Chapter Summary

Chapter Summary

Section 1: Consumer and Producer Surplus: A Tool for Measuring Economic Efficiency

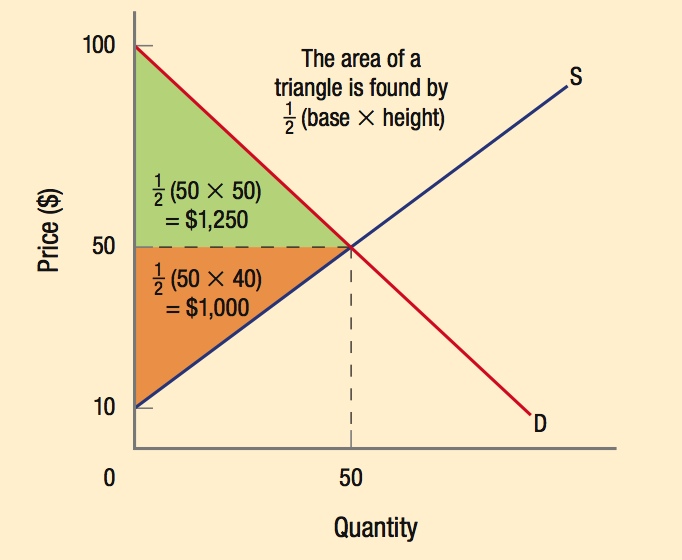

Consumer surplus is the difference between a person’s willingness-to-pay and the price paid. For a market, consumer surplus is the area between the demand curve and the market price. In the figure, consumer surplus equals $1,250.

Producer surplus is the difference between the price a seller receives and its marginal cost. For a market, producer surplus is the area between the market price and the supply curve. In the figure, producer surplus equals $1,000.

Economic efficiency is measured by the gains that consumers and producers achieve when engaging in an economic transaction.

Section 2: Using Consumer and Producer Surplus: The Gains from Trade

Markets exhibit efficiency when every buyer and every seller eager to buy and sell goods is able to do so, resulting in gains from trade. Gains from trade are measured by the total surplus, or the sum of consumer and producer surplus in a market. Total surplus is maximized when a market is at equilibrium.

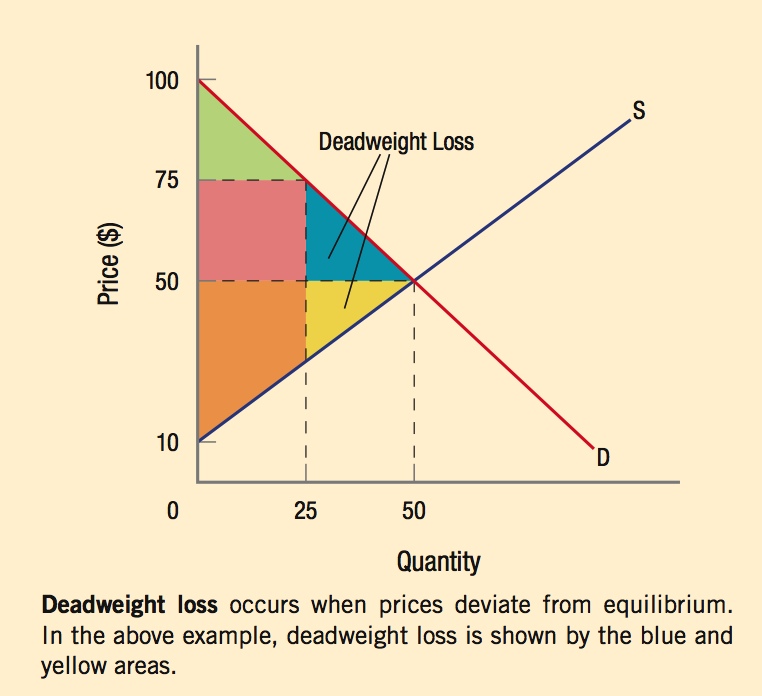

Suppose the price of a good rises above equilibrium to $75. The higher price causes two effects on consumer surplus and two effects on producer surplus:

- Consumers who are priced out of the market lose consumer surplus equal to the blue area.

- Consumers who continue to buy the good pay more, and lose consumer surplus equal to the pink area.

- Producers who want to sell more at $75 but cannot lose producer surplus equal to the yellow area.

- Producers who do sell units earn $25 more per unit, equal to the pink area.

Markets can sometimes fail to produce the socially optimal output. Reasons for market failure include:

Lack of competition

When a firm faces little to no competition, it has an incentive to raise prices.

Existence of external benefits or costs

Markets tend to provide too little of products that have external benefits, and too much of products with external costs.

A mismatch of information

Asymmetric information occurs when either a buyer or a seller knows more about a product than the other.

Existence of public goods

Public goods are nonrival and nonexclusive. This means:

- My consumption does not diminish your ability to consume.

- Once a good is provided for one person, others cannot be excluded from enjoying it.

Section 3: Price Ceilings and Price Floors

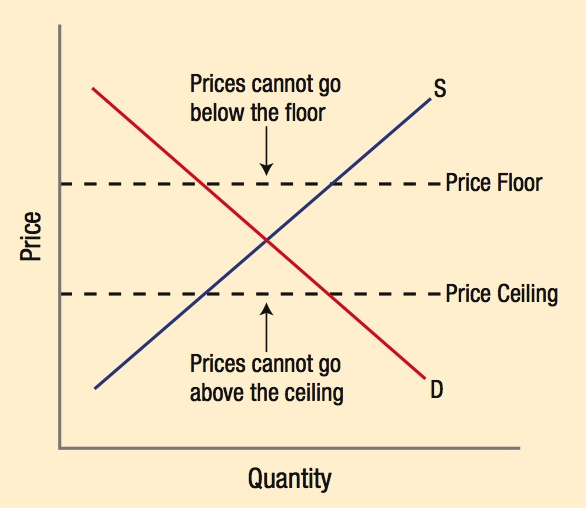

A price floor is a minimum price for a good. A binding price floor appears above equilibrium and causes a surplus.

A price ceiling is a maximum price for a good. A binding price ceiling appears below equilibrium and causes a shortage.