Chapter Introduction

After studying this chapter you should be able to:

- Describe the functions of money.

- Define the money supply according to M1 and M2.

- Use the loanable funds model to show how savers and borrowers are brought together.

- Explain how the financial system makes it easier for savers and borrowers.

- Describe the relationship between the price of bonds and interest rates.

- Describe the tradeoff between risk and return and how that influences the return on investment for bonds and stocks.

- Explain how the compounding effect makes debt and savings much larger over time.

- Understand how retirement savings programs function and the benefits they provide.

Alexandros Michailidis/Demotix/Demotix/Corbis

On August 13, 2004, the city of Athens, Greece, celebrated as the Summer Olympic Games returned to its historic homeland, the place where Olympic athletes nearly 3,000 years ago competed on the same land as athletes in the current games were about to compete.

Indeed, it was a proud moment for Greeks, and for their government, which had borrowed billions of dollars to build new stadiums, a modern transportation network, and a new airport, and to give the city a significant facelift to showcase its growing economic prosperity to a worldwide audience. Where did the government get this money? It borrowed money from banks and from the public by issuing bonds, and there was plenty of money to be borrowed. The Olympics were the ultimate showpiece of a nation on the rise.

No one could have predicted on that proud day that in less than a decade, that same city would be engulfed in financial turmoil, with large government debt, protests and riots, and a country in complete despair. What happened in Greece that led to such a dramatic reversal in fortune?

In short, it was a breakdown of financial institutions caused by a global recession along with uncontrolled government debt that caused long-term interest rates to skyrocket from 4% in 2009 to 27% in 2012. With interest rates so high, the ability to borrow, whether by the government, by businesses, or by consumers, became prohibitive, leading to a drastic decline in consumption and investment and subsequently a rise in unemployment. Clearly, Greece headed into a vicious cycle that threatened not only the country but the stability of the euro, the currency it shares with much of Europe.

Although Greece was not the only country to have undergone a financial crisis, it was one of the most difficult cases because of the challenges that affected the banks, bond market, and stock market—which form what we refer to as a country’s financial system. The financial system plays an important role in the health of the macroeconomy, and when the system breaks down, as it did in Greece, the economy often goes down with it.

Up to now, we have looked at how the federal government tries to manage the macroeconomy through fiscal policy, by using government taxation and spending. We now want to look at the government’s other policy approach—monetary policy. To analyze how government uses monetary policy to influence the macroeconomy, we must first lay the foundation by examining the financial system and the role of money, which is the subject of this chapter. Building on this foundation, in the following chapters we will see how financial institutions create money and how the government enacts policies that encourage the financial system to do things that mitigate fluctuations in the macroeconomy.

We begin by looking at money: what it is and what it does. We then examine why people save and why firms borrow. We next show how the market for loanable funds brings these two groups together, and how the financial system makes this process easier and better for all. The chapter concludes with an overview of financial tools that illustrates the importance of financial literacy in our everyday lives.

After completing this chapter, you will have gained an appreciation of how the financial system allows us to buy and sell items in an efficient manner, using forms of payment that have become increasingly electronic in the digital age. But more than that, the financial system allows all economic transactions to function efficiently by channeling funds from savers to borrowers. Without it, countries would essentially break down, as did Greece, affecting millions of lives.

The Financial System and Its Sheer Size and Scope

The U.S. financial system consists of commercial banks, money markets, and government institutions that issue and manage money. It is connected with the global financial system, consisting of banks and financial institutions around the world that influence one another.

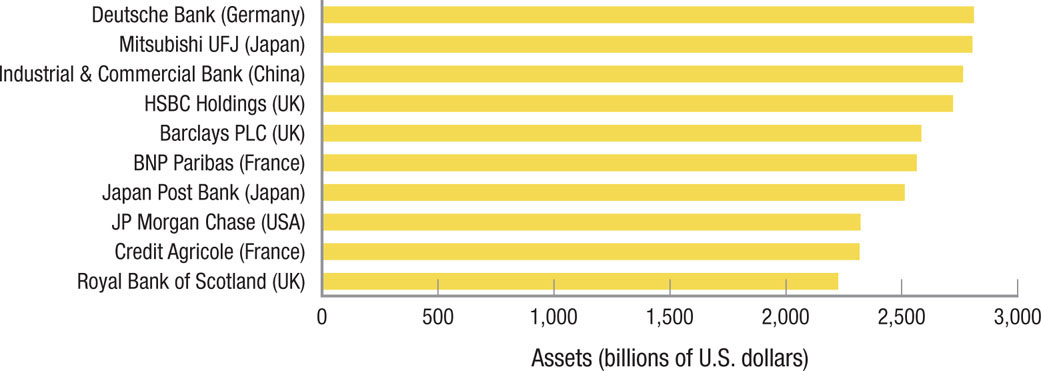

The largest banks in the world measured in billions of U.S. dollars in assets as of December 2012. Twenty years ago, Japanese and American banks dominated the top ten. In 2012, just two Japanese banks and one American bank remained in the top ten.

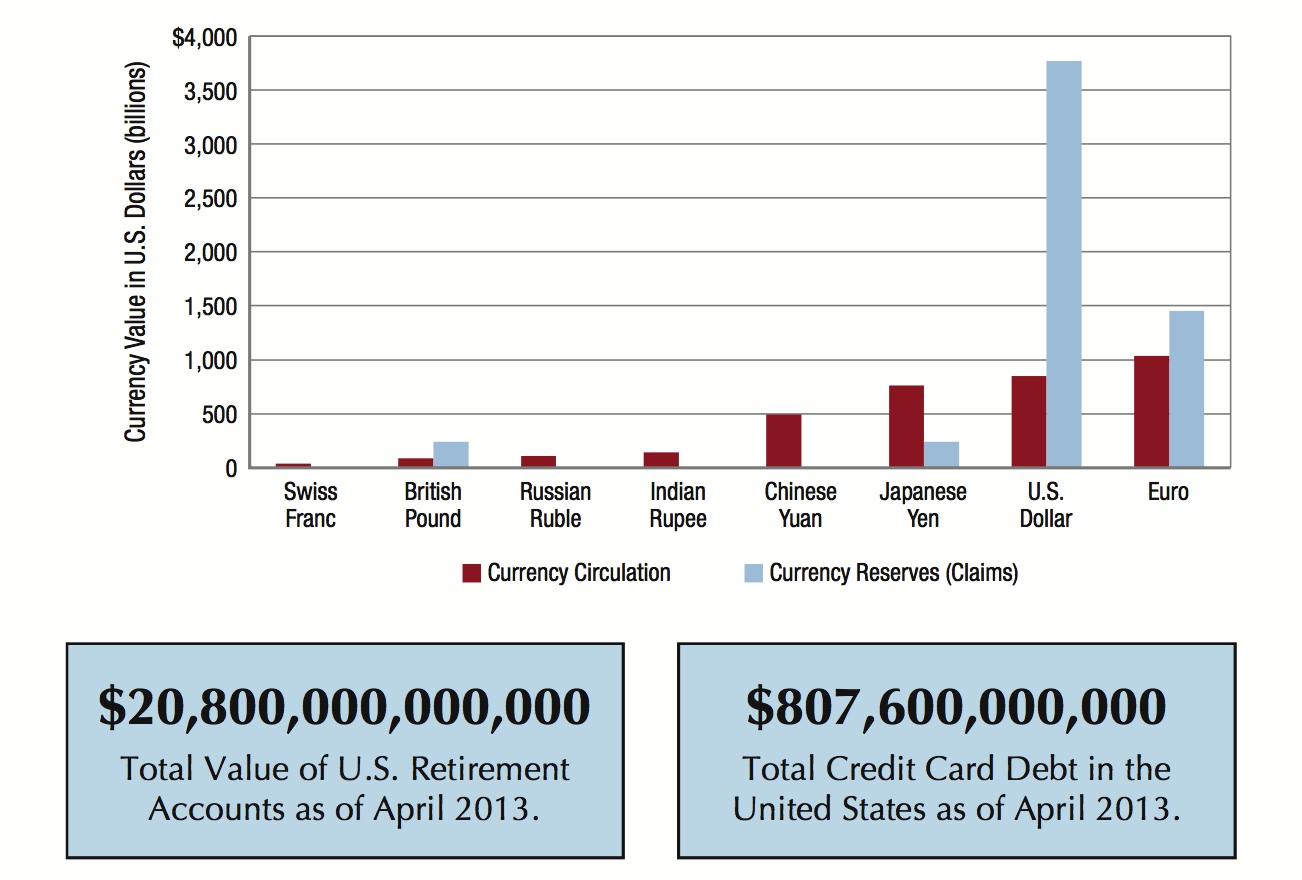

The world’s most circulated currencies:

The eight most circulated currencies in the world. Although more printed euro bills exist in circulation than U.S. dollars, the U.S. dollar remains by far the largest reserve “hard” currency held around the world (mostly in electronic form).