QUESTIONS AND PROBLEMS

Check Your Understanding

Question 16.1

1. What is the difference between absolute and comparative advantage? Why would Lexi Thompson, who is better than you at both golf and laundry, still hire you to do her wash?

Question 16.2

2. If the United States has a comparative advantage in the production of strawberries compared to Iceland, how might trade affect the prices of strawberries in the two countries?

Question 16.3

3. Who are the beneficiaries from a large U.S. tariff on French and German wines? Who are the losers?

Question 16.4

4. Why does a quota generate a larger loss to the importing country than a tariff that restricts imports to the same quantity?

Question 16.5

5. What is the difference between an infant industry and a key industry? Why do producers in both industries desire protection against foreign imports?

Question 16.6

6. How could free trade between the United States and China potentially lead to more jobs in the United States?

Apply the Concepts

Question 16.7

7. Some American politicians claim that China’s trade policies are unfair to the United States, and that a large tax (tariffs) should be placed on Chinese imports to protect American workers and industries. Why might such a policy sound better than it actually is in practice? What are the dangers of imposing large taxes on Chinese imports?

Question 16.8

8. Expanding trade in general benefits all countries, or they would not willingly engage in trade. But we also know that consumers and society often gain while particular industries or workers lose. Because society and consumers gain, how might the government compensate the few losers for their loss?

Question 16.9

9. Some activist groups are calling for “fair trade laws” by which other countries would be required to meet or approach our environmental standards and provide wage and working conditions approaching those of developed nations in order to be able to trade with us. Is this just another form of rent seeking by industries and unions for protection from overseas competition?

Question 16.10

10. Why is there free trade between states in the United States but not necessarily between countries?

Question 16.11

11. Remittances from developed countries amount to over $500 billion each year. These funds are sent to their home countries by migrants in developed nations. Is this similar to the gains from trade discussed in this chapter, or are these workers just taking jobs that workers in developed countries would be paid more to do in the absence of the migrants?

Question 16.12

12. Suppose Brazil developed a secret process that effectively quadrupled its output of coffee from its coffee plantations. This secret process enabled it to significantly undercut the prices of U.S. domestic producers. Would domestic producers receive a sympathetic ear to calls for protection from Brazil’s lower cost coffee? How is this case different from that of protection against cheap foreign labor?

In the News

Question 16.13

13. Much of the world’s trade in goods occurs by cargo ship. Sometimes, the routes taken seem bizarre. For example, a container of goods being shipped from Shanghai to Hawaii might travel over 7,000 miles to Long Beach and then backtrack nearly 3,000 miles to Hawaii, as opposed to just traveling about 4,500 miles directly. Why would cargo companies use circuitous (and seemingly inefficient) routes to reach their destinations?

Question 16.14

14. Since the Civil War, Hawaii had been a major producer and exporter of sugarcane. About the time Hawaii became a U.S. state in 1959, the sugar industry had already started its decline, and in 2015, the last sugar plantation in Hawaii closed. Explain how the sugar industry in Hawaii was affected by reductions in tariffs, world competition, and the opportunity costs of production relative to other states. Why does sugar continue to be produced in Florida and Louisiana but not Hawaii?

Solving Problems

WORK IT OUT  | interactive activity

| interactive activity

Question 16.15

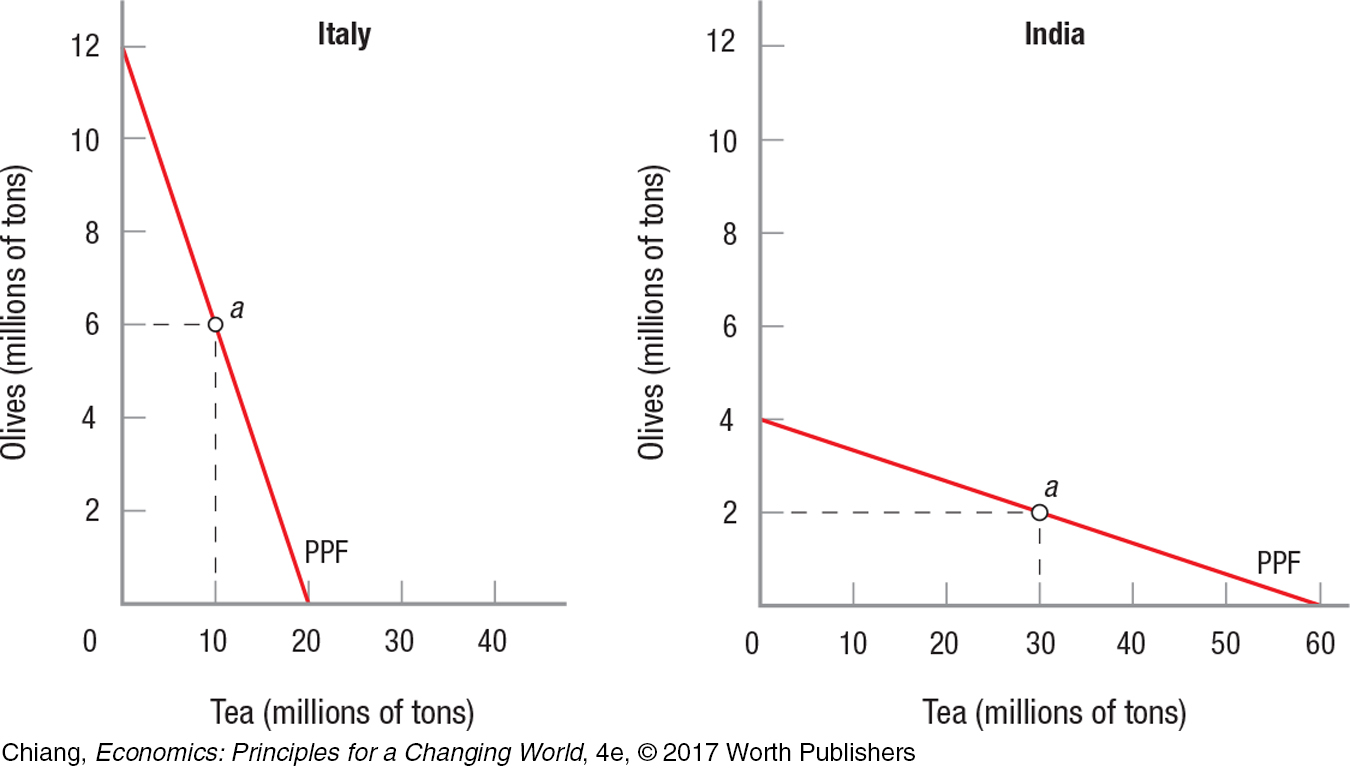

15. This figure shows the production possibilities frontiers (PPFs) for Italy and India for their domestic production of olives and tea. Without trade, assume that each is consuming olives and tea at point a.

If Italy and India were to consider specialization and trade, what commodity would each specialize in? What is India’s opportunity cost for tea and olives? What is Italy’s opportunity cost for tea and olives?

Assume that the two countries agree to specialize entirely in one product (the one for which each country has a comparative advantage), and agree to split the total output between them. Complete the following table. Are both countries better off after trade?

| Country and Product | Before Specialization | After Specialization | After Trade |

| Italy | |||

| Olives | 6 million tons | __________ | __________ |

| Tea | 10 million tons | __________ | __________ |

| India | |||

| Olives | 2 million tons | __________ | __________ |

| Tea | 30 million tons | __________ | __________ |

Question 16.16

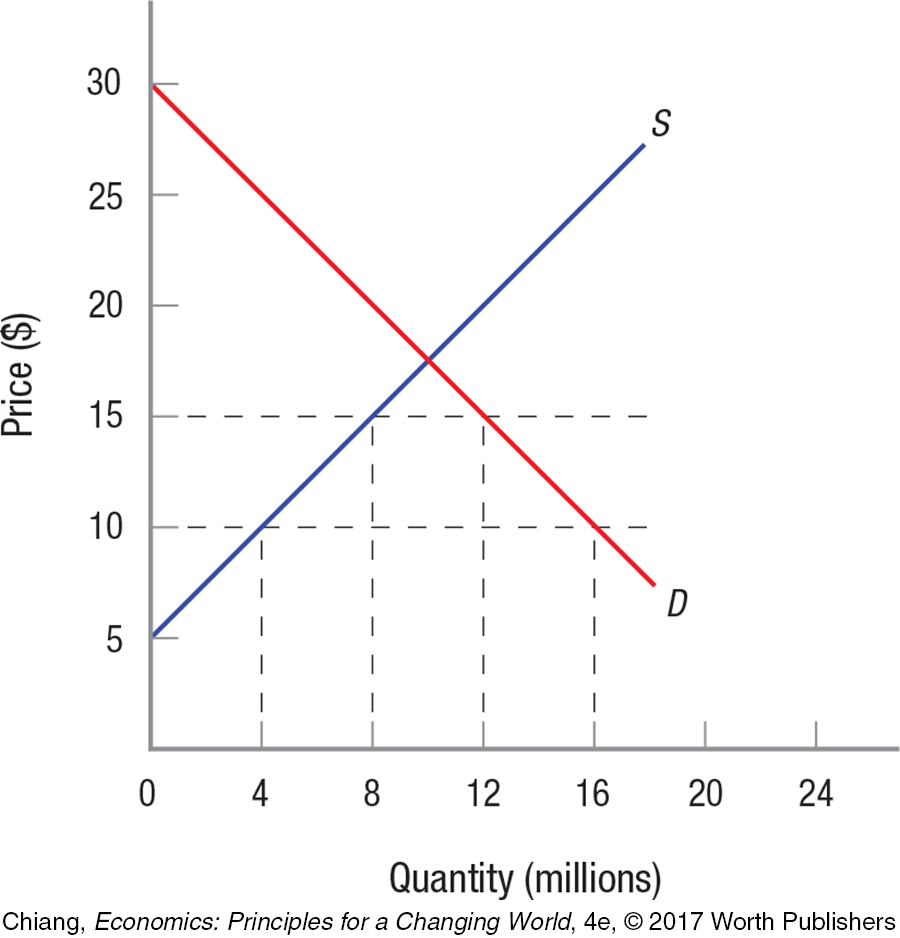

16. The following figure shows the annual domestic demand and supply for 16-

Assume that the worldwide price of these 16-

GB flash drives is $10. What percent of United States sales would be imported? Assume the U.S. government puts a $5 tariff per unit on flash drive imports. How many 16-

GB flash drives would be imported into the United States? Given the tariff in question (b), how much revenue would the government collect from this tariff?

Given the tariff in question (b), how much more sales revenue would domestic companies enjoy as a result of the tariff?

USING THE NUMBERS

USING THE NUMBERS

Question 16.17

17. According to By the Numbers, approximately when was the last time the United States had a trade surplus? As a percentage of GDP, what was the highest trade surplus the United States has achieved in the last 50 years? What was the highest trade deficit the United States has incurred in the last 50 years?

Question 16.18

18. According to By the Numbers, most of the developed countries (Canada, Australia, the United States, Switzerland, and Hong Kong) have relatively low tariff barriers, while much of the developing world still has high tariffs on imports. What reasons might account for why these countries continue to have high tariffs?