Chapter Summary

Chapter Summary

Section 1: Land and Physical Capital

Land prices are driven by a fixed supply and by demand factors such as the terrain, attributes, view, and location.

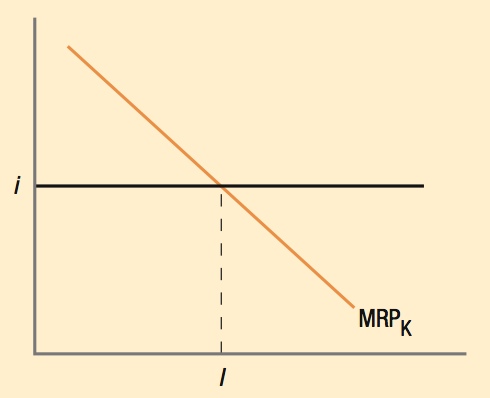

MRPK is the additional value that a unit of capital brings to the firm. It represents the maximum a firm is willing to pay for capital.

Present Value Versus Rate of Return

- Present value measures the value today of money collected in the future.

- PV = X/(1 + i)n, where i = discount rate and n = years.

- Rate of return is the interest rate that is required for a project to break even in the long run.

- Calculating the rate of return requires solving for the interest rate that makes the present value of all future income from a project equal to its cost of capital.

Section 2: Financial Capital

Banks: Offer loans based on credit history and ability to produce collateral in case of default; the amount borrowed is usually limited.

Stock market: Stocks give partial ownership in a company, entitling owners (shareholders) to a vote in company matters and a share of dividends.

Bond market: Bonds are claims on a company’s assets. A bond pays a fixed payment called a coupon rate and a face value upon maturity.

Venture capital: Provides seed money to new businesses in exchange for partial ownership in the company.

330

Section 3: Human Capital

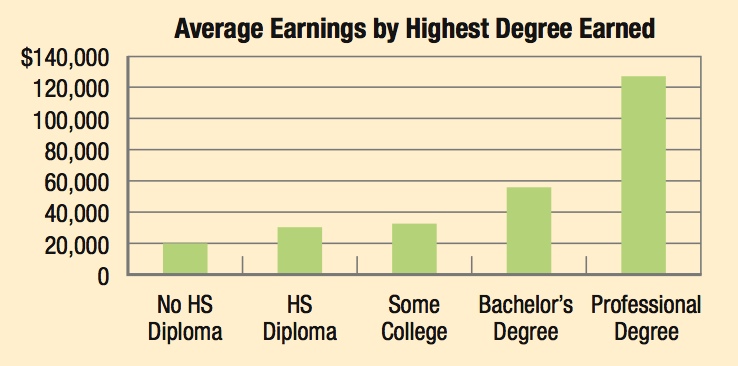

Investment in human capital can come from Education

Education On-the-job-training

On-the-job-training

Is education just a signal or does it provide inherent productive value? Economists believe it’s a little of both.

The greater the wage differential between two levels of human capital investment, the more people will pursue that next level.

Education is a good investment in terms of human capital ac- cumulation, which translates to higher average salaries.

Section 4: Entrepreneurship and Innovation

Success brings great rewards to entrepreneurs, many of whom have become very rich, such as the inventor of the Segway.

Entrepreneurs assume the risk of using capital and labor markets to create new goods and services and to make existing products better.

Intellectual property rights are needed to protect innovation and provide rewards for entrepreneurs. These include:

Failure is a part of free markets, as some innovations do not make it, such as Toshiba’s HD DVD format.

- Patents: to protect ideas and inventions

- Copyrights: to protect writings and artistic impression

- Trademarks: to protect names and symbols

- Industrial Designs: to protect product designs

Entrepreneurship is an important factor of production. It allows countries to turn limited resources into productive outputs and higher standards of living.

331