QUESTIONS AND PROBLEMS

Check Your Understanding

Question 8.1

1. Why must price cover average variable costs if the firm is to continue operating?

Question 8.2

2. Why do perfectly competitive firms sell their products only at the market price? Why not try to raise prices to make more profit or lower them to garner more sales?

Question 8.3

3. Describe the role that easy entry and exit play in competitive markets over the long run.

Question 8.4

4. Why are marginal revenue and price equal for the perfectly competitive firm?

Question 8.5

5. Why, if competitive firms are earning economic profits in the short run, are they unable to earn them in the long run?

Question 8.6

6. Describe the reasons why an industry’s costs might increase in the long run. Why might they decrease over the long run?

Apply the Concepts

Question 8.7

7. When a sports team consistently struggles, one strategy is to replace the coach. But when this happens, the new coach initially has the same players (its primary input). How can a new coach improve the team’s record when the players are mostly the same?

Question 8.8

8. Why isn’t a short-

Question 8.9

9. Suppose you master the art of growing herbs in your garden and selling them for profit at the local farmer’s market. Your neighbor sees your profitable business and decides to do the same; however, with less experience he faces a much higher marginal cost curve. How is it possible for both you and your neighbor to sell herbs at the same price?

Question 8.10

10. Assume a competitive industry is in long-

Question 8.11

11. When a competitive firm is earning economic profits, is it also maximizing profit per unit? Why or why not?

Question 8.12

12. In this chapter, we suggested that whenever market price fell below average variable costs, the firm would shut down. At that point, revenue is not covering its variable costs and the firm is losing more money than if it just shut down and lost fixed costs. Clearly, shutting the firm is more complicated than that. Under what circumstances might the firm continue to operate even though prices are below its average variable cost?

In The News

Question 8.13

13. The growth of ride-

Question 8.14

14. The opening of formal Cuban relations with the United States has led to greater trade between the two countries, especially in perfectly competitive products such as sugar, tobacco, and oranges. Explain what is likely to happen in the market for these agricultural products under increased trade with Cuba, and how that might affect individual farmers in the United States. What are the potential benefits to consumers and other producers?

Solving Problems

WORK IT OUT  | interactive activity

| interactive activity

Question 8.15

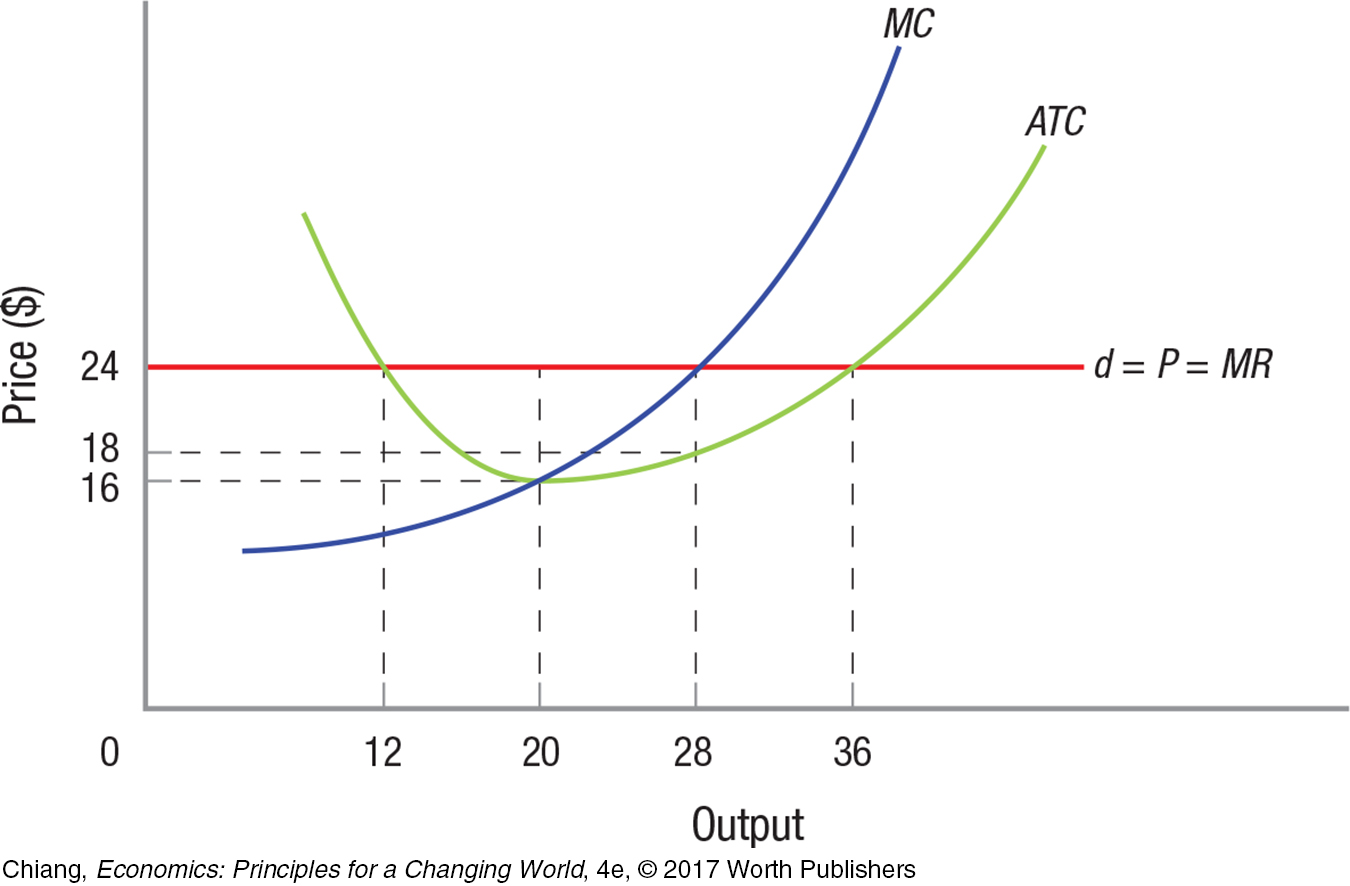

15. Use the following figure for a firm in a perfectly competitive market.

What is the output that maximizes the firm’s profit?

At the profit-

maximizing output, calculate total revenue and total cost. If the firm maximizes profit, how much profit does it earn?

What will likely happen to market demand or market supply in the long run?

What will likely happen to the market price in the long run?

Question 8.16

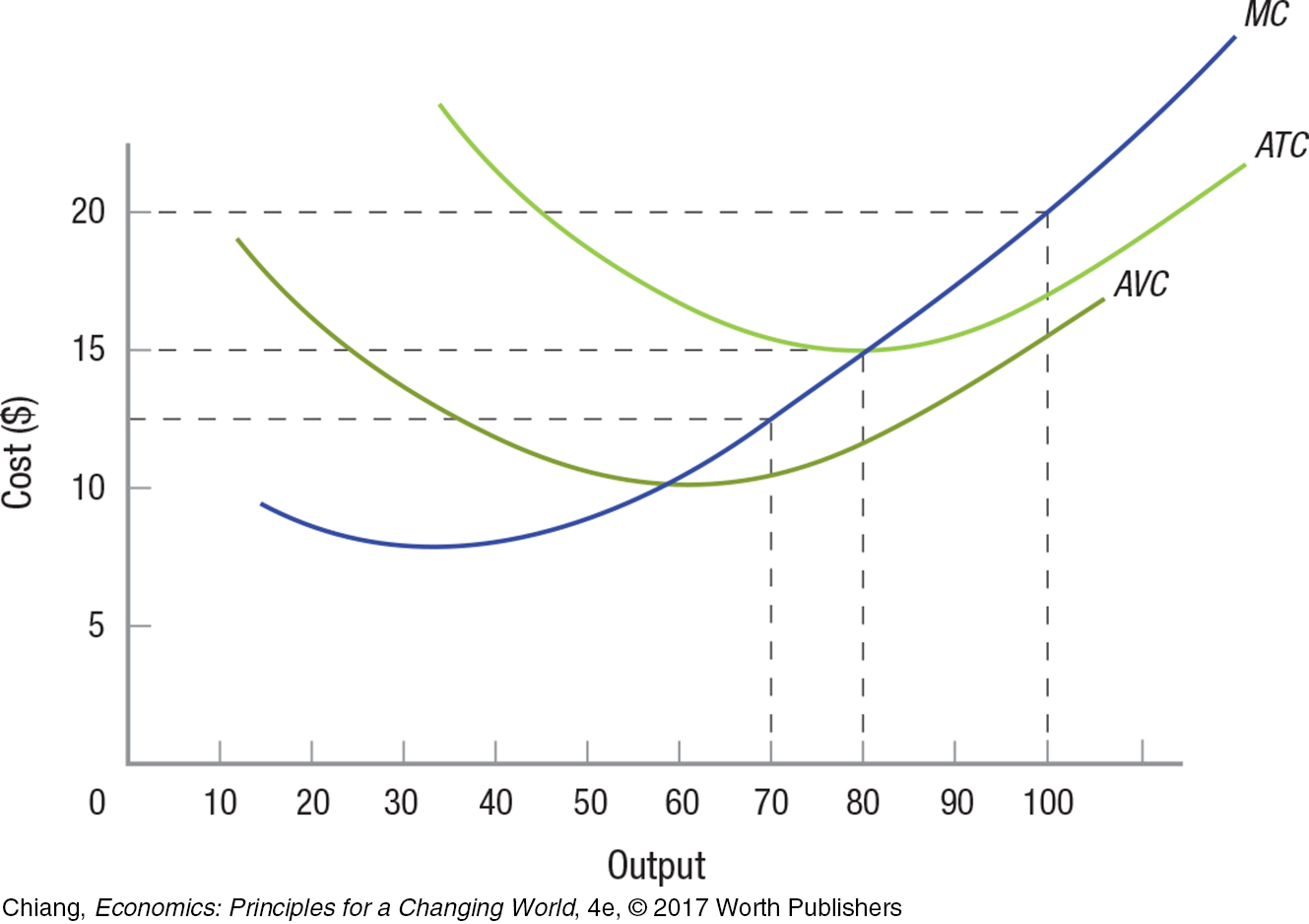

16. Use the figure below to answer the following true/false questions:

If market price is $25, the firm earns economic profits.

If market price is $20, the firm earns economic profit equal to roughly $100.

If market price is $9, the firm produces roughly 55 units.

If market price is $12.50, the firm produces roughly 70 units and makes an economic loss equal to roughly $210.

Total fixed costs for this firm are roughly $100.

If market price is $15, the firm sells 80 units and makes a normal profit.

USING THE NUMBERS

USING THE NUMBERS

Question 8.17

17. According to By the Numbers, which two regions employ the highest number of people in the farm and farm-

Question 8.18

18. According to By the Numbers, in which year (since 1991) did the following crops reach their highest and lowest prices per bushel: corn, wheat, soybeans?