Questions and Problems

Check Your Understanding

Question

Describe the important difference between the average propensity to consume (APC) and the marginal propensity to consume (MPC).

Prob 19 1. Describe the important difference between the average propensity to consume (APC) and the marginal propensity to consume (MPC).Question

List the factors that influence an individual’s marginal propensity to consume.

Prob 19 2. List the factors that influence an individual’s marginal propensity to consume.Question

Explain why we wouldn’t expect investment to grow sufficiently to pull the economy out of a depression.

Prob 19 3. Explain why we wouldn’t expect investment to grow sufficiently to pull the economy out of a depression.Question

Define the simple Keynesian multiplier. Describe why a multiplier exists.

Prob 19 4. Define the simple Keynesian multiplier. Describe why a multiplier exists.Question

Explain why a $100 reduction in taxes does not have the same impact on output and employment as a $100 increase in government spending.

Prob 19 5. Explain why a $100 reduction in taxes does not have the same impact on output and employment as a $100 increase in government spending.Question

How do injections and withdrawals into an economy affect its income and output?

Prob 19 6. How do injections and withdrawals into an economy affect its income and output?

Apply the Concepts

- Assume a simple Keynesian depression economy with a multiplier of 4 and an initial equilibrium income of $3,000. Saving and investment equal $400, and assume full employment income is $4,000.

Question

What is the MPC equal to? The MPS?

Prob 19 7a. What is the MPC equal to? The MPS?Question

How much would government spending have to rise to move the economy to full employment?

Prob 19 7b. How much would government spending have to rise to move the economy to full employment?Question

Assume that the government plans to finance any spending by raising taxes to cover the increase in spending (it intends to run a balanced budget). How much will government spending and taxes have to rise to move the economy to full employment?

Prob 19 7c. Assume that the government plans to finance any spending by raising taxes to cover the increase in spending (it intends to run a balanced budget). How much will government spending and taxes have to rise to move the economy to full employment?Question

From the initial equilibrium, if investment grows by $100, what will be the new equilibrium level of income and savings?

Prob 19 7d. From the initial equilibrium, if investment grows by $100, what will be the new equilibrium level of income and savings?

Question

Other than reductions in interest rates that increase the level of investment by businesses, what factors would result in higher investment at existing interest rates?

Prob 19 8. Other than reductions in interest rates that increase the level of investment by businesses, what factors would result in higher investment at existing interest rates?Question

The simple aggregate expenditures model discussed in this chapter concluded that one form of spending was just as good as any other; increases in all types of spending lead to equal increases in income. Is there any reason to suspect that private investment might be better for the economy than government spending?

Prob 19 9. The simple aggregate expenditures model discussed in this chapter concluded that one form of spending was just as good as any other; increases in all types of spending lead to equal increases in income. Is there any reason to suspect that private investment might be better for the economy than government spending?Question

Assume that the economy is in equilibrium at $5,700, and full employment is $4,800. If the MPC is 0.67, how big is the inflationary gap?

Prob 19 10. Assume that the economy is in equilibrium at $5,700, and full employment is $4,800. If the MPC is 0.67, how big is the inflationary gap?Question

How does the economy today differ from that of the Great Depression, the economy Keynes used as the basis for the macroeconomic model discussed in this chapter?

Prob 19 11. How does the economy today differ from that of the Great Depression, the economy Keynes used as the basis for the macroeconomic model discussed in this chapter?Question

In modern politics, the word Keynesian often is synonymous with “big government” spending. Does this characterization accurately reflect the role of government in spurring economic activity? How would a tax cut be characterized today versus in Keynes’s time?

Prob 19 12. In modern politics, the word Keynesian often is synonymous with “big government” spending. Does this characterization accurately reflect the role of government in spurring economic activity? How would a tax cut be characterized today versus in Keynes’s time?

In the News

Question

In recent years banks have encouraged their customers to save by giving incentives to join programs that automatically transfer money from checking accounts to savings accounts. For example, a bank might offer to round debit transactions to the nearest dollar, transferring the change to one’s savings account, and then boost this amount with a match up to a certain amount (“Just Save Already: Bank Gimmicks for Saving Only Sound Good,” Daily Finance, September 11, 2009). Although these programs were intended to encourage customers to save, some economists are not very enthusiastic about these programs. What reasons, both practical and theoretical, might cause some to be concerned?

Prob 19 13. In recent years banks have encouraged their customers to save by giving incentives to join programs that automatically transfer money from checking accounts to savings accounts. For example, a bank might offer to round debit transactions to the nearest dollar, transferring the change to one’s savings account, and then boost this amount with a match up to a certain amount (“Just Save Already: Bank Gimmicks for Saving Only Sound Good,” Daily Finance, September 11, 2009). Although these programs were intended to encourage customers to save, some economists are not very enthusiastic about these programs. What reasons, both practical and theoretical, might cause some to be concerned?Question

The $787 billion stimulus package passed in 2009 was designed to jumpstart the economy reeling from the worst economic recession since the Great Depression by injecting the economy with large amounts of government spending (“Much Ado About Multipliers,” The Economist, September 24, 2009). Explain how this spending, as designed, was meant to create a much greater economic effect than the $787 billion spent. What factors might explain why the full economic effect of the stimulus may have fallen short of expectations?

Prob 19 14. The $787 billion stimulus package passed in 2009 was designed to jumpstart the economy reeling from the worst economic recession since the Great Depression by injecting the economy with large amounts of government spending (“Much Ado About Multipliers,” The Economist, September 24, 2009). Explain how this spending, as designed, was meant to create a much greater economic effect than the $787 billion spent. What factors might explain why the full economic effect of the stimulus may have fallen short of expectations?

Solving Problems

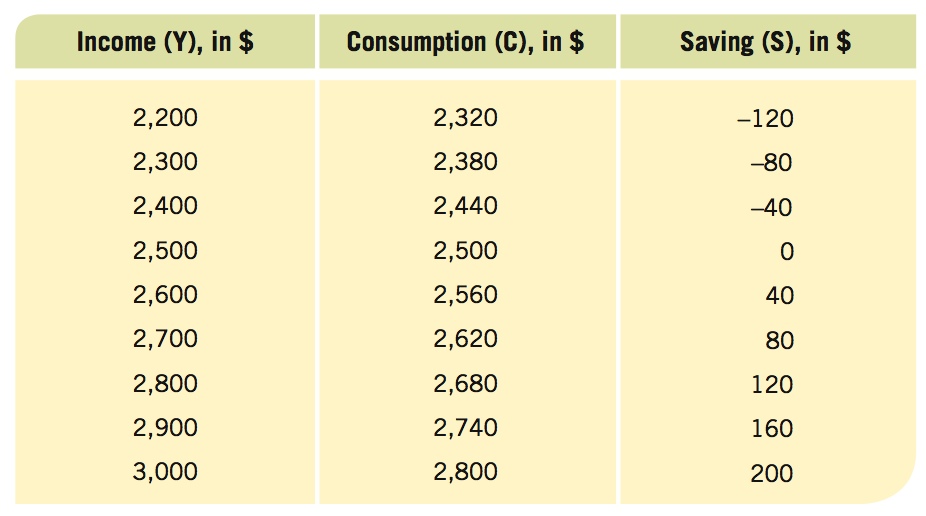

- Using the aggregate expenditures table below, answer the questions that follow.

Question

Compute the APC when income equals $2,300 and the APS when income equals $2,800.

Prob 19 15a. Compute the APC when income equals $2,300 and the APS when income equals $2,800.Question

Compute the MPC and MPS.

Prob 19 15b. Compute the MPC and MPS.Question

What does the simple Keynesian multiplier equal?

Prob 19 15c. What does the simple Keynesian multiplier equal?Question

If investment spending is equal to $120, what will be equilibrium income?

Prob 19 15d. If investment spending is equal to $120, what will be equilibrium income?Question

Using the following graph, show saving, investment, and equilibrium income.

Prob 19 15e. Using the following graph, show saving, investment, and equilibrium income.

Prob 19 15e. Using the following graph, show saving, investment, and equilibrium income.

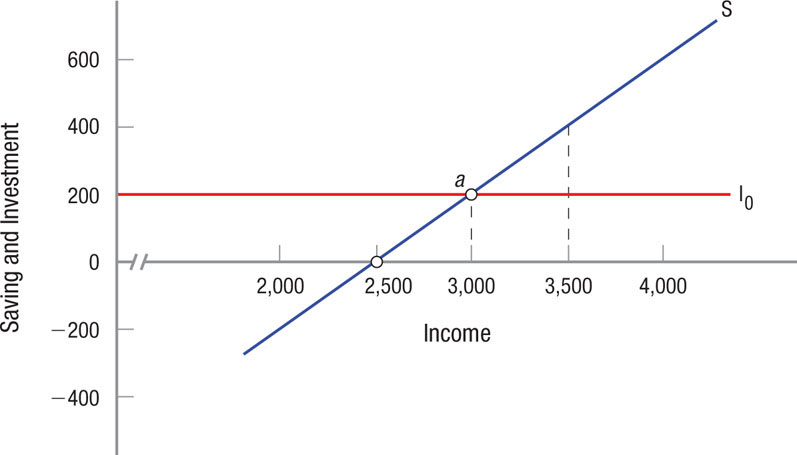

- Use the figure below to answer the following questions.

Question

What are the MPC, the MPS, and the multiplier?

Prob 19 16a. What are the MPC, the MPS, and the multiplier?Question

If the economy is currently in equilibrium at point a, and full employment income is $4,000, how much in additional expenditures is needed to move this economy to full employment? What is this level of spending called?

Prob 19 16b. If the economy is currently in equilibrium at point a, and full employment income is $4,000, how much in additional expenditures is needed to move this economy to full employment? What is this level of spending called?Question

Assume that the economy is currently in equilibrium at point a and full employment income is $4,000. How much of a tax decrease would be required to move the economy to full employment?

Prob 19 16c. Assume that the economy is currently in equilibrium at point a and full employment income is $4,000. How much of a tax decrease would be required to move the economy to full employment?

Question

According to By the Numbers, in what year (since 1973) did the U.S. government spend the most as a percentage of GDP? In what year did it spend the least? How do your answers correspond to the business cycle?

Prob 19 17. According to By the Numbers, in what year (since 1973) did the U.S. government spend the most as a percentage of GDP? In what year did it spend the least? How do your answers correspond to the business cycle?Question

According to By the Numbers, the U.S. government spends less per person than any other developed country on the list. Does this mean that the overall size of the U.S. government is smaller than that of the other developed countries? Why or why not?

Prob 19 18. According to By the Numbers, the U.S. government spends less per person than any other developed country on the list. Does this mean that the overall size of the U.S. government is smaller than that of the other developed countries? Why or why not?