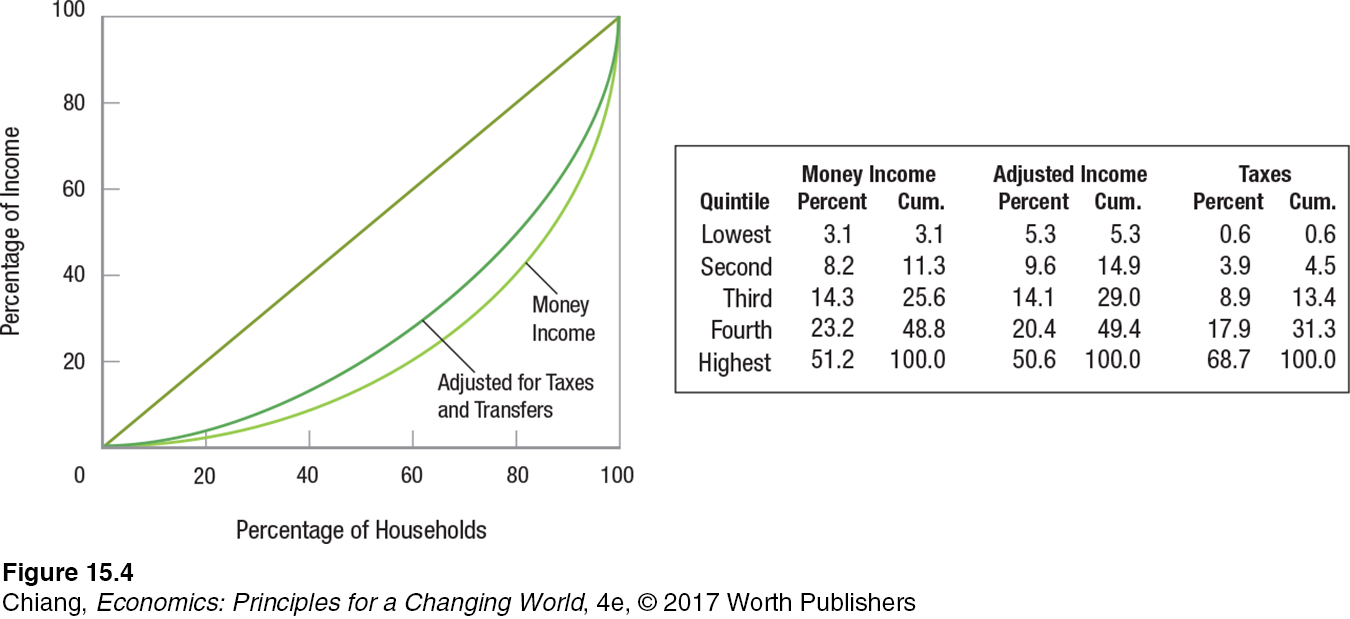

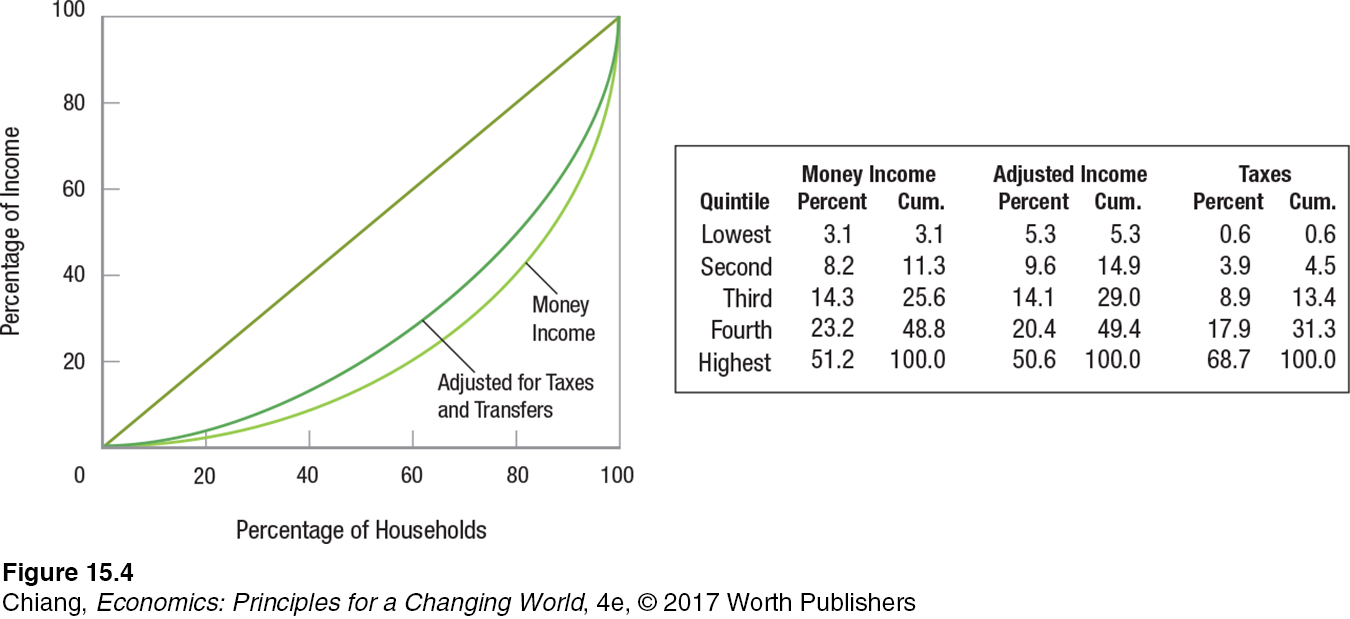

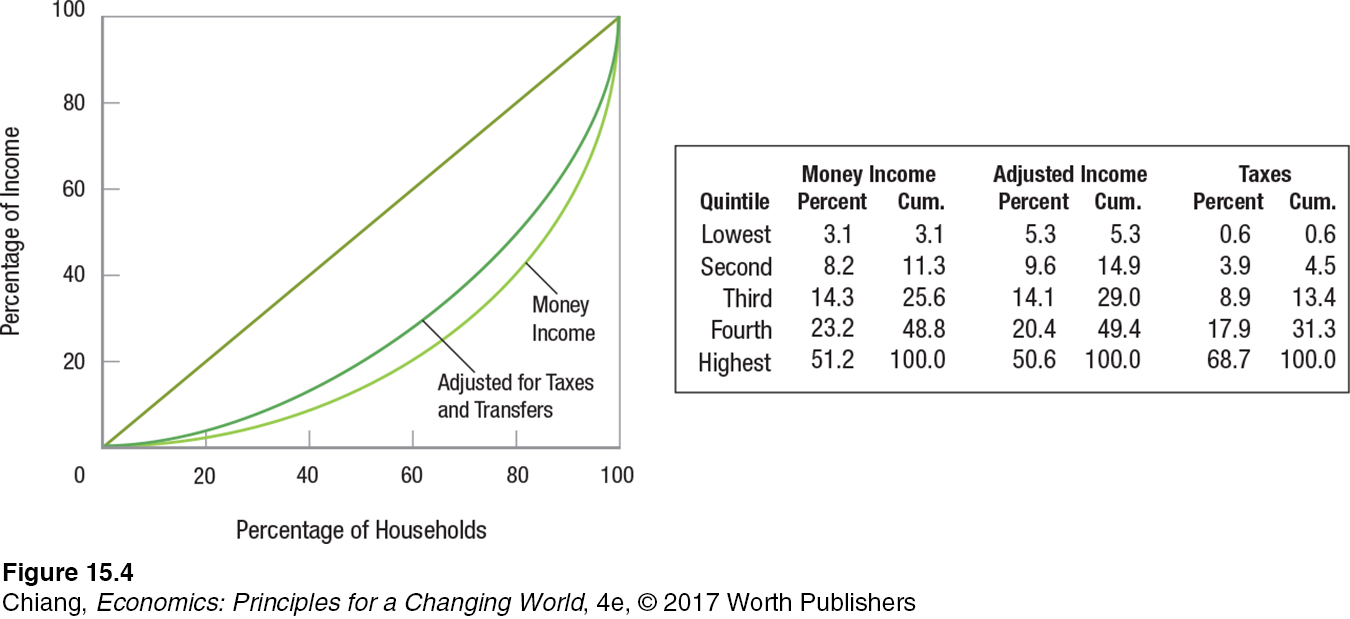

FIGURE 4 LORENZ CURVES FOR THE UNITED STATES: MONEY INCOME AND INCOME ADJUSTED FOR TAXES AND TRANSFER PAYMENTS

These Lorenz curves provide an estimate of the impact progressive taxes and transfer payments (cash and in-kind) had on income distribution in the United States. As one would expect, distribution becomes more equal once taxes and transfer payments are taken into account. In this case, the Gini coefficient declined from 0.480 to 0.391.

These Lorenz curves provide an estimate of the impact progressive taxes and transfer payments (cash and in-kind) had on income distribution in the United States. As one would expect, distribution becomes more equal once taxes and transfer payments are taken into account. In this case, the Gini coefficient declined from 0.480 to 0.391.Data from the U.S. Census Bureau.