FINANCIAL CAPITAL

financial capital The money required by businesses to purchase inputs for production and to run their operations.

To this point, we have introduced various physical inputs needed to produce a product, including labor, land, and physical capital. But how does a firm pay for these inputs? Most new businesses start out small, using personal savings or help from family to come up with the money to lease business space and rent or buy equipment. In fact, the founders of Apple, Steve Wozniak and Steve Jobs, started out in the Jobs family garage, and Mark Zuckerberg started Facebook out of his college dorm room. How does a relatively new business expand? Sometimes a business can expand using the profits earned and saved from its initial operation. But eventually, most if not all businesses require larger sources of financial capital, which is money required to purchase inputs for production. Firms use capital markets to acquire financial capital.

In the previous section, we described generally how firms calculate the cost of capital using the interest rate determined in the loanable funds market. Firms use the cost of capital to determine how many inputs to employ in their production process. But the loanable funds market is a general description of all sources of capital funding, whether that be borrowing from banks, or using more complex instruments such as bonds, stocks, or venture capital. In this section, we describe the specific mechanisms that firms can use to acquire financial capital to build, operate, and expand their businesses.

Banks and Borrowing

collateral An asset used to secure a loan; the asset can be sold if the borrower fails to repay a loan.

Let’s start with the simplest means of acquiring financial capital other than self-

The ability to run a business with a bank loan is restricted to what the bank is willing to lend. This amount may not be enough to build a business and sustain its operation until a consistent cash flow is established to pay back the loan. Further, banks are more likely to address the inherent information problem between lenders and borrowers by scrutinizing the business plan and auditing files to ensure that a business is capable of paying back its loan. When bank borrowing is not feasible, the bond market may offer a more plentiful source of financial capital.

Bonds (Debt Capital)

Because bank loans are subject to credit restrictions and are usually limited in amount, it often is necessary for firms to borrow money by issuing bonds. A bond is an IOU certificate that promises to pay back a certain amount over time. The bond market offers firms an opportunity to acquire financial capital. The bond market is made up of firms that issue bonds and bondholders willing to invest by loaning money in exchange for an interest rate commensurate with the risk of that loan. Would you be willing to buy a bond issued by Intel or Coca-

face value The value of a bond that is paid upon maturity. This value is fixed, and therefore not the same as the market value of a bond, which is influenced by changes in interest rates and risk.

coupon rate A periodic fixed payment to the bondholder measured as an annual percent of the bond’s face value.

maturity The date on which the face value of the bond must be repaid.

There are three main components to a bond: its face value, its coupon rate, and its maturity date. The face value of a bond is the amount that must be repaid to the bondholder upon its maturity. A coupon rate is a periodic fixed payment made to a bondholder expressed as a percent of the face value; some bonds do not have coupon payments, and instead are repaid in a single payment (these bonds are called zero-

yield The annual return to a bond measured as the coupon payment as a percentage of the current price of a bond.

Many types of bonds exist, including corporate bonds, Treasury bonds, and municipal bonds, in addition to the many bond choices within each category. Corporate bonds are most likely to be used by firms to purchase productive inputs. In most cases, corporate bonds can be bought and resold in a bond market between investors. Because the price of a bond will vary based on the coupon rate, current market interest rates, and risk factors at the time of the transaction, a bond’s yield is an important value for investors. The yield is the current annual return to a bond measured as the coupon payment as a percentage of the current price of a bond.

A bond’s yield is positively related to its risk. In other words, the greater the risk that the company issuing the bond might default on its bond payments, the greater return an investor would demand for holding that bond. A bond’s risk is measured by various bond agencies, including Moody’s, Standard & Poor’s (S&P), and Fitch. These agencies provide bond ratings that range from AAA (the safest bonds) to C (the riskiest rating by Moody’s) or D (the riskiest by S&P and Fitch).

Figure 3 shows a corporate bond listing on January 4, 2016, showing the coupon rate, maturity date, bond ratings, the last price, and the yield. Looking at the first row, for Bank of America, this bond pays a coupon rate of 5.0% per year. However, because the bond’s risk rating has improved since its initial issuance, the price has risen from its base price of 100 to 109.03. Because the face value of most corporate bonds is $1,000, this means one must pay $1,090.30 for this bond. Because the price exceeds the face value to earn the bond’s fixed coupon payment, the yield falls to 3.157%, reflecting the reduced risk perceived by investors.

Information from FINRA.

Looking at the last row, the Chesapeake Energy bond offers a coupon rate of 5.75%. In addition, you could have bought the bond for $305 in January 2016, and cash this bond in for $1,000 at maturity in March 2023. The yield for this bond is significantly higher at 29.49%. Sounds like a great investment, but notice its risk rating of B3/CCC+/B, indicating a high likelihood of default. If Chesapeake Energy files for bankruptcy at any time until March 2023, the expected 29.49% annual return will turn into a negative return after the bankruptcy filing. Indeed, high yields equal high risk.

Bonds provide advantages and disadvantages to acquiring financial capital compared to borrowing money from a bank. The benefits of bonds are that other investors share the risk of the business, and a business can generally raise more money through bonds by offering higher interest rates. The drawbacks are that bonds are a claim against a business, and the ability to issue future bonds depends on the ratings issued by ratings agencies and the overall demand and supply for its bonds in the market.

Although differences exist between bonds and bank loans, they still share similar characteristics. Both are IOUs to a lender, whether that be a bank or a bondholder. In both cases, the business maintains control over the management of the business. There is no risk of an outside investor or firm forcefully taking over the business, because the entire ownership is maintained by the company’s owners. The disadvantage of relying on bonds and banks, however, is that the ability to raise large sums of capital may be difficult or expensive, and the burden of making debt payments may limit the performance of the business. An alternative approach is for a firm to acquire financial capital from the public in exchange for a share of ownership in the company. This involves stocks, which we discuss next.

Stocks (Equity Capital)

share of stock A unit of ownership in a business that entitles the shareholder to one vote at shareholder meetings and one share of any dividends paid.

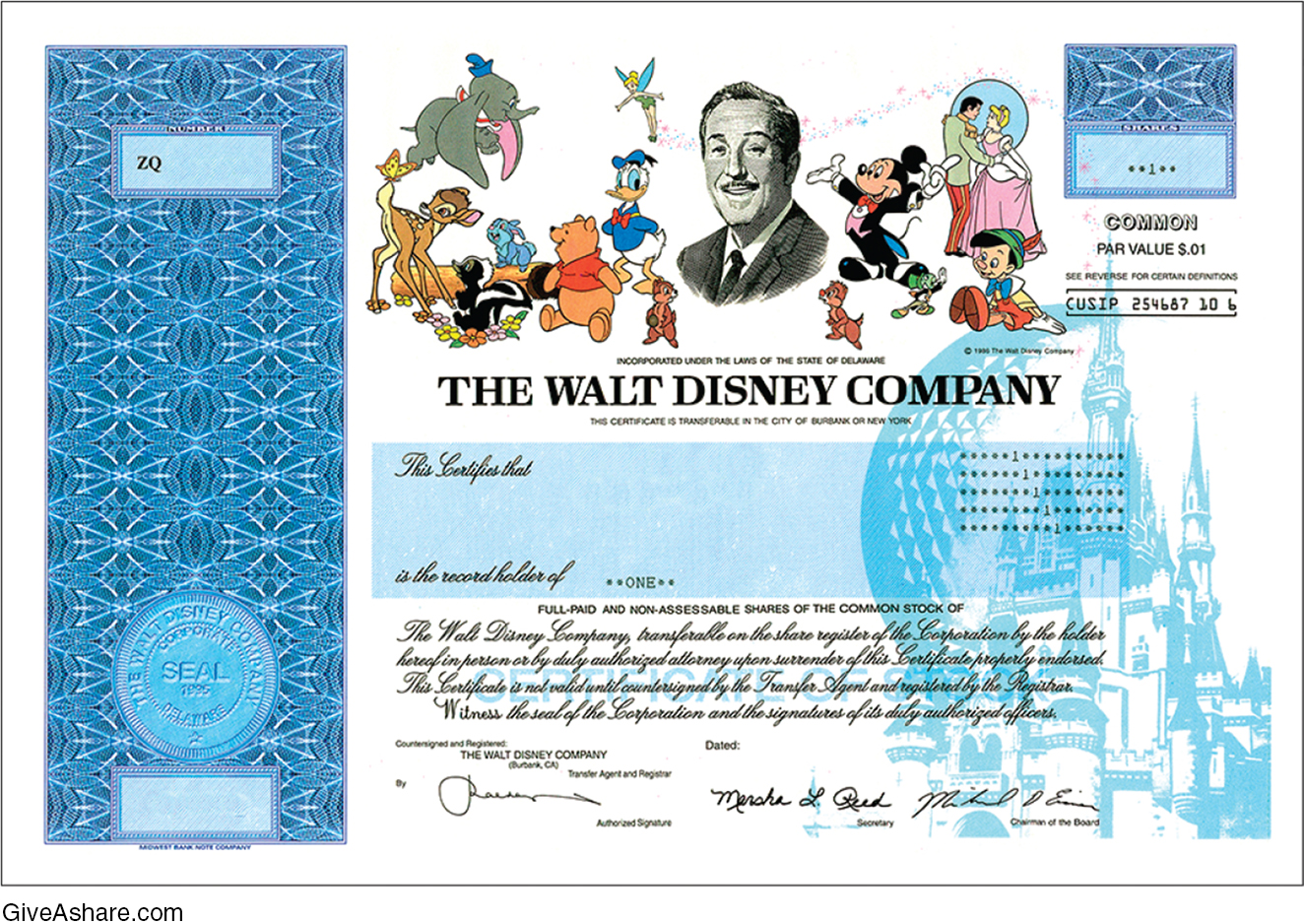

An alternative to using debt instruments such as a bank loan or the issuing of bonds to acquire financial capital is to offer partial ownership (also known as equity) in the company. The most common approach is to issue stock shares. Each share of stock issued represents one fraction (of the total shares issued) of ownership in the company, and subsequently one vote in shareholder meetings and one share of any dividends (periodic payments to shareholders).

When a firm issues stock, it receives money in exchange for ownership in the company. This is handled in what is known as an initial public offering, or IPO. Typically, the founders of the company will retain a significant portion of the shares for themselves. However, the more shares that are issued, the smaller the value that each share will be. Therefore, when firms increase the number of shares issued without justifying their value to existing shareholders through actual or potential earnings, it is likely that the price per share will fall.

market cap The market value of a firm determined by the current price per share of its stock multiplied by the total number of shares outstanding.

The market cap of a firm is what a firm is estimated to be worth based on its stock value, calculated as the current price per share multiplied by the total number of shares outstanding. The price of a share of stock is determined by supply and demand just as in any other market, and for every buyer of a share of stock there must be a seller. Shares of stock generally are traded in stock exchanges (such as the New York Stock Exchange or NASDAQ).

An important point here is that firms receive money only once from issuing a share of stock. Once a share of stock is issued, the trading of that share among investors and the corresponding price fluctuations of that share do not provide any additional funds to the company, although company executives who hold a significant number of shares clearly would benefit from a higher share price of their stock.

Like bonds, there are advantages and disadvantages to firms that raise financial capital from issuing stock. Advantages of issuing stock relative to bonds include the ability to raise substantial amounts of financial capital by sharing ownership in the business and its profits. In addition, businesses are not required to make repayments to stockholders, allowing them to reinvest their earnings as opposed to repaying lenders. Lastly, should the business fail, the losses are spread among all shareholders, not just to the business’s founder, a concept known as limited liability. The main disadvantage of issuing stock is that partial ownership in the business is given up. This means that full disclosure of company data must be made public, providing valuable information to competitors. Furthermore, with enough shareholder votes, an external investor can vote to replace a firm’s management and/or board of directors, or even take over the company outright by buying all or a majority of the shares in the company.

From an investor’s point of view, why would people find stocks an attractive investment given the real risks of businesses failing? Some companies do fail, and stockholders in these cases often lose their entire investment as opposed to bondholders, who are able to make claims on a firm’s remaining assets before shareholders. However, historical data have shown that investing in stocks, despite the higher risk, generates a much higher return over the long run than investing in bonds, buying certificates of deposit (CDs), or keeping money in a savings account. In other words, by owning a share of stock, one is entitled to a share of the company’s future value. For many businesses that do succeed, this can result in a very profitable return. In some cases, owning shares in certain businesses over time has made investors very wealthy.

Venture Capital and Private Equity

An alternative approach to raising financial capital using equity instruments is to secure venture capital or private equity, both of which are large sums of money offered by financial investment firms eager to earn potentially large profits by investing a significant amount of money in a company.

The difference between venture capital firms and private equity firms lies primarily in the type of firms targeted. Venture capital firms typically invest in new start-

ISSUE

Venture Capital: A Few Success Stories and One Big Missed Opportunity

Hardly a day goes by without most of us performing an Internet search using Google. Google has become one of the most successful Internet companies in history. How did Google get its start, and how did it find the financial capital to begin its remarkable climb to success? The story begins in 1996 with Larry Page and Sergey Brin.

Larry Page and Sergey Brin were Ph.D. candidates at Stanford University when in March 1996 they started a project called the Stanford Digital Library Project. It then became known as BackRub. Their first source of funding came in August 1998, when Andreas (Andy) von Bechtolsheim, co-

The following year, in June 1999, Google secured $25 million in venture capital from two venture capital firms (Sequoia Capital and Kleiner Perkins Caufield & Byers), which each received 10% ownership in the company. In the year prior to securing these funds, Page and Brin had made an offer to sell the entire company (albeit a much smaller company at the time) for as little as $750,000!

In 2004 Google made an initial public offering of stock shares, generating a huge infusion of cash, while Page, Brin, Bechtolsheim, Cheriton, the original venture capital firms, and Google’s employees collectively retained nearly 90% of the shares for themselves. As of April 2016, Google was worth over $500 billion based on its stock value. For the venture capitalists who turned $12.5 million into $50 billion (10% ownership), that is a 400,000% return over 17 years. For Bechtolsheim and Cheriton, who each turned $100,000 into $5.0 billion, that is a 5,000,000% return over 18 years. Unfortunately, not all venture capitalists became billionaires. It was quite a missed opportunity for those who turned down Page and Brin’s original offers.

How do venture capital and equity capital differ from financial capital acquired through the stock market? The key factors are timing, volume, and risk. A venture capital firm seeks out the next Fortune 500 company in its earliest stages, hoping to turn a relatively small amount of money into a huge return. Similarly, a private equity firm seeks large returns by reorganizing existing firms. In both cases, individual stock investors may be hesitant to invest, either because the company is too young (or has not established a product to generate revenues), or the company is nearing bankruptcy. By purchasing a large share of a company, venture capital and private equity firms take substantial risks in exchange for potential large returns to their own shareholders.

According to the National Venture Capital Association (NVCA), the largest trade association for venture capital firms, over 800 venture capital firms in the United States invested a total of $58.8 billion in new businesses in many industries in 2015. According to the Private Equity Growth Capital Council, there were over 4,100 private equity firms in the United States in 2015. The amount of private equity investment is more difficult to measure, given the frequent buying and selling of shares in existing firms as opposed to the providing of start-

Despite the year-

CHECKPOINT

FINANCIAL CAPITAL

Firms require financial capital to purchase inputs needed in their production.

Financial capital can be obtained from bank loans, from the issuing of bonds or stock shares, or from venture capital or private equity firms.

Bonds are IOU notes that provide a return based on their level of risk.

Owning a share of stock entitles an investor to one share of ownership in a business, and can lead to substantial gains if the business is successful.

Venture capital and private equity firms take on risk in exchange for potential large returns by investing in new or underperforming companies, respectively.

QUESTIONS: What is the difference between a bond and a share of stock? What are some advantages and disadvantages of acquiring financial capital by issuing bonds in the bond market instead of issuing shares in the stock market?

Answers to the Checkpoint questions can be found at the end of this chapter.

Bonds are promises to pay back a lender (bondholder) a specific amount on a specific date, while stocks represent actual ownership (to the extent of the number of shares held) in a business. A bondholder does not own any part of the business, and therefore does not influence the day-

An advantage of issuing bonds is that it allows a business to maintain control of its management. Another advantage is that the business is unlikely to be subjected to a forceful takeover by a large investor. A disadvantage of bonds is that a business must pay an interest rate that is sometimes high depending on how investors perceive their risk. Another disadvantage of bonds is that a business must make periodic coupon payments to bondholders, as well as pay back the bonds as they mature. This may restrict a business’s ability to use available cash funds to invest in additional capital inputs.