Introduction to Macroeconomics

16

Learning Objectives

16.1 Describe the four phases of the business cycle and how they are dated by the NBER.

16.2 Describe other methods used to measure the business cycle.

16.3 Describe the national income and product accounts (NIPA).

16.4 Describe the circular flow of income and discuss why GDP can be computed using either income or expenditure data.

16.5 List the four major expenditure components of GDP.

16.6 List the major income components of GDP.

16.7 Describe the shortcomings of GDP as a measure of our standard of living.

16.8 Describe how nonmarket activities and the informal economy create both positive and negative effects on society.

From 2009 to 2016, the U.S. economy created over 10 million new jobs, the unemployment rate fell from nearly 10% to below 5%, inflation remained at historic lows, the housing market soared in many cities, and cheap energy prices led to lower costs of transportation and production. Under normal circumstances, these statistics would suggest a booming economy with a high level of growth. However, these aren’t normal circumstances. These are the realities of a nation recovering from the most severe recession in over a generation. How severe of a recession did the United States experience such that despite the tremendous gains made since 2009, many Americans continue to believe that the economy is weak?

The Great Recession of 2007–

The ability for a country to maintain economic growth depends on the ability of companies to sell products not only domestically but also to foreign consumers as part of international trade. Countries in today’s global economy are highly interconnected. Therefore, the recent economic slowdown in China and Brazil, along with the continuing financial struggles facing many European nations in managing their unified currency (the euro), makes it more difficult for the U.S. economy to expand.

A significant challenge facing countries today is determining the best path to long-

Classical economics was the dominant form of thinking a century ago when macroeconomic policy was largely based on microeconomic analysis. That all changed during the Great Depression of the 1930s, when John Maynard Keynes explained the causes of the Great Depression and set forth a framework on which to develop policies to avoid future severe macroeconomic downturns. This led to the development of macroeconomics as a discipline. Today, the use of Keynesian policy is common, as evidenced by government actions taken to minimize the effects of past recessions.

Managing the economy is not an easy task. Changes in the macroeconomy occur every day, and many changes are beyond the control of government. Because the world has become more connected, recessions in one country have an effect on other countries. Competition for jobs intensifies with greater labor mobility through immigration and with more companies seeking to pay lower wages by moving production facilities overseas. Population growth means more jobs are needed for a country just to remain at its same employment level. And pressures to earn profits in a competitive global economy force businesses to find more efficient means of production, including the use of automation, leading to some job loss as workers are replaced by machines.

These factors help to explain why economies fluctuate up and down over time, a phenomenon called the business cycle. The development of macroeconomics as a discipline came after the realization that business cycles occurred and the fact that they can vary significantly in duration and severity.

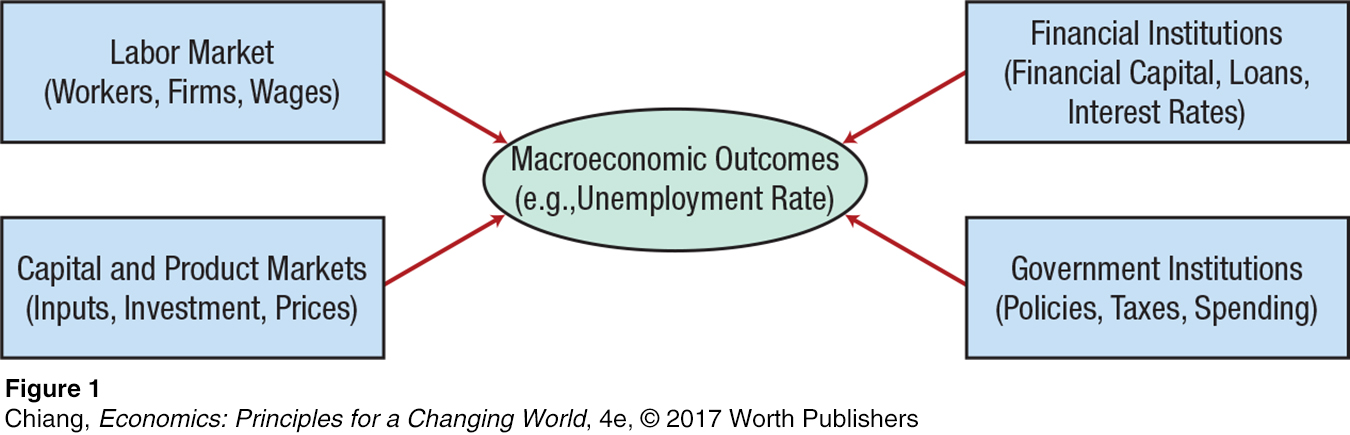

Macroeconomics describes how individuals, businesses, financial institutions, and government institutions interact to achieve the goals of job growth, low inflation, and economic growth. It is not just the conditions of one industry or group of workers that influence macroeconomic outcomes, but rather the conditions of all. Figure 1 illustrates how different markets and institutions come together to influence macroeconomic outcomes such as the unemployment rate and economic growth.

Most economists believe that the macroeconomy is too complex to function efficiently without policy interventions. Economists have developed many tools for managing the severity of business cycles. This chapter deals with how the macroeconomy is analyzed and measured. The first section considers how business cycles are defined. The second section looks at the system of national income accounts. These accounts give us our primary measures of income, consumer and government spending, business investment, and foreign transactions including exports and imports. The last section raises the question of how well the national income accounts measure our standard of living. We look at alternative measures of standard of living, nonmarket transactions, and the effect of environmental degradation and conservation. The foundation established in this chapter will apply to topics covered throughout the course.