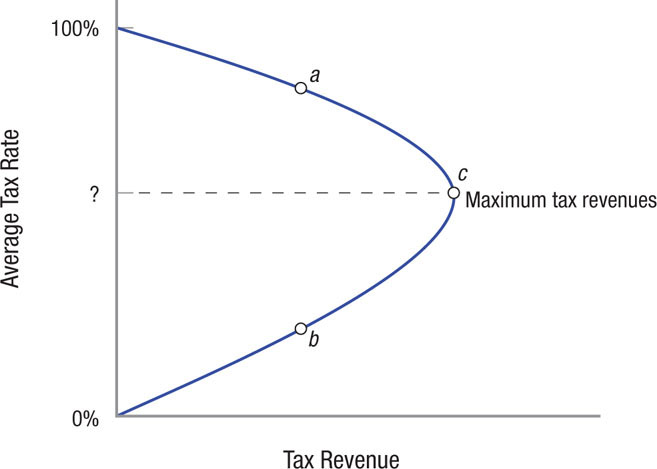

The Laffer Curve The Laffer curve shows the relationship between average tax rates and total tax revenues. As the tax rate rises from 0%, tax revenues increase. At point c, tax revenues are maximized. If tax rates continue to rise, Laffer’s argument was that the government could obtain revenues at point a based on a high tax rate, and equal revenues at point b based on a lower tax rate. The tax rates that correspond to points b and c are often debated by economists.