chapter summary

chapter summary

Section 1 The Balance of Payments

27.1 The current account includes payments for imports and exports of goods and services, incomes flowing into and out of the country, and net transfers of money.

The capital account includes flows of money into and out of domestic and foreign assets.

The sum of the current account and capital account balances must equal zero.

Foreign investment in the United States includes foreign ownership of domestic plants or subsidiaries; investments in mutual funds, stocks, and bonds; and deposits in U.S. banks. Similarly, U.S. investors hold foreign financial assets in their portfolios and own interests in foreign facilities and companies.

Section 2 Exchange Rates

27.2 The exchange rate defines the rate at which one currency can be exchanged for another.

A nominal exchange rate is the price of one country’s currency for another.

The real exchange rate takes price levels into account. The real exchange rate (er) is the nominal exchange rate (en) multiplied by the ratio of the price levels of the two countries:

er = en × (Pd /Pf)

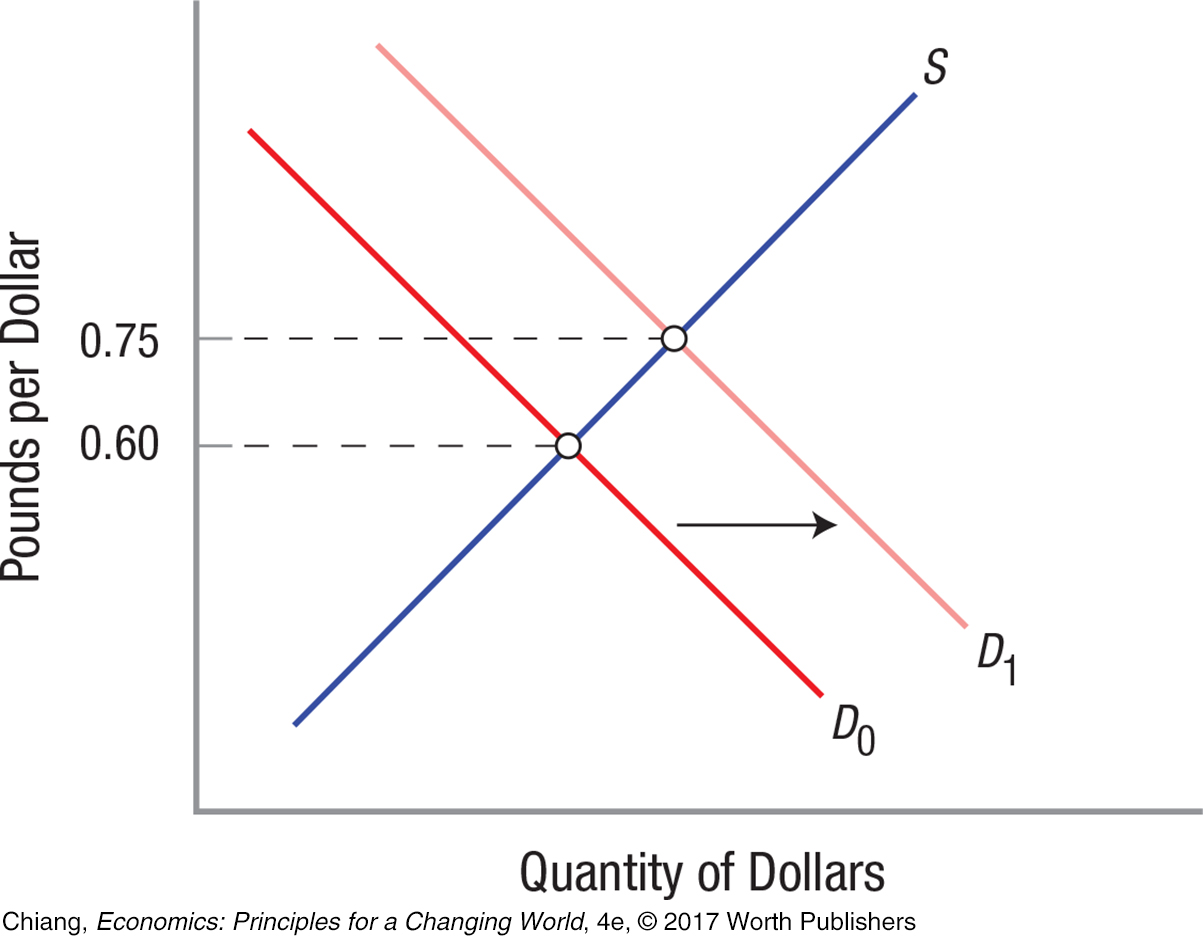

If exchange rates are fully flexible, markets determine the prevailing exchange rate. If there is an excess demand for dollars, the dollar will appreciate, or rise in value. If there is an excess supply of dollars, the value of dollars will decline, or depreciate.

In the figure, an increase in demand for U.S. dollars leads to its appreciation from 0.60 pounds per dollar to 0.75 pounds per dollar.

Interest rates and exchange rate expectations affect the capital account. An interest rate rise in one country will cause capital to flow into it from the other country.

Interest rates can differ between countries due to expected exchange rate changes (Δε) and a risk premium (x) when capital is not perfectly substitutable between countries.

rUS = rUK − Δε + x

Section 3 Monetary and Fiscal Policy in an Open Economy

27.5 A fixed exchange rate system is one in which governments determine their exchange rates, then use macroeconomic adjustments to maintain these rates.

A flexible or floating exchange rate system relies on currency markets to determine the exchange rates, given macroeconomic conditions.

Some countries choose to peg their currency to another in order to facilitate trade, attract foreign investment, or promote monetary stability.

27.6 The ability of a country to use fiscal policy and monetary policy is affected by the type of foreign exchange system in place.

A fixed exchange rate system hinders expansionary monetary policy because lower interest rates lead to capital outflows, which slow the economy.

A fixed exchange rate system reinforces expansionary fiscal policy because higher interest rates lead to capital inflows, which expand the economy.

Flexible exchange rates hamper expansionary fiscal policy because higher interest rates lead to currency appreciation, which reduces net exports.

Flexible exchange rates reinforce expansionary monetary policy because lower interest rates lead to currency depreciation, which increases net exports.