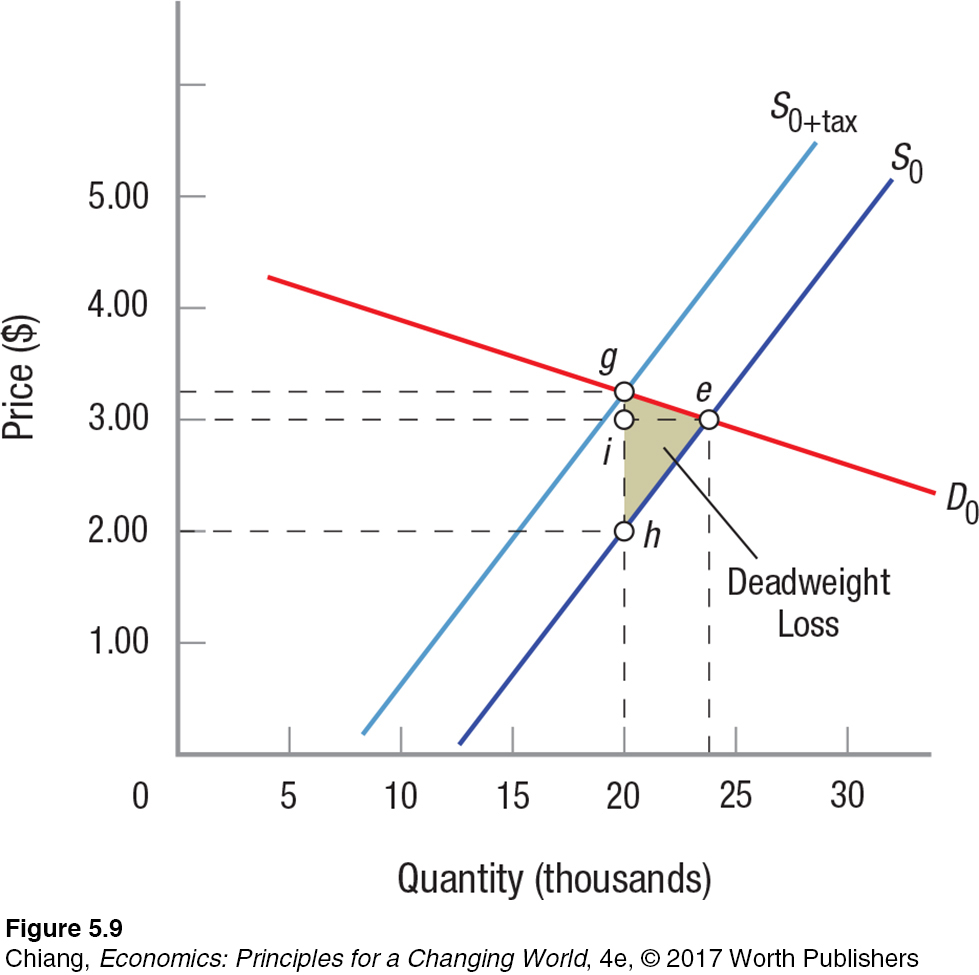

FIGURE 9 TAX BURDEN WITH ELASTIC DEMAND AND INELASTIC SUPPLY

S0 is the initial supply curve for a product with elastic demand. When a $1.25 excise tax is placed on the product, the supply curve shifts upward by the amount of the tax, to S0+tax. Assuming demand remains constant at D0, the new equilibrium will be at point g. Because demand is elastic, consumers are more responsive to the rise in price, and therefore producers are less able to shift the tax to consumers. And because supply is inelastic, producers are less responsive to changes in price, which forces them to bear more of the tax burden.

S0 is the initial supply curve for a product with elastic demand. When a $1.25 excise tax is placed on the product, the supply curve shifts upward by the amount of the tax, to S0+tax. Assuming demand remains constant at D0, the new equilibrium will be at point g. Because demand is elastic, consumers are more responsive to the rise in price, and therefore producers are less able to shift the tax to consumers. And because supply is inelastic, producers are less responsive to changes in price, which forces them to bear more of the tax burden.[Leave] [Close]