Questions and Problems

Check Your Understanding

Question

Are McDonald’s and Starbucks monopolies? Why or why not?

Prob 9 1. Are McDonald’s and Starbucks monopolies? Why or why not?Question

Explain why MR < P for the monopolist, but MR = P for perfectly competitive firms.

Prob 9 2. Explain why MR < P for the monopolist, but MR = P for perfectly competitive firms.Question

What do economists mean when they call monopolies inefficient? What is the deadweight loss of monopoly?

Prob 9 3. What do economists mean when they call monopolies inefficient? What is the deadweight loss of monopoly?Question

Why are monopoly firms able to earn long-run economic profits while perfectly competitive firms cannot?

Prob 9 4. Why are monopoly firms able to earn long-run economic profits while perfectly competitive firms cannot?Question

Under what market conditions would a firm find it easier to engage in price discrimination?

Prob 9 5. Under what market conditions would a firm find it easier to engage in price discrimination?Question

What is a natural monopoly and why is such a monopoly often regulated by government?

Prob 9 6. What is a natural monopoly and why is such a monopoly often regulated by government?

Apply the Concepts

Question

How important is the existence of a significant barrier to entry to maintaining a monopoly? What would be the result if a monopoly market could easily be entered? Why might a monopoly in a high-tech field, such as computers, the Internet, and consumer electronics be rather short-lived?

Prob 9 7. How important is the existence of a significant barrier to entry to maintaining a monopoly? What would be the result if a monopoly market could easily be entered? Why might a monopoly in a high-tech field, such as computers, the Internet, and consumer electronics be rather short-lived?Question

My dentist recently recommended that I have a tooth replaced with a titanium pin inserted in my jaw and capped with a crown. I went to an oral surgeon to have the tooth removed and the pin inserted. The bill for the procedure was $300 to remove the tooth and $1,500 to insert the titanium pin. Removing the tooth and inserting the pin each took roughly the same amount of time. Because the cost of the pin is negligible and both parts of the procedure took the same amount of time, why would the oral surgeon charge 5 times as much to set the pin as to pull the tooth? (Hint: Market power and level of competition underlies the answer.)

Prob 9 8. My dentist recently recommended that I have a tooth replaced with a titanium pin inserted in my jaw and capped with a crown. I went to an oral surgeon to have the tooth removed and the pin inserted. The bill for the procedure was $300 to remove the tooth and $1,500 to insert the titanium pin. Removing the tooth and inserting the pin each took roughly the same amount of time. Because the cost of the pin is negligible and both parts of the procedure took the same amount of time, why would the oral surgeon charge 5 times as much to set the pin as to pull the tooth? (Hint: Market power and level of competition underlies the answer.)Question

The taxi industry in many large cities spends millions of dollars lobbying local policymakers not to build rail links connecting airports to the city center, even if such mass transportation infrastructure would benefit many consumers traveling to and from the airport. Explain why such actions by the taxi industry are taken. Then, explain why taxi owners in cities without airport rail links are less likely to invest in fuel efficient cars and in-taxi technologies such as televisions and Internet access.

Prob 9 9. The taxi industry in many large cities spends millions of dollars lobbying local policymakers not to build rail links connecting airports to the city center, even if such mass transportation infrastructure would benefit many consumers traveling to and from the airport. Explain why such actions by the taxi industry are taken. Then, explain why taxi owners in cities without airport rail links are less likely to invest in fuel efficient cars and in-taxi technologies such as televisions and Internet access.Question

If the Miami Heat can sell five courtside seats for $2,000 each or six courtside seats if it reduces the price to $1,600 each, what is the marginal revenue of the sixth seat? Should the owner make this sixth seat available? If all six seats can be sold for $1,800 each, would this make the sixth seat worth selling? (Hint: What costs are involved with selling the sixth seat?)

Prob 9 10. If the Miami Heat can sell five courtside seats for $2,000 each or six courtside seats if it reduces the price to $1,600 each, what is the marginal revenue of the sixth seat? Should the owner make this sixth seat available? If all six seats can be sold for $1,800 each, would this make the sixth seat worth selling? (Hint: What costs are involved with selling the sixth seat?)Question

Sally owns the only cake shop in town (she is a monopolist). At a quantity of five, the marginal cost of producing one more cake is $12, while the marginal revenue from selling one more cake is $10. In order for Sally to maximize profits, should she increase or decrease output? Should she increase or decrease prices? Explain.

Prob 9 11. Sally owns the only cake shop in town (she is a monopolist). At a quantity of five, the marginal cost of producing one more cake is $12, while the marginal revenue from selling one more cake is $10. In order for Sally to maximize profits, should she increase or decrease output? Should she increase or decrease prices? Explain.Question

Airlines that compete against one another have at times merged with each other to create a larger airline. What are some factors that would determine whether such a merger would constitute an uncompetitive environment according to antitrust law?

Prob 9 12. Airlines that compete against one another have at times merged with each other to create a larger airline. What are some factors that would determine whether such a merger would constitute an uncompetitive environment according to antitrust law?

In the News

Question

In July 2012, a court found several electronics manufacturers guilty of price-fixing LCD television and computer panels in one of the largest price-fixing cases in history (“What the $1.1 Billion LCD Price-Fixing Settlement Means for You,” CNN Money, July 16, 2012). The alleged actions involved many major manufacturers, including Toshiba, Samsung, and Sharp. The total settlement that manufacturers paid to compensate victims of the scheme came to an astounding $1.12 billion. What potential benefits do companies gain by working together to fix prices on a good? Why do companies choose to engage in such unlawful behavior despite the risk of being caught and having to pay significant fines?

Prob 9 13. In July 2012, a court found several electronics manufacturers guilty of price-fixing LCD television and computer panels in one of the largest price-fixing cases in history (“What the $1.1 Billion LCD Price-Fixing Settlement Means for You,” CNN Money, July 16, 2012). The alleged actions involved many major manufacturers, including Toshiba, Samsung, and Sharp. The total settlement that manufacturers paid to compensate victims of the scheme came to an astounding $1.12 billion. What potential benefits do companies gain by working together to fix prices on a good? Why do companies choose to engage in such unlawful behavior despite the risk of being caught and having to pay significant fines?Question

Being number one in any business attracts a lot of attention. As The Economist (December 17, 2005) noted,

As soon as a firm climbs above the sharp elbows of its rivals, it starts getting pelted with the eggs of anti-business activities. People who hate big business aim high. So while big, bad Wal-Mart is pilloried, Target has in the past couple of years blithely cut the benefits of its non-union workers. And when was the last time you saw an anti-globalization mob destroy a Burger King outlet?

Describe some of the benefits of being number two in a large industry. In terms of total revenues (sales), name the number one and two firms in the following industries: major auto manufacturers, major drug manufacturers, and major integrated oil and gas.Prob 9 14. Being number one in any business attracts a lot of attention. As The Economist (December 17, 2005) noted,

As soon as a firm climbs above the sharp elbows of its rivals, it starts getting pelted with the eggs of anti-business activities. People who hate big business aim high. So while big, bad Wal-Mart is pilloried, Target has in the past couple of years blithely cut the benefits of its non-union workers. And when was the last time you saw an anti-globalization mob destroy a Burger King outlet?

Describe some of the benefits of being number two in a large industry. In terms of total revenues (sales), name the number one and two firms in the following industries: major auto manufacturers, major drug manufacturers, and major integrated oil and gas.

Solving Problems

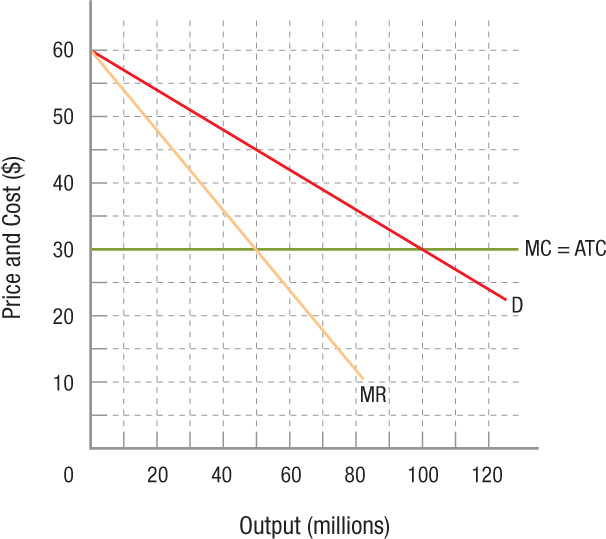

- Using the figure for a monopoly firm below, answer the following questions.

Question

What will be the monopoly price, output, and profit for this firm?

Prob 9 15a. What will be the monopoly price, output, and profit for this firm?Question

If this monopolist could perfectly price discriminate, what would profit equal?

Prob 9 15b. If this monopolist could perfectly price discriminate, what would profit equal?Question

If this industry were competitive, what would be the price, output, and profit?

Prob 9 15c. If this industry were competitive, what would be the price, output, and profit?Question

How large (in dollars) is the deadweight loss from this monopolist?

Prob 9 15d. How large (in dollars) is the deadweight loss from this monopolist?

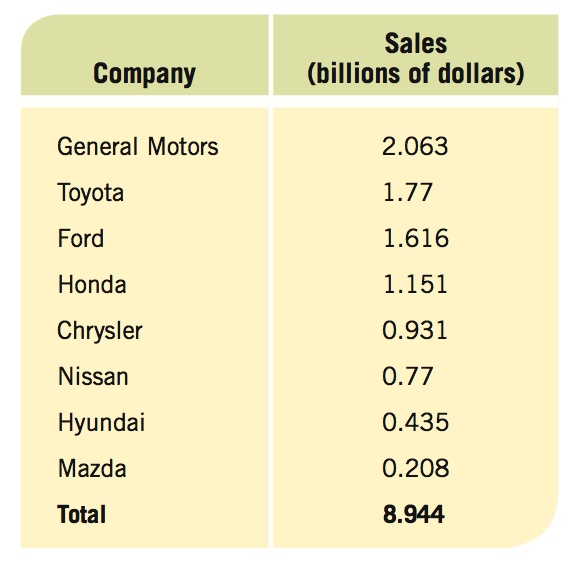

- Assume the following table represents the sales figures for the eight largest firms in the auto industry in the United States:

Question

Compute the four-firm concentration ratio for the industry.

Prob 9 16a. Compute the four-firm concentration ratio for the industry.Question

Compute the HHI for the industry (assuming the industry contains just these eight firms).

Prob 9 16b. Compute the HHI for the industry (assuming the industry contains just these eight firms).Question

Assuming the industry is represented by these eight firms, if Toyota and Ford wanted to merge, and you were the head of the Department of Justice, would you permit the merger? Why or why not? (Hint: Calculate the new values from parts a and b assuming the merger takes place.) How about if Hyundai and Mazda wanted to merge?

Prob 9 16c. Assuming the industry is represented by these eight firms, if Toyota and Ford wanted to merge, and you were the head of the Department of Justice, would you permit the merger? Why or why not? (Hint: Calculate the new values from parts a and b assuming the merger takes place.) How about if Hyundai and Mazda wanted to merge?

Question

According to By the Numbers, assuming that the number of viewers for each of the five games in the 2012 NBA Finals were the same, approximately how many more people watched the 2012 Super Bowl than the final game of the 2012 NBA Finals?

Prob 9 17. According to By the Numbers, assuming that the number of viewers for each of the five games in the 2012 NBA Finals were the same, approximately how many more people watched the 2012 Super Bowl than the final game of the 2012 NBA Finals?Question

According to By the Numbers, the annual growth in demand for electricity has fallen over the past half-century but remained positive nearly every year. In what years did actual electricity demand fall (negative growth in demand)?

Prob 9 18. According to By the Numbers, the annual growth in demand for electricity has fallen over the past half-century but remained positive nearly every year. In what years did actual electricity demand fall (negative growth in demand)?