Questions and Problems

Check Your Understanding

Question

Describe the role required reserves play in determining how much money the banking system creates.

Prob 12 1. Describe the role required reserves play in determining how much money the banking system creates.Question

Why are checking accounts (demand deposits) considered a liability to the bank?

Prob 12 2. Why are checking accounts (demand deposits) considered a liability to the bank?Question

Why do leakages reduce the money multiplier from its potential?

Prob 12 3. Why do leakages reduce the money multiplier from its potential?Question

What is the most common tool used by the Federal Reserve to conduct monetary policy and how does it affect interest rates?

Prob 12 4. What is the most common tool used by the Federal Reserve to conduct monetary policy and how does it affect interest rates?Question

For what type of borrowing do the federal funds rate and the discount rate apply? Which rate is used in more transactions in the United States?

Prob 12 5. For what type of borrowing do the federal funds rate and the discount rate apply? Which rate is used in more transactions in the United States?Question

Why are monetary policy lags generally shorter than fiscal policy lags?

Prob 12 6. Why are monetary policy lags generally shorter than fiscal policy lags?

Apply the Concepts

Question

The U.S. government produces billions of dollars in banknotes and coins for use in everyday transactions. Explain why currency alone does not represent money creation.

Prob 12 7. The U.S. government produces billions of dollars in banknotes and coins for use in everyday transactions. Explain why currency alone does not represent money creation.Question

During an economic boom, banks tend to increase their willingness to lend. How does this trend influence the actual money multiplier?

Prob 12 8. During an economic boom, banks tend to increase their willingness to lend. How does this trend influence the actual money multiplier?Question

The Federal Deposit Insurance Corporation (FDIC) insures individual bank accounts up to $250,000 per account. Does the existence of this insurance eliminate the need for reserve requirements? Does it essentially prevent “runs” on banks?

Prob 12 9. The Federal Deposit Insurance Corporation (FDIC) insures individual bank accounts up to $250,000 per account. Does the existence of this insurance eliminate the need for reserve requirements? Does it essentially prevent “runs” on banks?Question

Many central banks in the world are independent in the sense that they are partially isolated from short-run political considerations and pressures. How is this independence attained? How important is this independence to policymaking at the Federal Reserve?

Prob 12 10. Many central banks in the world are independent in the sense that they are partially isolated from short-run political considerations and pressures. How is this independence attained? How important is this independence to policymaking at the Federal Reserve?Question

Alan Greenspan, a former chairman of the Fed, noted that “the Federal Reserve has to be independent in its actions and as an institution, because if Federal Reserve independence is in any way compromised, it undercuts our capability of protecting the value of the currency in society.” What is so important about protecting the value of the currency? How does Fed independence help?

Prob 12 11. Alan Greenspan, a former chairman of the Fed, noted that “the Federal Reserve has to be independent in its actions and as an institution, because if Federal Reserve independence is in any way compromised, it undercuts our capability of protecting the value of the currency in society.” What is so important about protecting the value of the currency? How does Fed independence help?Question

The reserve requirement sets the required percentage of vault cash plus deposits with the regional Federal Reserve Banks that banks must keep for their deposits. Many banks have widespread branches and ATMs. Would the existence of branches and ATMs affect the level of excess reserves (above those required) that banks hold? Why or why not? What would be the effect on the actual money multiplier?

Prob 12 12. The reserve requirement sets the required percentage of vault cash plus deposits with the regional Federal Reserve Banks that banks must keep for their deposits. Many banks have widespread branches and ATMs. Would the existence of branches and ATMs affect the level of excess reserves (above those required) that banks hold? Why or why not? What would be the effect on the actual money multiplier?

In the News

Question

Eric Keetch offered an interesting anecdote in the Financial Times (August 12, 2009):

In a sleepy European holiday resort town in a depressed economy and therefore no visitors, there is great excitement when a wealthy Russian guest appears in the local hotel reception, announces that he intends to stay for an extended period and places a €100 note on the counter as surety while he demands to be shown the available rooms.

While he is being shown the room, the hotelier takes the €100 note round to his butcher, who is pressing for payment.

The butcher in turn pays his wholesaler who, in turn, pays his farmer supplier.

The farmer takes the note round to his favorite “good time girl” to whom he owes €100 for services rendered. She, in turn, rushes round to the hotel to settle her bill for rooms provided on credit.

In the meantime, the Russian returns to the lobby, announces that no rooms are satisfactory, takes back his €100 note and leaves, never to be seen again.

No new money has been introduced into the local economy, but everyone’s debts have been settled.

What’s going on here? In the end, no new money was introduced into the town, but all debts were paid. Is the money multiplier infinite? How do you explain what has happened? Did local GDP increase as a result of all debts being paid?Prob 12 13. Eric Keetch offered an interesting anecdote in the Financial Times (August 12, 2009):In a sleepy European holiday resort town in a depressed economy and therefore no visitors, there is great excitement when a wealthy Russian guest appears in the local hotel reception, announces that he intends to stay for an extended period and places a €100 note on the counter as surety while he demands to be shown the available rooms.While he is being shown the room, the hotelier takes the €100 note round to his butcher, who is pressing for payment.The butcher in turn pays his wholesaler who, in turn, pays his farmer supplier.The farmer takes the note round to his favorite “good time girl” to whom he owes €100 for services rendered. She, in turn, rushes round to the hotel to settle her bill for rooms provided on credit.In the meantime, the Russian returns to the lobby, announces that no rooms are satisfactory, takes back his €100 note and leaves, never to be seen again.No new money has been introduced into the local economy, but everyone’s debts have been settled.What’s going on here? In the end, no new money was introduced into the town, but all debts were paid. Is the money multiplier infinite? How do you explain what has happened? Did local GDP increase as a result of all debts being paid?Question

In the December 12, 2012, FOMC meeting, Chairman Ben Bernanke announced the start of QE4, a new round of quantitative easing in which the Fed committed to purchasing $85 billion in assets per month in order to keep the federal funds rate near 0% until the unemployment rate fell below 6.5%. The effect of this announcement resulted in the expectation that interest rates will remain extremely low until at least mid-2015. How might this announcement affect the lives of ordinary individuals, and what impact might this have on the economy?

Prob 12 14. In the December 12, 2012, FOMC meeting, Chairman Ben Bernanke announced the start of QE4, a new round of quantitative easing in which the Fed committed to purchasing $85 billion in assets per month in order to keep the federal funds rate near 0% until the unemployment rate fell below 6.5%. The effect of this announcement resulted in the expectation that interest rates will remain extremely low until at least mid-2015. How might this announcement affect the lives of ordinary individuals, and what impact might this have on the economy?

Solving Problems

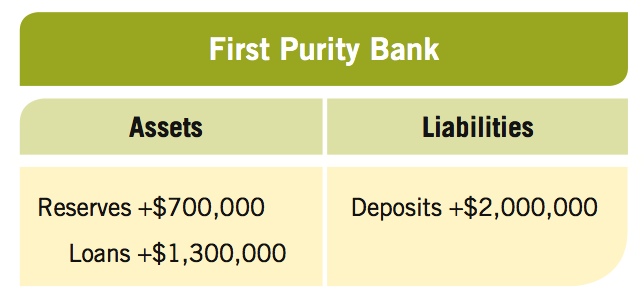

- Assume that First Purity Bank begins with the balance sheet below and is fully loaned-up. Answer the questions that follow.

Question

What is the reserve requirement equal to?

Prob 12 15a. What is the reserve requirement equal to?Question

If the bank receives a new deposit of $1 million and the bank wants to remain fully loaned-up, how much of this new deposit will the bank loan out?

Prob 12 15b. If the bank receives a new deposit of $1 million and the bank wants to remain fully loaned-up, how much of this new deposit will the bank loan out?Question

When the new deposit to First Purity Bank works itself through the entire banking system (assume all banks keep fully loaned-up), by how much will total deposits, total loans, and total reserves increase?

Prob 12 15c. When the new deposit to First Purity Bank works itself through the entire banking system (assume all banks keep fully loaned-up), by how much will total deposits, total loans, and total reserves increase?Question

What is the potential money multiplier equal to in this case?

Prob 12 15d. What is the potential money multiplier equal to in this case?

Question

Suppose that the leakage-adjusted money multiplier can be calculated using a modification of our money multiplier formula:

1/(Reserve Requirement + Excess Reserves + Cash Holdings)

where each component in the denominator is expressed as a percentage.

Suppose that the reserve requirement is 25%, but banks on average hold an additional 10% of their deposits as excess reserves. Further, assume that individuals and businesses choose to hold 15% of their borrowed funds in cash. Compare the potential money multiplier with the leakage-adjusted money multiplier. Does the existence of leakages make a significant impact on the ability to conduct monetary policy? Explain why or why not.Prob 12 16. Suppose that the leakage-adjusted money multiplier can be calculated using a modification of our money multiplier formula:1/(Reserve Requirement + Excess Reserves + Cash Holdings)where each component in the denominator is expressed as a percentage.Suppose that the reserve requirement is 25%, but banks on average hold an additional 10% of their deposits as excess reserves. Further, assume that individuals and businesses choose to hold 15% of their borrowed funds in cash. Compare the potential money multiplier with the leakage-adjusted money multiplier. Does the existence of leakages make a significant impact on the ability to conduct monetary policy? Explain why or why not.

Question

According to By the Numbers, by what percentage did the U.S. monetary base increase from 2000 to 2005? How about from 2005 to 2010? Why are the percentage changes in these periods so different?

Prob 12 17. According to By the Numbers, by what percentage did the U.S. monetary base increase from 2000 to 2005? How about from 2005 to 2010? Why are the percentage changes in these periods so different?Question

According to By the Numbers, during which decade did the greatest number of U.S. banks fail? During which decade did the second most number of U.S. banks fail?

Prob 12 18. According to By the Numbers, during which decade did the greatest number of U.S. banks fail? During which decade did the second most number of U.S. banks fail?