chapter summary

chapter summary

Section 1 What Is Monetary Policy?

24.1 Monetary policy is the process by which a country’s money supply is controlled to target interest rates that subsequently influences economic output and prices.

Importance of Interest Rates on the Economy

Higher interest rates affect aggregate demand by:

Making borrowing more expensive, forcing consumers and firms to cut spending and investing

Giving people more incentive to save than spend

Forcing the government to spend more on financing the national debt

Increasing the value of the U.S. dollar, making U.S. exports more expensive

24.2 Twin Goals of Monetary Policy

Economic growth and full employment

Stable prices and moderate long-

term interest rates

Expansionary Monetary Policy: More money → lower interest rates → higher C, I, G, and (X − M) = increase in aggregate demand and output

Contractionary Monetary Policy: Less money → higher interest rates → lower C, I, G, and (X − M) = decrease in aggregate demand and output

Section 2 Monetary Theories

24.3 The quantity theory of money is a product of the classical school of thought, which concludes that the economy will tend toward equilibrium at full employment in the long run.

Classical theorists do not believe that monetary policies are effective at all.

Keynesians and monetarists believe that monetary policy can be effective in the short run, but not in the long run.

Keynesian Money Theory

Increasing the money supply leads to greater investment when the economy is healthy. In times of severe recession, however, monetary policy is ineffective.

Fiscal policy is the preferred approach to restore the economy.

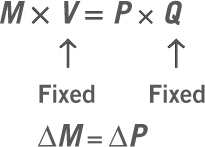

24.4 Equation of Exchange (Classical Theory)

Monetarist Theory

Increasing the money supply reduces interest rates, which leads to greater consumption and investment. Monetary policy is therefore effective in the short run.

Fiscal policy is ineffective as it crowds out consumption and investment.

24.5 Demand Shocks Versus Supply Shocks

Demand shocks affect the AD curve.

Caused by factors such as consumer confidence, business sentiment, or export demand.

Monetary policy is more effective because targeting one goal automatically targets the other.

Supply shocks affect the SRAS curve.

Caused by factors such as changing input prices or technological innovation.

Monetary policy is less effective because targeting one goal makes the other target worse.

Section 3 Modern Monetary Policy

24.6 Rules: Money grows by a fixed amount each year, preventing monetary policy from causing too drastic an effect because the economy is inherently stable in the long run.

versus

Discretion: A flexible money approach based on current economic conditions. It is useful in severe recessions when constant money growth might not be enough.

Alternative to money targeting is inflation targeting: implementing policy to keep inflation at about 2% to faciliate long-

24.7 Taylor rule: Used to approximate the Fed’s actions on interest rates based on economic conditions:

Fed Funds Rate Target = 2 + Inflation Rate + 1/2 (Inflation Gap) + 1/2(Output Gap)

Section 4 New Monetary Policy Challenges

24.8 The U.S. financial crisis in 2008 created a major challenge to the Fed, which had lowered the federal funds rate to near 0% but still faced an economy in deep recession.

To continue expansionary monetary policy with interest rates at 0%, the Fed engaged in various quantitative easing strategies, including purchasing long-

24.9 The nineteen member nations that form the Eurozone share a monetary policy set by the European Central Bank (ECB). In recent years, ECB has used aggressive monetary policy actions to prevent the effects of financial crises in individual nations from engulfing the entire region.