chapter summary

chapter summary

Section 1 Fiscal Policy and Aggregate Demand

10.1 Fiscal policy describes the use of government taxation and spending to influence the economy. Specifically, it involves three main tools: taxation, government spending on goods and services, and transfer payments.

10.2 Contractionary fiscal policy includes reducing government spending or transfer payments, or raising taxes. The effect is a shift of the AD curve to the left, decreasing prices and aggregate output.

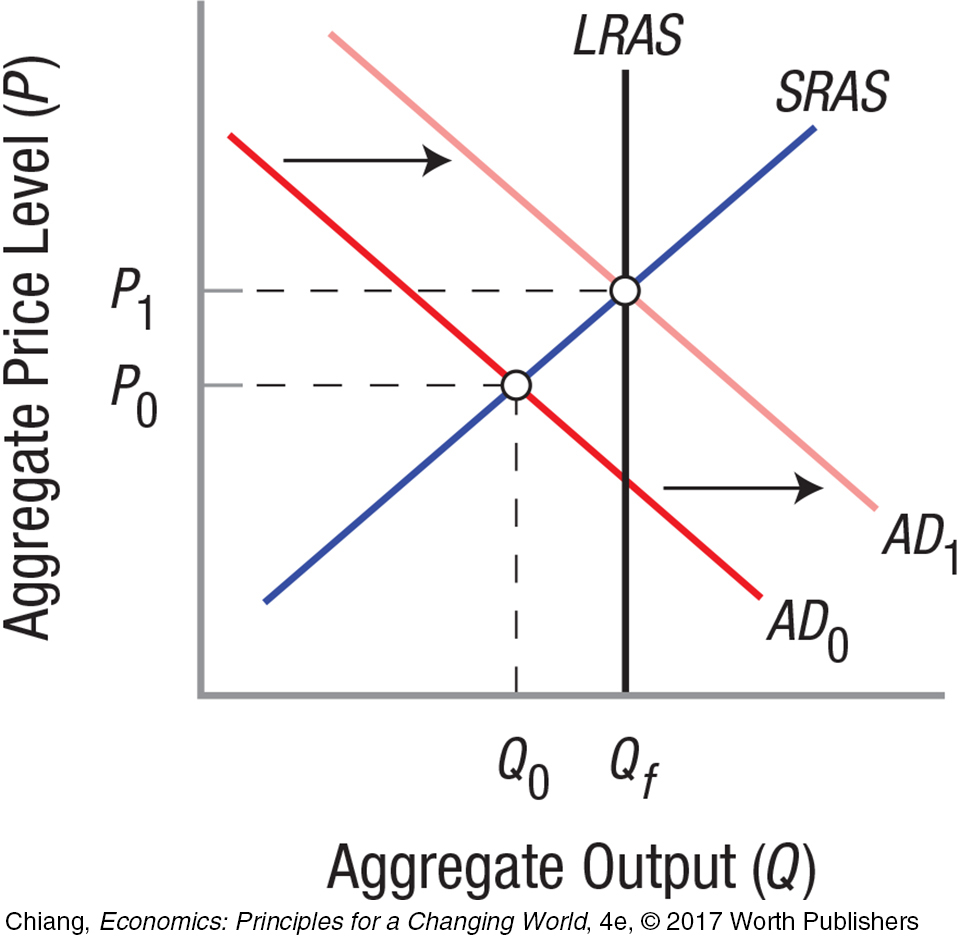

Expansionary fiscal policy includes increases in government spending or transfer payments, or reducing taxes. The effect is a shift of the AD curve to the right, increasing prices and aggregate output.

10.3 The multiplier effect allows each dollar of government spending to expand aggregate output by a multiple of the amount spent. Changes in government spending have a larger multiplier than changes in taxes.

Using expansionary fiscal policy to shift AD during a recession can reduce the time required to achieve full employment. The tradeoff of such policies is potential inflation, although the effect is small when used in a deep recession.

Section 2 Fiscal Policy

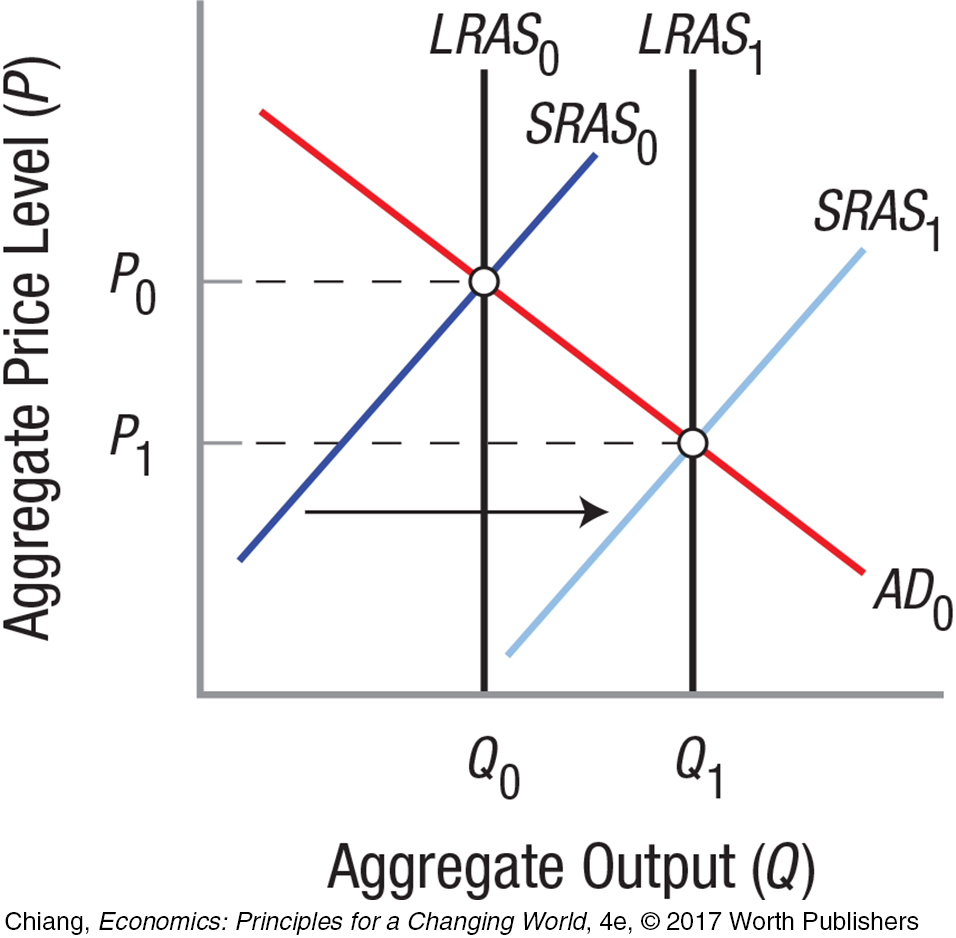

and Aggregate Supply

The goal of supply-

10.4 Common Supply-

Increase Infrastructure Spending: Improving roads and communications networks, stabilizing legal and financial systems, and improving human capital and technologies (R&D).

Decrease Tax Rates: Increases aggregate supply by providing firms incentives to expand or for individuals to work more.

Eliminate Burdensome Regulations: Leads to greater efficiency if the costs of regulation outweigh the benefits.

Section 3 Implementing Fiscal Policy

10.5 The economy contains automatic stabilizers:

Transfer payments fall

(both have contractionary effects to fight inflation)

10.6 Using fiscal policy involves timing lags:

Information lag: Time required to acquire macroeconomic data

Recognition lag: Time required to recognize trends in the data

Decision lag: Legislative process to enact policies

Implementation lag: Time required after laws are passed to set up programs

Transfer payments rise

(both have expansionary effects to offset the recession)

Section 4 Financing the Federal Government

10.7 The federal deficit is the annual amount by which government spending exceeds tax revenues.

A surplus occurs when tax revenues exceed government spending. The national debt is the accumulation of all past deficits less surpluses. The public debt is the portion of the national debt that is held by the public.

How Does the Government Finance Its Deficit (G – T)?

The Federal Reserve prints money to buy bonds: ΔM

Treasury bonds held domestically and externally: ΔB

Sales of government assets: ΔA

Section 5 Why Is the Public Debt So Important?

10.8 In 2015 the U.S. government paid $223 billion in interest payments on the public debt. Although this is a manageable expense, higher interest rates and rising future liabilities can make debt a more significant problem in the future.

About half of U.S. public debt is held externally, by foreign governments and investors. Of this amount, about 40%, or about $2.4 trillion, is held by China and Japan.

Borrowing money to finance the debt raises interest rates, making it more expensive for individuals and businesses to borrow money. This is the crowding-