Elasticity of Supply

So far, we have looked at the consumer when we looked at the elasticity of demand. Now let us turn our attention to the producer, and look at elasticity of supply.

price elasticity of supply A measure of the responsiveness of quantity supplied to changes in price. An elastic supply curve has elasticity greater than 1, whereas inelastic supplies have elasticities less than 1. Time is the most important determinant of the elasticity of supply.

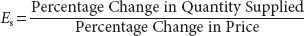

Price elasticity of supply (Es) measures the responsiveness of quantity supplied to changes in the price of the product. Price elasticity of supply is defined as

elastic supply Price elasticity of supply is greater than 1. The percentage change in quantity supplied is greater than the percentage change in price.

Note that because the slope of the supply curve is positive, the price elasticity of supply will always be a positive number. Economists classify price elasticity of supply in the same way that they classify price elasticity of demand. Classification is based on whether the percentage change in quantity supplied is greater than, less than, or equal to the percentage change in price. When price rises just a little and quantity increases by much more, supply is elastic, and vice versa. The output of many commodities such as gold and seasonal vegetables cannot be quickly increased if their price increases, so they are inelastic. In summary:

inelastic supply Price elasticity of supply is less than 1. The percentage change in quantity supplied is less than the percentage change in price.

Elastic supply: Es > 1

unitary elastic supply Price elasticity of supply is equal to 1. The percentage change in quantity supplied is equal to the percentage change in price.

Inelastic supply: Es < 1

Unitary elastic supply: Es = 1

Looking at the three supply curves in Figure 5, we can easily determine which curve is inelastic, which is elastic, and which is unitary elastic. First, note that all three curves go through point a. As we increase the price from P0 to P1, we see that the response in quantity supplied is different for all three curves. Consider supply curve S1 first. When price changes to P1 (point b), the change in output (Q0 to Q1) is the smallest for the three curves. Most important, the percentage change in quantity supplied is smaller than the percentage change in price, therefore S1 is an inelastic supply curve.

FIGURE 5

Price Elasticity of Supply All three supply curves in this figure run through point a, but they respond differently when price changes from P0 to P1. Considering supply curve S1 first, when price changes, the percentage change in quantity supplied is smaller than the percentage change in price, thus S1 is an inelastic supply curve. Curve S2 is a unitary elastic supply curve, because the percentage change in output is the same as the percentage change in price. For supply curve S3, the percentage change in output is greater than the percentage change in price, so S3 is elastic. Elastic linear supply curves cross the price axis, inelastic linear supply curves cross the quantity axis, and unitary elastic linear supply curves go through the origin.

Contrast this with S3. In this case, when price rises to P1 (point d), output climbs from Q0 all the way to Q3. Because the percentage change in output is larger than the percentage change in price, S3 is elastic. And finally, curve S2 is a unitary elastic curve because the percentage change in output is the same as the percentage change in price.

Here is a simple rule of thumb. When the supply curve is linear, like those shown in Figure 5, you can always determine if the supply curve is elastic, inelastic, or unitary elastic by extending the curve to the axis and applying the following rules:

- Elastic supply curves always cross the price axis, as does curve S3.

- Inelastic supply curves always cross the quantity axis, as does curve S1.

- Unitary elastic supply curves always cross through the origin, as does curve S2.

Time and Price Elasticity of Supply

The primary determinant of price elasticity of supply is time. To adjust output in response to changes in market prices, firms require time. Firms have both variable inputs, such as labor, and fixed inputs, such as plant capacity. To increase their labor force, firms must recruit, interview, and hire more workers. This can take as little time as a few hours—a call to a temp agency—or as long as a few months. On the other hand, building another plant or expanding the existing plant to increase output involves considerably more time and resources. In some instances, such as building a new oil refinery or computer chip plant, it can take as long as a decade, with environmental clearance alone often requiring years of study and costing millions of dollars. Finally, in some markets, such as that for original Rembrandt paintings, new supply will never be created (assuming that the dead cannot return). Economists typically distinguish among three types of time periods: the market period, the short run, and the long run.

market period Time period so short that the output and the number of firms are fixed. Agricultural products at harvest time face market periods. Products that unexpectedly become instant hits face market periods (there is a lag between when the firm realizes it has a hit on its hands and when inventory can be replaced).

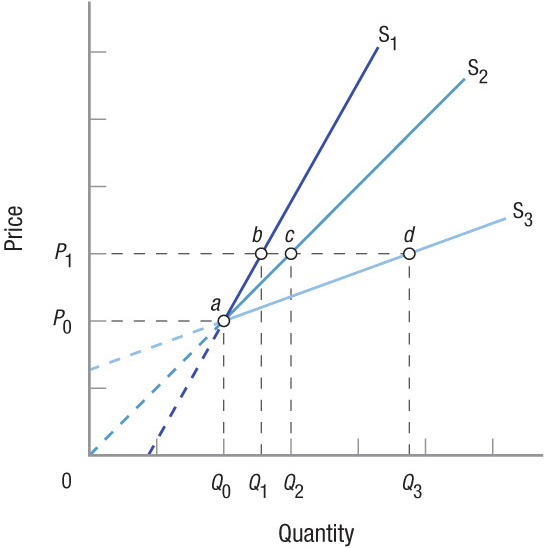

The Market Period The market period is so short that the output and the number of firms in an industry are fixed; firms have no time to change their production levels in response to changes in product price. Consider a raspberry market in the summer. Even if consumers flock to the market, their tastes having shifted in favor of fresh raspberries, farmers can do little to increase the supply of raspberries until the next year. Figure 6 shows a market period supply curve (SMP) for agricultural products such as raspberries. During the market period, the quantity of product available to the market is fixed at Q0. If demand changes (shifting from D0 to D1), the only impact is on the price of the product. In Figure 6, price moves from P0 (point e) to P1 (point a). In summary, if demand grows over the market period, price will rise, and vice versa.

FIGURE 6

Time and Price Elasticity of Supply During the market period, the quantity of output available to the market is fixed and the only impact will be on the price of the product, which will rise from P0 to P1 if demand increases. Over the short run, firms can change the amount of inputs they employ to adjust their output to market changes. Thus, the short-run supply curve (SSR) is more elastic than the market period curve; and price increases are more moderate. In the long run, firms can change their plant capacity and enter or exit an industry. Long-run supply curve SLR is elastic, and a rise in demand leads to only a small increase in price.

Changes in demand over the market period can be devastating for firms selling perishable goods. If demand falls, cantaloupes cannot be kept until demand grows; they must either be sold at a discount or trashed.

short run Time period when plant capacity and the number of firms in the industry cannot change. Firms can employ more people, have existing employees work overtime, or hire part-time employees to produce more, but this is done in an existing plant.

The Short Run The short run is defined as a period of time during which plant capacity and the number of firms in the industry cannot change. Firms can, however, change the amount of labor, raw materials, and other variable inputs they employ in the short run to adjust their output to changes in the market. Note that the short run does not imply a specific number of weeks, months, or years. It simply means a period short enough that firms cannot adjust their plant capacity, but long enough for them to hire more labor to increase their production. A restaurant with an outdoor seating area can hire additional staff and open this area in a relatively short timeframe when the weather gets warm, but manufacturing firms usually need more time to hire and train new people for their production lines. Clearly, the time associated with the short run differs depending on the industry.

This also is illustrated in Figure 6. The short-run supply curve, SSR, is more elastic than the market period curve. If demand grows from D0 to D1, output expands from Q0 to Q2 and price increases to P2 as equilibrium moves from point e to point b. Because output can expand in the short run in response to rising demand, the price increase is not as drastic as it was in the market period.

long run Time period long enough for firms to alter their plant capacities and for the number of firms in the industry to change. Existing firms can expand or build new plants, or firms can enter or exit the industry.

The Long Run Economists define the long run as a period of time long enough for firms to alter their plant capacity and for the number of firms in the industry to change. In the long run, some firms may decide to leave the industry if they think the market will be unfavorable. Alternatively, new firms may enter the market, or existing firms can alter their production capacity. Because all these conceivable changes are possible in the long run, the long-run supply curve is more elastic, as illustrated in Figure 6 by supply curve SLR. In this case, a rise in demand from D0 to D1 gives rise to a small increase in the price of the product, while generating a major increase in output, from Q0 to Q3 (point c).

In giving the long-run supply curve SLR a small but positive slope, we are assuming that an industry’s costs will increase slightly as it increases its output. Firms must compete with other industries to expand production. Wages and other input prices rise in the industry as firms attempt to draw resources away from their immediate competitors and other industries.

Some industries may not face added costs as they expand. Fast-food chains, copy centers, and coffee shops seem to be able to reproduce at will without incurring increasing costs. Therefore, their long-run supply curves may be nearly horizontal.

At this point, we have seen how elasticity measures the responsiveness of demand to a change in price and how total revenue is affected by different demand elasticities. We have also seen that supply elasticities are mainly a function of the time needed to adjust to price change signals. Next, let’s apply our findings about elasticity to a subject that concerns all of us: taxes.

ELASTICITY OF SUPPLY

- Elasticity of supply measures the responsiveness of quantity supplied to changes in price.

- Elastic supplies are very responsive to price changes. With inelastic supply, quantity supplied is not very responsive to changing prices.

- Supplies are highly inelastic in the market period, but can expand (become more elastic) in the short run because firms can hire additional resources to raise output levels.

- In the long run, supplies are relatively elastic because firms can enter or exit the industry, and existing firms can expand their plant capacity.

QUESTION: A number of products are made in preparation for the annual flu season, although the types of goods vary in terms of their elasticity of supply. Rank the following goods from most elastic to least elastic: (a) over-the-counter flu remedies, (b) flu shots, (c) chicken soup, and (d) boxes of tissue.

Although these rankings can be subjective, the most likely rank from most elastic to least elastic is: chicken soup, boxes of tissue, over-the-counter flu remedies, flu shots (generally requires over six months to produce, giving it the least flexibility in response to a price change for the current flu season).