Modern Monetary Policy

easy money, quantitative easing, or accommodative monetary policy Fed actions designed to increase excess reserves and the money supply to stimulate the economy (expand income and employment). See also expansionary monetary policy.

tight money or restrictive monetary policy Fed actions designed to decrease excess reserves and the money supply to shrink income and employment, usually to fight inflation. See also contractionary monetary policy.

When the Fed engages in expansionary monetary policy, it is buying bonds using money it creates by adding to the existing bank reserves deposited at the Fed. Other terms used to describe this process include easy money, quantitative easing, or accommodative monetary policy. It is designed to increase excess reserves and the money supply, and ultimately reduce interest rates to stimulate the economy and expand income and employment. The opposite of an expansionary policy is contractionary monetary policy, also referred to as tight money or restrictive monetary policy. Tight money policies are designed to shrink income and employment, usually in the interest of fighting inflation. The Fed brings about tight monetary policy by selling bonds, thereby pulling reserves from the financial system.

The Federal Reserve Act gives the Board of Governors significant discretion over conducting monetary policy. It sets out goals but leaves it up to the discretion of the Board of Governors how best to reach these objectives. As we have seen, the Fed attempts to frame monetary policy to keep inflation low over the long run, but also to maintain enough flexibility to respond in the short run to demand and supply shocks.

Rules Versus Discretion

monetary rule Keeps the growth of money stocks such as M1 or M2 on a steady path, following the equation of exchange (or quantity theory), to set a long-run path for the economy that keeps inflation in check.

The complexities of monetary policy, especially in dealing with a supply shock, have led some economists, most notably Milton Friedman, to call for a monetary rule to guide monetary policymakers. Other economists argue that modern economies are too complex to be managed by a few simple rules. Constantly changing institutions, economic behaviors, and technologies mean that some discretion, and perhaps even complete discretion, is essential for policymakers. Also, if policymakers could use a simple and efficient rule on which to base successful monetary policy, they would have enough incentive to adopt it voluntarily, because it would guarantee success and their job would be much easier.

Milton Friedman argued that variations in monetary growth were a major source of instability in the economy. To counter this problem, which is compounded by the long and variable lags in discretionary monetary policy, Friedman advocated the adoption of monetary growth rules. Specifically, he proposed increasing the money supply by a set percentage every year, at a level consistent with long-term price stability and economic growth.

Friedman and other monetarists, like the classical economists before them, believed the economy to be inherently stable. If they are correct, then generating a steady increase in the money supply should reduce the potentially destabilizing effects monetary policy can have on the economy.

If the change in aggregate demand is small or temporary, a monetary growth rule will probably function well enough. But if the shock is large, persistent, or continual, as was the case during the Great Depression and the recent financial crisis, a discretionary monetary policy aimed at bringing the economy back to full employment more quickly would probably be preferred.

In some cases, a monetary rule keeps policymakers from making things worse by keeping them from doing anything. Yet, the monetary rule also prevents policymakers from aiding the economy when a policy change is needed. Policymakers argue that they need to be able to balance one goal against another, rather than being tied down by strict rules that in the end do nothing.

inflation targeting The central bank sets a target on the inflation rate (usually around 2% per year) and adjusts monetary policy to keep inflation in that range.

Monetary targeting, the practice of setting a fixed rate for money supply growth, suggested by Milton Friedman, was the focus of the Fed from 1970 to 1980 but wasn’t considered successful.

The alternative to setting money growth rules that modern monetary authorities around the world have tried is the simple rule of inflation targeting, which is setting targets on the inflation rate, usually around 2% per year. If inflation (or the forecasted rate of inflation) exceeds the target, contractionary policy is employed; if inflation falls below the target, expansionary policy is used. Inflation targeting has the virtue of explicitly iterating that the long-run goal of monetary policy is price stability.

Assume once more that a negative demand shock hits the economy. Inflation targeting means that discretionary expansionary monetary policy will be used to bring the economy back to full employment. But now consider a negative supply shock from an increase in the price of energy or some other raw material. Inflation targeting means that contractionary monetary policy should be used to reduce the inflation spiral. As we saw, however, contractionary policy would deepen the recession, and in reality, few monetary authorities would stick to an inflation-targeting approach in this situation. They would be more likely to stimulate the economy slightly, hoping to move it back to full employment with only a small increase in inflation. The result is that inflation targeting could soon lose its credibility and effectiveness.

The Federal Funds Target and the Taylor Rule

Taylor rule A rule for the federal funds target that suggests that the target is equal to 2% + Current Inflation Rate + 1/2(Inflation Gap) + 1/2(Output Gap). Alternatively, it is equal to 2% plus the current inflation rate plus 1/2 times the difference between the current inflation rate and the Fed’s inflation target rate plus 1/2 times the output gap (current GDP minus potential GDP).

If not monetary targeting or inflation targeting, what other rule can the Fed use? We know that the Fed alters the federal funds rate as its primary monetary policy instrument. Under what circumstances will the Fed change its federal funds target? The Fed is concerned with two major factors: preventing inflation and preventing and moderating recessions. Professor John Taylor of Stanford University studied the Fed and how it makes decisions and he empirically found that the Fed tended to follow a general rule that has become known as the Taylor rule for federal funds targeting:

Federal Funds Target Rate = 2 + Current Inflation Rate + 1/2(Inflation Gap) + 1/2(Output Gap)

The Fed’s inflation target is typically 2%, the inflation gap is the current inflation rate minus the Fed’s inflation target, and the output gap is current GDP minus potential GDP. If the Fed tries to target inflation around 2%, the current inflation rate is 4%, and output is 3% below potential GDP, then the target federal funds rate according to the Taylor rule is:

Notice that the high rate of inflation (4%) drives the federal funds target rate upward while the fact that the economy is below its potential reduces the rate. If the economy were operating at its potential, the federal funds target would be 7%, because the Fed would not be worried about a recession and would be focused on controlling inflation.

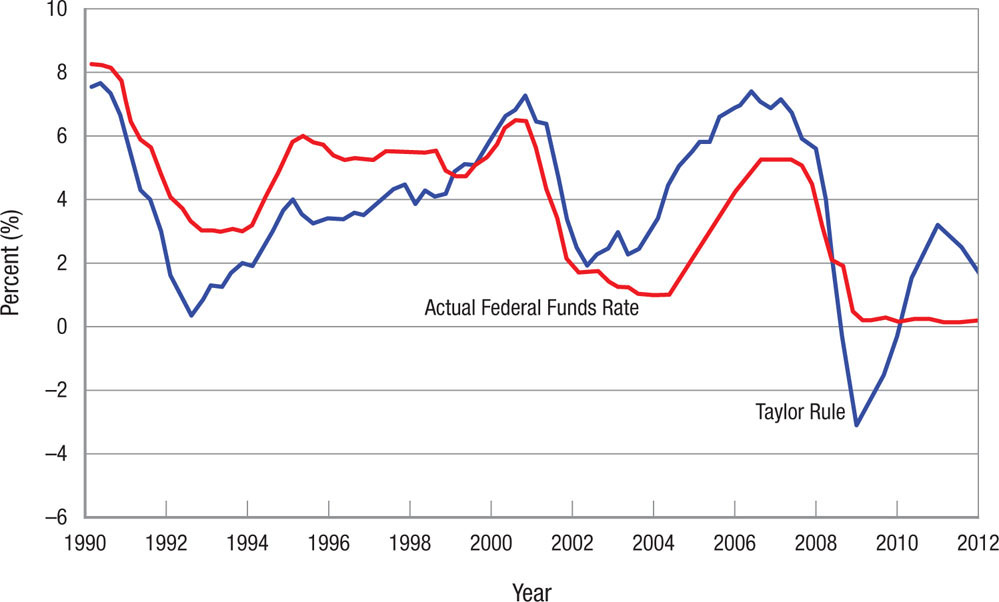

Figure 6 shows how closely the Taylor rule tracks the actual federal funds rate. Some economists have blamed the large spread between the two rates during the period between 2003 and 2007 for the housing boom that precipitated the financial crisis in 2008. They argue that the extremely low interest rates fueled the housing boom.

FIGURE 6

Actual Federal Funds Rate and the Taylor Rule The Taylor rule tracks the actual federal funds rate quite closely. Some economists have argued that the low federal funds rate during the period from 2003 to 2007 was the cause of the housing boom that precipitated the financial crisis in 2008 and the ensuing recession.

More important, what the Taylor rule tells us is that when the Fed meets to change the federal funds target rate, the two most important factors are whether inflation is different from the Fed’s target (typically 2%) and whether output varies from potential GDP. If output is below its potential, a recession threatens and the Fed will lower its target, and vice versa when output exceeds potential and inflation threatens to exceed the Fed’s target.

A Recap of the Fed’s Policy Tools

Now is a good time to summarize the monetary policy actions that the Fed can take to achieve its twin goals of price stability and full employment, Qf.

When output exceeds potential output (Q > Qf), firms are operating above their capacities and costs will rise, adding an inflationary threat that the Fed wants to avoid. Therefore, the Fed would increase the real interest rate to cool the economy. When output is below potential (Q < Qf), the Fed’s goal is to drive the economy back to its potential and avoid a recession and the losses associated with an economy below full employment. The Fed does this by lowering the real interest rate. This reflects the Fed’s desire to fight recession when output is below full employment and fight inflation when output exceeds its potential.

Today, monetary authorities set a target interest rate and then use open market operations to adjust reserves and keep the federal funds rate near this level. The Fed’s interest target is the level that will keep the economy near potential GDP and/or keep inflationary pressures in check. When GDP is below its potential and a recession threatens the economy, the Fed uses expansionary policy to lower interest rates, expanding investment, consumption, and exports. When output is above potential GDP and inflation threatens, the Fed uses a higher interest rate target to slow the economy and reduce inflationary pressure.

When inflation becomes a problem in the short run (assuming initially no change in output), the Fed will act in a similar manner. It will increase interest rates to slow the economy and reduce inflationary pressures. Raising interest rates is never a politically popular act, but the Fed will be forced to balance future economic growth against rising inflationary expectations. As former Fed Chairman William McChesney Martin said, “The job of a good central banker is to take away the punchbowl just as the party gets going.”

Transparency and the Federal Reserve

How does the Fed convey information about its actions, and why is this important? For many years, decisions were made in secrecy, and often they were executed in secrecy: The public did not know that monetary policy was being changed. Because monetary policy affects the economy, the Fed’s secrecy stimulated much speculation in financial markets about current and future Fed actions. Uncertainty often led to various counterproductive actions by people guessing incorrectly. These activities were highly inefficient.

When Alan Greenspan became head of the Fed in 1987, this policy of secrecy started to change. By 1994, the Fed released a policy statement each time it changed interest rates, and by 1998 it included a “tilt” statement forecasting what would probably happen in the next month or two. By 2000, the FOMC released a statement after each of its eight yearly meetings even if policy remained the same. As the chapter opener describes, the FOMC statement is now one of the most anticipated pieces of economic news.

This new openness has come about because the Fed recognized that monetary policy is mitigated when financial actors take counterproductive actions when they are uncertain about what the Fed will do. In the words of William Poole, former president of the Federal Reserve Bank of St. Louis,

Explaining a policy action—elucidating the considerations that led the FOMC to decide to adjust the intended funds rate, or to leave it unchanged—is worthwhile. Over time, the accumulation of such explanations helps the market, and perhaps the FOMC itself, to understand what the policy regularities are. It is also important to understand that many—perhaps most—policy actions have precedent value…. One of the advantages of public disclosure of the reasons for policy actions is that the required explanation forces the FOMC to think through what it is doing and why.1

The Record of the Fed’s Performance

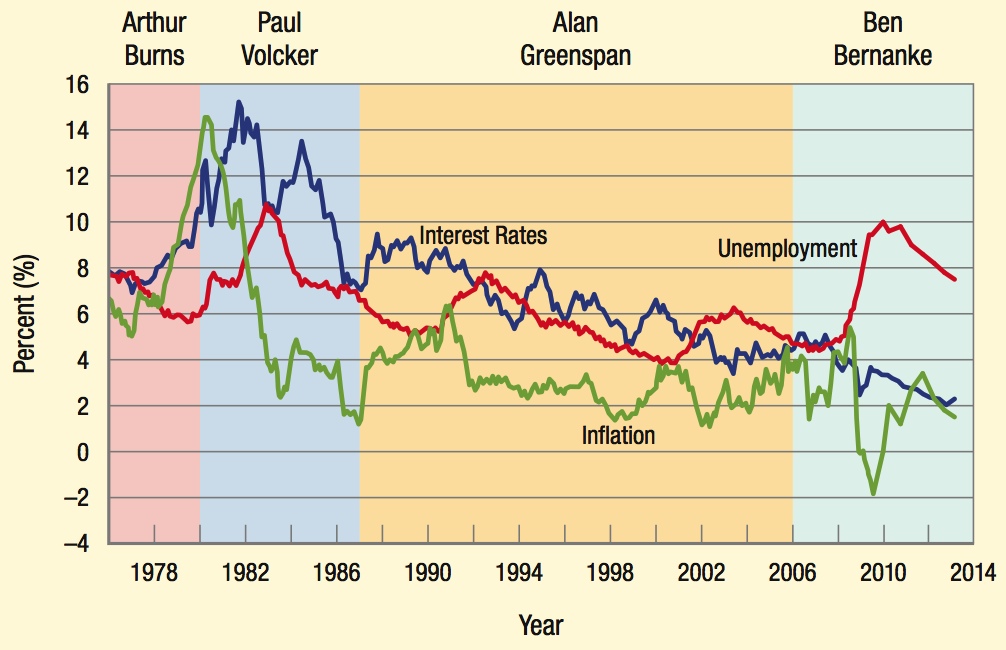

Determining how to measure the impact of Federal Reserve policy on our huge, complex economy is not easy. The figure shows how three variables—unemployment, inflation, and interest rates—have fared during the tenure of the four Fed chairmen over the last four decades.

Before 1980, when Arthur Burns headed the Fed, inflation was rising. An oil supply shock in 1973 was met with accommodative monetary policy and aggregate demand expanded.

The economy was hit with a second oil price shock in the late 1970s. By the early 1980s, inflation rose to double digits, peaking at over 14% in 1980. Paul Volcker, the head of the Fed at that time, tightened monetary policy to induce a recession (1981–1982) to reduce inflation. By the end of his term, inflation had been reduced to little more than 4%, a remarkable feat.

During the 1990s, the Greenspan Fed alternated between encouraging output growth (mid-1990s) and fighting inflation (early and late 1990s). The Fed under Greenspan did a good job of keeping the economy near full employment. Interest rates trended down and inflation was moderate during the 1990s and early 2000s. But a housing bubble, partly the result of the extremely low interest rates from 2003 to 2007, followed by its collapse in 2008, brought on a financial panic and a deep recession.

The problems stemming from the housing collapse and financial crisis became a challenge for Fed chairman Ben Bernanke. In 2008, the Fed under Bernanke lowered the fed funds rate to almost 0%. In addition, the Bernanke Fed continued to expand the monetary base by purchasing long-term assets from banks when interest rates had already hit the floor. As the chart shows, unemployment trended down and the short period of deflation in 2009 was corrected.

Fed transparency helps the public understand why it is taking certain actions. This helps the market understand what the Fed does in certain circumstances, and what the Fed is likely to do in similar situations in the future. The Fed also includes a “looking forward” or “tilt” comment after each meeting, which provides a summary of the Fed’s outlook on the economy and information on the target federal funds rate. Transparency helps the Fed implement its monetary policy.

Until very recently, the performance of monetary authorities over the previous several decades illustrated how effective discretionary monetary policy could be. Price stability was remarkable, unemployment and output levels were near full employment levels, interest rates were kept low, and economic growth was solid.

The recent global financial crisis has tested the limits of central banks in preventing economic catastrophe. On the one hand, some economists such as Janet Yellen (often referred to as “doves”) argue that greater Fed action is needed in times of economic hardship, while others (“hawks”) warn against the inflationary effects of too much monetary policy action. The concluding section of this chapter looks at the actions of the Fed and the European Central Bank in stemming the economic effects from a crisis, and how economic “doves” have gained significant influence in the way monetary policy has been implemented.

MODERN MONETARY POLICY

- In the long run, the Fed targets price stability. Low rates of inflation are most conducive to long-run economic growth.

- In the past, monetary targeting was used to control the rate of growth of the money supply. Later, an alternative approach of inflation targeting, targeting the inflation rate to around 2%, became more prevalent.

- The Fed sets a target federal funds rate and then uses open market operations to adjust reserves and keep the federal funds rate near this level.

- The Taylor rule is a general rule that ties the federal funds rate target to the inflation gap and the output gap for the economy, and has done a good job in estimating the actual federal funds rate target set by the Fed.

- When inflation rises, the Fed uses contractionary monetary policy to increase the federal funds rate to slow the economy. When the economy drifts into a recession and inflationary pressures fall, the Fed does the opposite and reduces the federal funds rate, giving the economy a boost.

- Fed transparency helps us to understand why the Fed makes particular decisions and also what the Fed will probably do in similar circumstances in the future.

QUESTION: “When central bankers aggressively bang the drum on inflation, bond investors quickly head for the exits. So it is not surprising that waves of selling have engulfed global government debt markets” (Michael Mackenzie, Financial Times, May 11, 2008, p. 23). Why should bond investors sell when the Fed or other central bankers decide that inflation is a growing problem?

When the Fed begins to view inflation as a growing problem, it usually means that some form of contractionary monetary policy is to follow. This typically means that interest rates will rise and, most important for bond investors, bond prices will fall and bondholders will incur capital losses.