Fiscal Policy and Aggregate Supply

supply-side fiscal policies Policies that focus on shifting the long-run aggregate supply curve to the right, expanding the economy without increasing inflationary pressures. Unlike policies to increase aggregate demand, supply-side policies take longer to have an impact on the economy.

Fiscal policies that influence aggregate supply are different from policies that influence aggregate demand, as they do not always require tradeoffs between price levels and output. That is the good news. The bad news is that supply-side fiscal policies require more time to work than do demand-side fiscal policies. The focus of fiscal policy and aggregate supply is on long-run economic growth.

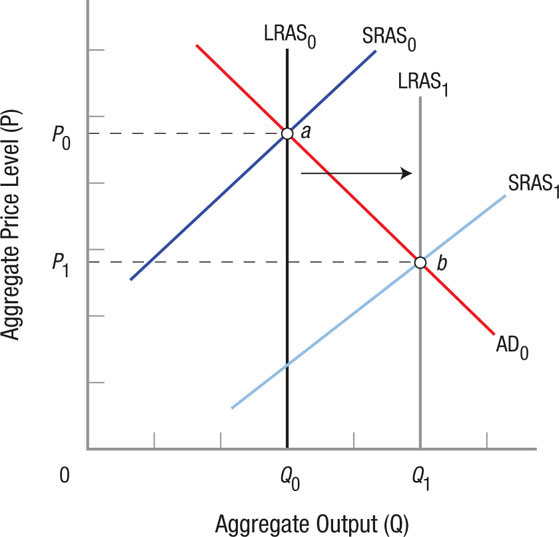

Figure 6 shows the impact that fiscal policy can have on the economy over the long run. The goal of these fiscal policies is to shift the long-run aggregate supply curve to the right, here from LRAS0 to LRAS1. This shift moves the economy’s full employment equilibrium from point a to point b, thereby expanding full-employment output while keeping inflation in check. In Figure 6, the price level falls as output expands. In practice, this would be unusual because when the economy grows, aggregate demand typically expands and keeps prices from falling.

FIGURE 6

Fiscal Policy and Aggregate Supply The ultimate goal of fiscal policy directed at aggregate supply is to shift the long-run aggregate supply curve from LRAS0 to LRAS1. This moves the economy’s full employment equilibrium from point a to point b, expanding output while keeping inflation in check. With these fiscal policies, the inflationary pressures are reduced as output expands, but these policies take a longer time to have an impact.

Figure 6 may well reflect what happens in general as the world economy embraces trade and globalization. Improvements in technology and communications increase productivity to the point that global long-run aggregate supply shifts outward. These changes, along with freer trade, help increase economic growth and keep inflation low.

Just what fiscal policies will allow the economy to expand without generating price pressures? First, there are government policies that encourage investment in human capital (education) and policies that encourage the development and transfers of new technologies. Second, there are the fiscal policies that focus on reducing tax rates. Third, there are policies that promote investment in new capital equipment, encourage investment in research and development, and trim burdensome business regulations. These policies are intended to expand the supply curves of all businesses and industries.

Infrastructure Spending

Governments can do a great deal to create the right environment to encourage economic growth. We already have seen the benefits of building and maintaining a nation’s infrastructure, including roads, bridges, dams, and communications networks, or setting up a fair and efficient legal system and stable financial system. Further, the higher the levels of human capital and the more easily technology is transferred to other firms and industries (the public good aspect of technology), the more robust economic growth. Therefore, long-run growth is enhanced through investments in higher education and research and development.

Reducing Tax Rates

Reducing tax rates has an impact on both aggregate demand and aggregate supply. Lower tax rates increase aggregate demand because households now have more money to spend. At the same time, lower tax rates mean that take-home wages rise and this may encourage more work effort. Also, entrepreneurial profits are taxed at lower rates, encouraging more people to take risks and start businesses. At different times, policymakers have lowered taxes to stimulate consumption: John F. Kennedy reduced tax rates in the early 1960s and George W. Bush in 2001 and 2008 provided tax rebates to taxpayers as part of economic stimulus packages. President Obama’s 2009 stimulus program included tax credits along with increases in government spending.

At other times, administrations have reduced marginal tax rates, the rate paid on the next dollar earned, with the express purpose of stimulating incentives to work and for businesses to take risks. President Kennedy reduced the top marginal rate from 70% to 50%, and President Reagan reduced the top marginal rate from 50% to 28%.

Clearly, high marginal income tax rates can have adverse effects on the economy. Still, there is considerable controversy regarding the benefits of the supply-side approach to macroeconomic fiscal policy. The supply-side movement that resulted in the marginal tax rate reductions in the 1980s by the Reagan administration was partially driven by reference to a simple tax revenue curve drawn by economist Arthur Laffer showing how reducing tax rates could increase tax revenues.

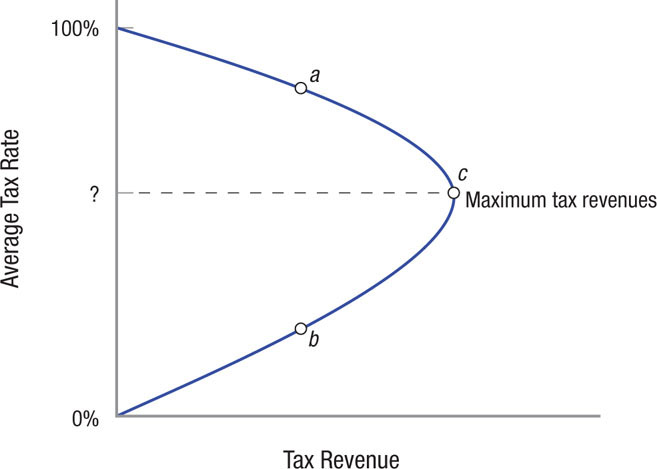

Laffer curve Shows a hypothetical relationship between income tax rates and tax revenues. As tax rates rise from zero, revenues rise, reach a maximum, then decline until revenues reach zero again at a 100% tax rate.

The Laffer curve in Figure 7 shows that if tax rates are 0% or 100%, tax revenues will be zero (the latter because there would be no incentive to earn income). In between these two extreme tax rates, tax revenues will be positive. Laffer argued that high tax rates (such as the one that generates revenues at point a on the Laffer curve) create disincentives to work and invest. He claimed that a lower tax rate would generate the same amount of revenue, seen as point b on the curve. Economists debate about what the tax rate corresponding to point b would be. Further, it raises a bigger debate about the tax rate at which the disincentive to work begins to reduce tax revenues. In other words, what tax rate corresponds to point c on the Laffer curve?

FIGURE 7

The Laffer Curve The Laffer curve shows the relationship between average tax rates and total tax revenues. As the tax rate rises from 0%, tax revenues increase. At point c, tax revenues are maximized. If tax rates continue to rise, Laffer’s argument was that the government could obtain revenues at point a based on a high tax rate, and equal revenues at point b based on a lower tax rate. The tax rates that correspond to points b and c are often debated by economists.

Expanding Investment and Reducing Regulations

We have already seen how closely standards of living are tied to productivity. Investment increases the capital with which labor works, thereby increasing productivity. Rising productivity drives increased economic growth and raises the average standard of living, shifting the long-run aggregate supply curve to the right.

Investment can be encouraged by such policies as investment tax credits (direct reductions in taxes for new investment) and more rapid depreciation schedules for plant and equipment. When a firm can expense (depreciate) its capital equipment over a shorter period of time, it cuts its taxes now rather than later, and therefore earns a higher return on the capital now. Similarly, government grants for basic research help firms increase their budgets for research and development, which results in new products and technologies brought to market.

Nowhere is this impact more evident than in the health care field. The National Institutes of Health, part of the U.S. Department of Health and Human Services, invests over $30 billion in health care research each year, mostly in grants to medical schools, universities, and research institutions. These investments have enabled new medicines to be developed at a much faster rate than previously. And beyond the obvious benefits this has for the people who require such medicines, investments of this sort pay dividends for the entire economy. As health care improves, workers’ absentee rates are lower and productivity rises.

Another way of increasing long-run aggregate supply involves repealing unnecessarily onerous regulations that hamper business and add to costs. Clearly, some regulation of business activities is needed, as the recent financial industry meltdown has shown. Still, these regulations should be subjected to rigorous cost-benefit analyses. Otherwise, excessive regulations end up adding to the costs of the products we buy, without yielding significant benefits. Examples of excessively regulated industries have included trucking and the airlines. When these industries were deregulated in the 1980s, prices fell and both industries expanded rapidly. Today, some economists argue that the Federal Drug Administration’s drug approval process is too long and costly; bringing a new drug to market can cost over $1 billion.

Fiscal policies to increase aggregate supply are promoted mainly through the government’s encouragement of human capital development and technology improvements, its power to tax, its ability to promote investment in infrastructure and research, and the degree and efficiency of regulation. Cutting marginal tax rates, offering investment tax credits, and offering grants for research are the favored policies. The political fervor of the 1980s supply-side movement has largely dissipated as marginal income tax rates have declined. But fiscal policies to encourage growth in long-run aggregate supply are still an important part of the government’s long-term fiscal policy arsenal.

FISCAL POLICY AND AGGREGATE SUPPLY

- The goal of fiscal policies that influence aggregate supply is to shift the long-run aggregate supply curve to the right.

- Expanding long-run aggregate supply can occur through higher investments in human capital and a focus on technological infrastructure with “public good” benefits.

- The Laffer curve suggested that reducing tax rates could lead to higher revenues in some cases.

- Other fiscal policies to increase long-run aggregate supply include providing incentives for business investment and reducing burdensome regulation.

- The major limitation of fiscal policies to influence long-run aggregate supply is that they take a longer time to have an impact compared to polices aimed at influencing aggregate demand.

QUESTIONS: Some economists have suggested that an improved tax structure would entail a reduction in income taxes for individuals, corporations (corporate income tax), and investors (capital gains taxes), that are offset by an increase in consumption taxes (such as sales and excise taxes). Which part(s) of this type of proposal would be consistent with supply-side economics? Why?

Supply-side economics focuses on providing incentives for individuals to work and for businesses to invest, and therefore advocate lower tax rates. The reduction in the individual, corporate, and capital gains taxes would each be consistent with supply-side economics. However, if a portion of these tax savings is offset through higher consumption taxes, this would not be consistent with supply-side economics because such a tax would discourage consumption and negatively affect business and investment outlook.