WHAT IS MONETARY POLICY?

Throughout the study of macroeconomic principles, we have emphasized the effect of the business cycle in creating natural ups and downs in the economy, which often lead to inflation or unemployment. The rest of our study has dealt largely with ways to manage these fluctuations and to limit the harm from deviating too far from the long-

One way of managing economic fluctuations is the use of fiscal policy, which we studied earlier. Fiscal policy uses the tools of taxation, government transfer payments, and government spending. The other way of managing economic fluctuations is the use of monetary policy, which deals with how the money supply is controlled to target interest rates in an economy.

The Twin Goals of Monetary Policy

The authority to control a nation’s monetary policy is typically held by a country’s central bank. In the United States, the central bank is the Federal Reserve, an independent organization unaffiliated with any political party. The seven members of its Board of Governors are appointed by the president for a 14-

As discussed in the previous chapter, the Fed uses its primary tools of conducting open market operations, setting reserve requirements, and setting the discount rate to manage the money supply in the economy. By doing so, it has tremendous influence on interest rates, including those on savings accounts, money market accounts, government bonds, mortgage payments, student loans, car loans, and credit card balances.

The Fed uses these tools to promote its twin goals of economic growth with low unemployment, and stable prices with moderate long-

Examples of Monetary Policy in Action

The business cycle of the economy produces frequent ups and downs, and the Fed is kept busy anticipating and reacting to prevent major economic crises from occurring. Let’s take a brief look at a few recent periods when the Fed stepped in to promote economic and price stability.

1998–

2001–

2004–

2007–

2010–

Why Is the Interest Rate So Important to the Economy?

Examine the economic decisions you make every day, and you might discover how interest rates play a powerful role. Interest rates affect the manner in which we borrow and consume, and the way in which we save and invest.

Suppose you are looking to buy a new car, and have budgeted $2,000 for a down payment and $400 a month toward the monthly payment on a five-

It depends a great deal on the interest rate. Suppose the current interest rate on a car loan is 8.99%. Using the money you have, you would be able to afford a car costing up to $21,275. But now suppose that the interest rate on a car loan is 2.99%. At the lower interest rate, you would be able to afford a car costing up to $24,265, or almost $3,000 in extra spending without changing your monthly payment.

This extra $3,000 in potential spending resulting from the lower interest rate adds to the amount of consumption in the economy. Recall that aggregate demand is the sum of consumption, investment, government spending, and net exports. Just as lower interest rates make cars more affordable, they also make homes more affordable, along with equipment purchases by businesses. Therefore, a reduction in interest rates promotes greater consumption and investment, which leads to an increase in aggregate demand, shifting the aggregate demand curve to the right.

When Is It Optimal to Loosen or Tighten Monetary Policy?

By influencing interest rates, the Fed influences aggregate demand. Specifically, the Fed loosens monetary policy in times of recessionary concerns and tightens monetary policy in times of inflationary concerns.

Loosening monetary policy: Reducing interest rates → increases consumption and investment → increases aggregate demand.

Tightening monetary policy: Raising interest rates → decreases consumption and investment → decreases aggregate demand.

Let’s explore “loosening” and “tightening” a bit more.

expansionary monetary policy Fed actions designed to increase the money supply and lower interest rates to stimulate the economy (expand income and employment).

Expansionary Monetary Policy During times of economic downturn, the Fed will engage in expansionary monetary policy by conducting open market operations. By buying government bonds from banks using money it creates, the Fed puts more money into the economy, thus expanding the money supply and reducing interest rates. Lower interest rates tend to reduce the proportion of income people save and increase the amount they consume or invest, all else equal. The increase in consumption and/or investment results in an increase in aggregate demand (AD).

As interest rates are lowered, consumers and businesses find the cost of borrowing decreasing as well. For a business, this reduces the financing cost for an expansion of a factory or the building of a new restaurant or store. To a consumer, a lower interest rate on a home or car purchase can significantly reduce monthly payments, freeing up some money for other purchases. As borrowing increases to finance consumption or investment, AD again increases.

Further, a reduction in interest rates, in particular on Treasury securities, means that the government is spending less on financing the national debt. By spending less on financing the debt, the government is then able to spend more on other purchases, which contributes to an increase in AD.

Finally, as the interest rate falls, American bonds become less attractive to foreign investors, and this often leads to a decline in the value of the U.S. dollar in foreign exchange markets. A falling dollar makes American products cheaper relative to foreign products, which stimulates exports and reduces imports, increasing AD.

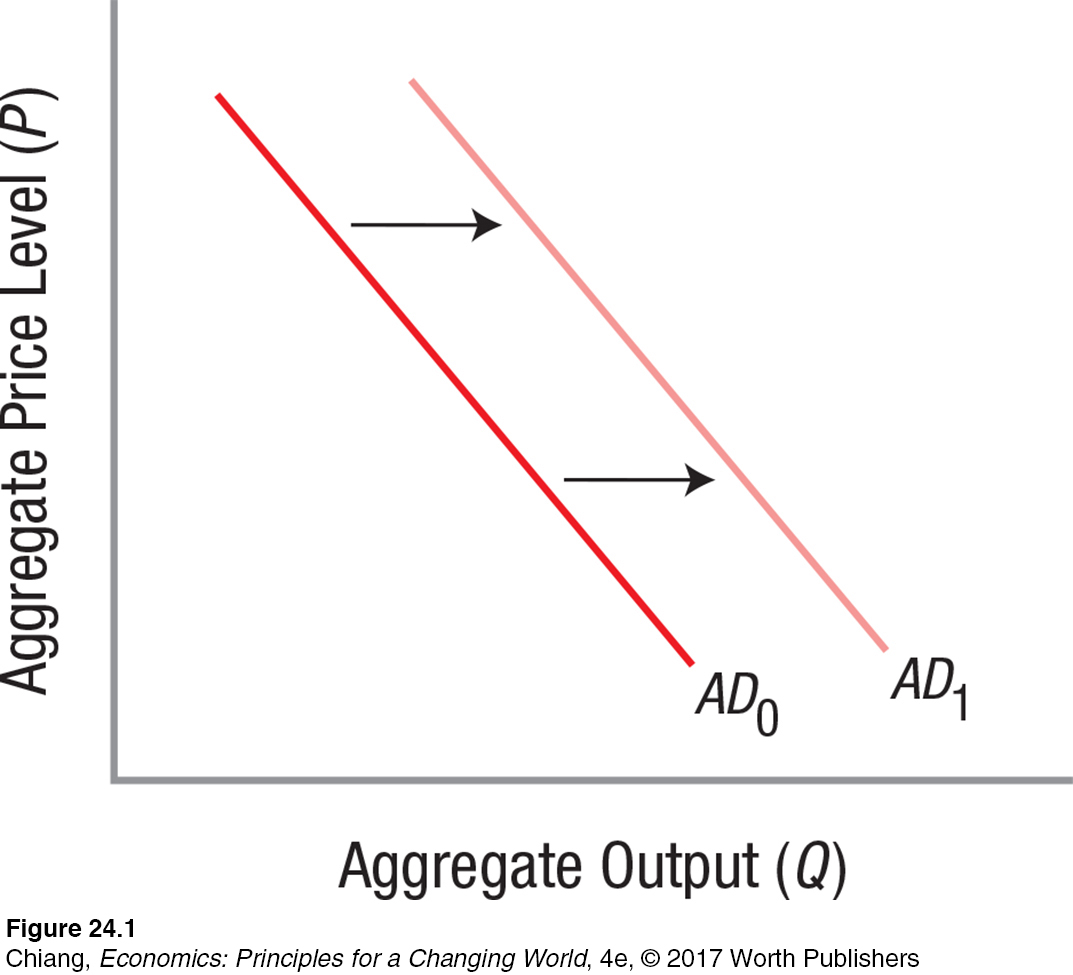

In sum, expansionary monetary policy is used when the economy faces a recessionary gap, in which output is below the level needed to reach full employment. By engaging in expansionary policy, the aggregate demand curve shifts to the right as shown in Figure 1, expanding output at every price level.

contractionary monetary policy Fed actions designed to decrease the money supply and raise interest rates to shrink income and employment, usually to fight inflation.

Contractionary Monetary Policy The opposite of expansionary monetary policy is contractionary monetary policy, which occurs when the Fed sells bonds, taking money out of the economy to reduce the money supply and raise interest rates. The Fed uses contractionary monetary policy when inflationary pressures build up. When do inflationary periods typically occur?

Inflationary pressures typically occur following a period of strong economic growth, such as during the housing bubble between 2004 and 2006. As eager consumers and investors bid up prices for homes, demand increased for related items such as furniture, appliances, and even plane tickets for those who bought second homes far away. As demand for goods and services rises, prices tend to rise as well. If prices rise too much, this would have consequences on the economy as the purchasing power of savings erodes.

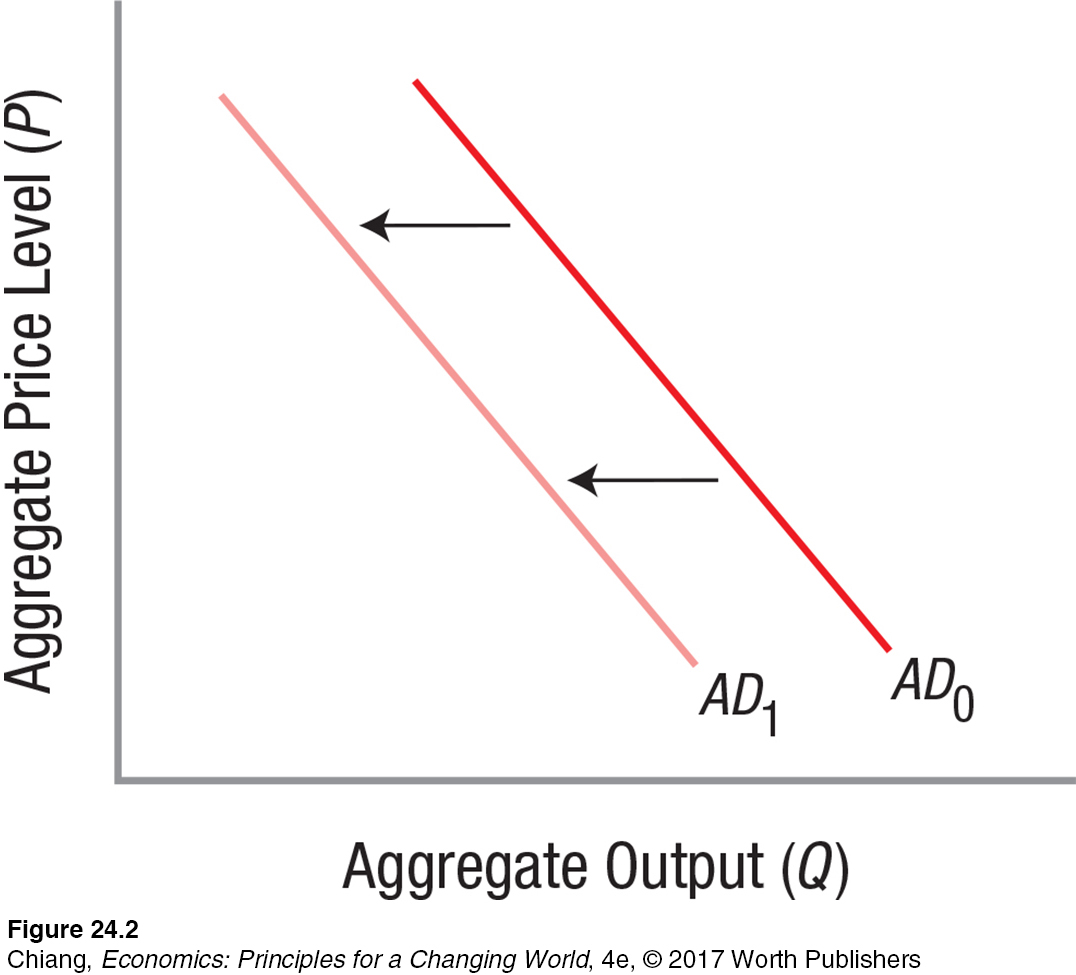

To stem the growth of inflation, the Fed would reduce the money supply, thereby increasing the interest rate to slow the growth of demand. In this case, rising interest rates would lead to a fall in consumption and investment. The government would spend more financing the national debt, reducing what it can spend on other goods and services. Moreover, a rise in the value of the dollar from increased demand for higher interest bonds makes American goods more expensive, reducing net exports. Each of these effects causes the aggregate demand curve to shift to the left as shown in Figure 2, reducing output at every price level and putting downward pressure on prices.

Up until now, we have assumed that monetary policy affects the interest rate, which subsequently influences aggregate demand. But how does a simple change in the money supply influence the amount of goods and services in the real economy? The next section explores this question by analyzing how prices and output change in the short run and long run.

CHECKPOINT

WHAT IS MONETARY POLICY?

Monetary policy involves the control of the money supply to target interest rates in order to stabilize fluctuations in the business cycle.

The Federal Reserve implements monetary policy. Its goals are to promote economic growth by maintaining full employment, stable prices, and moderate long-

term interest rates. Interest rates are crucial because they directly influence the components of aggregate demand, including consumption and investment.

Expansionary monetary policy is used during times of recession, and involves expanding the money supply to reduce interest rates.

Contractionary monetary policy is used during times of rising inflation, and involves reducing the money supply to raise interest rates.

QUESTION: Suppose the government passes legislation limiting the maximum interest rate that can be charged on student loans, reducing the monthly payment on your loans. How is this legislation similar to an expansionary monetary policy?

Answers to the Checkpoint questions can be found at the end of this chapter.

Expansionary monetary policy reduces interest rates in order to spur consumption and investment, leading to an increase in aggregate demand. A reduction in interest rates placed on student loans by the government, although technically not monetary policy, produces a similar effect. When your monthly payments are reduced due to the interest rate reduction, you now have extra money to spend on other items. This extra consumption contributes to an increase in aggregate demand, much like an expansionary monetary policy.