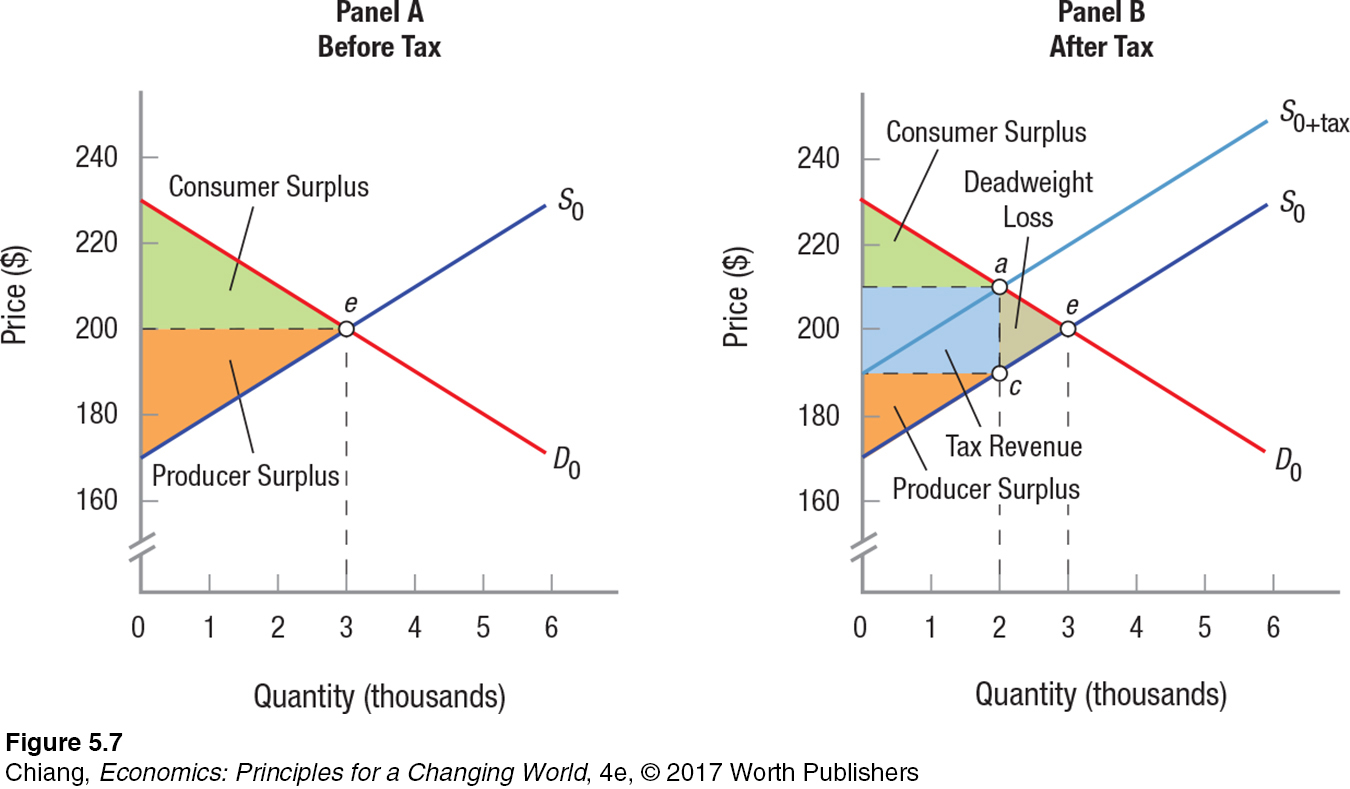

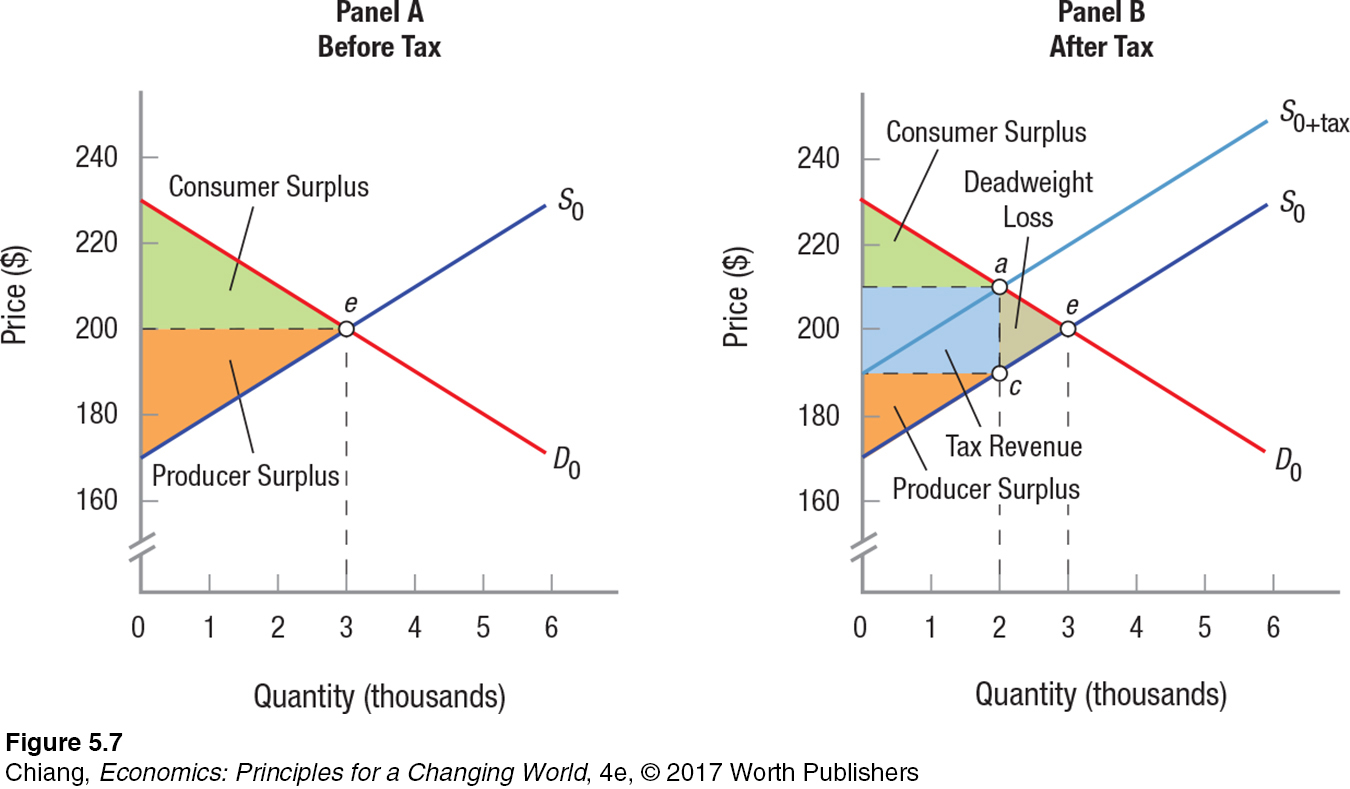

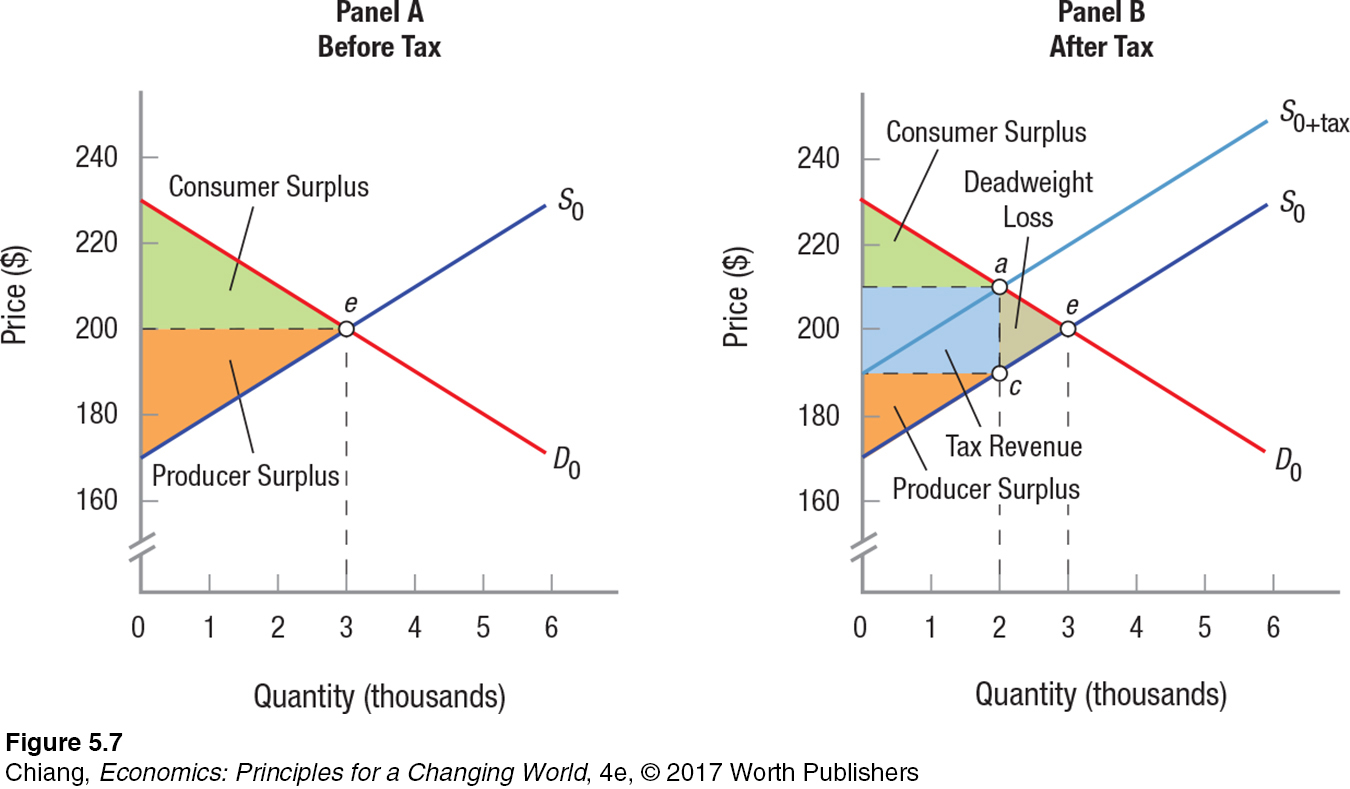

FIGURE 7 EFFECT OF AN EXCISE TAX ON AIRLINE TICKETS

The market for airline tickets shown in panel A is in equilibrium at point e. When a $20 excise tax is placed on each airline ticket, the supply curve shifts upward by the amount of the tax, from S0 to S0+tax (panel B). With demand remaining constant at D0, equilibrium moves to point a (2,000 units). When a tax is imposed, output falls because prices are pushed higher, and a deadweight loss is created. In this case, consumers and producers share the burden of the tax equally.

The market for airline tickets shown in panel A is in equilibrium at point e. When a $20 excise tax is placed on each airline ticket, the supply curve shifts upward by the amount of the tax, from S0 to S0+tax (panel B). With demand remaining constant at D0, equilibrium moves to point a (2,000 units). When a tax is imposed, output falls because prices are pushed higher, and a deadweight loss is created. In this case, consumers and producers share the burden of the tax equally.