Price Discrimination

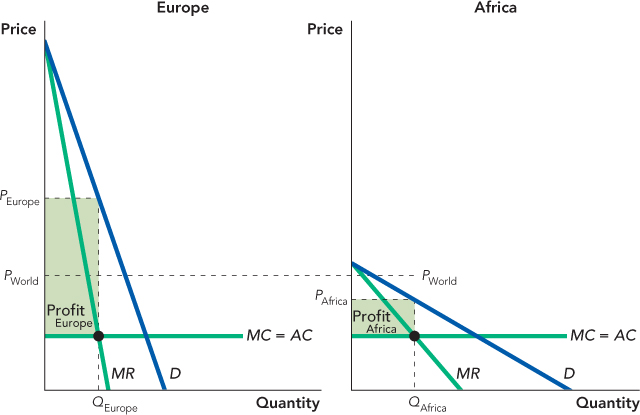

Figure 14.1 shows how price discrimination can increase profit. In the left panel we show the market for Combivir in Europe and in the right panel the market in Africa. The demand curve in Africa is much lower and more elastic (price sensitive) than in Europe because, on average, Africans are poorer than Europeans.

260

Now let’s suppose for the moment that Europe is the only market. What price should GSK set? We know from Chapter 13 that the profit-maximizing quantity is found where marginal revenue equals marginal cost. From MR = MC in the left panel, we find that the profit-maximizing quantity is QEurope. The profit-maximizing price is the highest price that consumers will pay to purchase QEurope units, which we label PEurope. Profit is given by the green area labeled ProfitEurope.

Similarly, if Africa were the only market, GSK would choose the profit-maximizing quantity QAfrica and the profit-maximizing price PAfrica, which would generate profit in the amount ProfitAfrica.

But what price should GSK set if it wants to have a single “world price” for both Europe and Africa? If GSK wants a single world price, it should lower the price in Europe and raise the price in Africa, setting a price somewhere between PEurope and PAfrica, say, at PWorld. (In a more advanced class, we would solve for the exact profit-maximizing world price, but that level of detail is not necessary here.)

But remember that PEurope is the profit-maximizing price in Europe and PAfrica is the profit-maximizing price in Africa, so by lowering the price in Europe, GSK must be reducing profit in Europe. Similarly, by raising the price in Africa, GSK must be reducing profit in Africa. Thus, profit at the single price PWorld must be less than when GSK sets two different prices earning the combined profit: ProfitEurope + ProfitAfrica.

We have now arrived at the first principle of price discrimination: (1a) If the demand curves are different, it is more profitable to set different prices in different markets than a single price that covers all markets.

We also know from Chapter 13 and from Figure 14.1 how a monopolist should set prices. Recall that the more inelastic the demand curve, the higher the profit-maximizing price. In this case, the demand for Combivir is more inelastic (less sensitive to price) in the European market than in the African market, so the price is higher in Europe. This really isn’t an independent principle; it’s an implication of profit maximization, as we showed in Chapter 13. But it’s a useful reminder, so we will add to our first principle: (1b) To maximize profit, the monopolist should set a higher price in markets with more inelastic demand.

261

The first principle of price discrimination tells us that GSK wants to set a higher price for Combivir in Europe than in Africa. But we also know from the introduction that setting two different prices for Combivir encourages drug smuggling. Smugglers buy Combivir at PAfrica and sell at PEurope, which leaves fewer sales for GSK. A smuggler’s profit comes out of GSK’s pocket.

If smuggling is extensive, GSK will end up selling most of its output at PAfrica, which is less profitable than if GSK set a single world price. Thus, if GSK can’t stop the drug smugglers, it will abandon its attempt at price discrimination and will instead set a single price—perhaps a single world price such as PWorld or, if the African market is small, GSK may abandon Africa altogether and set a single price of PEurope.

Arbitrage is taking advantage of price differences for the same good in different markets by buying low in one market and selling high in another market.

Smuggling is a special example of a more general (and legal) process that economists call arbitrage—buying low in one market and selling high in another market. Thus, we arrive at the second principle of price discrimination: (2) Arbitrage makes it difficult for a firm to set different prices in different markets, thereby reducing the profit from price discrimination.

We summarize the principles of price discrimination.

The Principles of Price Discrimination

1a. If the demand curves are different, it is more profitable to set different prices in different markets than a single price that covers all markets.

1b. To maximize profit, the firm should set a higher price in markets with more inelastic demand.

2. Arbitrage makes it difficult for a firm to set different prices in different markets, thereby reducing the profit from price discrimination.

The first principle tells us that a firm wants to set different prices in different markets. The second principle tells us that a firm may not be able to set different prices in different markets. To succeed at price discrimination, the monopolist must prevent arbitrage.

Preventing Arbitrage

If it wants to profit from price discrimination, GSK must prevent Combivir that it sends to Africa from being resold in Europe. GSK has a number of tools to discourage smuggling. GSK, for example, sends red Combivir pills to Africa and sells white Combivir in Europe. If GSK detectives find red Combivir in Europe, they know that a GSK distributor has broken its agreement. Using special bar codes on each package, GSK can then track the smuggled pills back to the distributor who was supposed to distribute them in Africa. Interpol is called in to make arrests.

Markets can differ in more ways than geographically. Rohm and Haas is a producer of plastics. One of its plastics, methyl methacrylate (MM), was used in industry and also in dentistry as a material for dentures. MM had lots of substitutes as an industrial plastic but few as a denture material, so Rohm and Haas sold MM for industrial uses at 85 cents per pound and sold a slightly different version designed for dentures at $22 per pound. At these prices, it wasn’t long before enterprising individuals started buying industrial MM and converting it to denture MM. Just like GSK, Rohm and Haas needed a way to prevent arbitrage between the two markets.

262

CHECK YOURSELF

Question 14.1

Why does a monopolist want to segment a market?

Why does a monopolist want to segment a market?

Question 14.2

Would a price-discriminating firm set higher or lower prices for a market segment with more inelastic demand?

Would a price-discriminating firm set higher or lower prices for a market segment with more inelastic demand?

Question 14.3

What is arbitrage? How does arbitrage affect the ability of a monopolist to price-discriminate?

What is arbitrage? How does arbitrage affect the ability of a monopolist to price-discriminate?

One bold thinker came up with what Rohm and Haas internal documents called “a very fine method of controlling the bootleg situation.” The innovator suggested that Rohm and Haas should mix industrial MM with arsenic. This wouldn’t reduce the value of MM in industry, but it would surely deter people from making it into dentures! Rohm and Haas’s legal department rejected this plan, but the company came up with an idea nearly as good: They planted a rumor that industrial MM was mixed with arsenic!2

Although Rohm and Haas never implemented the poisoning idea, the U.S. government has. The government taxes alcohol but subsidizes ethanol fuel. To prevent arbitrage, that is, to prevent entrepreneurs from buying ethanol fuel and converting it to drinkable alcohol, the government requires that ethanol fuel be poisoned!

It’s easier to prevent arbitrage of some products than of others. A masseuse, for example, may easily set different prices for different customers because it’s difficult for a customer who buys a massage at the low price to resell it to another customer at the higher price. Services, in general, are difficult to arbitrage.