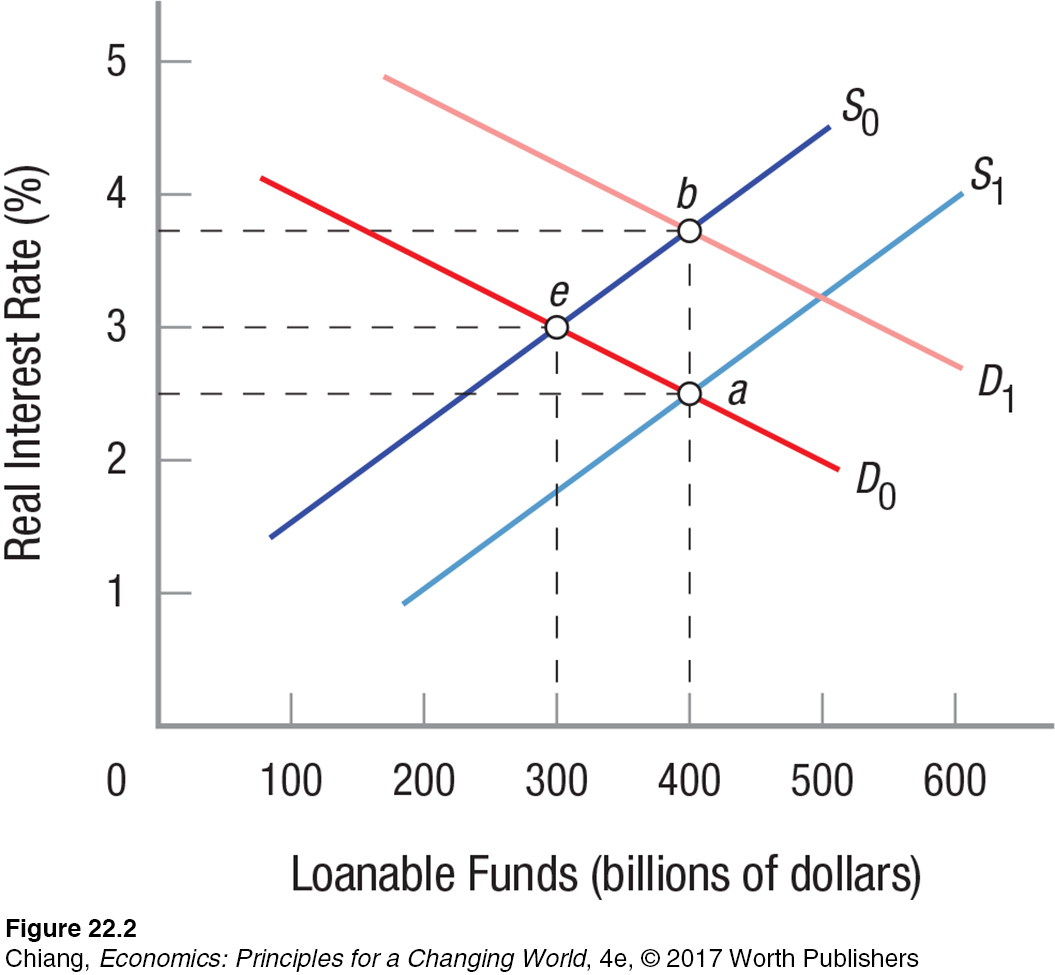

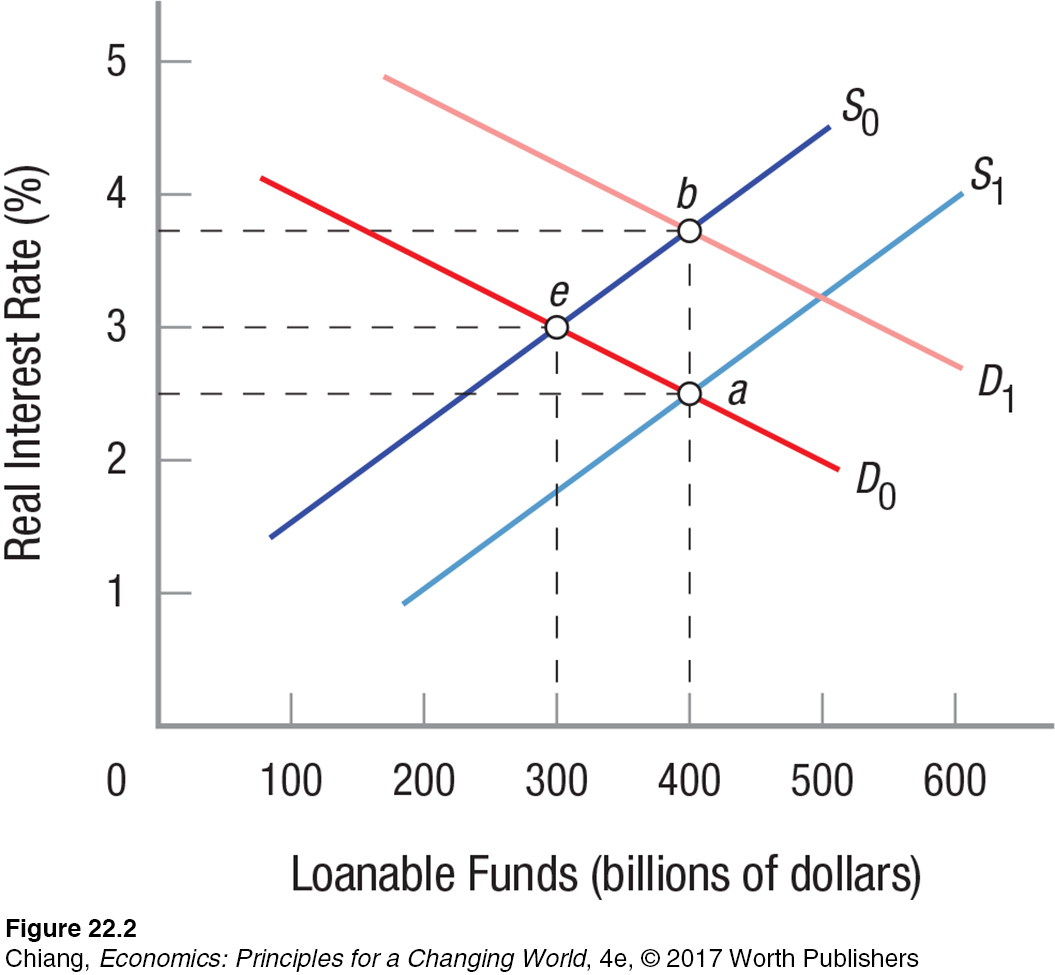

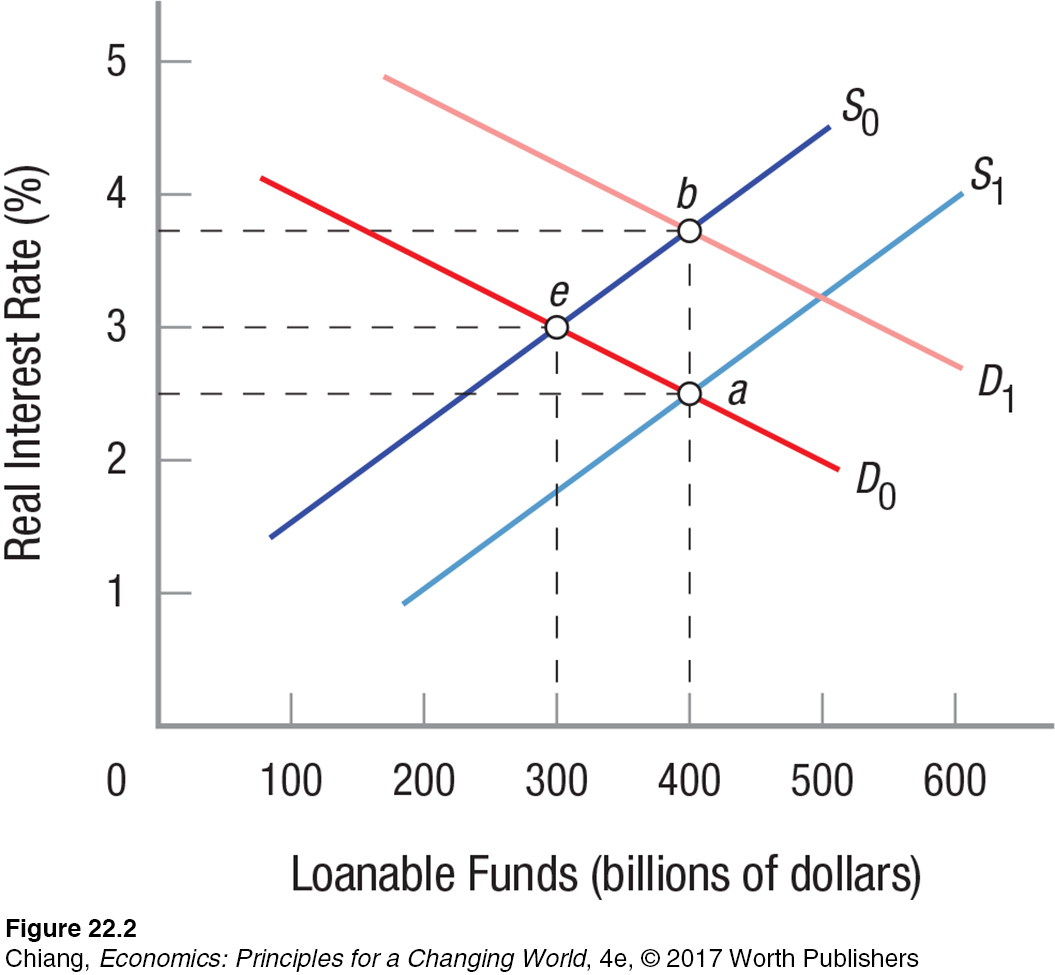

FIGURE 2 CHANGES IN SUPPLY, DEMAND, AND INTEREST RATES

If savers decide to save more, the supply of funds will grow to S1. At the new equilibrium, point a, interest rates fall and the amount of loanable funds rises. If instead there is an increase in the rate of return on investment (due to investment tax credits or increased demand for the firm’s product), demand for funds will increase to D1. At the new equilibrium, point b, interest rates and loanable funds rise.

If savers decide to save more, the supply of funds will grow to S1. At the new equilibrium, point a, interest rates fall and the amount of loanable funds rises. If instead there is an increase in the rate of return on investment (due to investment tax credits or increased demand for the firm’s product), demand for funds will increase to D1. At the new equilibrium, point b, interest rates and loanable funds rise.