honored.

Protection of Property Rights A stable legal system that protects property rights is essential for economic growth. Many developing countries do not systematically record the ownership of real property: land and buildings. Although ownership is often informally recognized, without express legal title, the capital locked up in these informal arrangements cannot be used to secure loans for entrepreneurial purposes. As a result, valuable capital sits idle; it cannot be leveraged for other productive purposes.1

In addition, a legal system that recognizes and protects ideas (or intellectual property) is critical to encouraging innovation. Common legal protections for ideas include patents (for inventions), copyrights (for written work), and trademarks (for names and symbols). Every country has its innovators; the question is whether these people are offered enough of an incentive to devote their efforts to coming up with the innovations that drive economic growth. The extent to which countries establish intellectual property rights varies, and even when such protections exist, enforcement of the protections varies.

Stable Financial System Another important component of a nation’s infrastructure is a stable and secure financial system. Such a financial system keeps the purchasing power of the currency stable, facilitates transactions, and permits credit institutions to arise. The recent global financial turmoil is an example of the problems caused by financial instability. Further, bank runs, like those that caused major economic disruption in Uruguay and Argentina in 2001–2002, are less likely when a nation’s financial environment is stable.

Unanticipated inflations or deflations are both detrimental to economic growth. Consumers and businesses rely on the monetary prices they pay for goods and services for information about the state of the market. If these price signals are constantly being distorted by inflation or deflation, the quality of business and consumer decisions suffers. Unanticipated price changes further lead to a redistribution of income between creditors and debtors. Financial instability is harmful to improving standards of living and generating economic growth.

Government as a Promoter of Free and Competitive Markets

A third role of government in promoting economic growth is maintaining competitive and efficient markets and the freedom for firms and individuals to pursue their interests.

Competitive Markets and Free Trade One of the challenges of government is choosing the right mix of policies to keep markets competitive and fair. Regulations are put into place to protect various interests, whether consumer welfare, worker rights and safety, or the environment. But government also must ensure such regulations not stand in the way of markets operating efficiently.

Competitive markets refer to the ability of firms to open and close businesses without unnecessary restrictions or other burdens. Free trade refers to the ability to buy and sell products with other countries without significant barriers such as tariffs or quotas. Allowing the market to function freely within the confines of sensible regulatory laws generally creates more potential for economic growth.

Economic Freedom One of the measures used to gauge the ability of individuals and businesses to make investment and production decisions freely is the Index of Economic Freedom.

Unlike physical infrastructure such as roads and dams, which are easy to measure, attempting to measure the intangibles of doing business often requires subjective judgments. One reasonably objective measure is the 2013 Index of Economic Freedom.2 This index incorporates information about freedoms in ten categories: business, trade, fiscal policy, government size, monetary policy, investment, finance, property rights, corruption, and labor.

Clearly, assigning some of these items a numeric value requires some subjective judgment. Even so, this index is one reasonable approach to measuring the overall infrastructure of a country.

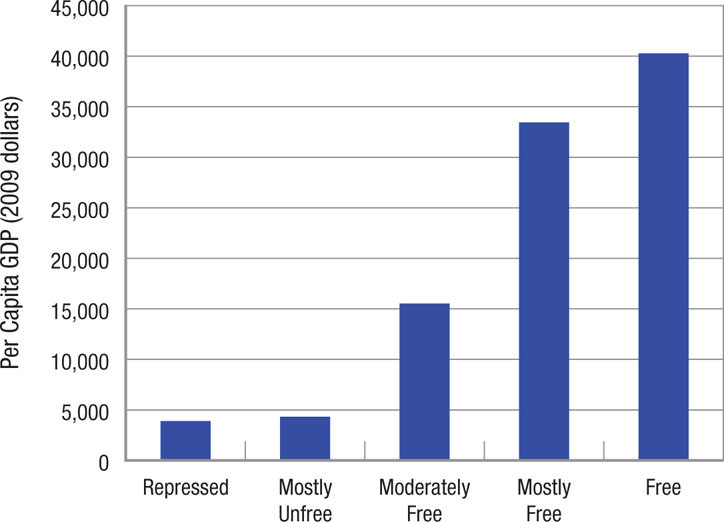

Figure 2 portrays the relationship between economic freedom and per capita GDP measured by purchasing power parity (what income will buy in each country). Those nations with the most economic freedom have the highest per capita GDP and also the highest growth rates (not shown).

FIGURE 2

Economic Freedom and Per Capita GDP The relationship between economic freedom and per capita GDP is shown here. Those nations with the most economic freedom also have the highest per capita GDP.

Economist Peter Bauer from the London School of Economics argued that “opportunities for private profit, not government plans, held the key to development. Governments had the limited though crucial role of protecting property rights, enforcing contracts, treating everybody equally before the law, minimizing inflation and keeping taxes low.”3 Today, his ideas are part of a new conventional wisdom that government should act as a promoter rather than as a provider of economic growth.

In this chapter, we have seen that economic growth in the long run comes from improvements in labor productivity, increases in capital, or improvements in technology. Investments in human capital and greater economic freedom also lead to higher growth rates and higher standards of living.

In the long run, all of these factors generate growth and higher standards of living. Yet, what are we to do if the economy collapses in the short run? The Great Depression of the 1930s was to prove that for a reasonably long period (a decade), the economy could be mired in a slowdown with high unemployment rates and negative growth. A deep economy-wide downturn inflicts high costs on both today’s citizens and future generations. In the next chapter we turn to the first of our discussions on managing the economy in the short run.

THE ROLE OF GOVERNMENT IN PROMOTING ECONOMIC GROWTH

- Government has an important role in promoting economic growth by providing physical and human capital, ensuring a stable legal system and financial markets, and promoting free and competitive markets.

- Infrastructure is a country’s public capital, including dams, roads, transportation networks, power-generating plants, and public schools.

- Governments provide capital and technology by purchasing public capital and providing incentives for private investment, supporting education through subsidies and financial aid, and supporting research and development.

- Other less tangible infrastructure elements include protection of property rights, enforcement of contracts, and a stable financial system.

- The Index of Economic Freedom measures a country’s infrastructure, which supports economic growth.

QUESTION: Imagine a country with a “failed government” that can no longer enforce the law. Contracts are not upheld and lawlessness is the order of the day. How well could an economy operate and grow in this environment?

Not very well. Large-scale businesses that we are accustomed to could not exist. What’s left is small individual businesses that serve small local populations. Growth is stymied, and everyone ekes out a small living. Countries such as Somalia are in this no-win situation.