chapter summary

chapter summary

Section 1 What Is Money?

Money is anything that is accepted in exchange for goods and services or for the payments of debts.

11.1 Three Primary Functions of Money

Medium of exchange: Eliminates the double coincidence of wants common to barter.

Unit of account: Reduces the number of prices needed to just one per good.

Store of value: Allows people to save now and spend later.

11.2 Two Primary Money Supply Measures

M1 = currency (banknotes and coins) and demand deposits (checking accounts).

M2 = M1 + “near monies” (savings accounts, money market deposit accounts, small-

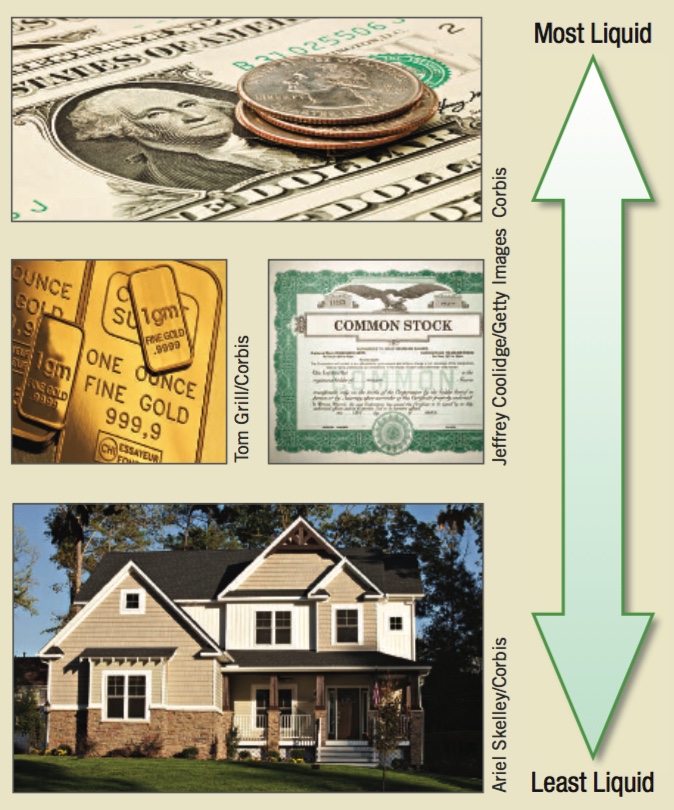

An asset’s liquidity is determined by how fast, easily, and reliably it can be converted into cash.

Section 2 The Market for Loanable Funds

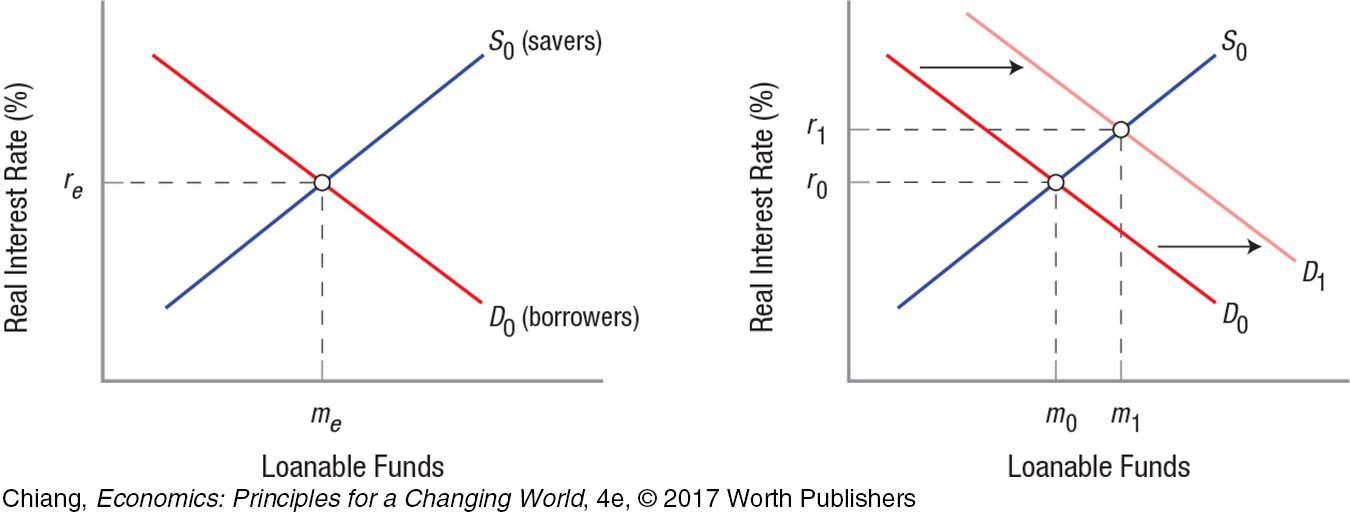

11.3 The market for loanable funds describes the financial market for saving and investment.

Savers provide more funds to the loanable funds market as interest rates increase.

Firms demand more funds for investment opportunities as interest rates fall.

11.4 Factors affecting the willingness to save or borrow lead to a change in the market for loanable funds. For example, growing business confidence increases firms’ willingness to invest, thus shifting the demand for loanable funds to the right, causing interest rates to rise.

Section 3 The Financial System

11.5 Financial intermediaries accept funds from savers and efficiently channel these to borrowers, reducing transaction and information costs, as well as lowering risk.

A bond is a contract between a seller (government or company) and a buyer. As a general rule, as market interest rates rise, the value of bonds (paying fixed dollars of interest) fall, and vice versa.

11.6 How to Calculate the Price of a Perpetuity Bond

Price of Bond = Annual Interest Payment ÷ Yield (%)

Example: If a bond pays $100 per year, and the yield is 6%, the price of the bond is $100 ÷ 0.06 = $1,667.

Section 4 Financial Tools for a Better Future

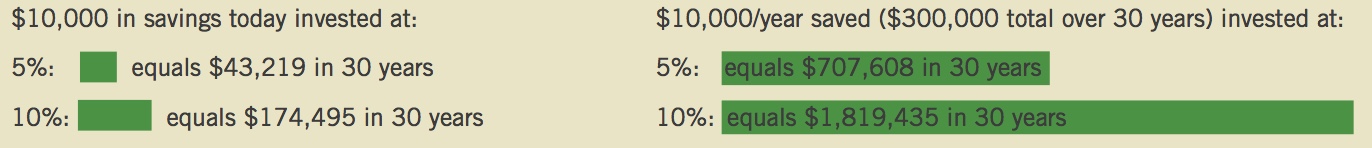

11.7 The compounding effect is powerful because it causes debt (if no payments are made) and savings to increase dramatically over time.

11.8 Tradeoff Between Risk and Return: The greater the risk involved, the higher the average annual return on investment.

11.9 Programs for Retirement Savings

Employer-

sponsored programs Fixed contribution plans, such as 401(k), 403(b), and TIAA-

CREF, allow workers to contribute pretax dollars and employers to partially match contributions. Pensions are monthly payments made by employers to their retired employees based on length of employment with the company.

Government-

sponsored programs Social Security: Current workers pay benefits of retirees through the payroll tax on wages.

Other retirement programs

Traditional IRAs use pretax dollars to fund investments; taxes are paid upon withdrawal after age 59.5.

Roth IRAs use after-

tax dollars to fund investments. Contributed funds (but not earnings on those contributions) can be withdrawn anytime without penalty, and no taxes are paid on withdrawals (including earnings on investment) after one reaches the age of 59.5.