COMPARING MONOPOLY AND COMPETITION

We have seen that perfectly competitive firms are price takers and produce as much as they can where MR = MC. In contrast, monopolies are price makers: They have the market power to set price and quantity, constrained only by their demand curve.

Would our economy be better off with more or fewer monopolies? This question almost answers itself. Who would want more monopolies—

Higher Prices and Lower Output From Monopoly

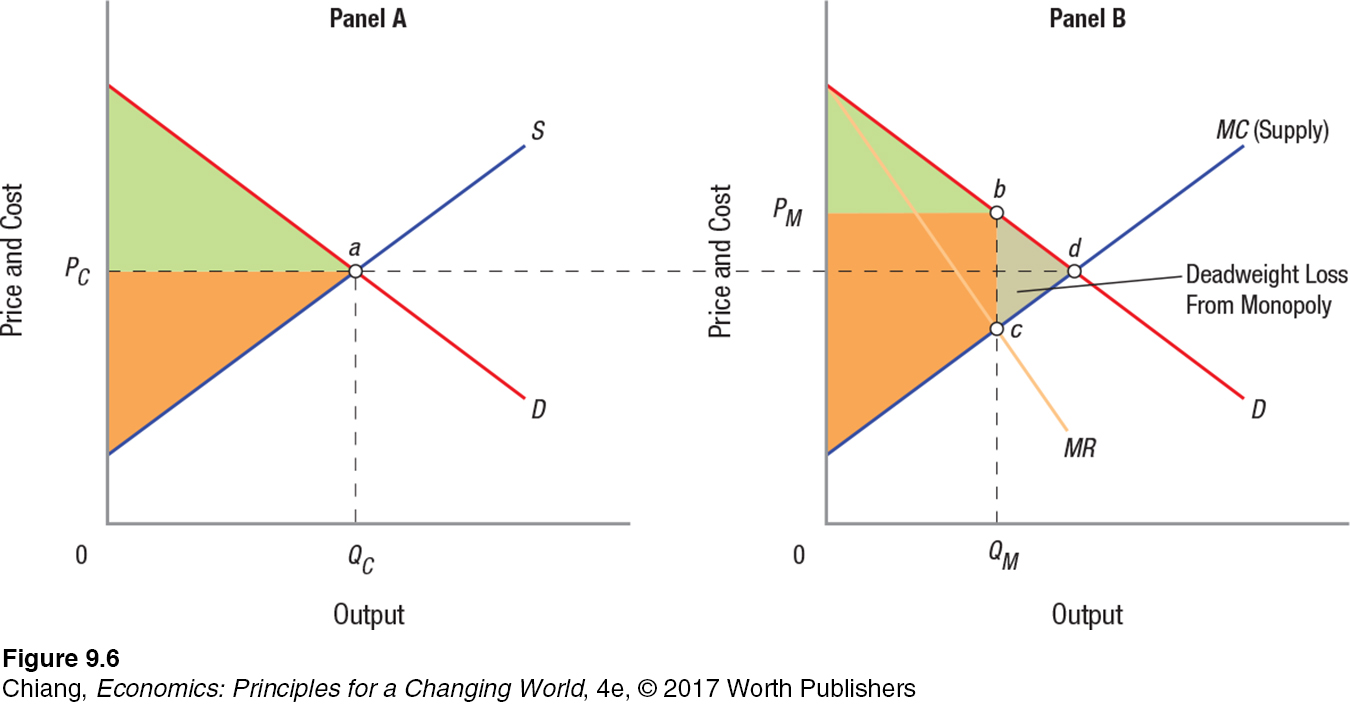

Imagine for a moment that a competitive industry is monopolized, and the monopolist’s marginal cost curve happens to be the same as the competitive industry’s supply curve. Figure 6 illustrates such a scenario. In panel A, the competitive industry produces where supply equals demand, and thus where price and output are PC and QC (point a). In panel B, monopoly price and output, as previously determined, are PM and QM (point b).

Clearly, monopoly output is lower, and monopoly price is higher, than the corresponding values for competitive industries. How does this translate into the welfare of consumers and producers? Recall that we measure consumer surplus as the difference between market demand and price, as shown by the green areas in each panel. Producer surplus is the difference between price and market supply (marginal cost), as shown by the orange areas in each panel. The higher price charged by a monopolist results in part of the consumer surplus from panel A being transferred into producer surplus in panel B. Panel B shows a smaller consumer surplus and a larger producer surplus under a monopoly compared to a competitive market in panel A. But this is not the end of the story.

Notice that at monopoly output QM, consumers value the QMth unit of the product at PM (point b), even though the cost to produce this last unit of output is considerably less (point c). This difference creates inefficiency because additional beneficial transactions could take place if output were expanded. This inefficiency, known as deadweight loss, is made up of consumer surplus and producer surplus that are lost from producing less than the efficient output. In panel B, deadweight loss from monopoly is shown as the shaded area bcd. This area represents the deadweight loss to society from a monopoly market.

Even though deadweight loss derives partly from lost producer surplus, monopoly firms willingly forgo this portion of producer surplus in order to transfer a larger portion of consumer surplus into producer surplus (the orange rectangular area above the Pc line in panel B). Therefore, monopoly firms use their market power to gain producer surplus at the expense of consumers and create inefficiency in the form of deadweight loss. But this is not the only source of inefficiency caused by firms with complete market power.

Rent Seeking and X-Inefficiency

Monopolies earn economic profits by producing less and charging more than competitive firms. Although these actions generate deadweight loss, monopolists are protective of the profits they earn. If barriers to entry to the market were eased, economic profit would evaporate as price falls, as it does in competitive markets. How, then, can a monopolist protect itself from potential competition? One way is to spend resources that could have been used to expand its production on efforts to protect its monopoly position.

rent seeking Resources expended to protect a monopoly position. These are used for such activities as lobbying, extending patents, and restricting the number of licenses permitted.

Economists call this behavior rent seeking—behavior directed toward avoiding competition. Firms hire lawyers and other professionals to lobby governments, extend patents, and engage in a host of other activities intended solely to protect their monopoly position. For example, in order to pick up passengers on the street, taxis in New York City require a medallion registered with the Taxi and Limousine Commission. Because restricting the number of medallions drives up their price, taxi drivers have an incentive to lobby for restrictions against companies such as Uber whose drivers do not require medallions but compete for the same customers. Many industries spend significant resources lobbying Congress for tariff protection to reduce foreign competition. All these activities are inefficient, in that they use resources and shift income from one group to another without producing a useful good or service. Rent seeking thus represents an added loss to society from monopoly.

x-

Another area in which society might lose from monopolies is called x-

Monopolies and Innovation

Much of our analysis of monopolies has focused on the inefficiencies created and the detrimental effects on consumers. However, monopolies do create some benefits that are shared among all of society. For example, monopolies provide new products, technologies, and medical breakthroughs that benefit many consumers. The incentives to earn monopoly profits created by patents and copyrights encourage firms to invest in developing these new products. Otherwise, what firm would be willing to spend hundreds of millions of dollars inventing a product only to have it copied and sold by other firms?

Similarly, much of the entertainment industry, including music, television shows, books, and movies, would not exist to such a great extent if copyrights did not provide singers, authors, and other media creators the monetary incentive to create such products for our enjoyment. Therefore, the ability to achieve market power through innovation provides an incentive to individuals and firms to invest time and money to create new products and other creative works that could generate substantial profits over time.

Benefits Versus Costs of Monopolies

Are there any other benefits to monopolies aside from innovation? The answer to this question is, “Possibly yes, though generally no.” If the economies of scale associated with an industry are so large that many small competitors would face substantially higher marginal costs than a monopolist, a monopolist would produce and sell more output at a lower price than could competitive firms.

This is the case of natural monopolies, and the justification for why monopolies are allowed to exist in industries such as the provision of water or electricity in many communities. Imagine what might happen if a storm knocks out power to your neighborhood, and instead of one electric company restoring power to your street, each household needed to wait for its specific electricity provider to show up.

Larger firms, moreover, can allocate more resources to research and development than smaller firms, and the possibility of economic profits may be the incentive monopolists require to invest.

Still, economists tend to doubt that monopolies are beneficial enough to outweigh their disadvantages.

In actuality, pure monopolies are rare, in part because of public policy and antitrust laws—

We have seen what monopolies are and how they arise. We also saw why a monopolist produces less than the socially optimal quantity at a higher than socially desirable price, and witnessed how monopoly compares unfavorably to the competitive model. Furthermore, we looked at an expensive drawback of monopolies: the amount of resources wasted in maintaining a monopolist’s position. In the next section, we relax the assumption of one price, revealing strategies monopolies use to increase profits.

A Convenience Store on Every Corner, as Far as the Eye Can See

Why don’t ABC stores in Hawaii use their market power to raise prices?

When traveling to Hawaii, one typically enjoys the beautiful beaches, mountains, and unique Polynesian culture. In Waikiki, the center of the tourist area, another ubiquitous sight can be seen: the ABC store. Founded in 1964, the ABC chain has stores throughout Hawaii. In fact, approximately thirty-

What made these stores so prominent in Waikiki, and how is this chain of convenience stores able to maintain its market power? The products sold in an ABC store are not unique. However, unlike a typical convenience store that sells snacks and other basic necessities, ABC stores are stocked with souvenirs, gifts, and other products catering specifically to tourists. Essentially, it’s a one-

Why does ABC have market power?

Because it was able to achieve economies of scale. Although each ABC shop is relatively small, the combined size of the thirty-

Why don’t they then use their market power to raise prices?

Because it is a contestable market. This means that the threat of new competition keeps ABC’s prices low, preventing it from exploiting its market power as fully as a true monopoly would. Therefore, although the sheer concentration of store locations has allowed ABC to achieve some market power, to survive and prosper, it serves its customers by offering convenient locations and a wide selection of items at reasonable prices.

GO TO  TO PRACTICE THE ECONOMIC CONCEPTS IN THIS STORY

TO PRACTICE THE ECONOMIC CONCEPTS IN THIS STORY

CHECKPOINT

COMPARING MONOPOLY AND COMPETITION

Monopoly output is lower and price is higher when compared to competition, resulting in deadweight loss.

Monopolies are subject to rent-

seeking behavior directed toward avoiding competition (lobbying and other activities to extend the monopoly). Because monopolies are protected from competitive pressures, they often engage in x-

inefficiency behavior— extending perks to management and other inefficient activities. Monopolies can provide benefits in the form of economies of scale and incentives to innovate. However, these benefits are outweighed by the costs resulting from the lack of competition.

QUESTIONS: About 25 years ago, nearly every household that wanted a wide selection of television channels subscribed to cable, which was essentially a monopoly with 98% of market share, facing only a tiny level of competition from expensive, behemoth satellite dishes. Today, cable companies control less than half of the market share. What has changed in the industry that led to increased competition? How has competition affected the efficiency and reliability of cable services?

Answers to the Checkpoint questions can be found at the end of this chapter.

Competition against cable began when satellite technologies improved, allowing satellite companies such as Dish Network and DIRECTV to offer television services using satellite dishes that were affordable and much more compact in design. Then, competition intensified with improved broadband access, allowing consumers to watch television using their computers and tablets with subscriptions to various streaming services. As cable’s market share fell, it had to improve the quality of service it offers. No more waiting all day for the notorious “cable guy.” Today, cable companies must provide precise service appointments and friendly customer service in order to stay in business.