Chapter Introduction

79

80

After studying this chapter you should be able to:

- Define the concepts of consumer surplus and producer surplus and explain how they are used to measure the benefits and costs of market transactions.

- Use consumer surplus and producer surplus to describe the gains from trade.

- Explain the causes of deadweight loss and how markets can mitigate them.

- Understand why markets sometimes fail to provide an optimal outcome.

- Describe what an effective price ceiling or price floor does to a market and how it creates shortages or surpluses.

- Determine the winners and losers when price ceilings and price floors are used.

Once an exotic food from the orient eaten by few outside Asia, sushi has become part of the American diet in all parts of the country, available in sushi bars, cafés, buffets, and even grocery stores. The popularity of sushi stems largely from the known health benefits of eating fish, providing omega-3-rich, low-fat, and low-calorie meals. But to have sushi, one must have access to fresh fish, not easy for those not living near a coastline. Or is it?

To provide fresh sushi to inland consumers, fish must be caught, flash frozen (to kill bacteria), then flown to destinations in a short period of time in order to maintain the fish’s freshness. In some cases, fish is flown around the world to meet the demand. At the Tsukiji fish market in Tokyo, Japan, the largest fish market in the world, over 6 million pounds of fish are auctioned off each morning and then flown to wholesalers and restaurants around the globe.

Why would fishermen, fish markets, wholesalers, and restaurants go through so much trouble just to provide fresh sushi to customers in faraway places whom they will never meet? Because the market provides incentives for each person to do so. Every person in the supply chain for sushi acts in his or her own best interest by supplying what the market wants (as determined by the prices received for their goods), and that leads to an efficiently functioning market. Adam Smith’s notion of the invisible hand works to ensure that, in a market society, consumers get what they want.

Everywhere we look in the world there are markets, and not just the big markets for fish or other major industries. Countless smaller markets dot our local landscapes, and many new virtual markets are springing up on the Internet. All play a similar role in terms of providing what consumers want, using prices as a way to signal the values placed on goods and services.

The previous chapter considered how supply and demand work together to determine the quantities of various products sold and the equilibrium prices consumers must pay for them in a market economy. The markets we have studied thus far have been stylized versions of competitive markets: They have featured many buyers and sellers, a uniform product, consumers and sellers who have complete information about the market, and few barriers to market entry or exit.

In this chapter, we start with this stylized competitive market and introduce tools for measuring the efficiency of competitive markets. We then apply these tools to reveal the gains from trade. We briefly consider some of the complexities inherent to most markets. The typical market does not meet all the criteria of a truly competitive market. That does not mean that the supply and demand analysis you just absorbed will not be useful in analyzing economic events. Often, however, you will need to temper your analysis to fit the specific conditions of the markets you study. Finally, we will look at what happens when government intervenes in markets.

81

Price Controls and Supports in the Economy Today

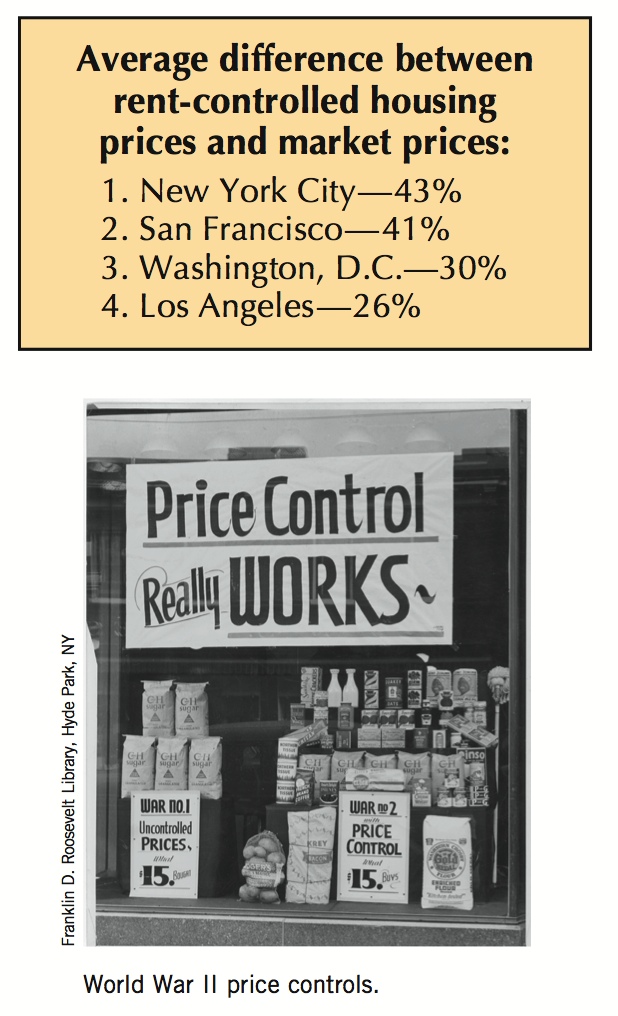

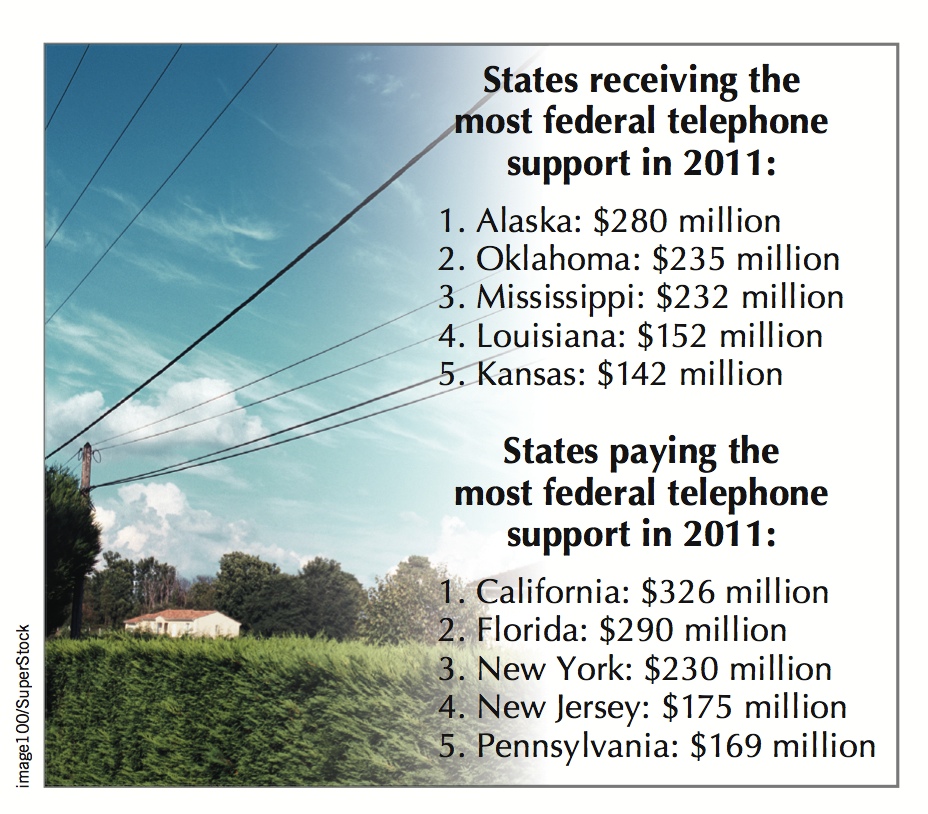

Efficient markets are an essential part of modern societies. However, sometimes governments intervene in markets to address equity concerns. The use of price controls and price supports is a common way of intervening in markets, as the following illustrates.

Prices for telephone landlines in rural communities are capped below their cost, with the shortfall in revenues compensated for by a government program funded by all U.S. states, resulting in some states paying more than they receive in support and some states receiving more than they pay.

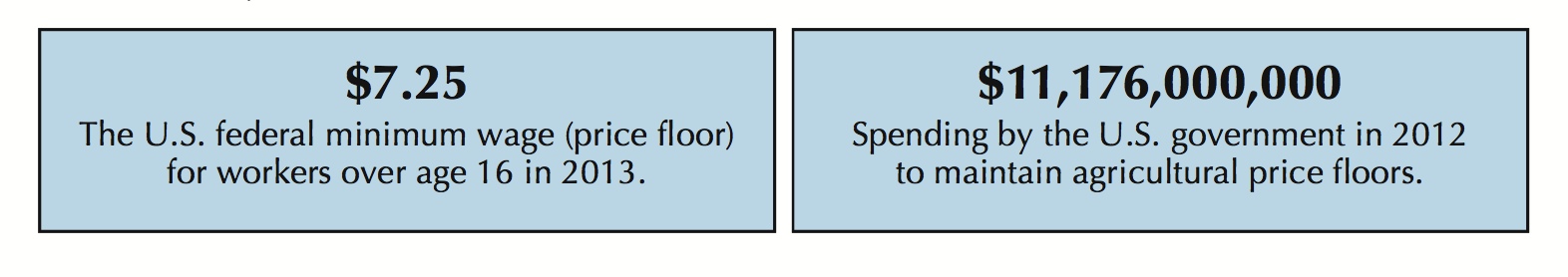

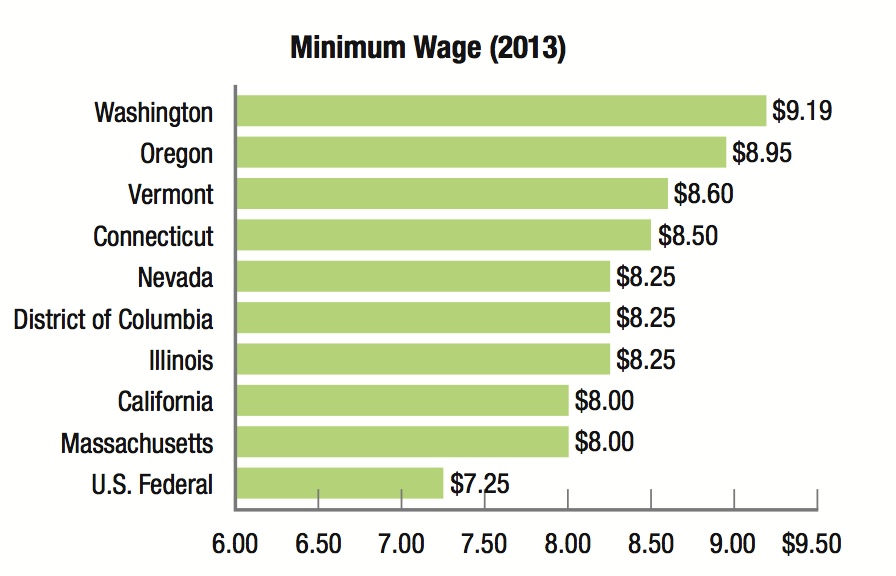

Nine U.S. states have a statewide minimum wage of $8.00 per hour or more, significantly higher than the federal minimum wage of $7.25 per hour.

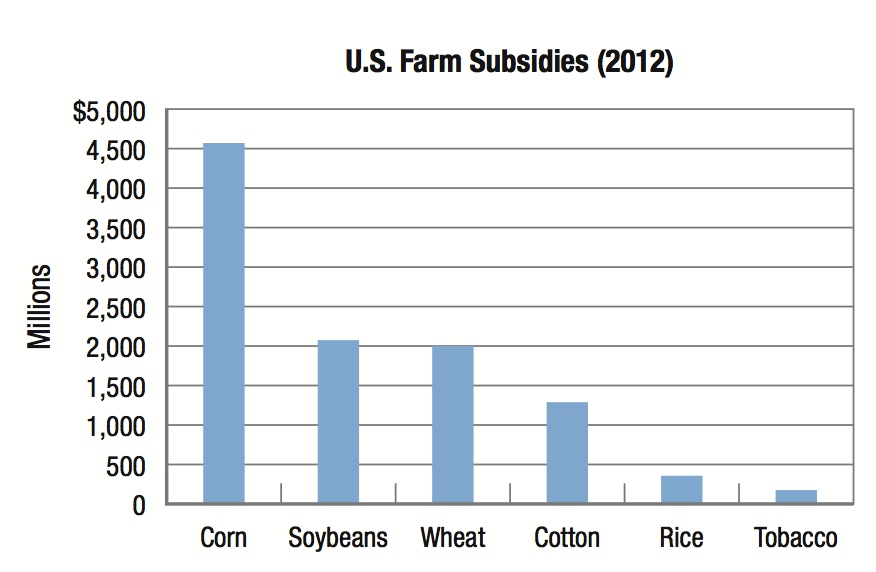

Certain agricultural crops are protected by price supports (price floors), with the difference from their market prices paid by the U.S. government.

82