Questions and Problems

Check Your Understanding

Question

Describe the balance of trade. What factors contribute to our trade deficit?

Prob 16 1. Describe the balance of trade. What factors contribute to our trade deficit?Question

Mexican immigrants working in the United States often send money back home (known as remittances) to help their families or to add to their savings account for the future. In 2012, these remittances surpassed $22 billion. How are these transfers recorded in the balance of payments accounts?

Prob 16 2. Mexican immigrants working in the United States often send money back home (known as remittances) to help their families or to add to their savings account for the future. In 2012, these remittances surpassed $22 billion. How are these transfers recorded in the balance of payments accounts?Question

What is the important difference between the current account and the capital account, given that the sum of the two values must equal 0?

Prob 16 3. What is the important difference between the current account and the capital account, given that the sum of the two values must equal 0?Question

If the euro appreciates by 30%, what will happen to imports of Mercedes-Benz automobiles in the United States?

Prob 16 4. If the euro appreciates by 30%, what will happen to imports of Mercedes-Benz automobiles in the United States?Question

Describe the difference between fixed and flexible exchange rates.

Prob 16 5. Describe the difference between fixed and flexible exchange rates.Question

Describe the difference between the nominal and real exchange rates. What does rising inflation do to a country’s real exchange rate?

Prob 16 6. Describe the difference between the nominal and real exchange rates. What does rising inflation do to a country’s real exchange rate?

Apply the Concepts

Question

Assume that global warming and especially high temperatures in Northern California have rendered it impossible for wine grapes in the Napa Valley (and all over California) to grow properly. Unable to get California wines, demand jumps dramatically for Australian wines. How would this affect the Australian dollar? Is this good for other Australian exports?

Prob 16 7. Assume that global warming and especially high temperatures in Northern California have rendered it impossible for wine grapes in the Napa Valley (and all over California) to grow properly. Unable to get California wines, demand jumps dramatically for Australian wines. How would this affect the Australian dollar? Is this good for other Australian exports?Question

If the European economies begin having a serious bout of stagflation—high rates of both unemployment and inflation—will this affect the value of the dollar? Explain.

Prob 16 8. If the European economies begin having a serious bout of stagflation—high rates of both unemployment and inflation—will this affect the value of the dollar? Explain.Question

Trace through the reasoning why monetary policy is enhanced by a flexible exchange rate system.

Prob 16 9. Trace through the reasoning why monetary policy is enhanced by a flexible exchange rate system.Question

Zimbabwe devalued its currency in mid-2006, essentially turning a $20,000 Zimbabwe bill into a $20 bill. People were permitted only three weeks during which to turn in their old currency for new notes; individuals were limited to $150 a day and companies were restricted to $7,000 a day. Who do you think were the losers from this devaluation, especially considering the limited turn-in period for the old currency?

Prob 16 10. Zimbabwe devalued its currency in mid-2006, essentially turning a $20,000 Zimbabwe bill into a $20 bill. People were permitted only three weeks during which to turn in their old currency for new notes; individuals were limited to $150 a day and companies were restricted to $7,000 a day. Who do you think were the losers from this devaluation, especially considering the limited turn-in period for the old currency?Question

Exchange rates and purchasing power parity should be the same between countries. If it costs 300 U.S. dollars to purchase an iPad in the United States and 400 Australian dollars to purchase one in Sydney, then the exchange rate between the Australian dollar and the U.S. dollar should be 4:3. Why might purchasing power parity be different from the exchange rate?

Prob 16 11. Exchange rates and purchasing power parity should be the same between countries. If it costs 300 U.S. dollars to purchase an iPad in the United States and 400 Australian dollars to purchase one in Sydney, then the exchange rate between the Australian dollar and the U.S. dollar should be 4:3. Why might purchasing power parity be different from the exchange rate?Question

When the dollar gets stronger against the major foreign currencies, does the price of French wine rise or fall in the United States? Would this be a good time to travel to Australia? What happens to U.S. exports?

Prob 16 12. When the dollar gets stronger against the major foreign currencies, does the price of French wine rise or fall in the United States? Would this be a good time to travel to Australia? What happens to U.S. exports?

In the News

Question

In the latter half of 2012, the worldwide musical hit Gangnam Style by South Korean K-pop singer Psy, contributed to a boost in tourism to South Korea (“Gangnam Brings Fans—and Tourism Revenue—to Korea,” CNBC.com, January 23, 2013). Record numbers of tourists from China, Japan, and even the United States wanting to see the Gangnam district in person helped South Korea’s economy in 2012. How does an increase in South Korean tourism affect the foreign exchange market for the South Korean won (its currency)?

Prob 16 13. In the latter half of 2012, the worldwide musical hit Gangnam Style by South Korean K-pop singer Psy, contributed to a boost in tourism to South Korea (“Gangnam Brings Fans—and Tourism Revenue—to Korea,” CNBC.com, January 23, 2013). Record numbers of tourists from China, Japan, and even the United States wanting to see the Gangnam district in person helped South Korea’s economy in 2012. How does an increase in South Korean tourism affect the foreign exchange market for the South Korean won (its currency)?Question

The Eurozone crisis has led more than one nation to consider abandoning the euro and returning to its previous currency (“Pondering a Dire Day: Leaving the Euro,” New York Times, December 12, 2011). If a nation were to exit the Eurozone and significantly devalue its currency against the euro and other major currencies, what are some implications for trade, the current account, and the standard of living for its citizens?

Prob 16 14. The Eurozone crisis has led more than one nation to consider abandoning the euro and returning to its previous currency (“Pondering a Dire Day: Leaving the Euro,” New York Times, December 12, 2011). If a nation were to exit the Eurozone and significantly devalue its currency against the euro and other major currencies, what are some implications for trade, the current account, and the standard of living for its citizens?

Solving Problems

Question

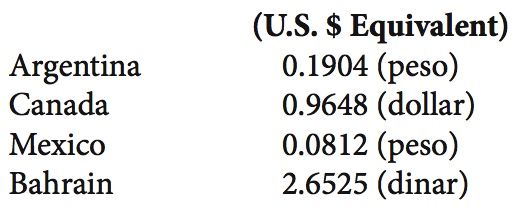

Assume that the following exchange rates prevail:

How many Mexican pesos does it take to get 1 Bahraini dinar? If you had 20 U.S. dollars, could you take a ferry ride in Canada if it cost 25 Canadian dollars? If someone gave you 50 Argentinean pesos to settle a 150 Mexican peso bet, would it be enough?Prob 16 15. Assume that the following exchange rates prevail:How many Mexican pesos does it take to get 1 Bahraini dinar? If you had 20 U.S. dollars, could you take a ferry ride in Canada if it cost 25 Canadian dollars? If someone gave you 50 Argentinean pesos to settle a 150 Mexican peso bet, would it be enough?Question

Suppose that you are given an opportunity to work in Tokyo over the summer as an English tutor, and you are provided with all living expenses and a 500,000-yen cash stipend which you plan to save and bring home. If the exchange rate is 103 yen per U.S. dollar, how much is your stipend worth in dollars if you traded your money right away? Suppose you predict that the exchange rate will change in the next few months to 92 yen per dollar. Would you receive more dollars if you wait until after the exchange rate changes?

Prob 16 16. Suppose that you are given an opportunity to work in Tokyo over the summer as an English tutor, and you are provided with all living expenses and a 500,000-yen cash stipend which you plan to save and bring home. If the exchange rate is 103 yen per U.S. dollar, how much is your stipend worth in dollars if you traded your money right away? Suppose you predict that the exchange rate will change in the next few months to 92 yen per dollar. Would you receive more dollars if you wait until after the exchange rate changes?

Question

According to By the Numbers, if approximately $4 trillion of currency is traded each day in foreign exchange markets, about how much of this is traded in U.S. dollars? Euros? Japanese yen?

Prob 16 17. According to By the Numbers, if approximately $4 trillion of currency is traded each day in foreign exchange markets, about how much of this is traded in U.S. dollars? Euros? Japanese yen?Question

According to By the Numbers, if you travel to Jordan to visit the archaeological site of Petra and exchange 200 U.S. dollars, about how many Jordanian dinars would you receive? If you had traveled to Petra last year, would the amount of money received for your $200 have been different?

Prob 16 18. According to By the Numbers, if you travel to Jordan to visit the archaeological site of Petra and exchange 200 U.S. dollars, about how many Jordanian dinars would you receive? If you had traveled to Petra last year, would the amount of money received for your $200 have been different?