APPLICATIONS OF GAME THEORY

This section focuses on four common categories of games: Prisoner’s Dilemma, repeated games, leadership games, and chicken games. In each of the examples within each category, we solve for a Nash equilibrium using the best-

The Prisoner’s Dilemma

Prisoner’s Dilemma A noncooperative game in which players cannot communicate or collaborate in making their decisions, which results in inferior outcomes for both players. Many oligopoly decisions can be framed as a Prisoner’s Dilemma.

Ever notice how competing stores pay very close attention to what their competitors do? When Office Depot offers back-

Given the similarities of products sold by monopolistically competitive and oligopoly firms, Prisoner’s Dilemma outcomes occur frequently as firms compete for market share, such as AT&T and Verizon in wireless communications, Carnival and Royal Caribbean in cruise vacations, and Target and Walmart in discount retailing.

For consumers, however, Prisoner’s Dilemma outcomes are beneficial because they result in lower prices for goods. As competing firms lower their prices to gain market share, they earn a smaller profit from each customer. In some cases, competition becomes so intense that a competitor is forced out of business. Just ask Circuit City, Borders, Sharper Image, and Linens-

Alas, here’s the dilemma: Firms cannot openly collude to raise prices (that is illegal under antitrust laws). However, firms can silently collude by raising prices unilaterally and hoping that others will follow. But will the others follow?

Suppose two shoe stores operate near campus, Shoe Carnival and Shoe Festival. Assume, for simplicity, that each has two pricing strategies: a high markup and a low markup. If both stores choose the same strategy, they each attract the same number of customers. But if one store is less expensive than the other, it takes most of the customers and profits (despite earning less profit per customer at the lower price). Figure 9 shows a game table with presumed profits under the four outcomes.

Using the best-

Does this equilibrium seem odd? It might because another outcome (where both stores price high) provides greater profit to both stores. Yet, that outcome is not a Nash equilibrium. A Prisoner’s Dilemma therefore results because players are unable to cooperate effectively with one another. Why don’t the stores just agree to price their products high? They can’t do it by colluding; that is illegal. And if one store raises its prices unilaterally, there is no guarantee the other store will follow, thus risking a loss of customers and profit.

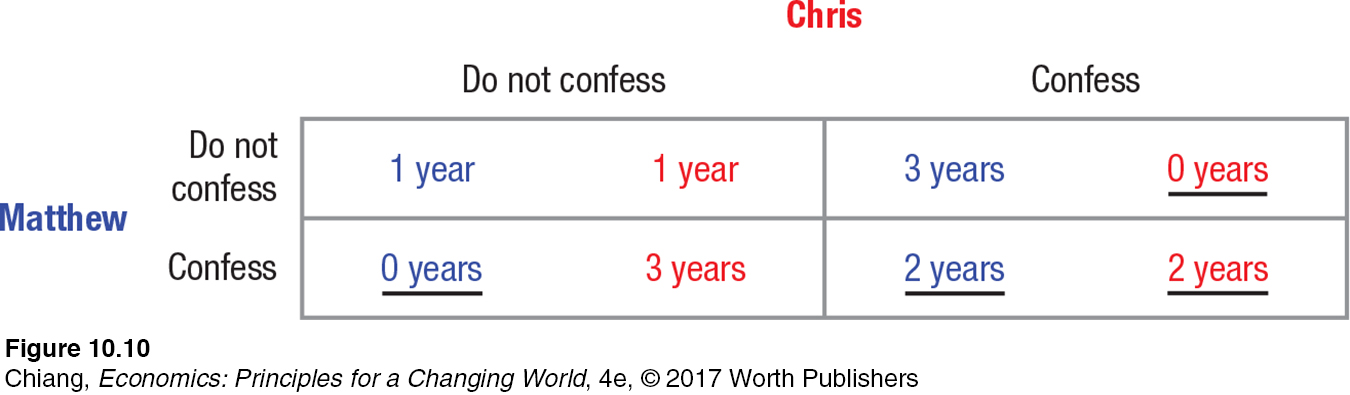

The Classic Prisoner’s Dilemma How did the Prisoner’s Dilemma get its name? Two criminal suspects (say, Matthew and Chris) are apprehended on a charge of robbery. They are separated, put in solitary confinement, are unable to speak to each other, and are not expected to meet each other even after the prison term is finished. Each prisoner is offered the same bargain: Confess that you and your partner both committed the crime and you will go free while your non-

Figure 10 illustrates this game in which payoffs represent the number of years in prison. The prisoners must make a decision without knowing what the other chose, and decisions are irrevocable. Each prisoner is only concerned with his own welfare—

Using the best-

Other Examples of Prisoner’s Dilemma Outcomes Now that you have an idea of what a Prisoner’s Dilemma entails, particularly when oligopoly firms compete, let’s mention a few other examples in which a Prisoner’s Dilemma might occur.

Political Campaigns: Politicians spend immense amounts of time, effort, and money to win elections. Some members of Congress in swing districts spend half of their two-

year terms in office campaigning, leaving little time to get anything else done, like passing laws. If competing candidates have roughly equal amounts of time and money, the result is likely to be similar if the candidates agree not to campaign at all; but that requires each candidate to trust the other not to break that promise, which is not an easy proposition. Legal Disputes: When individuals or firms end up in litigation, plaintiffs and defendants often will spend large amounts of money in legal fees and for consultants merely to offset what the other side spends. For high-

profile cases, add the costs of media coverage and the costs incurred by family, friends, and curious onlookers, and the outcome often is more costly for all parties involved. Trade Disputes: When one country restricts imported goods to protect domestic producers from foreign competition, other countries have an incentive to do the same, making it difficult for domestic producers to sell their goods abroad. When countries restrict trade against each other, a Prisoner’s Dilemma outcome occurs because trade barriers cause a reduction in the gains from specialization and trade, harming all countries.

Resolving the Prisoner’s Dilemma Prisoner’s Dilemma type of situations are difficult to resolve in a noncooperative framework when the players are not able to coordinate their strategies, whether as a result of antitrust laws or an inability to retaliate against other players if the cooperative action is not played. Although Prisoner’s Dilemma outcomes might be bad for firms in a pricing game or for litigants in a trial, they surely are beneficial for consumers who enjoy lower prices and for lawyers who might earn a lot of money in a high-

Let’s consider a case of trade protection in which a Prisoner’s Dilemma might be resolved successfully. A Prisoner’s Dilemma occurs when countries enact trade barriers, causing the gains from trade to be restricted. Free trade agreements are a way for countries to overcome the Prisoner’s Dilemma by agreeing to promote free trade among members. And unlike collusive agreements between firms, free trade agreements are legal and have been implemented extensively in recent decades.

Another way to overcome the Prisoner’s Dilemma is by ensuring that the game is repeated over time. When games are played just once, players have an incentive to maximize their payoffs in the game without worrying about long-

Repeated Games

Pick up a Sunday newspaper and notice the large selection of circulars included. Many retailers advertise their products using a Sunday ad without knowing what their competitors’ ads look like. But because this game is repeated every Sunday, no firm would risk retaliation by advertising prices that are too low relative to other firms. Thus, repeated games provide a way for competing players to check how other players are behaving, and to provide a way of punishing unfair players.

Games can be endlessly (infinitely) repeated or repeated for a specific number of rounds. In either case, repeating opens the game to different types of strategies that are unavailable for a game played only once. These strategies can take into account the past behavior of rivals. This section briefly explores such strategies and some of their implications for understanding oligopoly behavior.

trigger strategies Action is taken contingent on your opponent’s past decisions.

One possibility is simply to cooperate or defect from the beginning. These strategies, however, leave you at the mercy of your opponent, or lead to unfavorable outcomes where both firms earn less or suffer losses. A more robust set of strategies are trigger strategies, where action is taken contingent on your opponent’s past decisions. Here are a few of them.

Grim Trigger Let’s start by considering an industry that is earning oligopoly profits. Suppose that all of a sudden, one firm lowers its price, maybe because it is in financial trouble and wants to increase sales right away. Under the grim trigger rule, the other firms lower their prices—

Any decision by your opponent to defect (choose an unfavorable outcome) is met by a permanent retaliatory decision forever. This grim trigger is a harsh decision rule. Moreover, misinterpretation of a player’s actions can result. For example, has your competition lowered its price in an attempt to gain market share at your expense, or has the market softened for the product in general? This strategy can quickly lead to the unfavorable Prisoner’s Dilemma result. To avoid this problem, oligopoly firms might use other trigger strategies.

Trembling Hand Trigger A trembling hand trigger strategy allows for a mistake by your opponent before you retaliate. This gives your opponent a chance to make a mistake and reduces misreads that are a problem for the grim trigger strategy. This approach can be extended to accept two nonsequential defects, and so on, but they can be exploited by clever opponents who figure out that they can get away with a few “mistakes” before their opponent retaliates.

tit-

Tit-

This short list of strategies illustrates the richness of repeated games. Strategies tend to be more successful if they are relatively simple and easy to understand by competitors, tend to foster cooperation, have some credible punishment to reduce defections, and provide for forgiveness to avoid the costly mistakes associated with misreading opponents.1

1 Nick Wilkinson, Managerial Economics: A Problem Solving Approach (Cambridge, U.K.: Cambridge University Press), 2005, p. 373.

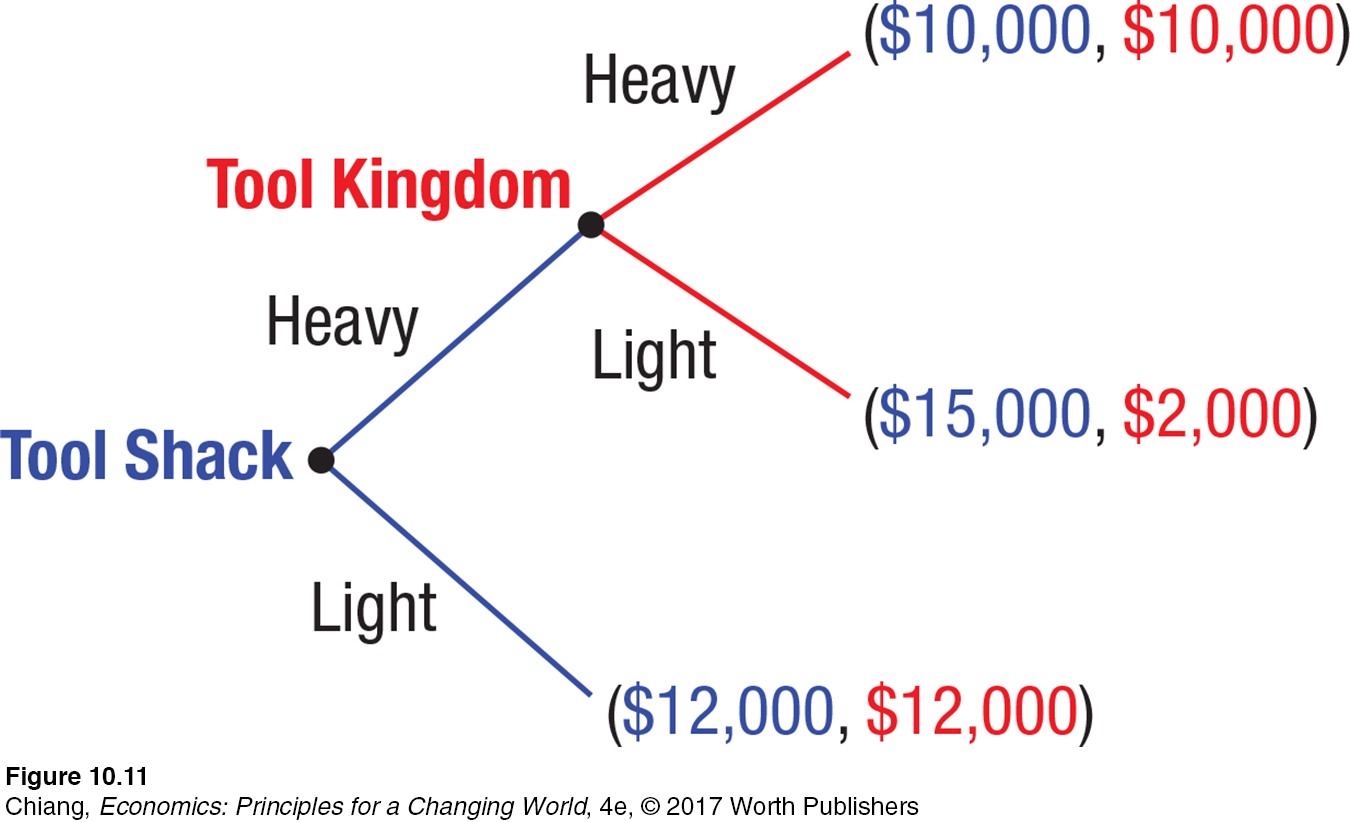

Using Sequential-

Looking at Tool Kingdom’s payoffs, it is in its best interest to advertise heavily if Tool Shack chooses to advertise heavily. Tool Shack, knowing that advertising heavily would be Tool Kingdom’s best response in the next stage, would likely choose to maintain its light advertising to avoid the Prisoner’s Dilemma outcome. The sequential nature of game trees allows players to see the progression of moves across time from start to finish.

Resolving the Prisoner’s Dilemma is an important outcome of cooperative strategies. But not all competitive games lead to a Prisoner’s Dilemma. One example is called a leadership game, where an industry is dominated by a market leader.

Leadership Games

Facebook is the world’s largest social media provider, which earns its revenues primarily through advertising and sets prices to maximize its profits. Yet, other smaller social networks also compete for revenues. Unlike earlier examples, in which competing firms are of similar size, Facebook’s market dominance allows it to ignore the pricing actions of its smaller competitors. In other words, if Facebook loses a few advertisers due to lower prices on other networks, the loss in revenues is smaller than what it would lose if Facebook lowered its prices.

Another example of a leadership game occurs when a small low-

Chicken Games

Another category of game that does not result in a Prisoner’s Dilemma can be seen where collective bargaining (organized labor) is powerful, such as labor unions and unions for professional sports. Every once in a while, a labor dispute reaches a point where a strike is either threatened or sometimes carried out. Although we discuss labor disputes in the next chapter, this is an example of an important class of games called chicken.

A chicken game is portrayed in the classic movie Rebel Without a Cause, in which James Dean’s character is challenged by a rival to a stunt challenge. Both players race their cars toward a cliff, and the first person to jump out is the “chicken.” The winner is the person who stays in the car longer. Of course, if neither player leaves his car, they both plunge to their deaths.

Chicken games describe games of holdouts or brinkmanship. Players involved in chicken games want to hold out as long as they can to win, trying to get the other side to give in. If neither side does, the worst outcome occurs. Examples of brinkmanship occur regularly in Congress. Neither Democrats nor Republicans wish to concede anything up to the very end, when some catastrophic consequence threatens the economy such as a government default (from failing to raise the debt ceiling) or a fiscal cliff of higher taxes and severe spending cuts (from failing to agree on a budget). Brinkmanship often ties one’s hands.

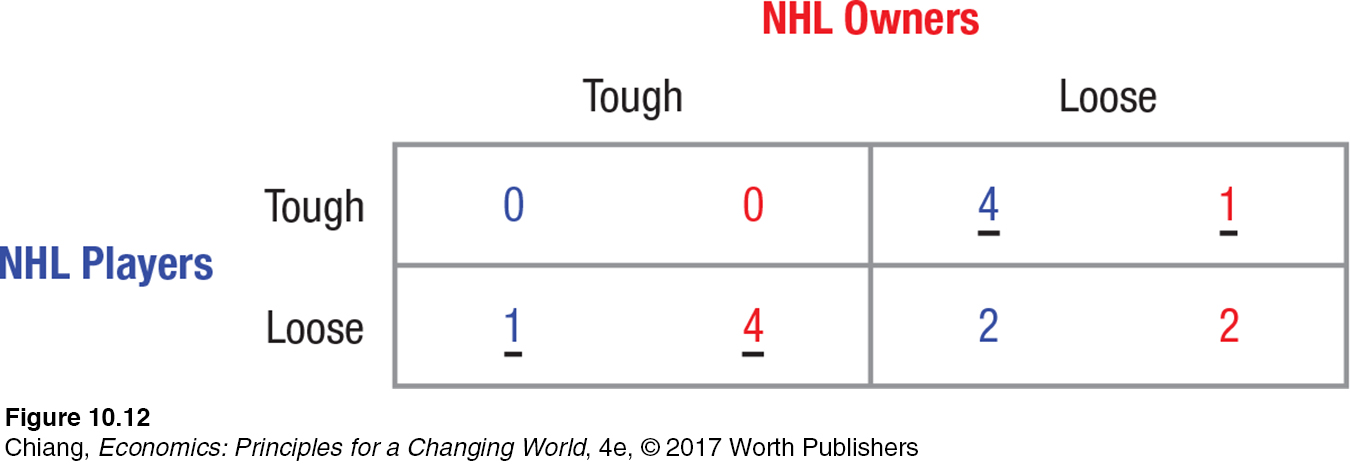

Figure 12 illustrates a chicken game using the 2012 NHL labor dispute as an example. The players union and the team owners were in a dispute over salaries. Each side can remain tough, or loosen their position. The worst outcome occurs when both sides refuse to give in, resulting in a lockout or strike that is devastating to both sides, not to mention all the fans, who are not able to watch their favorite teams play.

Using the best-

Thus, in a chicken game, one party is much happier with a Nash equilibrium result than the other. Yet, the loser still would not have wanted to change its strategy, for doing so unilaterally would result in an even worse outcome. Unfortunately for the NHL, a Nash equilibrium did not occur as both sides refused to give in, resulting in a lockout and a severely compromised 2012–

As seen in the many applications in this and the last section, game theory is a powerful tool to analyze market competition when firms each have the ability to influence price and the market share of their competitors. The ability to anticipate another player’s actions and respond optimally is the key to achieving a Nash equilibrium. Nash equilibrium is the outcome that maximizes all players’ expected payoffs. Recognizing such outcomes allows all players to achieve the best outcome given the self-

Summary of Market Structures

In this and the previous two chapters, we have studied the four major market structures: perfect competition, monopolistic competition, oligopoly, and monopoly. As we move through this list, market power becomes greater, and the ability of the firm to earn economic profits in the long run grows.

Table 1 summarizes the important distinctions among these four market structures. Keep in mind that market structure analysis allows you to look at the overall characteristics of the market and predict the pricing and profit behavior of the firms. The outcomes for perfect competition and monopolistic competition are particularly attractive for consumers because firms price their products equal to average total costs and earn just enough to keep them in business over the long haul.

| TABLE 1 | SUMMARY OF MARKET STRUCTURES | ||||

| Perfect Competition | Monopolistic Competition | Oligopoly | Monopoly | ||

| Number of Firms | Many | Many | Few | One | |

| Product | Homogeneous | Differentiated | Homogeneous or differentiated | Unique | |

| Barriers to Entry or Exit? | None | Little to none | Substantial | Impenetrable | |

| Strategic Interdependence? | No | No | Yes | Not applicable | |

| Ability to Set Price (Market Power) | None | Limited | Some | Absolute | |

| Long- |

P = ATC | P = ATC | P > ATC | P > ATC | |

| Long- |

Zero | Zero | Usually economic | Economic | |

| Key Summary Characteristic | Price taker | Product differentiation | Mutual interdependence | One- |

|

In contrast, the outcomes for oligopoly and monopoly industries are not as favorable to consumers. Concentrated markets have considerable market power, which shows up in pricing and output decisions. However, keep in mind that markets with market power (oligopolies) often involve giants competing with giants. Even though there is a mutual interdependence in their decisions and they may not always compete vigorously over prices, they often are innovative because of some competitive pressures. We see this today especially in the electronics and automobile markets.

CHECKPOINT

APPLICATIONS OF GAME THEORY

The Prisoner’s Dilemma is a noncooperative game in which players minimize their maximum prison time by both confessing, a strategy that neither would have taken had they been able to communicate with one another.

Applications of Prisoner’s Dilemma games extend well beyond criminal cases, and can involve firm pricing strategies, legal disputes, international trade protection, and political campaigns.

Resolving the Prisoner’s Dilemma is not easy because of antitrust laws preventing firms from colluding. However, when games are repeated, the threat of retaliation encourages players to use a cooperative strategy.

Games that are repeated lead to more nuanced trigger strategies, including grim trigger, trembling hand trigger, and tit-

for- tat. Leadership games describe competitive games in which one player is dominant in size relative to the rest of the players.

Chicken games involve players who try to hold out for the optimal outcome; however, if neither side gives in, the worst outcome occurs. Labor disputes that often end in strikes or lockouts are examples of chicken games.

QUESTIONS: Suppose your economics professor grades the class on a curve, such that exactly 25% of the class receives an A, 25% receives a B, 25% receives a C, and 25% receives a D, regardless of how the class actually performs. One of your classmates comes up with an idea: Instead of having the entire class study for hours and hours for each exam, everyone in the class agrees not to study, with the presumption that everyone would likely receive the same grade as if they did study given the grade distribution. Would this strategy work? Why or why not? What type of game does this best represent, a chicken game or a Prisoner’s Dilemma? Explain.

Answers to the Checkpoint questions can be found at the end of this chapter.

This strategy might work in theory if everybody in the class is committed to it. Practically speaking, it’s highly unlikely that everyone would stick to the agreement. For example, if you were someone destined to receive a C or a D, and you know that the A and B students promised not to study if you don’t study, you would have a strong incentive to break your promise and study hard knowing that an A or a B is now within easier reach. At the same time, those destined for an A or a B might want to insure themselves against the plan by studying to secure the high grade. In the end, the cooperative agreement does not hold, because each player has a dominant strategy to study. This represents a Prisoner’s Dilemma because, in the end, everyone studies and the scheme falls apart.