Chapter Summary

Chapter Summary

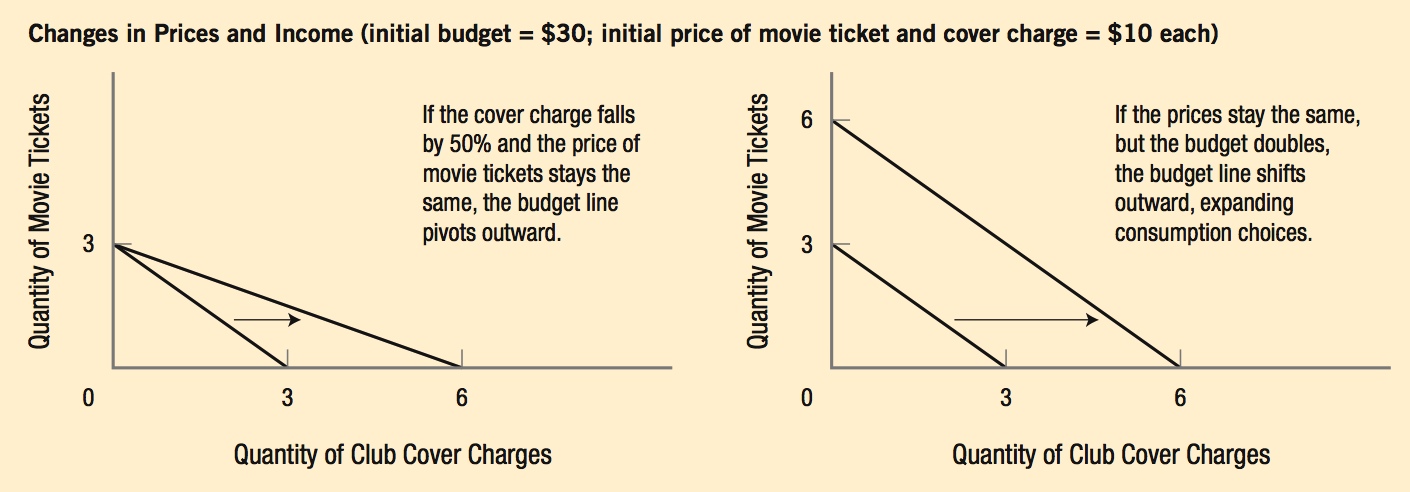

Section 1: The Budget Line and Choices

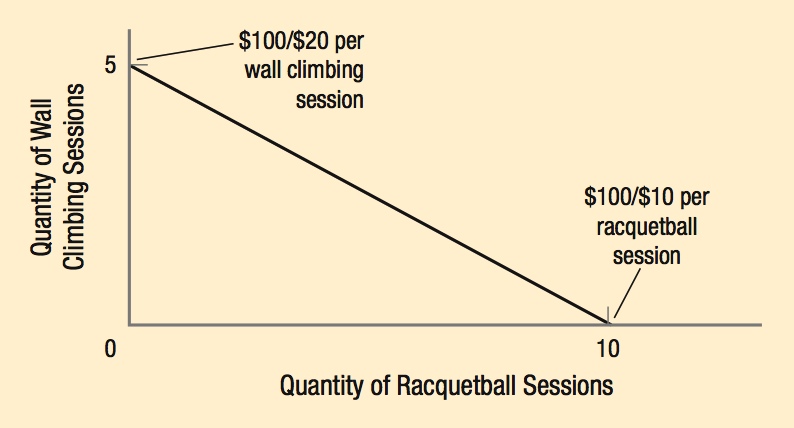

A budget line shows all the combinations of two goods that can be purchased with a given income and given the prices of each good. Example: Monthly workout budget = $100; price per wall climbing session = $20; price per racquet-ball session = $10.

Section 2: Marginal Utility Analysis

Utility is a hypothetical measure of satisfaction.

Total utility is the satisfaction a person receives from consuming a quantity of a good, while marginal utility is the satisfaction received from consuming one more unit of a good.

Where should one consume on the budget?

The budget line shows what combinations are affordable, but not which point maximizes utility. This is determined using the utility maximization rule, which says that utility is maximized when the marginal utility per dollar is equal across all goods.

150

Watching a boring movie is likely to provide very little utility, resulting in even smaller marginal utility per dollar spent at the cinema. Money in this case ought to have been spent on an activity providing greater marginal utility per dollar in order to maximize total utility.

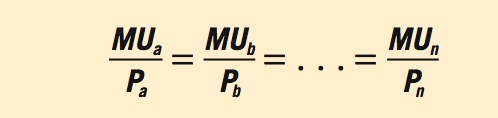

The utility maximization rule states that total utility is maximized when the marginal utility per dollar is equal for all products purchased:

When this rule is not met, one should consume fewer goods providing smaller marginal utility per dollar and more goods providing larger marginal utility per dollar.

Section 3: Behavioral Economics

Behavioral economics is the incorporation of human psychology into economic decision making to explain why individuals sometimes act differently from what economic models predict.

Psychological Factors Influencing Economic Decisions

- Sunk cost fallacy: occurs when individuals take sunk costs into account when making decisions about the present or future.

- Framing bias: occurs when individuals are steered toward making one decision over another, or when individuals are led to believe that they are getting a better deal than they actually are.

- Overconfidence: occurs when strong feelings of one’s abilities lead to irrational decisions.

- Overvaluing the present relative to the future: occurs when future decisions appear too distant to be concerned about in the present, leading to irrational decisions.

- Altruism: occurs when feelings of goodwill lead individuals to make decisions that benefit others at the expense of their own consumption.

151