Questions and Problems

Check Your Understanding

Question

Explain why government spending theoretically gives a bigger boost to the economy than tax cuts.

Prob 21 1. Explain why government spending theoretically gives a bigger boost to the economy than tax cuts.Question

Explain why increasing government purchases of goods and services is expansionary fiscal policy. Would increasing taxes or reducing transfer payments be contractionary or expansionary? Why?

Prob 21 2. Explain why increasing government purchases of goods and services is expansionary fiscal policy. Would increasing taxes or reducing transfer payments be contractionary or expansionary? Why?Question

Changes in tax rates affect both aggregate demand and aggregate supply. Explain why this is true.

Prob 21 3. Changes in tax rates affect both aggregate demand and aggregate supply. Explain why this is true.Question

What is one benefit to businesses when the government budget is in surplus?

Prob 21 4. What is one benefit to businesses when the government budget is in surplus?Question

How might interest paid on the national debt lead to greater income inequality?

Prob 21 5. How might interest paid on the national debt lead to greater income inequality?Question

Is the absolute size of the national debt or the national debt as a percent of GDP the best measure of its importance to our economy? Explain.

Prob 21 6. Is the absolute size of the national debt or the national debt as a percent of GDP the best measure of its importance to our economy? Explain.

Apply the Concepts

Question

One argument often heard against using fiscal policy to tame the business cycle is that the lags associated with getting a fiscal policy implemented are so long that when the program is finally passed and implemented, the business cycle has moved on to the next phase and the new program may not be necessary and may even be potentially destabilizing at that point. Does this argument seem reasonable? What counterarguments can you make in support of using fiscal policy?

Prob 21 7. One argument often heard against using fiscal policy to tame the business cycle is that the lags associated with getting a fiscal policy implemented are so long that when the program is finally passed and implemented, the business cycle has moved on to the next phase and the new program may not be necessary and may even be potentially destabilizing at that point. Does this argument seem reasonable? What counterarguments can you make in support of using fiscal policy?Question

As mandatory federal spending becomes increasingly a larger share of the budget, should we worry that the economic stabilization aspects of fiscal policy are becoming so limited as to be ineffective?

Prob 21 8. As mandatory federal spending becomes increasingly a larger share of the budget, should we worry that the economic stabilization aspects of fiscal policy are becoming so limited as to be ineffective?Question

Our current personal income tax system is progressive: Income tax rates rise with rising incomes and are lower for low-income individuals. Some policymakers have favored a “flat tax” as a replacement for our modestly progressive income tax system. Most exemptions and deductions would be eliminated, and a single low tax rate would be applied to personal income. Would such a change in the tax laws alter the automatic stabilization characteristics of the personal income tax?

Prob 21 9. Our current personal income tax system is progressive: Income tax rates rise with rising incomes and are lower for low-income individuals. Some policymakers have favored a “flat tax” as a replacement for our modestly progressive income tax system. Most exemptions and deductions would be eliminated, and a single low tax rate would be applied to personal income. Would such a change in the tax laws alter the automatic stabilization characteristics of the personal income tax?Question

In 1962 in a speech before the Economic Club of New York, President Kennedy argued that “…it is a paradoxical truth that taxes are too high today and tax revenues are too low—and the soundest way to raise revenues in the long run is to cut rates now.” Is President Kennedy’s argument consistent with supply-side economics? Why or why not?

Prob 21 10. In 1962 in a speech before the Economic Club of New York, President Kennedy argued that “…it is a paradoxical truth that taxes are too high today and tax revenues are too low—and the soundest way to raise revenues in the long run is to cut rates now.” Is President Kennedy’s argument consistent with supply-side economics? Why or why not?Question

A balanced budget amendment to the Constitution requiring Congress to balance the budget every year is introduced in Congress every so often. What sort of problems would the passage of such an amendment introduce for policymakers and the economy? What would be the benefit of the passage of such an amendment?

Prob 21 11. A balanced budget amendment to the Constitution requiring Congress to balance the budget every year is introduced in Congress every so often. What sort of problems would the passage of such an amendment introduce for policymakers and the economy? What would be the benefit of the passage of such an amendment?Question

If the economy (gross domestic product) is growing faster than the growth of the national debt held by the public (both domestic and foreign), how does that affect the ability of the government to manage the national debt? What arguments can you make to rebut the common assertion that the national debt is bankrupting the country?

Prob 21 12. If the economy (gross domestic product) is growing faster than the growth of the national debt held by the public (both domestic and foreign), how does that affect the ability of the government to manage the national debt? What arguments can you make to rebut the common assertion that the national debt is bankrupting the country?

In the News

Question

The last two of elections have seen more states and municipalities passing ballot measures legalizing some forms of soft drugs such as marijuana for medicinal or recreational purposes (“Marijuana Legalization Wins Majority Support in Poll,” The Los Angeles Times, April 4, 2013). Previously, sales of such drugs took place in the informal or underground economy, where taxes are avoided and crime runs high. What would be some fiscal policy justifications for legalizing soft drugs?

Prob 21 13. The last two of elections have seen more states and municipalities passing ballot measures legalizing some forms of soft drugs such as marijuana for medicinal or recreational purposes (“Marijuana Legalization Wins Majority Support in Poll,” The Los Angeles Times, April 4, 2013). Previously, sales of such drugs took place in the informal or underground economy, where taxes are avoided and crime runs high. What would be some fiscal policy justifications for legalizing soft drugs?Question

In June of 2009, The Economist discussed the ability to manage a country’s debt:

Arithmetically, a government’s debt burden is sustainable if it can pay the interest without borrowing more. Otherwise the government will eventually fall into a debt trap, borrowing ever more just to service earlier debt.

What kind of problems might cause a country to fall into a debt trap as described above? What policies enacted today could reduce the probability of falling into a debt trap?Prob 21 14. In June of 2009, The Economist discussed the ability to manage a country’s debt: Arithmetically, a government’s debt burden is sustainable if it can pay the interest without borrowing more. Otherwise the government will eventually fall into a debt trap, borrowing ever more just to service earlier debt. What kind of problems might cause a country to fall into a debt trap as described above? What policies enacted today could reduce the probability of falling into a debt trap?

Solving Problems

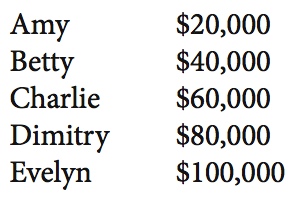

- Suppose a small economy has two income tax rates: 15% for all income up to $50,000 and 30% for any income earned above $50,000. Suppose that prior to the recession, the economy had five workers earning the following salaries:

Question

Calculate the total tax revenues paid by the five workers. What percent of total income does this represent?

Prob 21 15a. Calculate the total tax revenues paid by the five workers. What percent of total income does this represent?Question

Now assume that a recession causes each of the five salaries to fall by 25%. Given the lower salaries, what would be the total tax revenues paid by the five workers? What percent of total income does this represent?

Prob 21 15b. Now assume that a recession causes each of the five salaries to fall by 25%. Given the lower salaries, what would be the total tax revenues paid by the five workers? What percent of total income does this represent?Question

Explain how this progressive tax structure acts as an automatic stabilizer.

Prob 21 15c. Explain how this progressive tax structure acts as an automatic stabilizer.

Question

Suppose an economy has a national debt of $10 billion, and the average interest rate on this debt is currently 3%. Its GDP is $20 billion. What percentage of this economy’s GDP is spent on interest payments on its debt? Suppose that next year one of two events occurs: (1) GDP and interest rates stay the same, but the economy adds $2 billion to its national debt, (2) GDP and the national debt stays the same, but interest rates increase to 4%. Which of these two events would increase the interest rate burden of the national debt more? Show your calculations.

Prob 21 16. Suppose an economy has a national debt of $10 billion, and the average interest rate on this debt is currently 3%. Its GDP is $20 billion. What percentage of this economy’s GDP is spent on interest payments on its debt? Suppose that next year one of two events occurs: (1) GDP and interest rates stay the same, but the economy adds $2 billion to its national debt, (2) GDP and the national debt stays the same, but interest rates increase to 4%. Which of these two events would increase the interest rate burden of the national debt more? Show your calculations.

Question

According to By the Numbers, what percent of total national debt and foreign held debt is held by China? How about OPEC nations? What does this suggest about the relative importance of U.S. relations with China and OPEC nations?

Prob 21 17. According to By the Numbers, what percent of total national debt and foreign held debt is held by China? How about OPEC nations? What does this suggest about the relative importance of U.S. relations with China and OPEC nations?Question

According to By the Numbers, in which year between 1990 and 2012 did the United States have the biggest budget surplus and what was that value? In which year did it have the biggest budget deficit and what was that value?

Prob 21 18. According to By the Numbers, in which year between 1990 and 2012 did the United States have the biggest budget surplus and what was that value? In which year did it have the biggest budget deficit and what was that value?