Chapter Introduction

209

210

After studying this chapter you should be able to:

- Explain what an aggregate demand curve is and what it represents.

- Describe why the aggregate demand curve has a negative slope.

- Describe the effects of wealth, exports, and interest rates on the aggregate demand curve.

- List the determinants of aggregate demand.

- Analyze the aggregate supply curve and differentiate between the short run and long run.

- Describe the determinants of an aggregate supply curve.

- Define the multiplier and describe why it is important.

- Describe demand-pull and cost-push inflation.

What does Dubai, a large city in the Middle East, have in common with Williston, a small town in North Dakota? Both cities experienced rapid economic growth in the past decade as oil production funneled money into new construction and infrastructure, drawing in new residents and generating a dramatic rise in spending. Meanwhile, in the industrial states of Illinois and Michigan, stagnant wages and persistent unemployment forced residents to cut back on purchases from vacations and new cars to even some necessities, such as food and health care.

The recession of 2007–2009 created much hardship in the United States and throughout the global economy. However, the extent to which different regions, industries, and households were affected varied, from the extreme to not at all. In fact, in some areas, such as in western North Dakota, jobs were plentiful and lives improved.

The variation in economic performance extended to industries as well. In the manufacturing sector, certain industries all but closed, while other industries saw record growth. Popular store chains such as Circuit City, Borders, Linens ’n Things, and Filene’s Basement fell victim to an economy in which many consumers were not eager to spend. By closing stores, tens of thousands of workers lost their jobs, which led to a greater reduction in consumption, creating a ripple effect that made economic recovery even more difficult. Meanwhile, the health care and energy industries flourished, creating thousands of new jobs that will lead to greater consumption.

How does one assess the state of the economy and evaluate the effectiveness of policy when different areas of the country and different industries vary in performance? It would be dangerous to look at just one region or one industry (or even one time of the year, for that matter) and come to conclusions or make policy recommendations for the nation as a whole.

British economist John Maynard Keynes recognized the need to develop tools to analyze the macroeconomy as a whole. He focused on aggregate expenditures by consumers, businesses, and governments as the key drivers for the economy that determined employment and output. But the model he developed during the Great Depression did not fully consider the effect that changes in the economy would have on prices. Why?

Keynes focused on the problem at hand, when resources were underutilized. For this reason, an expansion of consumption or production did not create much upward pressure on prices. For example, in times of high unemployment, more labor can be hired without raising wages because firms with job openings often are inundated with applicants.

Therefore, the initial Keynesian model was a fixed price model, one that essentially ignored the supply side because increasing production would occur without a rise in prices. The lessons from Keynes, with their focus on spending, formed the foundation of the demand side of the modern macroeconomic model. In this chapter, we add the supply side and move from a fixed price model to a flexible price model, where prices and wages adjust to macroeconomic conditions. We call this model the aggregate demand—aggregate supply (AD/AS) model. This model looks a lot like the supply and demand model developed in Chapter 3, but it has several important differences: It measures real output of the aggregate (overall) economy, it uses the average price level for an economy, and it focuses on short-run fluctuations around a long-run equilibrium output.

The response of prices and wages does not always change in a consistent manner. As we will see, sometimes prices and wages can be sticky in the short run, a condition that allows an economy to respond positively to economic stimulus policies. But in the long run, prices and wages tend to be very responsive to changing macroeconomic conditions.

This flexible price model expands the analysis that began with Keynes to many more modern problems facing economies. And when economies face a deep recession like that in 2007–2009, with high unemployment and reduced spending and investment, the policy prescriptions from Keynesian analysis return to the forefront. The beauty of this AD/AS approach is that it builds on skills you already have: defining demand and supply curves, assessing changes in economic facts, and determining a new equilibrium. These techniques provide policymakers with a way of looking at the overall economy when many factors and differences in economic performance prevail across regions and industries.

211

The Sheer Size of Aggregate Demand and Aggregate Supply

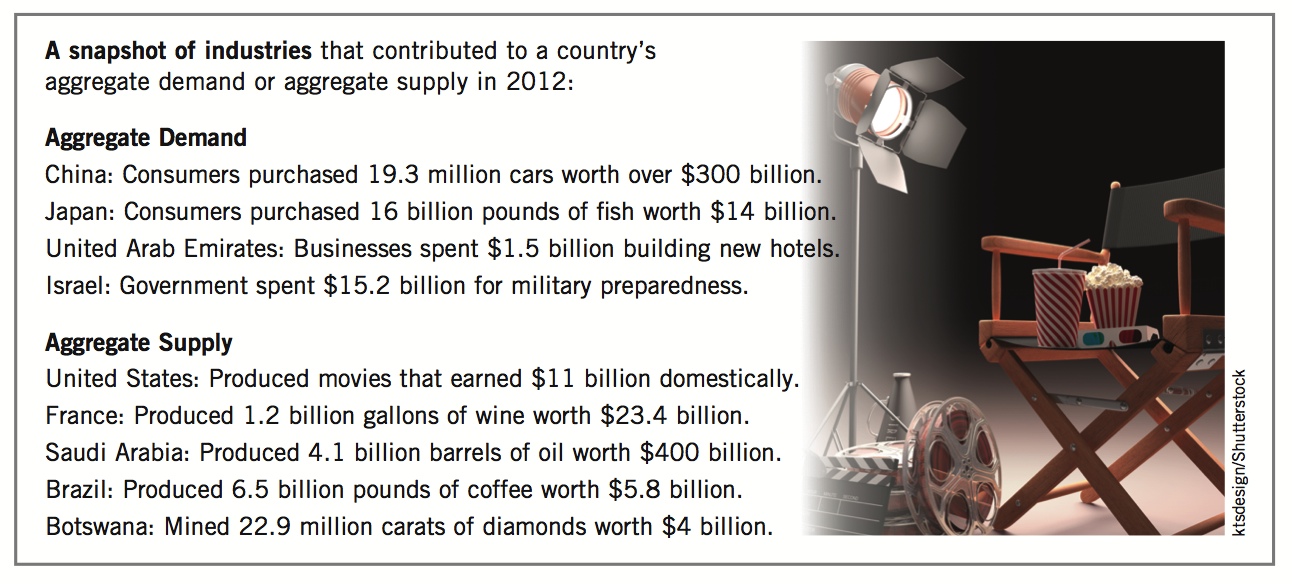

Aggregate demand and aggregate supply are made up of many components in the economy. Factors that influence the extent to which consumers, businesses, and governments spend make up aggregate demand, while various short-run and long-run factors influence producers and aggregate supply.

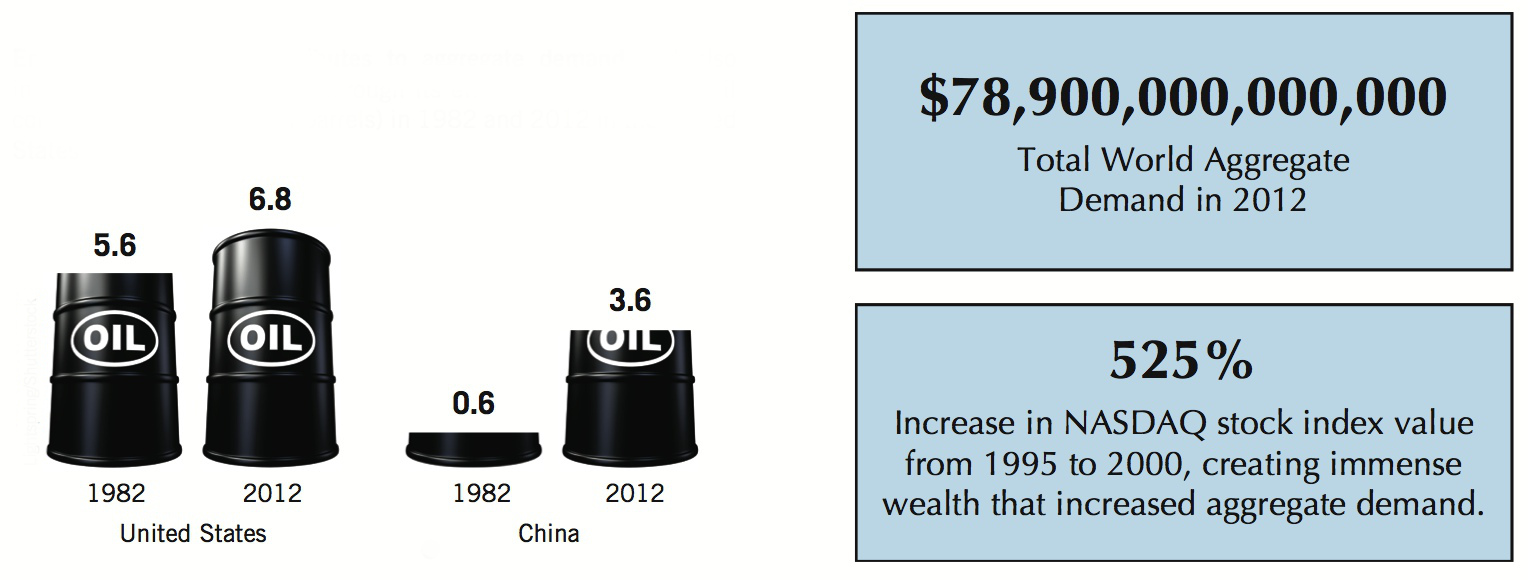

Energy consumption contributes to aggregate demand and also influences aggregate supply through its effect on input prices. Oil consumption (in billions of barrels) in 1982 and 2012 in the United States and China:

98% of all apparel and 99% of all footwear sold in the United States is imported. Imports reduce aggregate demand because money is flowing out of the country to pay for these goods.

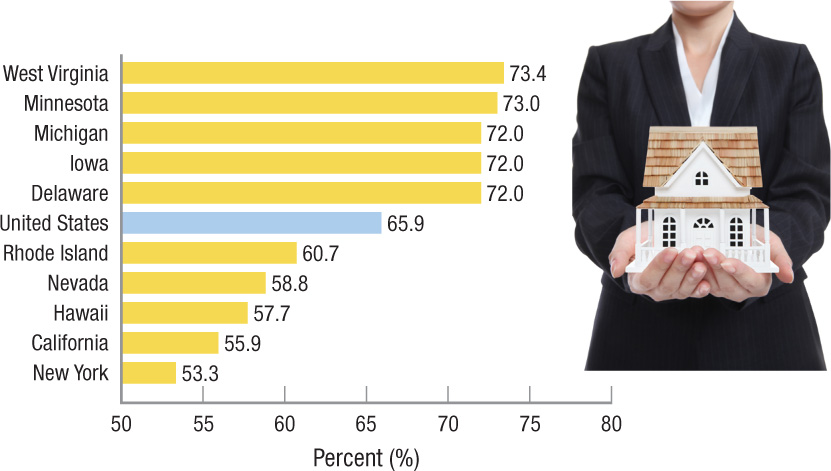

Home ownership provides a wealth effect that influences aggregate demand. States with the highest and lowest rates of home ownership in 2012.

212

This chapter begins with an analysis of aggregate demand and its determinants. We then turn to aggregate supply, studying the differences between a long-run aggregate supply curve and a short-run aggregate supply curve, and the determinants of each. Finally, we put the aggregate demand and aggregate supply curves together to analyze macroeconomic equilibrium. The AD/AS model gives you the tools to analyze tradeoffs between economic output and inflation. It will allow you to understand the causes of recessions and inflation, and how government policy is sometimes used to correct these problems.