AGGREGATE SUPPLY

aggregate supply The real GDP that firms will produce at varying price levels. The aggregate supply curve is positively sloped in the short run but vertical in the long run.

The aggregate supply curve shows the real GDP that firms will produce at varying price levels. Even though the definition seems similar to that for aggregate demand, note that we have now moved from the spending side of the economy to the production side. We will consider two different possibilities for aggregate supply: the short run and the long run. In the short run, aggregate supply is positively sloped and prices rise when GDP grows. In contrast, long-

Long Run

long-

The vertical long-

Full employment is often referred to as the natural rate of output or the natural rate of unemployment by economists. This long-

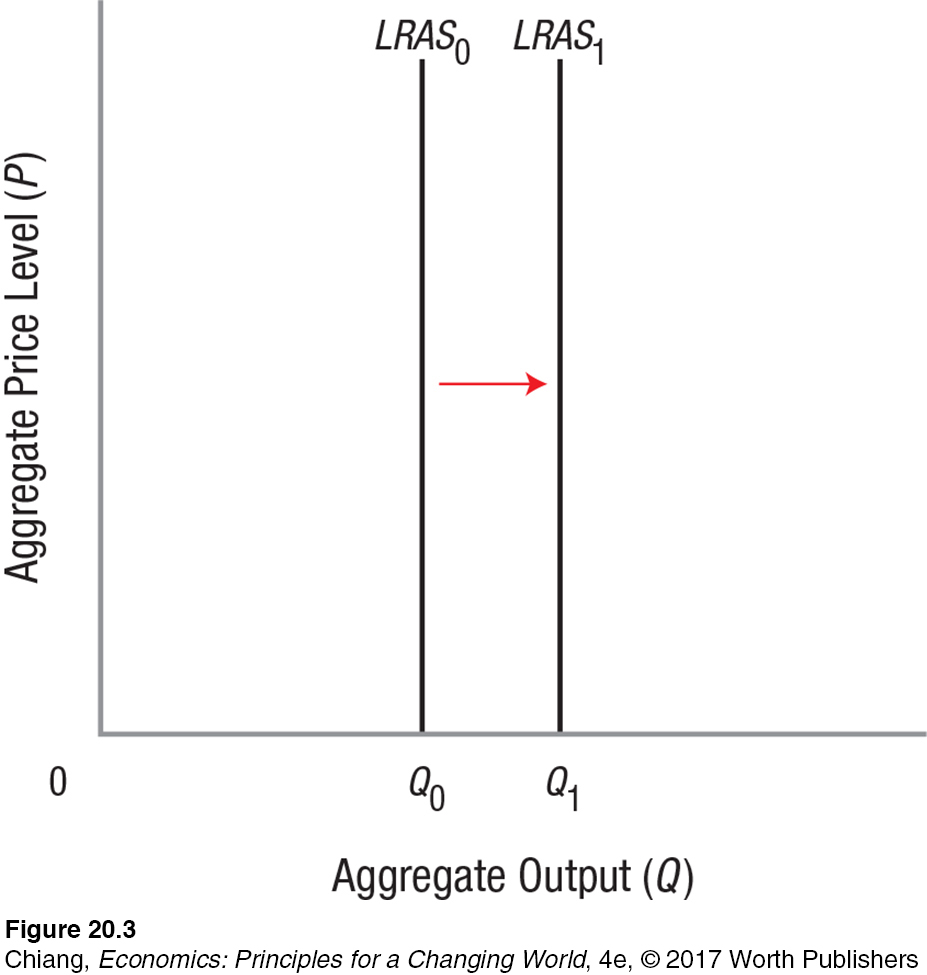

In general terms, the vertical LRAS curve represents the full employment capacity of the economy and depends on the amount of resources available for production and the available technology. Full employment is determined by the capital available, the size and quality of the labor force, and the technology employed; in effect, the productive capacity of the economy. Remember from earlier chapters that these are also the big three factors driving economic growth (shifting the LRAS0 curve to the right to LRAS1) once a suitable infrastructure has been put in place.

Determinants of Long-Run Aggregate Supply

Attempts to improve technology such as automation and digitalization are clear examples of an increase in productive capacity. But so is the enhancement of labor quality. As a greater percentage of people pursue college and postgraduate degrees, productivity increases and leads to economic growth. Finally, increased trade and globalization have allowed resources to flow more freely, permitting the United States to gain access to better or cheaper inputs and more specialized labor.

Each of the shifts in the LRAS curve takes time. It’s not easy to improve the human capital of an entire nation or to develop new production technologies. Therefore, although the LRAS is of concern to the long-

Short Run

short-

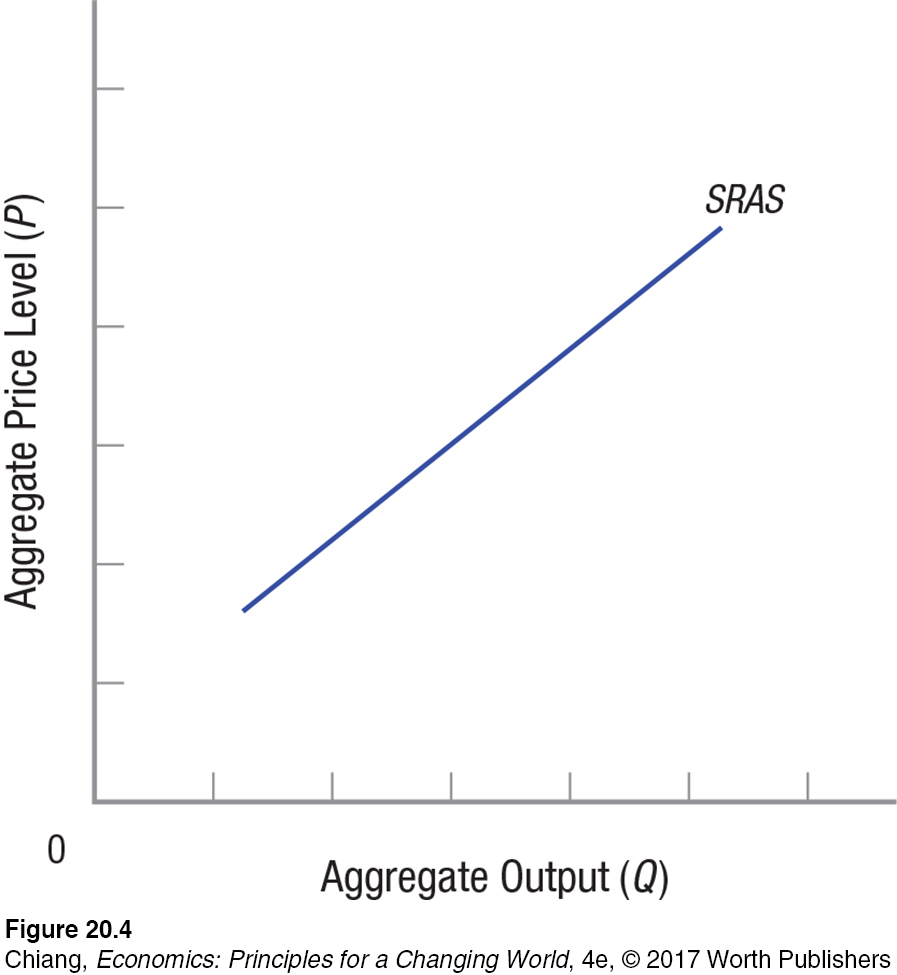

Figure 4 shows the short-

This situation, however, cannot last for long. As an entire industry or the economy as a whole increases its production, firms must start hiring more labor or paying overtime. As each firm seeks more employees, wages are driven up, increasing costs and forcing higher prices.

For the economy as a whole, a rise in real GDP results in higher employment and reduced unemployment. Lower unemployment rates mean a tightening of labor markets. This often leads to fierce collective bargaining by labor, followed by increases in wages, costs, and prices. The result is that a short-

Determinants of Short-Run Aggregate Supply

We have seen that, because the aggregate supply curve is positively sloped in the short run, a change in aggregate output, other things held constant, will result in a change in the aggregate price level. The determinants of short-

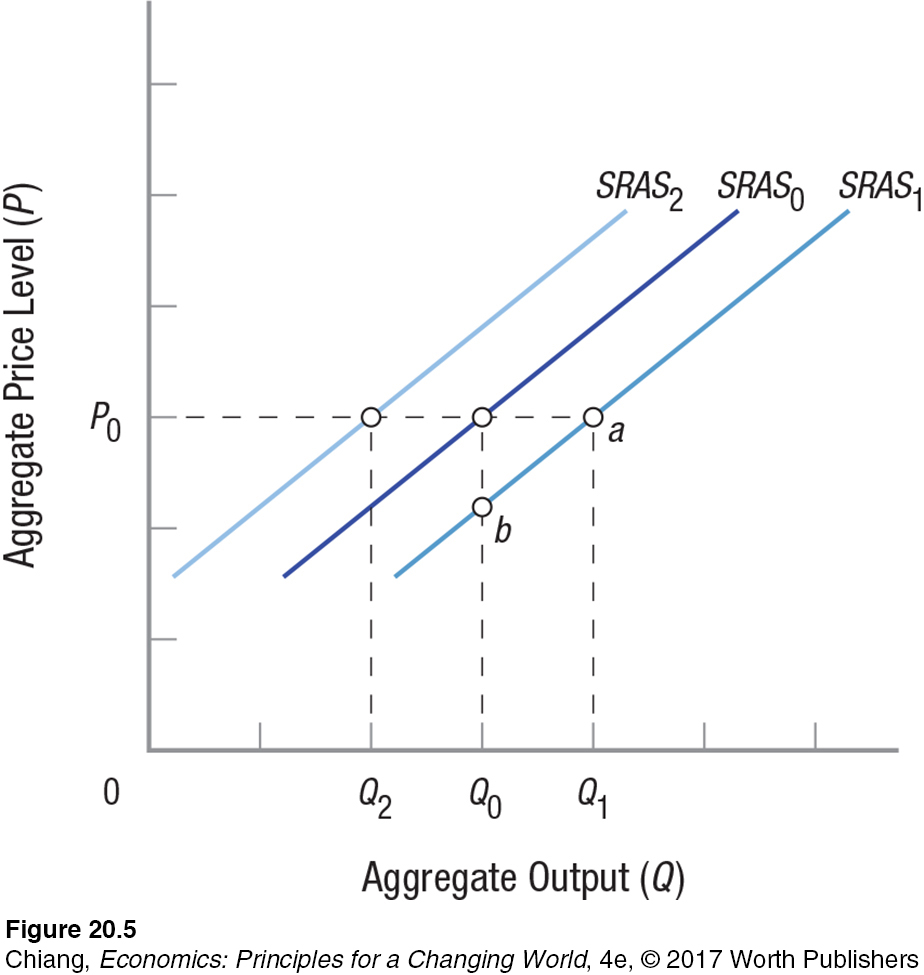

Input Prices Changes in the cost of land, labor, or capital will change the output that firms are willing to provide to the market. When world crude oil prices rise, it is never long before prices rise at the gasoline pump. Rising input prices are quickly passed along to consumers, and the opposite is true as well. New discoveries of raw materials result in falling input prices, causing the prices for products incorporating these inputs to drop. This means that more of these products can be produced at a price of P0 in Figure 5 as short-

Productivity Changes in productivity are another major determinant of short-

An example of a technological advance is the improvement in traffic-

Taxes and Regulation Rising taxes or increased regulation can shift the short-

Alternatively, tax reductions such as investment tax credits reduce the costs of production, resulting in an increase in short-

Market Power of Firms Monopoly firms charge more than competitive firms. Therefore, a change in the market power of firms can increase prices for specific products, thereby reducing short-

Today, with many non-

Inflationary Expectations A change in inflationary expectations by businesses, workers, or consumers can shift the short-

To summarize, the short-

| TABLE 2 | DETERMINANTS OF SHORT- |

|||||

| Determinant | SRAS Increases | SRAS Decreases | ||||

| Changes in Input Prices | Prices decline | Prices rise | ||||

| Changes in Productivity | ||||||

|

Improvements | Reductions | ||||

|

Improvements | Reductions | ||||

| Changes in Taxes and Regulations | ||||||

|

Lower | Higher | ||||

|

Higher | Lower | ||||

|

Reductions | Additions | ||||

| Change in Market Power | Reductions | Increases | ||||

| Changes in Inflationary Expectations | Lower | Higher | ||||

CHECKPOINT

AGGREGATE SUPPLY

The aggregate supply curve shows the real GDP that firms will produce at varying price levels.

The vertical long-

run aggregate supply (LRAS) curve represents the long- run full- employment capacity of the economy. Increasing resources or improved technology shift the LRAS curve, which represents economic growth.

The short-

run aggregate supply (SRAS) curve is upward- sloping, reflecting rigidities in the economy because input and output prices are slow to change (sticky). The determinants of short-

run aggregate supply include changes in input prices, productivity, taxes, regulations, the market power of firms, and inflationary expectations.

QUESTION: Because interest rates had been kept extremely low for almost a decade, many investors worried that access to cheap loans will drive prices higher as more people borrow money for purchases. How might this change in inflationary expectations affect the SRAS curve?

Answers to the Checkpoint questions can be found at the end of this chapter.

Low interest rates make it easier for individuals and firms to borrow for consumption and investment, which may lead to higher inflation, especially when the economy fully recovers and production resources are no longer sitting idle. As investors anticipate a rise in inflation, they will adjust production in anticipation of higher input (wage and raw materials) prices, which means SRAS will decrease.