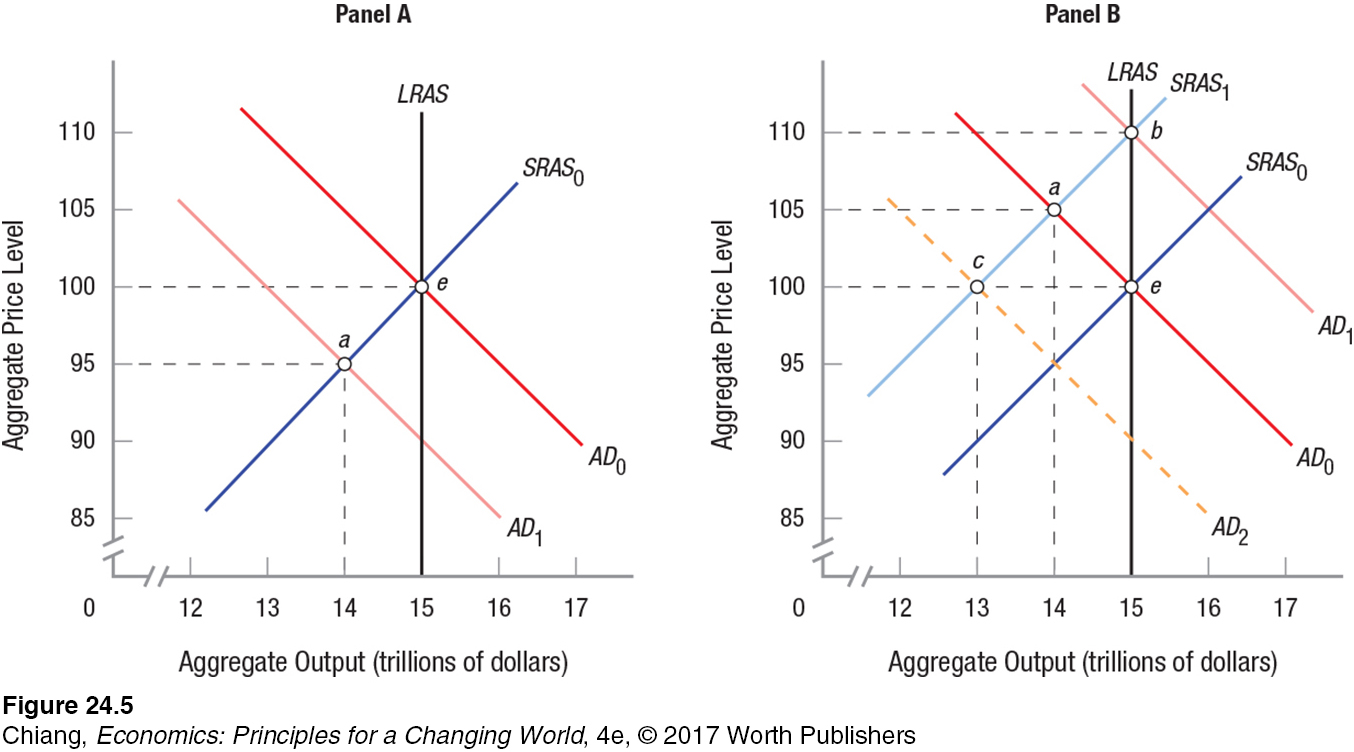

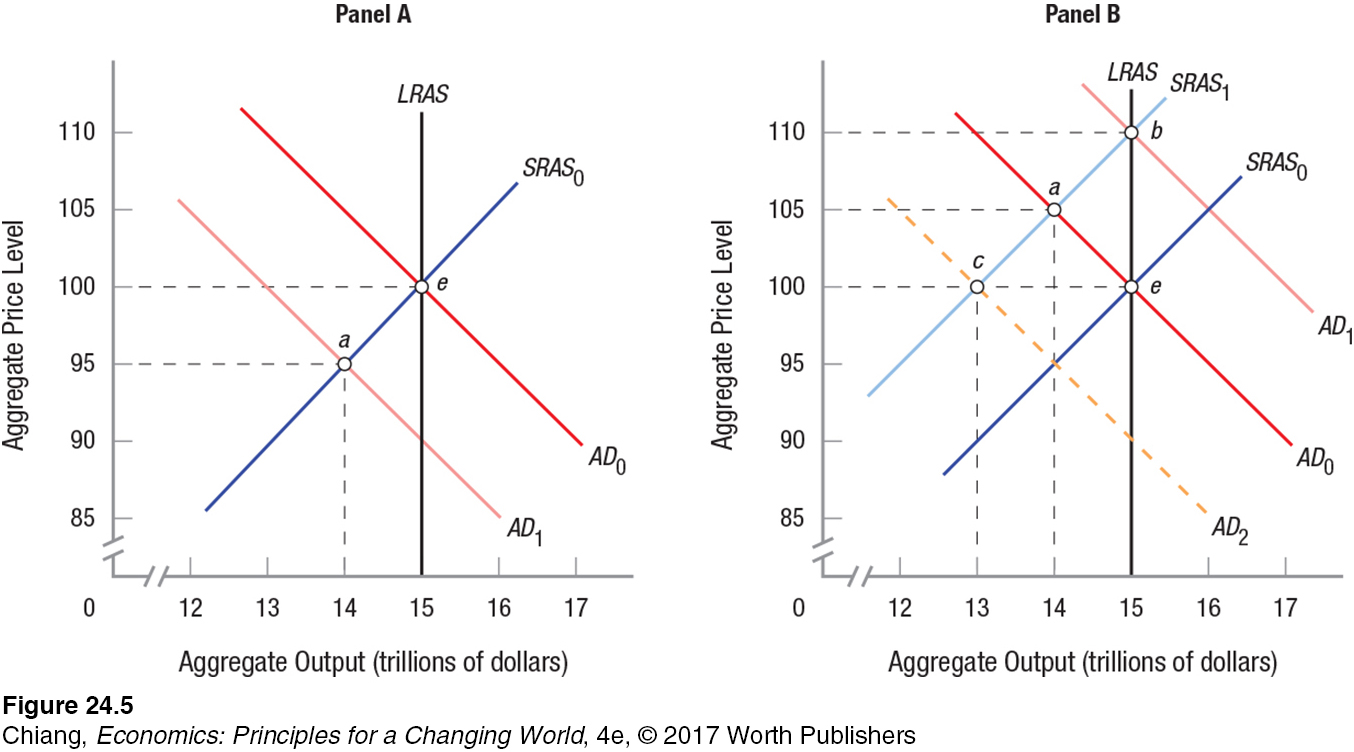

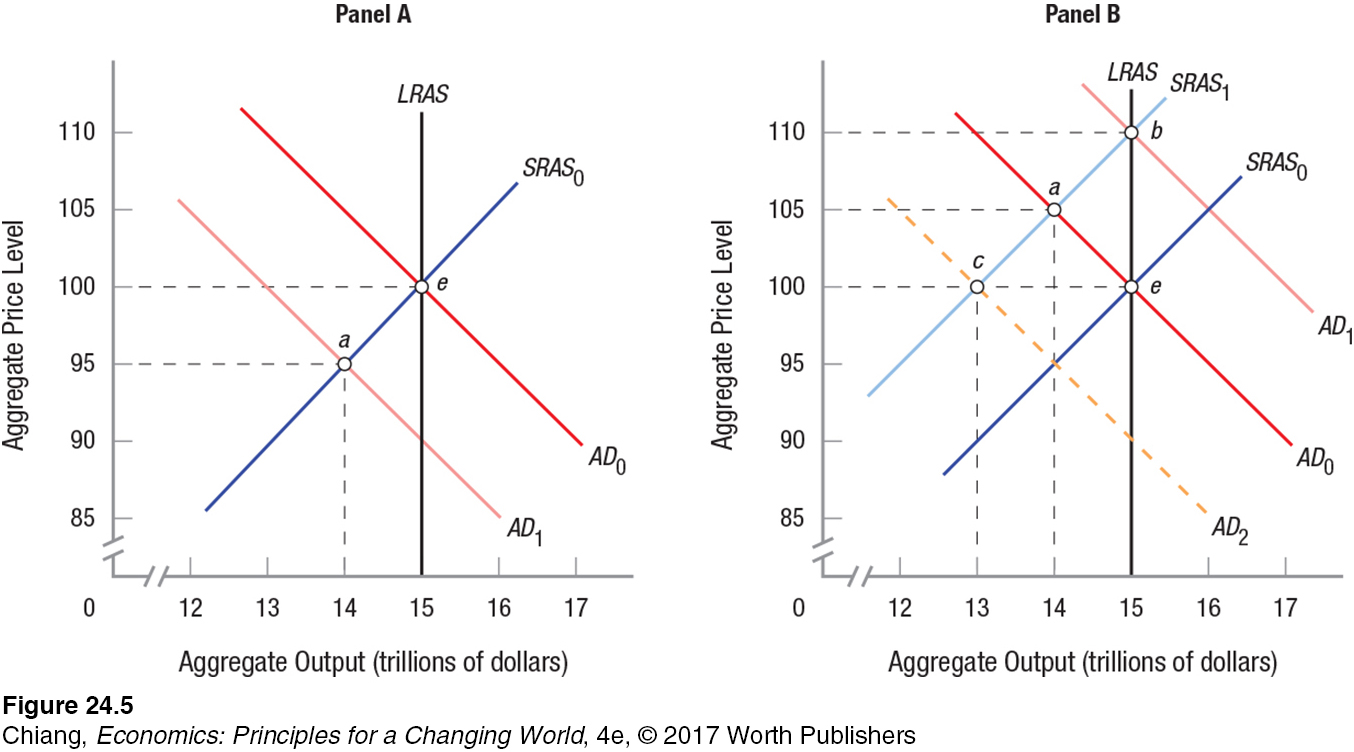

FIGURE 5 DEMAND SHOCKS, SUPPLY SHOCKS, AND MONETARY POLICY

Monetary policy can be effective in counteracting a demand shock. In panel A, the economy begins in full employment equilibrium at point e and then a demand shock reduces aggregate demand to AD1, resulting in a new equilibrium (point a). Expansionary monetary policy will shift aggregate demand back to AD0, restoring full employment output ($15 trillion) and prices (100). Monetary policy is less effective in counteracting a supply shock. In panel B, a negative supply shock shifts SRAS0 to SRAS1. The new equilibrium (point a) is at a higher price level, 105, and lower output, $14 trillion, a doubly negative result. The Fed could use expansionary monetary policy to shift AD0 to AD1; this would restore the economy to full employment output (point b), but at an even higher price level (110). Alternatively, the Fed could focus on price level stability, using contractionary monetary policy to shift aggregate demand to AD2, but this would further deepen the recession as output falls to $13 trillion (point c).

Monetary policy can be effective in counteracting a demand shock. In panel A, the economy begins in full employment equilibrium at point e and then a demand shock reduces aggregate demand to AD1, resulting in a new equilibrium (point a). Expansionary monetary policy will shift aggregate demand back to AD0, restoring full employment output ($15 trillion) and prices (100). Monetary policy is less effective in counteracting a supply shock. In panel B, a negative supply shock shifts SRAS0 to SRAS1. The new equilibrium (point a) is at a higher price level, 105, and lower output, $14 trillion, a doubly negative result. The Fed could use expansionary monetary policy to shift AD0 to AD1; this would restore the economy to full employment output (point b), but at an even higher price level (110). Alternatively, the Fed could focus on price level stability, using contractionary monetary policy to shift aggregate demand to AD2, but this would further deepen the recession as output falls to $13 trillion (point c).