The Budget Line and Choices

To begin an analysis of consumption choices, we first must consider how a limited income and the prices of goods and services put constraints on our choices.

The Budget Line

As a student, you came to college to improve your life not only intellectually but also financially. As a college graduate, you can expect your lifetime earnings to be triple those of someone with only a high school education. Even once you have achieved these higher earnings, there will be limits on what you can buy. But first, let us return to the present.

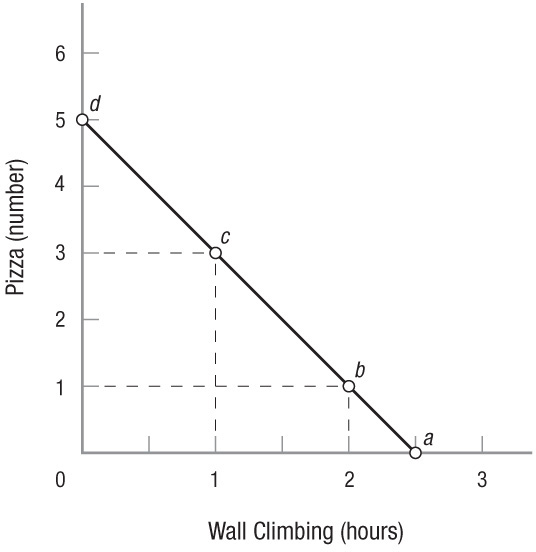

Assume you have $50 a week to spend on pizza and wall climbing. This is a proxy for a more general choice between food and entertainment. We could use different goods or more goods, but the principle would still be the same. In our specific example, if pizzas cost $10 each and an hour of wall climbing costs $20, you can climb walls for 2.5 hours or consume 5 pizzas each week, or do some combination of these two. Your options are plotted in Figure 1.

FIGURE 1

The Budget Constraint or Line When pizzas cost $10 each, wall climbing costs $20 per hour, and you have $50 a week to spend, you could buy 5 pizzas per week, 2.5 hours of wall climbing, or some combination of the two. The budget line makes clear all of the possible purchasing combinations of two products on a particular budget.

budget line Graphically illustrates the possible combinations of two goods that can be purchased with a given income, given the prices of both goods.

This budget line (constraint) is a lot like the production possibilities frontier (PPF) discussed in Chapter 2. Although you might prefer to have more of both goods, you are limited to consumption choices lying on the budget line, or inside the budget line if you want to save any part of your $50 weekly budget. As with the PPF curve, however, any points to the right of the line are unattainable for you—they exceed your available income.

In this example, the budget line makes clear that many different combinations of wall climbing and pizzas will exhaust your $50 budget. But which of these possible combinations will you select? That depends on your personal preferences. If you love pizza, you will probably make different choices than if you are a fitness fanatic who rarely consumes fatty foods. Your own preferences determine how much pleasure you can expect to get from the various possible options. We study how optimal choices are made in the next section of this chapter.

Changes to the Budget Line

The budget line, like most money matters, is subject to changes in the prices of goods or changes in income. When the price of a good or income changes, the combinations of goods that become affordable change as well. Let’s look at how the budget line changes.

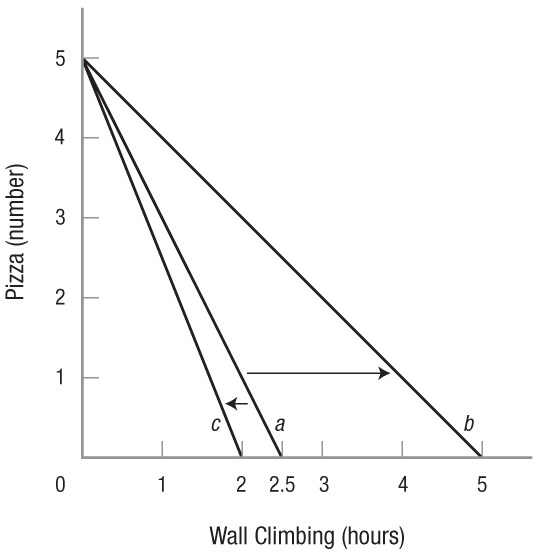

Changes to the Price of a Good Suppose the wall-climbing establishment offers a half-price discount to college students, reducing the price of wall climbing from $20 to $10 per hour. Figure 2 illustrates what happens when the price of wall climbing changes as the price of pizza stays the same. Notice that the vertical intercept remains at 5 pizzas; because the price of pizza did not change, the total number of pizzas that can be purchased for $50 is still 5. However, the reduction in the price of wall climbing allows the total number of hours that can be purchased to increase from 2.5 to 5. In Figure 2, the budget line pivots outward to budget line b, which opens up many more combinations of pizza and wall climbing that previously were unaffordable.

FIGURE 2

Changes in Price on a Budget Line Budget line a shows the consumption choices available with a budget of $50 and prices of pizza and wall climbing at $10 and $20, respectively. When the price of wall climbing decreases to $10, the budget line pivots outward to budget line b. The combinations of pizza and wall climbing that can be purchased increases. When the price of wall climbing increases to $25, the budget line pivots inward to budget line c, reducing the amounts that can be purchased.

Notice that in this case it is possible for a person to actually consume more of both pizza and wall climbing, even though the price of pizza did not change, nor did the income of $50. Suppose that originally you would spend the entire $50 on wall climbing, purchasing 2.5 hours. Because the price is now $10, the new cost of maintaining the same purchase of 2.5 hours is $25, leaving $25 to use on either more wall climbing or pizza, or both. By virtue of the price of wall climbing decreasing to $10, what this income can buy increases, even though the actual income stays the same. This is true for any point along the original budget line except for the one point at which the entire budget was spent on pizza. Only in this case does the fall in price of wall climbing not increase the number of pizzas that can be purchased.

Now suppose that instead of a discount on wall climbing, the gym decides to raise the price to $25. How would this affect the budget line? It pivots inward. In Figure 2, budget line c shows the maximum quantity of wall climbing decreasing to two hours. The increase in price reduces the combinations of both pizza and wall climbing that can be purchased with $50.

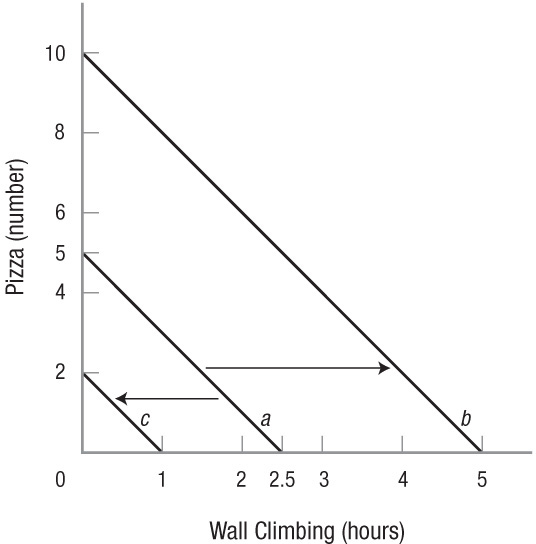

Changes to Income We now know that changes in the price of a good will pivot the budget line inward or outward along the axis for that good. But what if income itself changes? Suppose that prices of pizza and wall climbing remain at $10 and $20, respectively, but you are given extra money by your parents, allowing you to increase your entertainment budget to $100 per week. Figure 3 illustrates how an increase in income shifts your budget line outward to budget line b in a parallel fashion. Because $100 is double the original income, you can now afford twice as many pizzas and wall climbing hours as before as long as prices do not change. Budget line b shows that the maximum quantity of pizza that can be purchased increases to 10 and the maximum quantity of climbing hours increases to 5.

FIGURE 3

Changes in Income on a Budget Line Budget line a shows the consumption choices available with a budget of $50 and prices of pizza and wall climbing at $10 and $20, respectively. When the budget increases to $100, the budget line shifts parallel outward to budget line b, doubling the quantities that can be purchased. When the budget falls to $20, the budget line shifts inward to budget line c, reducing the amounts that can be purchased.

Smaller Cars and Larger Homes: A Permanent Trend?

Housing and auto transportation are the two largest monthly expenditures of a typical American household. As the prices of homes and cars change, along with the costs associated with their maintenance, the types of homes and cars consumers buy change as well.

The average home price in the United States fell by nearly 20% from 2006 to 2012, while the average price of a new car rose by nearly 20% over this same period. Although the effect of these price changes on consumption is predictable, other factors influence consumption patterns as well.

Unlike most consumer goods, individuals rarely buy homes and cars outright, but instead lease them or borrow money to pay them off over time. Therefore, an important factor influencing how homes and autos affect one’s budget is the interest rate for borrowing. Further, maintaining a house or a car is not limited to the monthly payment. Complementary items, such as property taxes, utility bills, and furniture expenses affect the cost of home ownership, while gas prices and auto insurance premiums affect auto purchases.

Has there been a change in the costs of home and auto ownership?

From 2006 to 2012, mortgage interest rates declined significantly, from an average of 6% to 3%. As mortgage interest rates fell, housing payments fell, allowing people to seek larger homes that are now affordable with the same budget. The opposite occurred in the auto industry, as gas prices rose from an average of $2.50 per gallon in 2006 to $3.60 per gallon in 2012. As gasoline prices increased, transportation costs rose significantly, causing people to seek smaller and more fuel-efficient cars.

Changes in the costs of home and automobile ownership lead individuals to adjust their consumption habits as their budgets adjust. As a result, smaller cars and larger homes have been a trend for much of the past decade. Whether this trend continues depends on how prices, which play a critical role in the budget line, adjust in the future.

Like prices, we can analyze the effect of a decrease in income on the budget line as well. Suppose increased expenses elsewhere force you to cut back on entertainment spending from $50 to $20 per week. Figure 3 shows how the reduced income shifts the budget line parallel inward to budget line c.

Now that we have analyzed how budget lines determine what we can afford, we must now answer the important question of what combination of goods and services achieves the highest satisfaction. One approach is to use marginal utility analysis, which we turn to next.

THE BUDGET LINE AND CHOICES

- The budget line graphically illustrates the limits on purchases for a given income (budget).

- Changes in the price of a good cause the budget line to pivot inward or outward, affecting the combinations of goods that can be afforded.

- When the price of one good decreases, perceived income increases, allowing one to purchase more of both goods.

- Changes in income (budget) cause a parallel shift in the budget line.

QUESTION: Suppose that each week you eat ten meals on campus at $7.50 each and five meals off campus at $15 each. What is your total spending on meals? Suppose the price of off-campus meals decreases to $10. Explain how you can eat more meals in both locations (on campus and off campus), even though the price of on-campus meals stayed the same.

The total amount spent on meals each week is (10 × $7.50) + (5 × $15) = $150. If the price of off-campus meals decreases to $10, the cost of maintaining the same routine as before (10 meals on campus and 5 meals off campus) falls to $125, leaving $25 left over. This extra money (savings from the price decrease) can be used to purchase more meals at either location, including more meals on campus.