Government Solutions to Externality Problems

We have already discussed one kind of government solution to externality problems, namely taxes and subsidies. Two other solutions are also common: command and control and tradable allowances for the activity in question. We will look at both of these solutions in the context of another externality, acid rain, and we will also offer some comparisons with taxes and subsidies.

Acid rain damages forests and lakes, it corrodes metal and stone, and in the form of particulates, it creates haze and increased lung diseases such as asthma and bronchitis. Acid rain is caused when sulfur dioxide (SO2) and nitrogen oxides (NOx) are released into the atmosphere. A majority of SO2 and a significant fraction of NOx are created in the process of generating electricity from coal. Let’s look at how the government has reduced the external cost of acid rain.

Command and Control

When external costs are significant, we know that QMarket > QEfficient, so the most obvious (but not necessarily the best) method to reduce the external cost of electricity generation is for the government to order firms to use (or make) less electricity. This is called a command and control method. Command and control methods are not always efficient. The government, for example, issued a command and control regulation that required manufacturers to make clothes washers that use less electricity. Consumer Reports reviewed the clothes washers produced under this new standard and the reviewers were not happy with the results:3

185

Not so long ago you could count on most washers to get your clothes very clean. Not anymore. Our latest tests found huge performance differences among machines. Some left our stain-soaked swatches nearly as dirty as they were before washing. For best results, you’ll have to spend $900 or more.

What happened? As of January [2007], the U.S. Department of Energy has required washers to use 21 percent less energy, a goal we wholeheartedly support. But our tests have found that traditional top-loaders, those with the familiar center-post agitators, are having a tough time wringing out those savings without sacrificing cleaning ability, the main reason you buy a washer.

The problem with command and control is that there are typically many methods to achieve a goal and the government may not have enough information to choose the least costly method. Let’s suppose, for example, that the Department of Energy’s regulation on clothes washers reduces electricity consumption by 1% (this number is too large but it will do for our purposes). Now let’s compare command and control with a tax on electricity consumption that causes people to reduce their electricity consumption by exactly the same amount, 1%.4 Faced with an increase in price, how would people choose to reduce their electricity consumption?

If the price of electricity increased, some people would choose to cut back on electricity by turning their lights off more often or by switching to lower-consumption LED bulbs. Other people would respond by turning down the heat or the air conditioning, or by buying a cover for their pool, or by installing insulation in their attic. The ways in which people would reduce electricity consumption are as different as the people themselves. But notice that probably very few people would respond to an increase in the price of electricity by spending a lot more on a clothes washer that saves electricity or by buying a clothes washer that saves electricity but doesn’t clean very well. Thus, the government’s method of reducing electricity consumption is not the lowest-cost method.

A tax on electricity can reduce the consumption of electricity by exactly the same amount as a regulation on clothes washers but a tax will cost less. The tax costs less because a tax gives people the flexibility to reduce consumption in the way that is least costly to them. Recall from Chapter 7 that prices are signals. A tax on electricity sends a signal to every user of electricity that says “Economize!” But the tax leaves it to each person to use his or her local knowledge and unique preferences to choose the least costly method of economizing.

It’s better to reduce electricity consumption with a tax than with a regulation on clothes washers, but we can do even better. After all, we don’t really want to reduce electricity—we want to reduce pollutants like SO2 and NOx. It’s true that pollutants are a by-product of electricity generation but there are many ways of reducing SO2 and NOx other than by producing less electricity. Thus, taxing the pollutants directly is a better way of creating incentives to reduce pollution than is taxing electricity. Taxing the pollutants directly gives firms the maximum flexibility to adopt the least costly methods of reducing pollution. Remember it’s the pollutants that are creating the external cost so taxing the pollutants sends the right signal.

Command and control is not always a bad idea. The advantage of using incentives like taxes to control an externality is flexibility. The government corrects the price with a tax or subsidy so the price sends the right signal and people adapt using their own information and preferences (with all the benefits of the price system that we described in Chapter 4 and Chapter 7). But flexibility is not always desirable. Consider, for example, one of the great triumphs of humanity—the eradication of smallpox. Smallpox killed 300–500 million people in the twentieth century alone. As late as 1967, 2 million people died and millions more were scarred and blinded from smallpox, but in that year the World Health Organization (WHO) launched a program of mass vaccination, intensive surveillance, and immediate quarantine. The WHO program relied on command and control because so long as any reservoir of smallpox remained anywhere on the planet, the virus could reemerge and spread worldwide. To be successful, the WHO could not rely on taxes because it needed everyone to follow its policies—flexibility was not desirable. Fortunately, the WHO program was successful and by 1978 smallpox was extinct—the first and so far the only human infectious disease to be stopped dead in its tracks.*

186

The bottom line is that command and control can be useful if the best approach to a problem is well known and if success requires very strong compliance. If it’s important to control the externality at the least possible cost and if the government doesn’t have full information, then more flexible approaches such as taxes and subsidies are preferable.

Tradable Allowances

Another type of command and control program is to require that firms reduce pollutants by a specific quantity. In the 1970s, for example, the government limited SO2 from all generators of electricity to a maximum rate. The problem with this approach is that because of differences in location, fuel, and technology, it’s much cheaper to reduce emissions of SO2 from some firms than from others. By treating all firms the same, the government reduced flexibility and increased the cost of eliminating a given amount of pollution.

Trading Pollution

http://qrs.ly/no4ax6o

A simple example illustrates the problem with quantity restrictions and a potential solution. Suppose that there are two firms. We begin with a command and control regulation that limits each firm to 100 tons of SO2 emissions in a year. Now imagine that reducing pollution at High-Cost Industries is expensive, so High could save $1,100 if it were allowed to produce 101 tons of SO2 instead of being limited to 100 tons. Low-Cost Industries can control its pollution quite cheaply, so if Low reduces its pollution level even further to 99 tons, its costs increase by only $200.

Now imagine that the CEOs of High and Low approach the head of the Environmental Protection Agency with a proposal. The CEOs suggest that High be allowed to increase its pollution level by 1 ton to 101 tons. High will also pay $500 to Low. In return, Low will cut its pollution level by 1 ton to 99 tons. It’s clear why High and Low want the deal—it’s profitable. High cuts its pollution control costs by $1,100 for which it pays $500 for a net increase in profit of $600. Low increases its pollution control costs by $200, but it receives a $500 payment for a net increase in profit of $300. But should the EPA accept this deal?

Yes, if the EPA cares about social surplus, it should accept the deal. Notice that pollution stays exactly the same, 200 units, so the deal does not harm the environment. The deal, however, does increase profits by $900 ($600 to High and $300 to Low). Should the EPA care about firm profits? Maybe not directly, but notice why profits increase in this example. Profits increase because the costs of reducing pollution fall. By trading, the firms reduce the cost of eliminating the last unit of pollution from $1,100 to just $200—a $900 fall in costs and that represents an increase in resources available to society.

187

So, let’s ask our question in a different way. Should the EPA care about decreasing the costs of reducing pollution? Of course, the answer is yes. If we can reduce the same amount of pollution at lower cost, that means more resources are available for other goods. And the lower the costs of eliminating pollution, the more pollution it makes sense to eliminate.

What we have shown is that trading pollution allowances is like a new technology that reduces pollution at lower cost. The EPA should always be in favor of new technologies to reduce pollution and so it should also be in favor of trades in the right to pollute.

Tradable Allowances in Practice A formal version of the tradable allowances system that we have just described was created by the Clean Air Act of 1990. Under this reform, the EPA distributes pollution allowances to generators of electricity, and each allowance gives the owner the right to emit 1 ton of SO2. Firms may trade allowances as they see fit and they have organized sophisticated markets in tradable allowances. Firms can even bank allowances for future use. The EPA monitors each firm’s emissions of SO2, and it also tracks how many allowances each firm owns so no firm can emit more pollution than it has allowances for. Congress sets the total number of allowances.

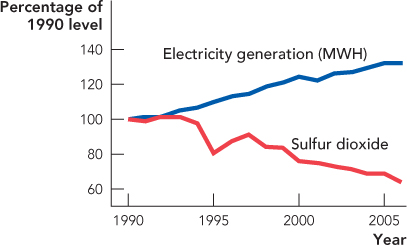

The EPA’s tradable allowances program has been very successful, as SO2 emissions have been reduced, air quality has improved, and illness has been reduced.5 Remarkably, as shown in Figure 10.4, electricity generation has increased even as SO2 emissions have decreased.

The EPA’s system of tradable allowances is a successful application of the Coase theorem. Recall that the Coase theorem says that markets can internalize externalities when transaction costs are low and property rights are clearly defined. The Clean Air Act of 1990 clearly defined rights to emit SO2, and the EPA has reduced transaction costs by distributing the allowances, monitoring emissions, and creating a database that tracks ownership. Trading in markets has then allocated the allowances among firms in the way that minimizes the costs of reducing pollution.

One of the most interesting aspects of the market in rights to emit sulfur dioxide is that anyone can participate in this market, not just generators of electricity. We bought the rights to emit 30 pounds of SO2. We don’t intend to emit any pollutants; rather, we bought the rights and ripped them up in order to create more clean air. Environmentalists and industry often oppose one another, but when markets in externalities are created, environmentalists can buy pollutants and industry is happy to sell—as always, trade makes both parties better off.

An important result of the SO2 trading program is that firms that generate electricity from relatively clean sources such as solar power can make money by selling their pollution allowances. In contrast, firms that generate electricity from relatively dirty sources must buy allowances. In essence, clean energy is subsidized and dirty energy is taxed—thus, a program of tradable allowances correctly reflects the fact that clean energy has lower social costs than dirty energy.

188

The success of the acid rain program in reducing SO2 emissions at low cost and concern over global climate change motivated President Barack Obama to propose a tradable allowances plan for carbon dioxide, a greenhouse gas that contributes to global warming. Tradable allowances in carbon dioxide would change the economics of all energy, not just electricity, and would create incentives for firms to move toward nuclear, solar, and biomass fuels that contribute less to global warming. Since global warming is a worldwide problem, tradable allowances ideally would be distributed and bought and sold on a worldwide basis. As of yet, however, not enough cooperation exists in the world community to establish such a system. Smaller programs, however, have been created around the world including in Europe and in California. The California Cap and Trade program limits carbon emissions only in California but it lets California firms buy permits from any firm in the United States that can prove that it has limited its own carbon emissions. In this way, the California program reduces the cost to California firms of limiting carbon emissions to the lowest possible U.S. cost.

Comparing Tradable Allowances and Pigouvian Taxes—Advanced Material

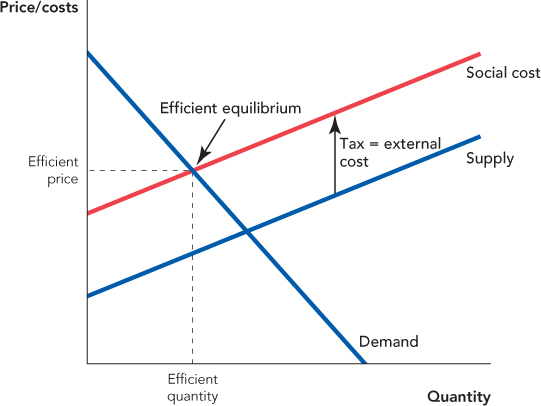

There is a close relationship between using Pigouvian taxes and tradable allowances to solve externality problems. A tax set equal to the level of the external cost is equivalent to tradable allowances, where the number of allowances is set equal to the efficient quantity. To achieve the efficient equilibrium in Figure 10.5, for example, the government can either use taxes to raise the price to the efficient price or it can use allowances to reduce the quantity to the efficient quantity. The equilibrium is identical no matter which method is used.

Differences between Pigouvian taxes and tradable allowances do occur when there is uncertainty. Imagine, for example, that we know any quantity above a certain threshold level of SO2 will acidify thousands of lakes and thus cause an environmental disaster. Any level below the threshold, however, will be acceptable or at least tolerable. In this case, tradable allowances are best because we can set the allowance below the threshold level and be certain that we will avoid disaster. If we set a tax, however, and we don’t know the exact position of the supply curve, then we could easily set the tax too low, leading to SO2 emissions above the threshold level. A fixed quantity, even if tradable, is like a command and control regulation, and just as in our discussion of eliminating smallpox, the best argument for command and control is when flexibility is not a virtue.

On the other hand, sometimes we know a lot about the cost that a unit of SO2 creates, but we aren’t sure about the efficient quantity of pollution because demand and supply are changing. If the supply curve in Figure 10.5 were to shift down, for example, if the cost of producing electricity falls, the efficient quantity will increase. With a Pigouvian tax, the adjustment to the new equilibrium occurs automatically, but with allowances we could be stuck with a quantity of allowances that is much lower than the new efficient quantity. In this case, a Pigouvian tax is best because it can more easily adjust to changes in demand and supply.

189

CHECK YOURSELF

Question 10.5

Government sets a total quantity of tradable pollution allowances and auctions them off. After the auction, the price for an individual allowance is high. Over time, the price falls dramatically. What does this tell you?

Government sets a total quantity of tradable pollution allowances and auctions them off. After the auction, the price for an individual allowance is high. Over time, the price falls dramatically. What does this tell you?

Question 10.6

The local government has decided to set and apportion tradable allowances for pollution in your neighborhood. Name three groups that would press for a large total quantity of allowances. Name three groups that would press for a smaller total quantity of allowances. Considering these groups, how likely is it that government would set a total quantity of allowances that would achieve an efficient equilibrium?

The local government has decided to set and apportion tradable allowances for pollution in your neighborhood. Name three groups that would press for a large total quantity of allowances. Name three groups that would press for a smaller total quantity of allowances. Considering these groups, how likely is it that government would set a total quantity of allowances that would achieve an efficient equilibrium?

The second difference between taxes and pollution allowances is not economic but political. With a tax, firms must pay the government for each ton of pollutant that they emit. With pollution allowances, firms must either use the pollution allowances that they are given or, if they want to emit more, they must buy allowances from other firms. Either way, firms that are given allowances in the initial allocation get a big benefit compared with having to pay taxes. Thus, some people say that pollution allowances equal corrective taxes plus corporate welfare.

That’s not necessarily the best way of looking at the issue, however. First, allowances need not be given away; they could be auctioned to the highest bidder, as under some proposed tradable allowance programs for carbon dioxide—this would also raise significant tax revenue. Making progress against global warming, moreover, may require building a political coalition. A carbon tax pushes one very powerful and interested group, the large energy firms, into the opposition. If tradable allowances are instead given to firms initially, there is a better chance of bringing the large energy firms into the coalition. Perhaps it’s not fair that politically powerful groups must be bought off, but as Otto von Bismarck, Germany’s first chancellor, once said, “Laws are like sausages, it is better not to see them being made.” We can only add that producing both laws and sausages requires some pork.