COMPETITION AND MARKET STRUCTURE FOR NETWORK GOODS

The network goods industry provides opportunities for firms to gain substantial market power. Such opportunities often lead to intense competition. A recent example of competition in network goods was the market for high-

AT&T focused on bundling strategies with their U-

This section describes some of the common strategies used to protect network goods from entering a vicious cycle or to increase the likelihood of entering a virtuous cycle. Undoubtedly, as a consumer, you encounter many of these marketing strategies when making decisions about which network goods to purchase. The goal of firms using these strategies is to attract you to their product and to keep you as a customer for a long time.

Competition and Pricing Strategies

Network goods are characterized as having high fixed costs with low marginal costs. Further, network effects can cause some firms to flourish while causing others to fail, even when little or no quality differences exist between the firms’ products. The determinant of market success is not always dependent on the quality of the good, but rather on competitive strategies to capture market share. Low marginal costs means it does not cost much to serve customers once they are committed to a product. Therefore, firms spend significant sums of money to gain new customers and use various strategies to keep existing customers. These strategies include teaser strategies, lock-

teaser strategies Attractive up-

Capturing New Customers Using Teaser Strategies Teaser strategies are used by firms to gain new customers by offering various sign-

Why do companies offer such great deals to new customers? Unlike decisions for non-

switching cost A cost imposed on consumers when they change products or subscribe to a new network.

Have you ever had to switch from a software program that you have used for many years? Once you learn how to use a particular software program or once you are accustomed to a certain email program, it can be a hassle to switch to another. These switching costs, which include monetary and nonmonetary costs of switching from one good to another, often are substantial for network goods. Therefore, to provide incentives for consumers to incur these costs to switch, firms must offer attractive up-

lock-

Retaining Existing Customers Using Lock-

Switching costs include the hassle of learning a new format and its features, dealing with the loss of other features one has become accustomed to, and so forth. In some cases, switching costs may be minimal or offset by benefits; for example, the excitement of purchasing the latest smartphone or computer may outweigh the switching costs of learning how to use it. But consumers generally do not like changing network goods once they are accustomed to one brand.

Common examples of lock-

market segmentation A strategy of making a single good in different versions to target different consumer markets with varying prices.

Using Market Segmentation to Maximize Profits In an earlier chapter, we saw how market power can reduce the elasticity of demand for a firm’s product and increase potential profits of monopolies and monopolistically competitive firms. We draw from those analyses by studying how market segmentation strategies can be used to increase market share and profits in the market for network goods. Market segmentation is achieved when firms can differentiate their products in a way that allows similar goods to be priced differently to different groups of consumers. In other words, it allows firms to price discriminate, which increases producer surplus.

Because network goods generally have a low marginal cost of production, firms have greater flexibility in segmenting their products to allow for a greater range of prices, each targeting a different subset of the market. Market segmentation strategies in network goods include versioning, intertemporal pricing, peak-

ISSUE

A 0% Credit Card Offer: Is It Too Good to Be True?

Credit card debt is one of the most common forms of consumer debt in the United States. The average American carries over $5,000 in credit card debt, often at interest rates higher than what is paid on home mortgages, car loans, or student loans. However, many credit card companies offer new credit card subscribers 0% financing for a limited period of time. These offers are attractive for individuals with debt, many of whom might transfer debt from another credit card. Do credit card companies profit by giving customers such a great deal? Yes, more than you might think.

Nearly all 0% financing offers are teaser strategies, and not all are created equal. They vary in terms of the length of the offer, the initial transfer fees, and whether finance charges are accrued. Zero percent interest offers generally vary from 6 to 18 months from the opening of a new credit card, and most are balance transfer offers that pay off another credit card balance but require an initial transfer fee of 3% to 5%. Therefore, if one pays a 5% fee to enjoy a 0% interest rate for 6 months, that is the equivalent of a 10% annual interest rate. Finally, some credit card companies accrue finance charges over the promotional period if the balance is not paid off. For example, if one has a $1,000 balance at 0% for 12 months, which then increases to 15% after 12 months, an accrued finance charge means that if the $1,000 balance is not paid off in 12 months, the 15% rate is charged from day 1, eliminating any benefit from the 0% offer. One should always read the terms of a 0% offer to avoid unexpected fees.

Finally, there is an income effect. When a consumer can buy goods at a 0% interest rate, a consumer feels wealthier, which may lead to greater spending. Because credit card companies charge businesses 2% to 3% on every purchase for processing the transaction, they will still earn money on every purchase, even if you never pay a penny in finance charges.

versioning A pricing strategy that involves differentiating a good by way of packaging into multiple products for people with different demands.

Versioning refers to pricing strategies that involve differentiating a good by way of packaging it into multiple products for people with different needs. A common example is the choice of a wireless plan. Do you choose an unlimited monthly plan, a fixed-

intertemporal pricing A type of versioning in which goods are differentiated by the level of patience of consumers. Less patient consumers pay a higher price than more patient consumers.

A similar but slightly different strategy is intertemporal pricing. Like versioning, a firm uses intertemporal pricing strategies to target different groups of consumers by differentiating their product, but in this case, by time. Specifically, they use the fact that some consumers are more impatient than others to buy a product. For example, new books often first appear in bookstores as expensive hardcover editions, then as less expensive paperbacks or eBook versions a couple of months later, followed by the availability of the book for loan from public libraries at no cost for the most patient consumers.

Another example of intertemporal pricing, shown in Table 2, is the release of a new movie. A new movie first appears in theaters, followed by on-

| TABLE 2 | INTERTEMPORAL PRICING OF A NEW MOVIE | |||

| Movie Format | Average Wait Time from Movie Release | Approximate Cost to View | ||

| Movie theater | Immediate | $10 per person | ||

| On- |

2 to 3 months | $10 per group of viewers | ||

| Paid streaming/DVD rental | 3 to 6 months | $5 per group of viewers | ||

| Premium channels | 6 months to 1 year | Cost of channel subscription | ||

| Network TV/free streaming | 1 year or longer | Free (basic TV or Internet access) | ||

Firms that successfully use versioning and intertemporal pricing can price-

peak-

Peak-

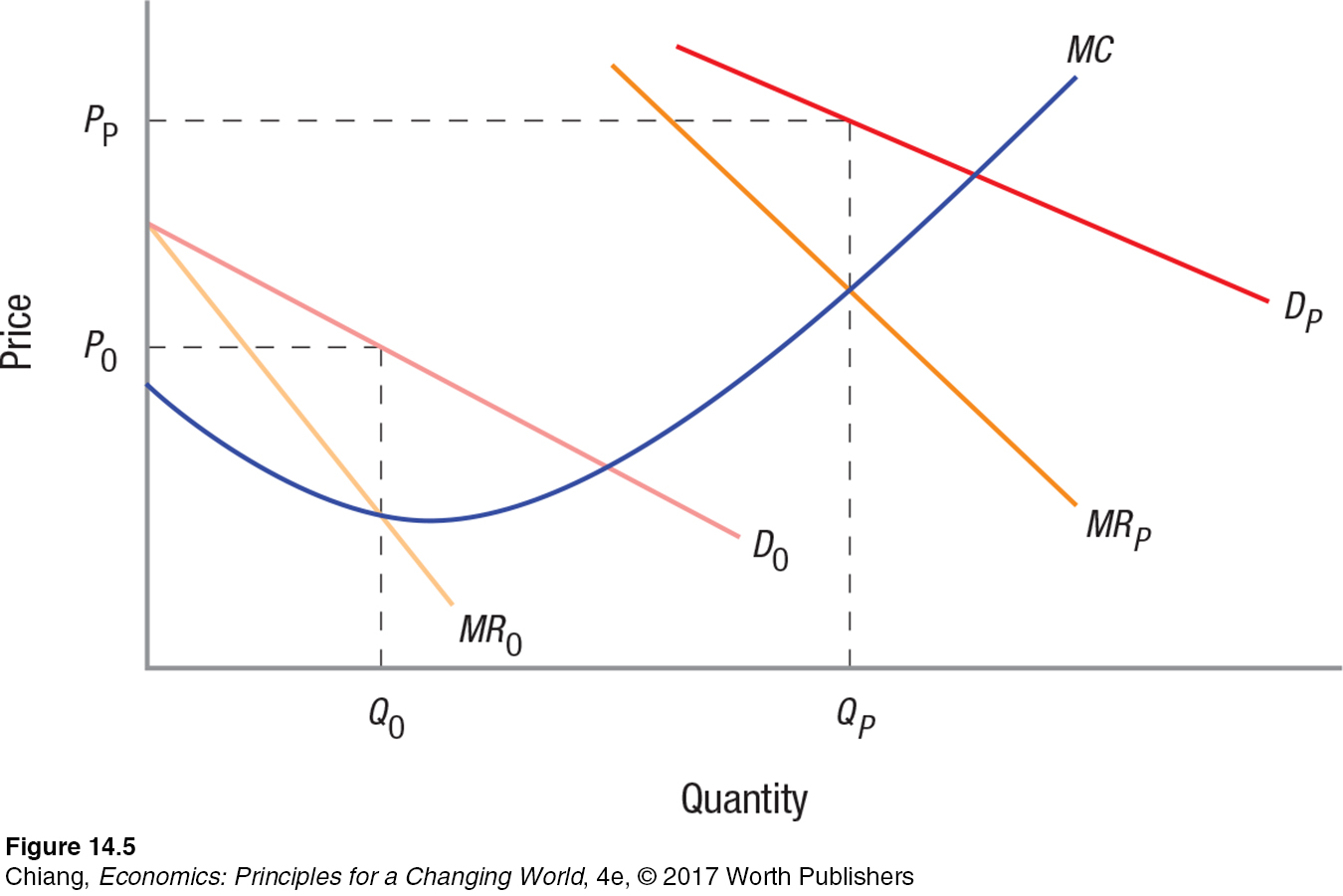

Figure 5 illustrates a market with peak-

bundling A strategy of packaging several products into a single product with a single price. Bundling allows firms to capture customers of related products by making it more attractive to use the same firm’s products.

Finally, network industries engage in bundling strategies to increase demand for related products. Because network goods generally have low marginal costs to produce, it does not cost the firm much to package several products together. Customers who purchase one product are then more likely to use other products from the same company, thus supporting the firm’s network and the value of all its goods. One example is Apple’s strategy of bundling many types of software into its iOS operating system. Bundled programs such as Safari, iMovie, iTunes, and GarageBand provide users with convenient “free” options, thereby reducing the need to use other network providers (such as Adobe and Real), which sell competing media products.

CHECKPOINT

COMPETITION AND MARKET STRUCTURE FOR NETWORK GOODS

Competition for market share in network goods is often intense as firms attempt to avoid the vicious cycle of a failed network good.

Teaser strategies include attractive up-

front savings to customers willing to switch to another network good provider, while lock- in strategies are used to make it more costly to leave a network good provider. Market segmentation involves separating consumers based on their elasticity of demand, with less patient consumers (those with inelastic demands) paying more than patient consumers with elastic demands.

Versioning is the practice of differentiating a good into multiple products from which consumers can choose. Versioning also can be done by time (intertemporal pricing) or by peak usage (peak-

load pricing). Firms bundle their goods because the marginal cost of adding additional products is minimal and the benefit from network effects is high if consumers use the included products instead of purchasing them separately from competing firms.

QUESTIONS: Why would a firm selling a network good choose to segment its customers by charging different prices? Wouldn’t it make more money by just charging everyone a high price?

Answers to the Checkpoint questions can be found at the end of this chapter.

A network good generally has a low marginal cost of production; therefore, any revenue a firm collects, even at low prices, typically increases its profit. By segmenting the market, the firm is separating customers based on their elasticity of demand. Customers with lower elasticities of demand are willing to pay a higher price than customers with higher elasticities of demand. Firms can segment the market by versioning their products. Products can be differentiated by time, peak usage, or bundling to create different versions of the same good at different prices.