QUESTIONS AND PROBLEMS

Check Your Understanding

Question 20.1

1. Describe the impact of rising interest rates on consumer spending.

Question 20.2

2. When the economy is operating at full employment, why is an increase in aggregate demand not helpful to the economy?

Question 20.3

3. When the economy is hit with a supply shock, such as rising prices for energy, food, or raw materials, why is this doubly disruptive and harmful to the economy?

Question 20.4

4. Explain why the aggregate supply curve is positively sloped during the short run and vertical in the long run.

Question 20.5

5. Explain how imports and exports affect aggregate demand.

Question 20.6

6. List some examples of factors that will shift the long-

Apply the Concepts

Question 20.7

7. There is little doubt that computers and the Internet have changed the economy. Information technology (IT) can boost efficiency in nearly everything: Markets are more efficient, IT is global, and IT improves the design, manufacture, and supply chain of products we produce. Use the aggregate demand and supply framework discussed in this chapter to show the impact of IT on the economy.

Question 20.8

8. Unemployment can be caused by a reduction in aggregate demand or short-

Question 20.9

9. Why is cost-

Question 20.10

10. Why is consumer confidence so important in determining the equilibrium level of output and employment?

Question 20.11

11. As the Japanese yen appreciated in value during the 1980s and 1990s, more Japanese auto companies built manufacturing plants in other parts of Asia and in the United States. What impact did this have on net exports for the United States? Why did Japanese automakers build plants in the United States? Were the reasons similar to the reasons that American firms build plants (or establish offshore production) in China and other parts of Asia?

Question 20.12

12. Some advocates have suggested that the United States should move to a universal health care plan paid for at the federal level, like Medicare, which would be funded out of general tax revenues. Such a plan, it is argued, would guarantee quality health care to all. Ignoring all the controversy surrounding such a plan, would the introduction of universal health care paid for from tax revenues have an impact on short-

In the News

Question 20.13

13. In 2016 a worldwide health scare resulted from the rapid spread of the mosquito-

Question 20.14

14. In late 2015 congressional House Speaker Paul Ryan helped pass a major budget bill signed by President Obama that eliminated many of the “sequester” provisions, or automatic spending cuts, that were implemented in 2013 after significant political gridlock. Many economists applauded the elimination of the spending cuts because they believed the cuts increased the risk of another recession when the economy was still in recovery. Using the AD/AS model and what you know about the spending multiplier, explain why economists would come to this conclusion.

Solving Problems

Question 20.15

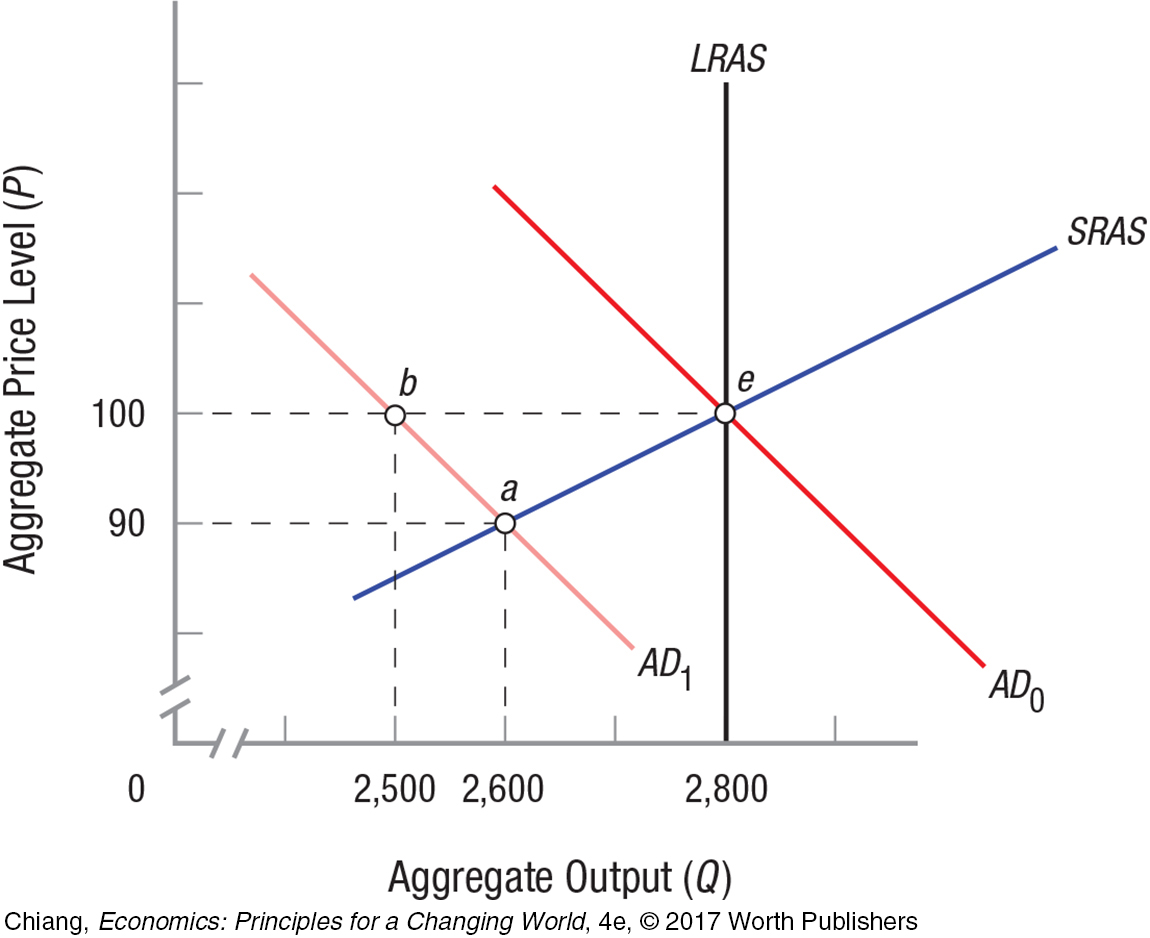

15. In the figure, the economy is initially in equilibrium at full employment at point e. Assume that consumption falls by 100, leading to a shift in aggregate demand from AD0 to AD1.

What is the new short-

run macroeconomic equilibrium price and output? How large is the simple Keynesian multiplier if there were no changes to the aggregate price level?

How large is the spending multiplier if the aggregate price level adjusts to the new equilibrium?

WORK IT OUT  | interactive activity

| interactive activity

Question 20.16

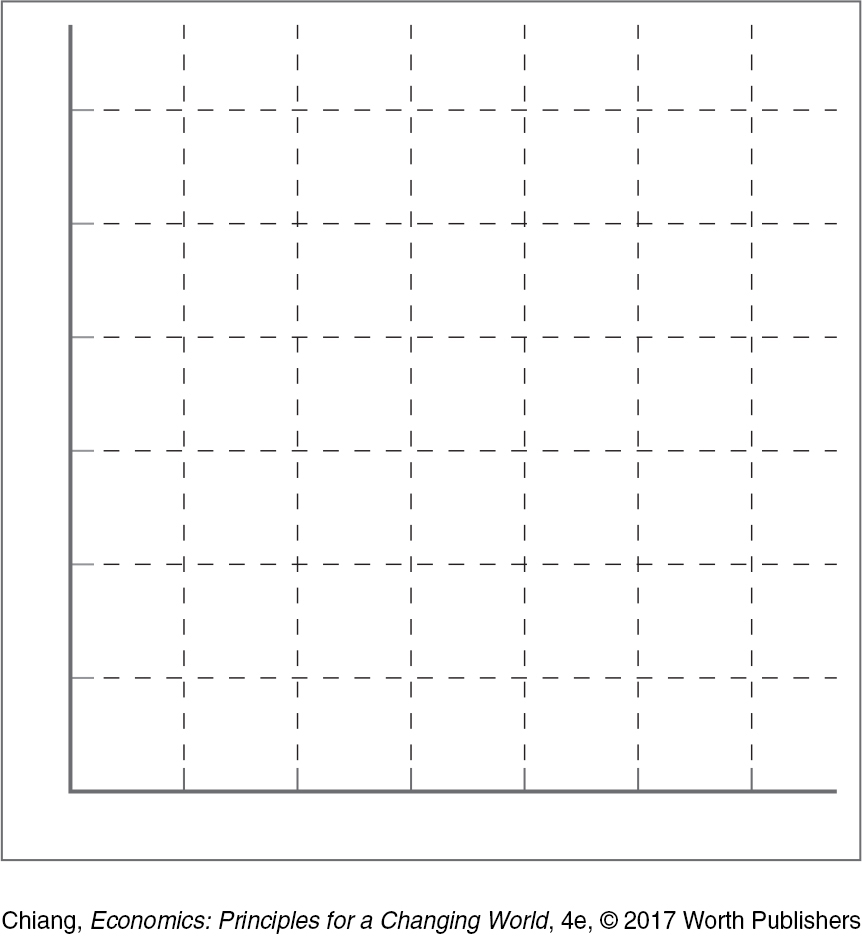

16. Use the table and grid below to answer the following questions:

| Aggregate Price Level | Output (short- |

Output (aggregate demand) |

| 150 | 1,000 | 200 |

| 125 | 800 | 400 |

| 100 | 600 | 600 |

| 75 | 400 | 800 |

| 50 | 200 | 1,000 |

In the grid, graph the aggregate demand and short-

run aggregate supply curves (label them AD0 and SRAS0). What are equilibrium output and the aggregate price level? Assume aggregate demand grows by 200 at each price level. Graph the new aggregate demand curve and label it AD1. What are the new equilibrium output and aggregate price level?

If full employment output is 600, is the economy experiencing recessionary or inflationary pressures?

By how much does the SRAS curve need to shift in order for the economy to return to full employment output at 600? What would the new equilibrium aggregate price level be?

USING THE NUMBERS

USING THE NUMBERS

Question 20.17

17. According to By the Numbers, if the average price of a barrel of oil is $50, and total aggregate demand in 2015 was $18 trillion in the United States and $11 trillion in China, what percentage of aggregate demand did oil consumption represent in each country?

Question 20.18

18. According to By the Numbers, by what percentage did M&E revenues increase from 2012 to 2015? How does M&E growth compare to the percentage growth in overall aggregate output over this time period (which was approximately 2-