Questions and Problems

Check Your Understanding

Question

When the demand curve is relatively inelastic and the price falls, what happens to total revenue? If the demand is relatively elastic and price rises, what happens to total revenue?

Prob 5 1. When the demand curve is relatively inelastic and the price falls, what happens to total revenue? If the demand is relatively elastic and price rises, what happens to total revenue?Question

Why is the demand for gasoline relatively inelastic, while the demand for Exxon’s gasoline is relatively elastic?

Prob 5 2. Why is the demand for gasoline relatively inelastic, while the demand for Exxon’s gasoline is relatively elastic?Question

Describe cross elasticity of demand. Why do substitutes have positive cross elasticities? Describe income elasticity of demand. What is the difference between normal and inferior goods?

Prob 5 3. Describe cross elasticity of demand. Why do substitutes have positive cross elasticities? Describe income elasticity of demand. What is the difference between normal and inferior goods?Question

Describe the impact of time on the price elasticity of supply.

Prob 5 4. Describe the impact of time on the price elasticity of supply.Question

Why would the demand for business airline travel be less elastic than the demand for vacation airline travel by retirees?

Prob 5 5. Why would the demand for business airline travel be less elastic than the demand for vacation airline travel by retirees?Question

Would an excise tax placed on cereal be more likely or less likely to be passed on to consumers than an excise tax on wireless phone and data services? Why or why not?

Prob 5 6. Would an excise tax placed on cereal be more likely or less likely to be passed on to consumers than an excise tax on wireless phone and data services? Why or why not?

Apply the Concepts

Question

One major rationale for farm price supports is that rapidly improving technology, better crop strains, improved fertilizer, and better farming methods increased supply so significantly that farm incomes were severely depressed. Explain how the elasticity of demand for these crops influences this rationale.

Prob 5 7. One major rationale for farm price supports is that rapidly improving technology, better crop strains, improved fertilizer, and better farming methods increased supply so significantly that farm incomes were severely depressed. Explain how the elasticity of demand for these crops influences this rationale.Question

If the price of chicken rises by 15% and the sales of turkey breasts expand by 10%, what is the cross elasticity of demand for these two products? Are they complements or substitutes?

Prob 5 8. If the price of chicken rises by 15% and the sales of turkey breasts expand by 10%, what is the cross elasticity of demand for these two products? Are they complements or substitutes?Question

For which of the following pairs of goods and services would the cross elasticity of demand be negative: (a) iPods and songs downloaded from iTunes, (b) digital satellite service and digital video recorders, (c) recreational vehicles and camping tents, (d) bowling and co-ed softball, (e) textbooks and study guides.

Prob 5 9. For which of the following pairs of goods and services would the cross elasticity of demand be negative: (a) iPods and songs downloaded from iTunes, (b) digital satellite service and digital video recorders, (c) recreational vehicles and camping tents, (d) bowling and co-ed softball, (e) textbooks and study guides.- Consider chip plants: potato and computer. Assume there is a large rise in the demand for computer chips and potato chips.

Question

How responsive to demand is each in the market period?

Prob 5 10a. How responsive to demand is each in the market period?Question

Describe what a manufacturer of each product might do in the short run to increase production.

Prob 5 10b. Describe what a manufacturer of each product might do in the short run to increase production.Question

How does the long run differ for these products?

Prob 5 10c. How does the long run differ for these products?

Question

If one automobile brand has an income elasticity of demand of 1.5 and another has an income elasticity equal to −0.3, what would account for the difference? Give an example of a specific brand for each type of car.

Prob 5 11. If one automobile brand has an income elasticity of demand of 1.5 and another has an income elasticity equal to −0.3, what would account for the difference? Give an example of a specific brand for each type of car.Question

Suppose you estimated the cross elasticities of demand for three pairs of products and came up with the following three values: 2.3, 0.1, −1.7. What could you conclude about these three pairs of products? If you wanted to know if two products from two different firms competed with each other in the marketplace, what would you look for?

Prob 5 12. Suppose you estimated the cross elasticities of demand for three pairs of products and came up with the following three values: 2.3, 0.1, −1.7. What could you conclude about these three pairs of products? If you wanted to know if two products from two different firms competed with each other in the marketplace, what would you look for?

In the News

Question

A February 24, 2012, New York Times article titled “Access to the Car Pool Lane Can Be Yours, for a Price” describes the growing number of cities implementing express toll lanes alongside free lanes, allowing drivers to pay to avoid traffic (with higher tolls during times of greater traffic). However, when Atlanta introduced its express tolls lanes in October 2011, hardly anyone used them, causing even greater gridlock on the free lanes. Within a week and after much criticism, Governor Nathan Deal slashed the maximum toll from $5.50 to $3.05. When the express toll lanes were put in, what did the policymakers in Atlanta believe about the elasticity of demand for using the express toll lanes? Given the evidence, were they correct? By reducing the maximum toll, how would total revenues change given the elasticity of demand of Atlanta motorists?

Prob 5 13. A February 24, 2012, New York Times article titled “Access to the Car Pool Lane Can Be Yours, for a Price” describes the growing number of cities implementing express toll lanes alongside free lanes, allowing drivers to pay to avoid traffic (with higher tolls during times of greater traffic). However, when Atlanta introduced its express tolls lanes in October 2011, hardly anyone used them, causing even greater gridlock on the free lanes. Within a week and after much criticism, Governor Nathan Deal slashed the maximum toll from $5.50 to $3.05. When the express toll lanes were put in, what did the policymakers in Atlanta believe about the elasticity of demand for using the express toll lanes? Given the evidence, were they correct? By reducing the maximum toll, how would total revenues change given the elasticity of demand of Atlanta motorists?Question

According to a report from the Federal Trade Commission (FTC), in the first three weeks of August 2003, gas prices in Phoenix, Arizona, jumped from $1.52 to $2.11 a gallon, roughly a 40% increase, due to a ruptured pipeline between Tucson and Phoenix. The pipeline normally brought 30% of Phoenix’s fuel from a Texas refinery. During this period, Phoenix gas stations were able to buy gas from West Coast refineries at higher prices. By the end of the month, the rupture was repaired and prices returned to normal. During this three-week period of supply disruption, gasoline sales fell by 8%. What was the approximate price elasticity of demand for gasoline during this period? If the gas stations were unable to get additional gas from the West Coast and supplies fell by the full 30%, how high might have prices risen during that three-week period?

Prob 5 14. According to a report from the Federal Trade Commission (FTC), in the first three weeks of August 2003, gas prices in Phoenix, Arizona, jumped from $1.52 to $2.11 a gallon, roughly a 40% increase, due to a ruptured pipeline between Tucson and Phoenix. The pipeline normally brought 30% of Phoenix’s fuel from a Texas refinery. During this period, Phoenix gas stations were able to buy gas from West Coast refineries at higher prices. By the end of the month, the rupture was repaired and prices returned to normal. During this three-week period of supply disruption, gasoline sales fell by 8%. What was the approximate price elasticity of demand for gasoline during this period? If the gas stations were unable to get additional gas from the West Coast and supplies fell by the full 30%, how high might have prices risen during that three-week period?

Solving Problems

- Rising world wholesale fair-trade coffee bean prices force the local Dunkin’ Donuts franchise to raise its price of coffee from 89 cents to 99 cents a cup. As a result, management notices that donut sales fall from 950 to 850 a day. Shortly after the coffee price spike, the local Cinnabon franchise reduced its price on cinnamon rolls from $1.89 to $1.69. This resulted in a further decline in Dunkin’ Donuts donut sales to 750 a day.

Question

What is the cross elasticity of demand for coffee and donuts? Are these two products complements or substitutes?

Prob 5 15a. What is the cross elasticity of demand for coffee and donuts? Are these two products complements or substitutes?Question

What is the cross elasticity of demand for Dunkin’ Donuts donuts and Cinnabon cinnamon rolls? Are these two products complements or substitutes?

Prob 5 15b. What is the cross elasticity of demand for Dunkin’ Donuts donuts and Cinnabon cinnamon rolls? Are these two products complements or substitutes?

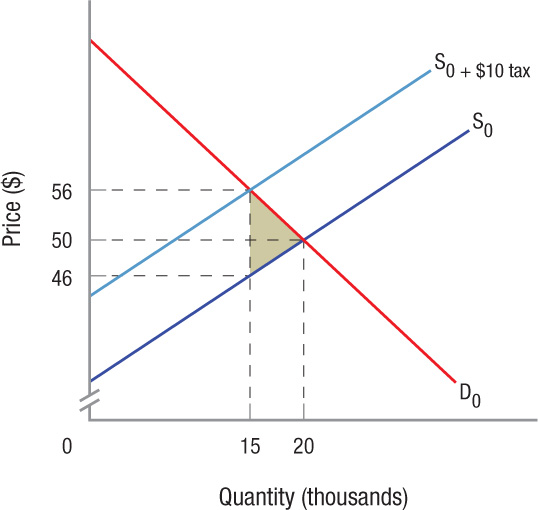

- Suppose the demand and supply for imported Kobe beef is as shown in the figure below. Now assume that the U.S. government imposes an import tax of $10 per pound on Kobe beef.

Question

How does the market price change with the imposition of the $10 per pound tax?

Prob 5 16a. How does the market price change with the imposition of the $10 per pound tax?Question

Do the buyers or the sellers of Kobe beef bear the greater burden of the tax?

Prob 5 16b. Do the buyers or the sellers of Kobe beef bear the greater burden of the tax?Question

How much tax revenue does the government collect from this market?

Prob 5 16c. How much tax revenue does the government collect from this market?Question

Calculate the approximate value of deadweight loss created in this market from the tax.

Prob 5 16d. Calculate the approximate value of deadweight loss created in this market from the tax.

Question

According to By the Numbers, how much greater is the elasticity of demand for food in Canada than in the United States? How about Mexico compared to the United States?

Prob 5 17. According to By the Numbers, how much greater is the elasticity of demand for food in Canada than in the United States? How about Mexico compared to the United States?Question

According to By the Numbers, what type of alternative-fuel car generated the highest sales in the year 2012? Which type of alternative-fuel car generated the second highest sales?

Prob 5 18. According to By the Numbers, what type of alternative-fuel car generated the highest sales in the year 2012? Which type of alternative-fuel car generated the second highest sales?