Questions and Problems

Check Your Understanding

Question

If you look at income distribution over the life cycle of a family, would it be more equally distributed than for one specific year?

Prob 15 1. If you look at income distribution over the life cycle of a family, would it be more equally distributed than for one specific year?Question

List some of the reasons why household incomes differ.

Prob 15 2. List some of the reasons why household incomes differ.Question

How does the Gini coefficient differ from the Lorenz curve?

Prob 15 3. How does the Gini coefficient differ from the Lorenz curve?Question

Currently the poverty threshold for a family of four is just over $23,000 a year. What does this amount take into account and not take into account?

Prob 15 4. Currently the poverty threshold for a family of four is just over $23,000 a year. What does this amount take into account and not take into account?Question

Are the poor in year 2014 just as poor as the poor in 1954? What has changed in 60 years to make poverty different today?

Prob 15 5. Are the poor in year 2014 just as poor as the poor in 1954? What has changed in 60 years to make poverty different today?Question

What are the primary factors that lead to poverty?

Prob 15 6. What are the primary factors that lead to poverty?

Apply the Concepts

Question

Is there an efficiency-equity tradeoff when income is redistributed from the rich to the poor? Explain.

Prob 15 7. Is there an efficiency-equity tradeoff when income is redistributed from the rich to the poor? Explain.Question

What do you think has been the impact on the distribution of income in the United States from the combined impact of the large number of unskilled illegal immigrants and the growing number of dual-earner households?

Prob 15 8. What do you think has been the impact on the distribution of income in the United States from the combined impact of the large number of unskilled illegal immigrants and the growing number of dual-earner households?Question

It is probably fair to say that when we classify people as rich or poor at any given moment in time, we are simply describing similar people at different stages in life. Does this life cycle of income and wealth make the income distribution concerns a little less relevant? Why or why not?

Prob 15 9. It is probably fair to say that when we classify people as rich or poor at any given moment in time, we are simply describing similar people at different stages in life. Does this life cycle of income and wealth make the income distribution concerns a little less relevant? Why or why not?Question

What would be the change in the distribution of income (Gini coefficient) if the United States decided to permit 10 million new immigrants into the United States who were highly skilled doctors, engineers, executives of large foreign firms, and wealthy foreigners who just want to migrate to the United States? How would the Gini coefficient change if, instead, the United States decided to permit 10 million unskilled foreign workers to enter?

Prob 15 10. What would be the change in the distribution of income (Gini coefficient) if the United States decided to permit 10 million new immigrants into the United States who were highly skilled doctors, engineers, executives of large foreign firms, and wealthy foreigners who just want to migrate to the United States? How would the Gini coefficient change if, instead, the United States decided to permit 10 million unskilled foreign workers to enter?Question

Roughly half of all marriages in the United States end in divorce. What is the impact of this divorce rate on the distribution of income and poverty?

Prob 15 11. Roughly half of all marriages in the United States end in divorce. What is the impact of this divorce rate on the distribution of income and poverty?Question

Poverty rates have declined for blacks and have been relatively stable for everyone else over the last 40 years. But the poverty rate still hovers around 15%. What makes it so difficult to reduce poverty below 10% to 15% of the population?

Prob 15 12. Poverty rates have declined for blacks and have been relatively stable for everyone else over the last 40 years. But the poverty rate still hovers around 15%. What makes it so difficult to reduce poverty below 10% to 15% of the population?

In the News

Question

In 2006, the Nobel Peace Prize went to economist Muhammad Yunus and the Grameen Bank “for their efforts to create economic and social development from below.” Yunus led the development of micro loans to poor people without financial security: loans of under $200 to people so poor they could not provide collateral, to use for purchasing basic tools or other basic implements of work. This helped to pull millions of people out of poverty. Discuss how economic prosperity and security for everyone can result in a more peaceful planet.

Prob 15 13. In 2006, the Nobel Peace Prize went to economist Muhammad Yunus and the Grameen Bank “for their efforts to create economic and social development from below.” Yunus led the development of micro loans to poor people without financial security: loans of under $200 to people so poor they could not provide collateral, to use for purchasing basic tools or other basic implements of work. This helped to pull millions of people out of poverty. Discuss how economic prosperity and security for everyone can result in a more peaceful planet.Question

According to the U.S. Department of the Treasury, people in the top income quintile (20%) pay roughly 70% of all federal income taxes, with the remaining 80% paying less than 30%. Further, the bottom half of the population pays less than 10% of all taxes. Many politicians often assert that they want to bring tax relief (presumably with the idea of redistributing income) to “middle- and lower-income” families. Given this distribution of income tax payments, what would middle- and lower-income tax relief look like?

Prob 15 14. According to the U.S. Department of the Treasury, people in the top income quintile (20%) pay roughly 70% of all federal income taxes, with the remaining 80% paying less than 30%. Further, the bottom half of the population pays less than 10% of all taxes. Many politicians often assert that they want to bring tax relief (presumably with the idea of redistributing income) to “middle- and lower-income” families. Given this distribution of income tax payments, what would middle- and lower-income tax relief look like?

Solving Problems

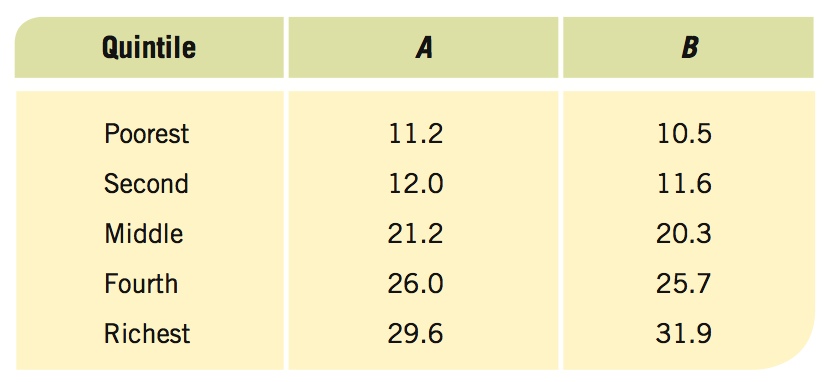

- Use the two different distributions of income in the table below to answer the questions that follow.

Question

Use the grid below and graph the two Lorenz curves.

Prob 15 15a. Use the grid below and graph the two Lorenz curves.

Prob 15 15a. Use the grid below and graph the two Lorenz curves.Question

Which curve has a more equal distribution?

Prob 15 15b. Which curve has a more equal distribution?Question

Are these distributions more or less equal than that for the United States today?

Prob 15 15c. Are these distributions more or less equal than that for the United States today?

Question

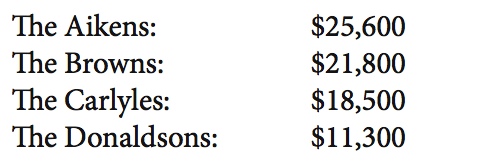

The following households each have four persons. Their annual incomes are as follows:

Assume that the poverty threshold for a household of four is $23,000. Calculate the income deficit and the income-to-poverty ratio for each family. Classify each family as either not poor, near poor, poor, or severely poor.Prob 15 16. The following households each have four persons. Their annual incomes are as follows:

Assume that the poverty threshold for a household of four is $23,000. Calculate the income deficit and the income-to-poverty ratio for each family. Classify each family as either not poor, near poor, poor, or severely poor.

412

Question

According to By the Numbers, over what period of time did the gap between the full-time minimum wage earnings and the poverty threshold expand the most?

Prob 15 17. According to By the Numbers, over what period of time did the gap between the full-time minimum wage earnings and the poverty threshold expand the most?Question

According to By the Numbers, about how many Americans used food stamps (now known as SNAP benefits) in the year 2000? How about in the year 2012? (Hint: Use the approximate U.S. population of 300 million to calculate the answers for both years.)

Prob 15 18. According to By the Numbers, about how many Americans used food stamps (now known as SNAP benefits) in the year 2000? How about in the year 2012? (Hint: Use the approximate U.S. population of 300 million to calculate the answers for both years.)