chapter summary

chapter summary

Section 1 The Great Recession and Macroeconomic Policy

25.1 Events Leading to the Great Recession

A glut in worldwide savings in the early years of the 21st century reduced interest rates.

Low interest rates and easy bank loans fueled a housing bubble.

Risky subprime mortgages were packaged into securities that were inadequately investigated and given perfect AAA ratings.

Loan defaults led to a reduction in home prices and the collapse of mortgage-

backed securities. Banks lost money from poor investments, insurance companies could not cover losses, and the contagion spread to other industries and eventually to the entire economy.

25.2 The Government’s Policy Response

Passed the $700 billion Troubled Asset Relief Program (TARP) to bail out banks nearing bankruptcy.

Loaned over $100 billion to AIG to prevent its insolvency in insuring risky assets by financial institutions.

Passed the $787 billion American Recovery and Reinvestment Act (stimulus package).

Bailed out the U.S. automobile industry.

Reduced the federal funds target rate to 0% and began a series of quantitative easing (QE) programs to purchase risky assets from banks.

Section 2 Effectiveness of Macroeconomic Policy: Phillips Curves and Rational Expectations

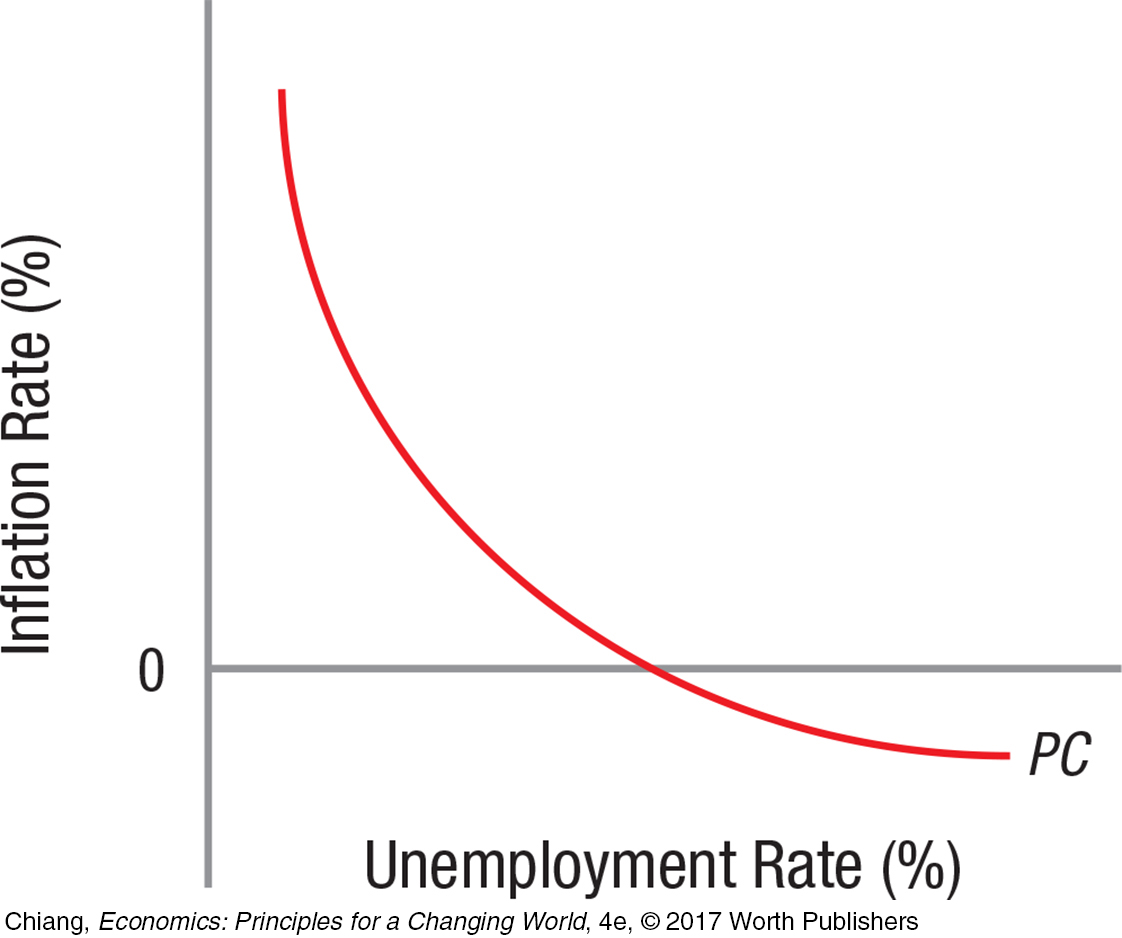

25.3 The Phillips curve shows a negative relationship between unemployment rates and inflation. As unemployment falls, firms bid up the price of labor. Greater employment increases aggregate demand, pushing prices higher.

The Phillips curve presented policymakers with a menu of choices. By accepting modest inflation, they can keep unemployment low.

25.4 Phillips curves are affected by inflationary expectations. Rising inflationary expectations by the public would be reflected in a shift in the Phillips curve to the right, worsening the tradeoff between inflation and unemployment.

If policymakers use monetary and fiscal policy to attempt to keep unemployment continually below the natural rate, they will face accelerating inflation.

Once inflation reaches a high level, the risk of stagflation occurs, in which high inflation is coupled with high unemployment. Reducing stagflation requires tough contractionary monetary policies to bring down inflation.

25.5 The adaptive expectations model assumes that people form their future expectations based on their past experiences. Therefore, it is a backward-

The rational expectations hypothesis suggests that policymakers cannot stimulate output in the short run by raising inflation unless they keep their actions secret.

Market imperfections and information problems are two reasons why the policy ineffectiveness conclusions of rational expectations analysis have met with mixed results empirically.

Section 3 Macroeconomic Issues That Confront Our Future

25.6 The use of fiscal policy or monetary policy, or both, depends on the type of issues confronting our economy. Important issues facing our country today and in the future include:

Jobless recoveries, which are common after severe financial crises

Rising deficits and debt

Higher long-

term inflation Globalization and its effect on economic growth

25.7 Jobless recoveries have become common after the last few recessions. Factors that have led to jobless recoveries include:

Rapid increases in productivity

Changes in employment patterns

Offshoring

25.8 Globalization affects what we buy and what we produce, as goods and inputs move across borders.